Summary:

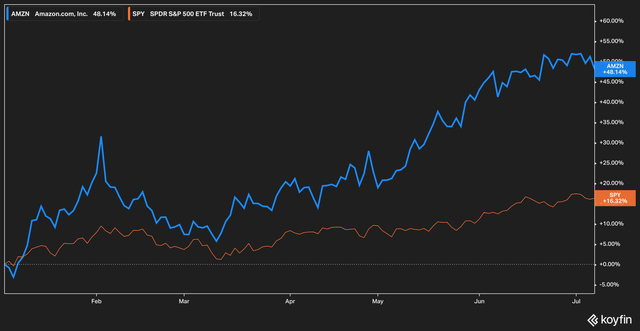

- Amazon’s shares have rallied by 48% this year, but concerns remain over the company’s ability to control costs.

- The company’s stock-based compensation has grown by 113% from 2020 to 2022, outpacing revenue growth.

- Amazon’s AWS unit continues to show weakness, with sales growth being outpaced by costs.

4kodiak/iStock Unreleased via Getty Images

Background

It seems like a lifetime ago that in 2022, the wider market believed that things were going generally not well for the everything store. From the January to December 2022, Amazon (NASDAQ:AMZN) shares plummeted by 50% as the market worried increasingly about the pressure inflation and subsequent interest rate hikes by the Fed would place on margins and what a possible recession would do to the company’s Amazon Web Services [AWS] offerings.

What a difference a few months can make.

This year the stock has rallied off of its low and rallied 48%, handily beating the broader S&P 500’s (SPY) year to date total return of 16%. However, despite this run-up, concerns still remain. The FTC has sued Amazon over what it calls deceptive practices regarding the customer cancellation process for Amazon Prime membership, and investors in general are worried that the broad market rally of 2023 might not have legs.

While litigation often grabs headlines, we don’t know what the total impact to the company could ultimately be, and we try to not concern ourselves with macro narratives where we can. However, we have three big concerns about Amazon going forward that keep us cautious. Let’s dive in.

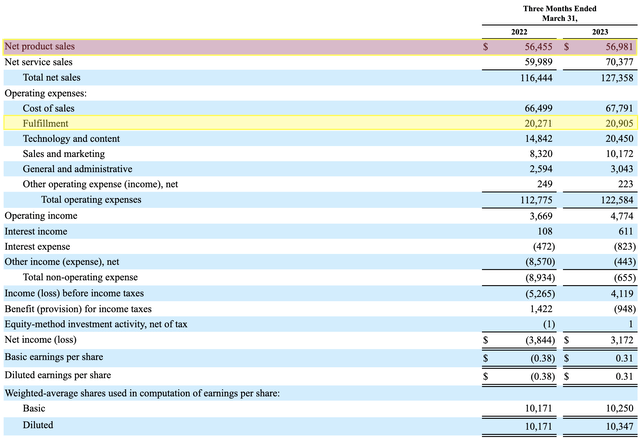

1. Fulfillment Sales & Margin

Amazon has always run on a razor thin margin, opting to keep prices low to gain market share overall. However, in recent years investors have been clamoring for the company to turn a more substantial profit. To this end, CEO Andy Jassey took time to emphasize on the Q4 2022 conference call that controlling costs in the fulfillment segment was going to be a top priority going forward.

The results of the company’s first quarter, however, don’t reflect the sense of urgency that investors were likely hoping for.

Company Filings, Author’s Highlights

While net product sales for the quarter were up 0.9% (highlighted in red), the cost of Fulfillment went up, not down, by 3.1%. Addressing this slow top line growth in product sales, CFO Brian Oslavsky noted in the Q1 conference call that “the uncertain economic environment and ongoing inflationary pressures continue to be a factor, and we believe it’s continuing to drive cautious spending across consumers. This means our customers are looking to stretch their budgets further and are focused on value.”

As far as cost-cutting, executives on the call noted that the company incurred an estimated $470 million charge for severance costs, but this is a proverbial drop in the bucket.

For his part, Jassey noted that the company had completed in the first quarter a re-vamping of its fulfillment network from a national to a regional focus. He said:

we spent the last several months not only redesigning dozens of processes to drive better productivity but also re-architecting our placement approach and larger fulfillment center footprint to move from a national fulfillment network in the U.S. to a regional one. It means we’ve created 8 interconnected regions in geographic areas with each of these regions having broad relevant selection to operate in a largely self-sufficient way while still being able to ship nationally when necessary.

