Summary:

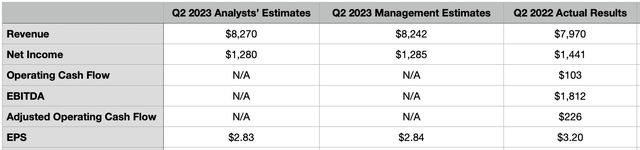

- Netflix, Inc. is expected to announce its Q2 2023 financial results on July 19, with management predicting sales of $8.24 billion, a 3.4% increase from Q2 2022, and earnings per share of $2.84.

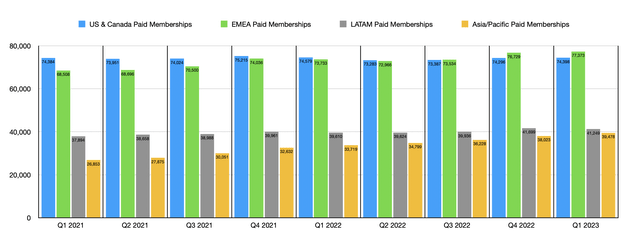

- The company’s subscriber numbers will also be closely watched; at the end of the most recent quarter, Netflix had 232.5 million subscribers globally, with the majority of growth coming from the Asia/Pacific region.

- Other factors to watch include the company’s recent initiatives to monetize users sharing subscriptions and its advertising activities.

Dean Mitchell/E+ via Getty Images

After the market closes on July 19th, the management team at streaming giant Netflix, Inc. (NASDAQ:NFLX) is expected to announce financial results covering the second quarter of the company’s 2023 fiscal year. As with any company in any year, it’s important to keep an eye out on quarterly results. After all, it’s usually during these times that big fundamental changes are revealed, changes that cause the perceived value of companies to shift materially. But this quarter more than most any should prove particularly interesting. Management has been working on a couple of initiatives aimed at boosting revenue and profits.

On top of this, the streaming market is being looked upon in a fairly negative light because of the risk of oversaturation by the other streaming services that are out there. Given everything that is going on, I would argue that Netflix likely will post some promising financial results for the quarter. But this still does not make the company an attractive purchase at this time in my book.

Keep an eye out on headline news

The first thing that investors will focus on when management announces financial results for the second quarter of the 2023 fiscal year will be the headline news items. This will largely center around revenue, profits, and subscriber numbers. At present, management is forecasting sales of $8.24 billion. If this comes to fruition, it would translate to a 3.4% increase over the $7.97 billion the company reported during the second quarter of its 2023 fiscal year. Analysts have a similarly positive outlook. The only difference is that they think revenue will be even higher at $8.27 billion.

On the bottom line, the picture is not quite as positive. The current expectation by management is that earnings per share will be around $2.84. That would represent a decline compared to the $3.20 per share reported the same time last year. Analysts, meanwhile, expect earnings per share of $2.83. Matching management’s expectations would translate to profits for the company of $1.28 billion, while matching the expectations of analysts would it result in a number that rounds out to that same amount. By comparison, during the second quarter of the 2022 fiscal year, the company generated profits of $1.44 billion.

There are, of course, other profitability metrics that investors would be wise to pay attention to. These are metrics analysts have been silent on and the same can be said of management. For context, operating cash flow in the second quarter of 2022 was only $102.8 million. But if we adjust for changes in working capital, that number more than doubled to $225.5 million. Meanwhile, EBITDA was substantially higher at $1.81 billion. If this disparity between the cash flow figures and the other two profitability metrics seems peculiar, it’s because of how the company manages its books. The firm doesn’t do anything wrong, mind you. Rather, it strips out from operating cash flow additions that are made to its content assets, while then stripping out from this the amortization of content assets. If we were to adjust for this, then adjusted operating cash flow for the second quarter last year would be $1.65 billion instead.

The last big item that investors will be paying attention to will be the number of paying subscribers on the company’s platform. At the end of the most recent quarter, the company had 232.5 million subscribers globally. This is up nicely from the 221.6 million that the company had at the end of the first quarter of 2022. In the most recent quarter available, and in many prior quarters, the vast majority of the growth for the enterprise involved its operations in the Asia/Pacific region. In the course of a single quarter, the company added 1.46 million paying subscribers to its platform from this area of the world. By comparison, the Latin America region reported a loss of 450,000. Throughout the EMEA (Europe, Middle East, and Africa) regions, the company added 644,000 to its roster. And in its most developed region, the U.S. and Canada, it added only 102,000.

