Summary:

- Apple’s customer loyalty and brand strength are so strong that it would take a significant event to dislodge the company.

- The company’s new product, the ‘Vision Pro’, is expected to be a success and contribute to impressive annual numbers in fiscal 2024.

- Apple’s resilience in iPhone sales and strong Services business revenue are key parts of our investment thesis on the name.

- We’re huge fans of Apple’s impressive free cash flow generation and strong net cash position on the balance sheet — two of the most important cash-based sources of intrinsic value.

- The high end of our fair value estimate range of Apple stands at $200 per share, and we love its dividend growth potential.

nyc russ

By Brian Nelson, CFA

Let’s face it: There is a whole cohort of consumers that don’t even care about phones that aren’t the iPhone. I’m probably in that cohort. These people are hooked on Apple (NASDAQ:AAPL) products. There’s another, perhaps overlapping, cohort that only consider the iPad for a tablet, too. They’re really not looking at anything else out there. In some ways, the iPad may have become the name for a tablet, much like Kleenex has become the generic name for tissues.

Toddlers everywhere aren’t asking for their “tablets;” they are asking for their “iPad.” Apple is so entrenched within the customer psyche these days that it would take a cataclysmic event for the company to get dislodged. From where we stand, Apple is not going anywhere in the longer run, and mom and dad will continue to shell out money for more and more Apple products, not only for themselves but for their kids, too.

Even Warren Buffett gets it. Here’s what the Oracle of Omaha had to say about Apple at Berkshire Hathaway’s (BRK.A) (BRK.B) annual event:

The good thing about Apple is (Berkshire) can go up (in our ownership stake). They keep buying their stock; instead of our owning 5.6%, if they get down to…15.25 billion of shares outstanding, without our doing anything we got 6%. Our criteria for Apple isn’t different than the other businesses we own; it just happens to be a better business than any we own. And we put a fair amount of money in it…and our railroad business is a very good business, but it is not remotely as good as Apple’s business. Apple has a position with consumers where they are paying $1,500 or whatever it may be for a phone, and these same people pay $35,000 for having a second car, and if they had to give up their second car or give up their iPhone, they’d give up their second car. I mean it’s an extraordinary (product). We don’t have anything like that that we own 100% of…but we’re very, very, very, happy to have 5.6% or whatever it may be percent (of Apple), and we’re delighted every tenth of a percent that it goes up.

We tend to agree with Uncle Warren on his main point: People’s phones are more important than even things like their second car. One might even put the iPhone near the base on an updated ‘Maslow’s Hierarchy of Needs’ image. Apple’s products are simply amazing, and people are hooked…and likely for life. On a personal level, I can’t foresee myself buying another phone that is not an Apple product. I can’t foresee myself buying a tablet that is not an iPad. In some ways, at least from a personal level, I haven’t made the switch to Apple wearables, as the Fitbit, now owned by Alphabet (GOOG) (GOOGL), remains relevant, but this may be an inevitability for me, too. Then there’s the Apple ‘Vision Pro,’ which was unveiled at the company’s Worldwide Developers Conference on June 5.

We were impressed with the ‘Vision Pro,’ Apple’s first major product launch since the release of the Apple Watch nearly a decade ago. The Vision Pro is expected to be available in early 2024 and will compete in many areas with the Meta (META) Quest. Granted, estimating the total market opportunity for a $3,499 device like the ‘Vision Pro’ is a difficult one, but we expect Apple’s annual numbers come next year to be impressive, regardless. From what we can tell, there are a significant number of possible applications of the Vision Pro. We recently made a few changes to our valuation model of Apple, and the Vision Pro may very well end up being another winner for the company.

