Summary:

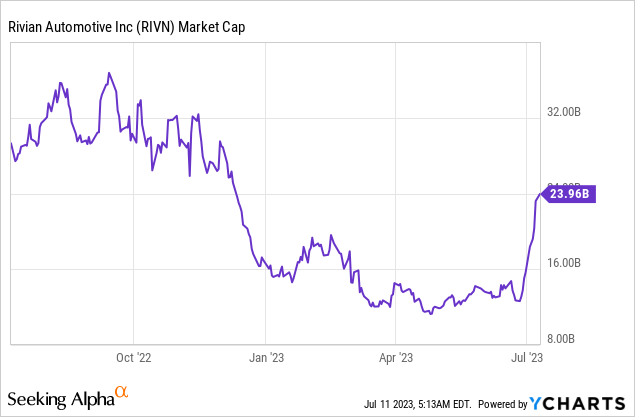

- I am downgrading Rivian following its release of Q2 production and delivery figures as the company’s share price has soared 53% since the end of June.

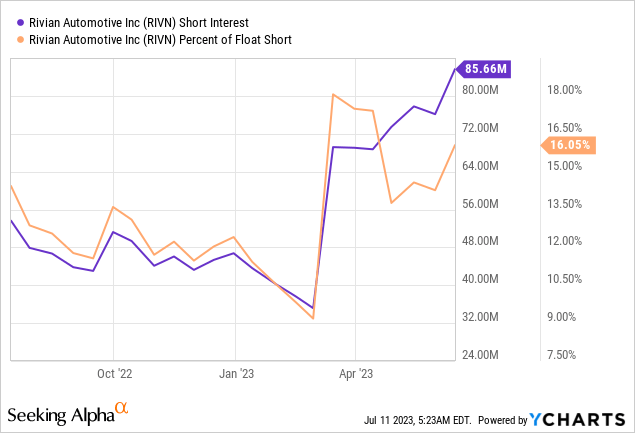

- The surge in Rivian’s share price is likely due to the company’s Q2 production figures, which soared 218% Y/Y, as well as the unwinding of short positions.

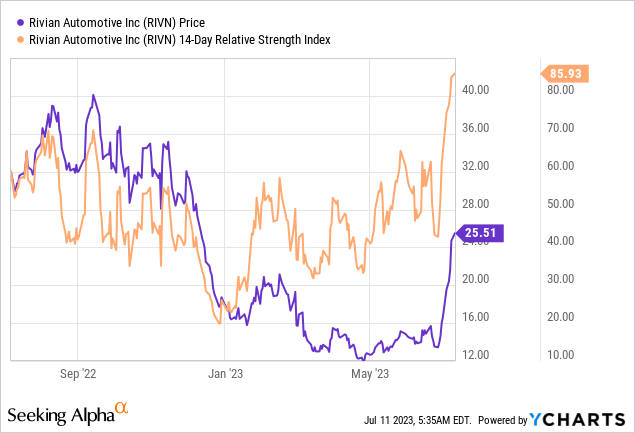

- Despite these strong Q2 results, RIVN’s shares are expensive and strongly overbought based on RSI. Investors buying now accept huge correction risks.

hapabapa

Less than two weeks ago, on the last day of June, I submitted my work about electric vehicle company Rivian Automotive (NASDAQ:RIVN) to Seeking Alpha called Rivian: Now A Short Squeeze Candidate. I upgraded Rivian Automotive to hold because Rivian was a heavily shorted stock and the company maintained a large cash position of approximately 75% of Rivian’s market cap (I didn’t recommend Rivian, however, due to the company’s high valuation). Since publication, shares of Rivian have soared by 53% with the company experiencing more buyer interest after it released Q2 production and delivery figures. While production and delivery accomplishments in the second-quarter were solid, the massive increase in Rivian’s market cap and investors’ euphoria in the last two weeks prompt me to change my rating on the EV company to sell!

Hold recommendation no longer relevant

In my last work on Rivian, I mentioned the company’s soaring short interest and called the EV company a potential short-squeeze candidate. I did not specifically recommend Rivian as a buy, however, due to the company’s slow manufacturing ramp in FY 2022 and high valuation based on revenues. Considering that Rivian’s share price has increased by more than half since the end of June, I am downgrading my recommendation back to sell.

Rivian’s production numbers for the second-quarter likely a catalyst

The upswing in Rivian’s share price has likely something to do with the company’s strong release of production figures for the second-quarter.