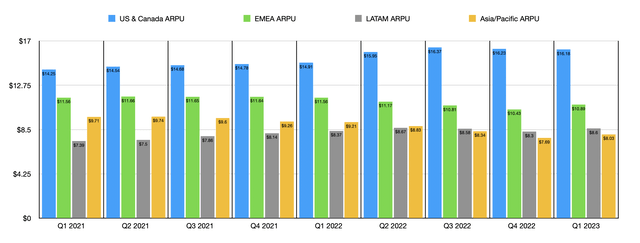

Where the company adds customers is very important. This is largely because not every customer is equal. In the U.S. and Canada, for instance, the average revenue per user totaled $16.18 per month in the first quarter of 2023. The lowest contribution came from the Asia/Pacific region at $8.03. What’s particularly worrisome is that, in every single quarter since the second quarter of 2022, with the sole exception of the most recent quarter, the company has seen a decline in its average revenue per user throughout the Asia/Pacific region the company is growing so rapidly in. Of course, this is nothing new. With the exception of Latin America, the company has been experiencing declines as it pushes for a larger customer base. If this trend persists, investors should expect the increase in revenue to be driven largely by additional users, with some of that growth being offset by a further decline in average revenue per user in most areas.

Watch out for recent initiatives

Outside of the fundamental data that I discussed already, there are a couple of other things that investors should be aware of. Most importantly, we should get some additional data regarding the company’s recent move to monetize users that had previously been sharing their subscriptions. During the first quarter of this year, management launched paid sharing in Canada, New Zealand, Spain, and Portugal. At present, Netflix has four different subscription services (in the U.S. at least). The cheapest of these, called standard with ads, is $6.99 per month. It also has a basic version for $9.99 per month, a standard subscription at $15.49, and a premium one at $19.99. For any subscriber who pays for the standard or premium offerings, there is the option to add additional paid users as part of the paid sharing program at a price of $7.99 per month per user.

On a global scale, addressing the sharing issue could prove to be a boon for the business. Management believes that there are over 100 million households that they have missed out on because of this. Not much data has been provided at this time regarding the first four countries that the company expanded paid sharing to. But they did say that, in Canada, they initially saw a decline in the number of overall subscribers. Having said that, by the second quarter of this year, the overall user base in Canada had grown to be larger than before they cracked down on free sharing. Given that there are a lot of similarities between Canada and the U.S., the hope is that a similar experience will be seen here at home.

Outside of this, another initiative involves the company’s advertising activities. During the first quarter of 2023, management said that it was able to achieve 95% content parity across the globe between the type of content on its platform for the advertising related subscriptions and those that do not involve advertising. In the U.S. market, plans that are offered discounted pricing in exchange for the ability to have ads resulted in average revenue generated per month coming in higher than the company’s standard plan. This means that their decision to bet on some consumers prioritizing savings over an ad free experience ended up being correct.

To further its advertising opportunities, the company also launched, during the first quarter, a programmatic private marketplace to allow for its advertising partners to manage their ad inventory. The company has implemented Microsoft’s (MSFT) sales platform and it has partnered up with other firms to help validate campaign engagements. Another feature included in this is the ability for its advertising partners to upgrade the quality of the video that their advertisements play on. It’s unclear how much of an impact this will ultimately have on the company. But investors should pay close attention to management’s rhetoric and any data that comes out on this issue.

Takeaway

At this moment, Netflix, Inc. looks set to have a really interesting quarter. I wouldn’t be surprised, with the paid sharing, advertising initiatives, and other things the company has going on, to see its financial performance come in quite strong. The bottom line will be more questionable though. While revenue growth will almost certainly be appealing, bottom line results will likely suffer compared to what they were last year.

This isn’t just me talking. Both management and analysts are of that opinion. In the long run, I suspect the company would do just fine for itself. Frankly, I do not view Netflix, Inc. as the best player in the streaming space. I personally believe that designation belongs to The Walt Disney Company (DIS). But for those who want a pure play in this space, Netflix is far from the worst prospect that could be entertained.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!