Our Discounted Cash Flow Valuation of Apple

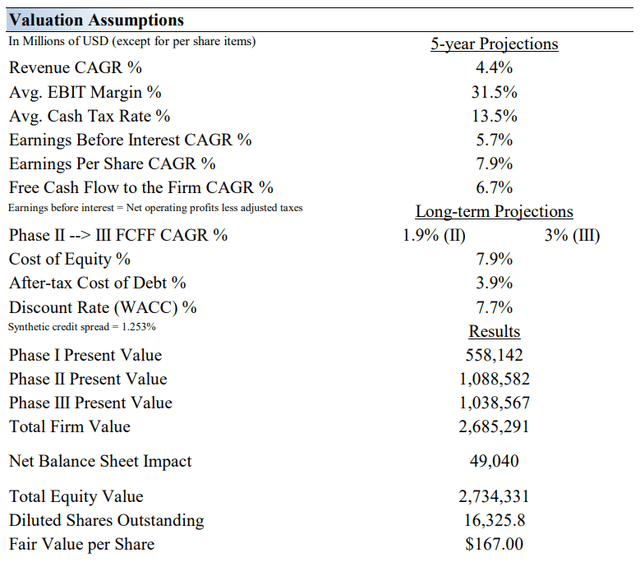

Our Valuation Assumptions for Apple (Valuentum)

We use a discounted cash-flow [DCF] model in our processes to value shares of general operating companies, and we value shares of Apple at $167 each. The way to think about stock prices is that each stock price reflects a discounted cash flow model. When the price of a stock changes, the underlying assumptions of the discounted cash flow model that matches that new price change, too. We like to view the stock market in this manner; it helps conceptualize what moves stock prices. If future expectations of revenue, earnings and free cash flow are increased, the DCF-derived fair value estimate and the price should increase, too, all else equal. If the discount rate increases, as in an increase in the 10-year Treasury rate, the intrinsic value of the company and its share-price should fall, all else equal.

As noted previously, on the basis of the DCF-process, we think Apple is worth $167 per share. Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates, though we are building in a slightly more optimistic fiscal 2024 than consensus. Our model reflects a compound annual revenue growth rate of 4.4% during the next five years, a pace that is lower than Apple’s 3-year historical compound annual growth rate of 14.9%. Our valuation model reflects a 5-year projected average operating margin of 31.5%, which is above Apple’s trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 1.9% for the next 15 years and 3% in perpetuity. For Apple, we use a 7.7% weighted average cost of capital to discount future free cash flows.

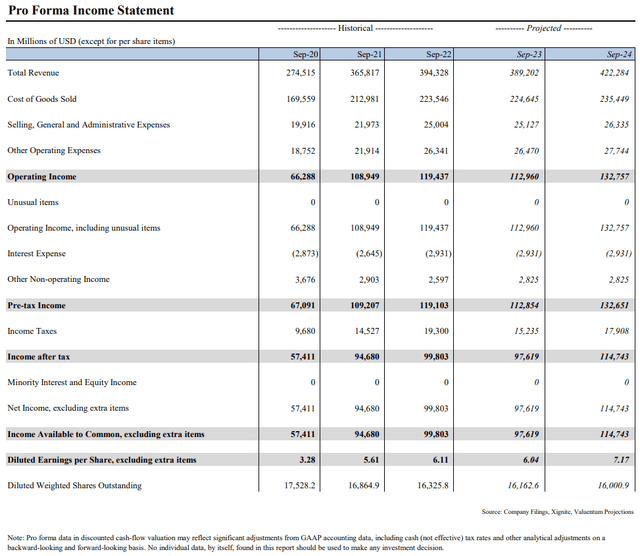

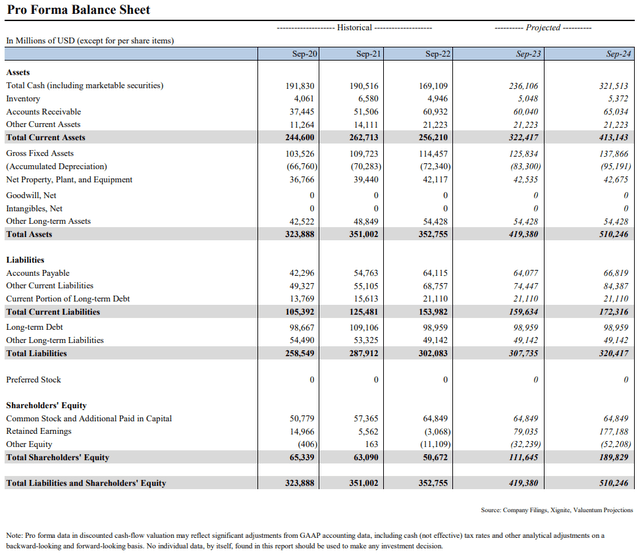

Pro Forma Income Statement of Apple (Valuentum) Pro Forma Balance Sheet of Apple (Valuentum)