Notably absent from his remarks were any insight on the cost savings to the fulfillment network that he alluded to in the Q4 call.

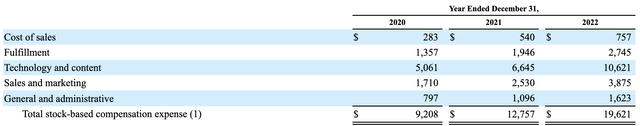

2. Accelerating Stock-Based Compensation

We are not strangers to criticizing stock-based compensation, especially in tech companies where the practice seems to run amok. However, Amazon has always been an exception to the rule, with fairly conservative stock-based compensation overall. That trend, however, seems to be moving in the wrong direction.

In the past three years, Amazon’s stock based compensation has grown by 113% from $9.2 billion in 2020 to $19.6 billion at the end of 2022. Revenue, in the meantime, has grown by 33% in the same period. Operating income in the same time frame shrank from $22.8 billion to $12.2 billion, and cash flow from operations has fallen similarly from $66 billion to $46 billion.

While it may be easy to shrug off $19 billion (as big as that number is) in the face of a company that pulled in over $500 billion in revenue in 2022, our point is more that a trend seems to be forming, since stock based compensation went from 2% of revenue in 2020 to 4% of revenue in 2022. Bottom line: we aren’t fans of stock based compensation growing at a faster clip than operating income or cash flow.

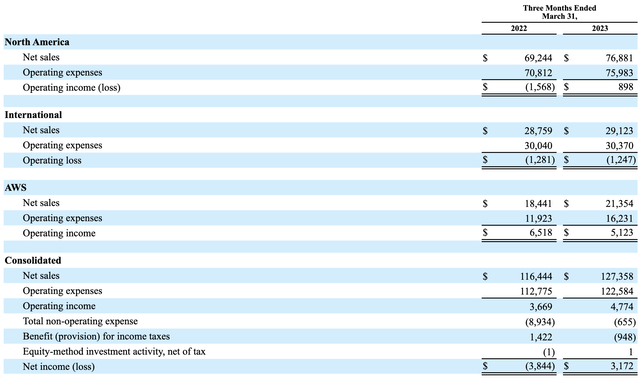

3. Continued AWS Softness

A looming concern for Amazon for the past few quarters has been continued weakness in its AWS unit, which has for many years now served as the true engine of Amazon’s growth and a main reason why the company can afford to run so close to the edge in its fulfillment business. This is not a new thesis, it has been promulgated among several analysts and even here on this site.

As readers can see in the chart above, AWS net sales rose by 16% year over year, but expenses grew by 37%–more than double–in the same time frame. Operating income declined in the same period.

For investors who were hoping to see Amazon pull back and adjust to market conditions, this isn’t exactly welcome news. And the rise in costs does not appear to be accidental.

CFO Brian Oslavsky commented on AWS sales weakness, noting “customers of all sizes in all industries continue to look for cost savings across their businesses,” while also stating later in the conference that “[w]e’re continuing to invest in infrastructure to support AWS customer needs, including investments to support Large Language Models and generative AI.”

Amazon appears to be placing a bet on the idea that headwinds in the AWS space will be temporary, and as such investments in AWS infrastructure remain a good bet. We wonder about this, however, given the fact that things seem to have changed in the macro environment–interest rates that are likely to be higher for longer are discouraging for startups and the smaller customers which are important for AWS.

The Bottom Line

We find it exceedingly difficult to bet against Amazon–the company has a scale that boggles the mind and a corporate culture that prioritizes ruthless execution above all else. It is in part, then, this very culture of growth and execution that makes us pause and wonder about the sustainability of the current rally. If management is unable to adapt to the current environment and generate returns for shareholders–to not grow indiscriminately but to recognize when to strategically pull back on the reins in an effective way–then we will have to remain on the sidelines for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information contained herein is opinion and for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. The opinion of the author may change at any time and the author is under no obligation to disclose said change. Nothing in this article should be construed as personalized or tailored investment advice. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.