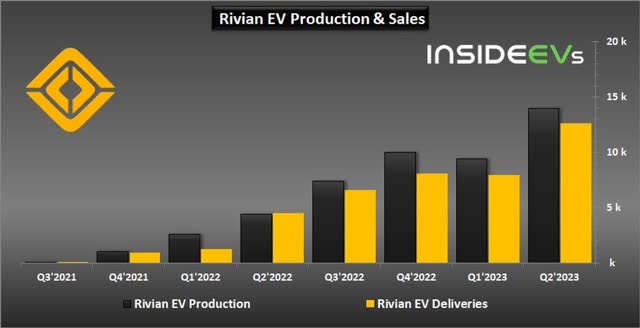

The electric vehicle company produced 13,992 electric vehicles in the second-quarter and delivered 12,640 electric vehicles to customers during that same period. Rivian’s production and delivery volumes, therefore, increased 218% and 183% year over year and were the highest numbers the company has achieved in its history.

All EVs were produced at the company’s manufacturing plant in Illinois and the company also confirmed its outlook for 50 thousand EVs to be produced in FY 2023. Including the 9,395 electric vehicles produced in the first-quarter, Rivian’s year-to-date production total is 23,387 electric vehicles… which calculates to approximately 47% of Rivian’s full-year production guidance. I believe Rivian will be able to meet its production forecast for FY 2023.

Obviously, the strong increase in production and deliveries has reignited interest in the electric vehicle company after a slower than expected ramp in FY 2022 — which is when Rivian cut its production outlook from 50 thousand to 25 thousand EVs due to supply chain and logistical challenges. The second-quarter delivery update certainly was a catalyst for Rivian’s shares and my suspicion is that the strong delivery card has led to the unwinding of at least some short positions that were previously built up.

According to the latest available information, Rivian had a short interest ratio of 16% at the end of June. While it is entirely speculation on my part that short interest positions may have been undone in the last two weeks, it would be a reasonable explanation nonetheless why Rivian’s share price exploded during this time.

Rivian’s valuation, correction risks

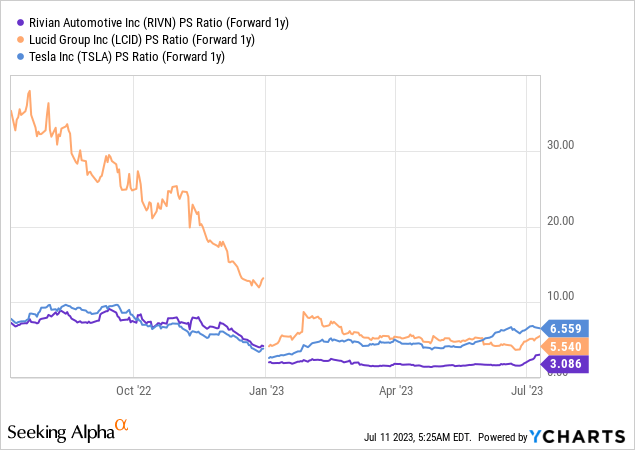

Rivian was not the most expensive electric vehicle company the last time I covered it. Rivian was the third-most expensive U.S.-based electric vehicle company at the end of June, after Tesla (TSLA) and Lucid Group (LCID). Rivian had a price-to-sales ratio of 1.94X at the end of June which has since risen to 3.1X, reflecting a more than 50% increase in the company’s market valuation since the end of June. Previously, I was not a fan of Rivian’s valuation, and RIVN is currently overbought and ripe for a correction.

Technically, shares of Rivian are now overbought: with an RSI of 85.93, investors buying shares today are accepting huge correction risks, in my opinion.

Risks with Rivian

The biggest short-term risk that I see for Rivian is that the current run-up in price is not sustainable. From a commercial perspective, I consider Rivian’s production ramp to be the biggest risk for the company, regardless of Q2’23 production and delivery accomplishments. Rivian originally guided for a 50 thousand EV production volume in FY 2022, so the company is about 1 year behind its original ramp. Slowing production growth and a high valuation based on revenue are two key risks that investors need to consider.

Final thoughts

I believe the market has gotten a little bit ahead of itself when it comes to Rivian and I would not consider a 50% increase in the company’s market cap to be justified based on Rivian’s operational achievements in Q2. Rivian’s second-quarter production and delivery card contributed to the strong run-up in price in the last two weeks, potentially combined with an unwinding of short positions in the electric vehicle company. While Rivian clearly had a good Q2 regarding production and delivery growth, a more than 50% increase in the firm’s market valuation indicates to me that investors’ optimism is overshooting. Shares of Rivian are massively overbought based on RSI and the firm’s price-to-sales ratio of 3.1X makes the EV company vulnerable to a correction, in my opinion.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LCID either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.