Apple’s Fiscal Second Quarter Results Were “Good Enough”

Apple’s second-quarter results for its fiscal 2023 for the period ending April 1, 2023, were decent and what we would describe as being “good enough.” Revenue dropped 2.5% in the quarter from the same period a year ago, but iPhone sales showed better-than-expected resilience, even though the pace did not offset weakness in Mac and iPad performance. Apple’s quarterly EPS of $1.52 was unchanged from last year’s mark, and we’re viewing that as okay. Perhaps what we liked the most was that revenue in Apple’s Services business jumped more than 5%. This revenue tends to be higher margin, too

Based on difficult comparisons as a result of the rollout of the M1 chip last year, the weakness in quarterly Mac sales could probably have been expected, but the resilience in iPhone sales made the quarterly results good enough to stymie any potential sell-off in shares on the report. The long battery life and powerful camera of the iPhone 14 and iPhone 14 Plus and the strength in its Services operations were key. It’s amazing how Apple continues to deliver even in an uncertain global economy with so many moving parts across its supply chain.

Now let’s get to brass tacks: Would we be interested in “adding” Apple to the newsletter portfolios at current levels? Well, for starters, Apple is already a “position” in both the simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio, but to answer the question: Yes, even as it bumps against the high end of the fair value estimate range. It’s simply hard not to own Apple these days, in our view, even if only on an equal-weight basis. The high end of our fair value estimate range stands at $200 per share.

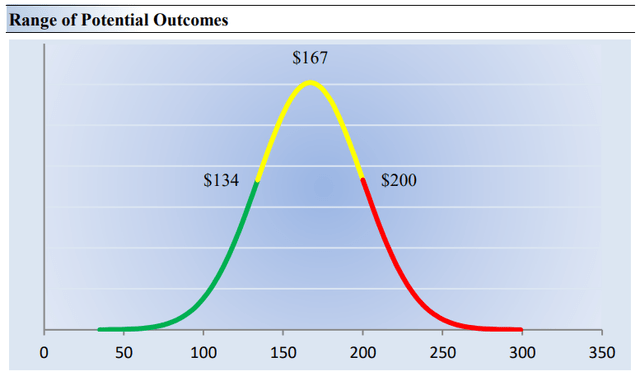

The High End of Our Fair Value Estimate Range for Apple is $200 (Valuentum)

Though we estimate Apple’s intrinsic value at ~$167 per share, it’s very important to note that, while the future is key in estimating intrinsic value, it is also uncertain and there are a range of probable outcomes. If the future were known with certainty, for example, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values. Why wouldn’t they? That’s why we like to use a fair value estimate range in our work; the larger the fair value estimate range, the wider the possibilities of future expectations.

In the graph above, we show this probable range of fair values for Apple based on the sensitivity analysis we perform. We think Apple is extremely attractive below $134 per share (the green line), but quite expensive above $200 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion. For investors that are more optimistic about Apple’s future expected performance, the high end of our fair value estimate range ($200) may be a reasonable valuation of the firm for them, and we generally fall into that ‘more optimistic’ camp.

Apple is extremely shareholder-friendly, too. The firm recently announced a $90 billion buyback program as it upped its quarterly dividend by more than 4%, to $0.24 per quarter. Apple continues to generate gobs of free cash flow, and the firm continues to showcase a net cash position of ~$57 billion at the end of its most recently-reported quarter, all the while the firm’s equity is supported by index fund flows into the largest holdings of the S&P 500. We continue to prefer the area of large cap growth, of which Apple is a key constituent, over small cap value, a view that has led to considerable alpha since the release of the first edition of our book Value Trap in late 2018. We expect Apple dominance to continue for the foreseeable future, and we’re excited about Apple’s future as we have ever been.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article and any links within are for informational and educational purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.