Summary:

- Lucid Group, Inc. Q2 deliveries report was disappointing, with the company producing 2,173 vehicles but delivering only 1,404, leading to a drop in its stock by over 10%.

- The company is struggling to meet its FY23 production guidance, having produced just 4,487 vehicles in H1, and is likely to fall short of its downgraded production guidance of 10,000 vehicles.

- Despite that, I assessed that Lucid’s price action likely bottomed out in June, although it has underperformed Tesla and Rivian lately.

- As such, the market has likely reflected significant pessimism, setting up Lucid for a possible reversal as buyers return to defend the selloff.

- The opportunity to become more constructive in Lucid has arrived. Upgrade to Speculative Buy.

Khosrork/iStock Editorial via Getty Images

If there was a time that I would consider Lucid Group, Inc. (NASDAQ:LCID) stock as a speculative set-up, the time is likely here.

Lucid delivered a highly disappointing Q2 deliveries report today (July 12), as the market sent it down more than 10% at writing. Accordingly, Lucid produced 2,173 vehicles in Q2 but delivered just 1,404. As such, it represented a deliveries/production ratio of below 65%, coming in well below the recent performance of Tesla (TSLA) and Rivian Automotive (RIVN).

It demonstrates that Lucid is still facing significant headwinds in meeting its production guidance for FY23 in the first half. Notably, it produced a total of just 4,487 vehicles in H1 (including 2,314 in Q1), indicating that it could fail to meet its already downgraded FY23 production guidance of 10K.

Another quarter of overpromising and underdelivering seems to be in the cards for Lucid holders, suggesting why short-sellers remained stubborn in their prognosis. Based on LCID’s short interest ratio as a percentage of its outstanding float, it reached nearly 40% in mid-June, setting up a potential for a massive short squeeze.

The critical question facing investors is whether some squeeze has occurred since LCID took out new lows in June.

The good news for LCID’s “diamond hands” is that it likely did. LCID bottomed out in June, as market operators set the “trap” following the decision by its EV rivals to adopt Tesla’s charging standard.

Barron’s attributed LCID’s relative underperformance then to the Lucid potentially losing its “charging speed advantage if Tesla’s charging standard prevails.”

I assessed that it likely encouraged bearish investors to hold on to their shorts and possibly load more as they tried to force LCID into lower lows decisively. However, LCID buyers refused to let that happen, as it also culminated with positive sentiments attributed to Lucid’s partnership with Aston Martin (OTCPK:AMGDF) and additional investments from Saudi PIF.

As such, dip buyers likely took the cue from the wave of selling in LCID to return as LCID bottomed out, taking the bearish investors by surprise. As such, while LCID recovered remarkably through this week’s highs (recovering all its losses in June), today’s selling could mark another opportunity for investors who missed buying its June lows.

While LCID is still priced at a premium, the market seems confident that it will continue to receive robust support from Saudi PIF as its cornerstone investor. That’s critical for a fledgling EV player, expected to burn through more than $9.6B in free cash flow from FY23-25. As such, PIF’s commitment to see through its investments in LCID has likely provided sufficient confidence for dip buyers to hold the line in June, anticipating further support as LCID looks to climb out from its underperformance.

I also expect the consensus estimates to be revised further downward for Lucid, as CEO Peter Rawlinson and his team could underperform its FY23 production outlook. However, with LCID underperforming TSLA and RIVN recently, I believe it has set up the stock well for a possible mean-reversion opportunity.

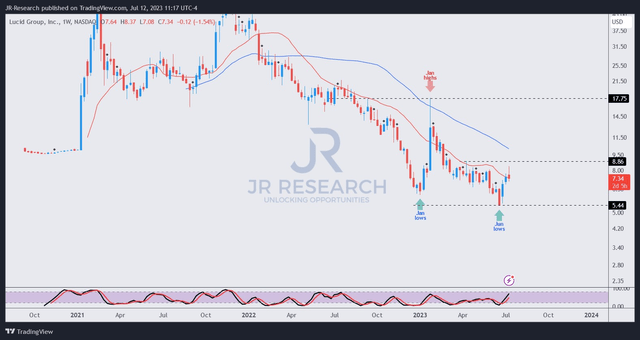

LCID price chart (weekly) (TradingView)

As seen above, LCID formed a bear trap or false downside breakdown in June, stunning bearish investors into a “well-disguised” trap. I believe some short-sellers who shorted into the lows have likely covered, as LCID recovered all its losses in June through this week.

However, LCID’s high short interest should persist (given its massive cash burn runway), providing more ammunition for dip buyers to return after today’s selloff to force them to cover further, intensifying the buying momentum.

However, the recent downward volatility could compel LCID to the $6 level before recovering. Hence, my thesis of a reversal could be earlier than anticipated. Despite that, I predicate my proposition on buyers holding the defense line at LCID June lows stoutly, suggesting that the risk/reward is favorable if the pullback doesn’t breach those levels decisively.

With that in mind, I gleaned that a speculative opportunity for Lucid Group, Inc. to reverse its underperformance against its peers has arrived, as the market has likely priced in significant pessimism.

Rating: Speculative Buy (Revised from Hold).

See additional disclosure below for important notes accompanying the thesis presented.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!