Summary:

- Netflix’s crackdown on password sharing and ad-supported tier subscription could increase its subscriber base, but growth estimates do not justify the company’s current valuation.

- Despite competition in the streaming market, Netflix’s financials are healthy with no insolvency or liquidity issues, and a strong return on assets and equity.

- The company’s intrinsic value is estimated at $319.63 a share, implying a 27% downside from the current valuation, suggesting it is slightly overpriced at present.

Wachiwit

Investment Thesis

After rallying over 140% in the last year and with earnings just around the corner, I wanted to take a look at Netflix’s (NASDAQ:NFLX) potential, to see if even after the rally, it would be a good investment in the long run. The company has a lot of potential of gaining more subscribers with its ad-supported tier, however, I would not buy into the company right now because the growth estimates do not justify the company’s valuation. Instead, I would look into taking some profits before earnings.

Outlook

I have seen with my own eyes how effective password-sharing initiatives worked in real-life. The people who were sharing accounts, without hesitation, added extras to their accounts. Sure, there will be some churn in the beginning in many instances, but over time it seems like NFLX will come out on top from this crackdown on the password-sharing business. The company rolled it out in LATAM first and seeing that it has expanded to other countries like Canada and Spain, I expect it will crackdown on password sharing in the US sometime in Q2 of this year. The company saw the biggest growth in sign-ups since 2019 after the initiative, so of course, it will be rolled out worldwide in the next year or two.

I think this initiative coupled with ad-supported tier subscription will go hand in hand. To add an extra user to the standard or premium subscription it will cost the person $7.99. Some will be fine in opting into adding, however, some others find it is easier and cheaper to get their subscription on the ad-supported tier, which will set them back $6.99 for 1080p quality and about 4 ads per 1 hour of watch time. I could see myself opting in for this tier especially now that 1080p is the standard on the tier. When it supported only up to 720p, I don’t think that was worth it.

So, what kind of growth prospects are we looking here at? An analyst estimates that the ad-supported tier will bring in $8.5B globally. That may sound like a lot; however, I don’t think that number is all new revenues. A lot of people may trade their subscription down from the standard and premium, and even the basic one. I could see a lot of people looking back at their budget and seeing that they are only watching two shows and are paying for a premium subscription, they may opt to downgrade to the ad tier, which means less revenue for NFLX.

The competition in the streaming market is fierce. There are so many players these days that companies need to come up with compelling stories that will keep the audience entertained. It is getting harder and harder to justify all the streaming subscriptions right now when in all of them, people watch only one thing or are waiting for the one thing to finally come out. At least that’s been my story for a while now.

With around 70m paying subscribers in the US, there is a lot of customers still waiting to be converted, unless they can make compelling TV for these new customers, they won’t attract a larger audience.

I will be very interested to see how NFLX performed in Q2. If we see negative subscriber growth, the volatility will be off the charts in the stock price, and I can’t wait to see it unfold.

Financials

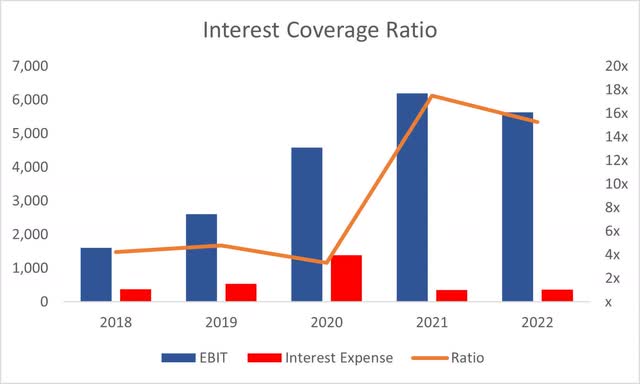

As of Q1 ‘23, the company had around $7.8B in liquidity against $14B in long-term debt. NFLX has not been paying down debt much, but I don’t think it’s a bad thing. A lot of investors will not even look at a company with massive amounts of leverage on books, however, if the annual interest expense on debt is manageable, then the company is safe from default. In the case of NFLX, the interest coverage ratio has been very healthy over the last 5 years, and it stood at around 15x as of FY22. What this means is that EBIT can cover annual interest expenses 15 times over. Many analysts and websites quote a coverage ratio of 2 as being healthy, so it seems NFLX has no insolvency issues.

Coverage Ratio (Author)

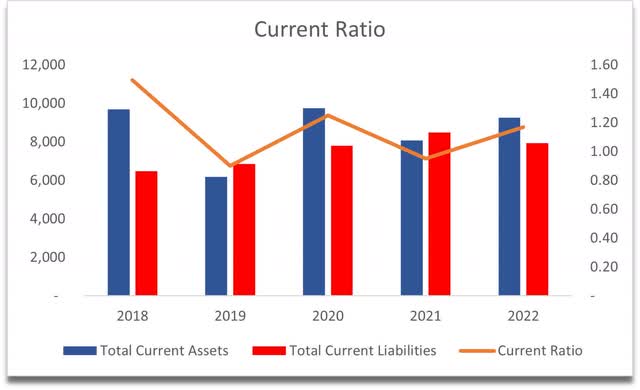

The company’s current ratio is about the minimum I’d like to see, around 1, meaning if the company had to pay down all its short-term obligations at once, it would be able to and will still have some liquidity left over because the ratio stood at 1.17 at the end of FY22. The company seems to have no liquidity issues either.

Current Ratio (Author)

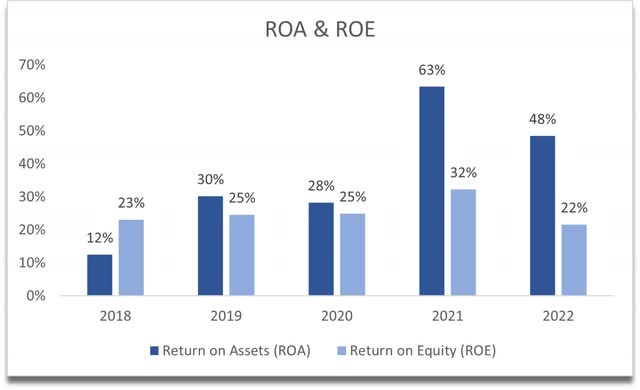

Looking into profitability and efficiency, the company’s ROA and ROE have been very strong in recent years, with a slight dip in FY22. But it is still well above my minimum of 5% on ROA and 10% on ROE. This tells me that the company seems able to utilize the company’s assets and shareholder capital effectively and efficiently, thus creating value.

ROA and ROE (Author)

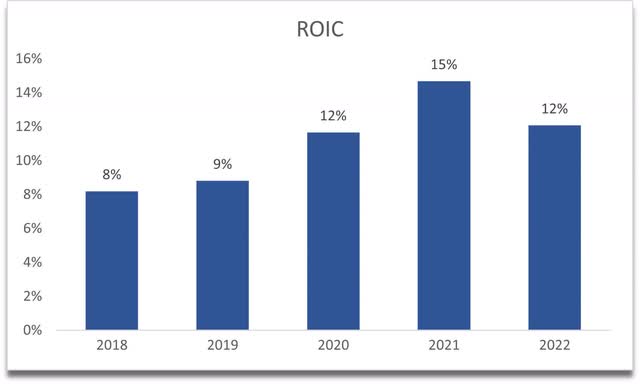

In terms of competitive advantage and moat, the company’s ROIC is still very decent with a similar dip in FY22 like the above metrics show, however, it still looks like the company has a competitive advantage and a strong moat even with so many other streaming platforms in the world. I’d want to see ROIC stabilizing or coming back up in the future.

Return on Invested Capital (Author)

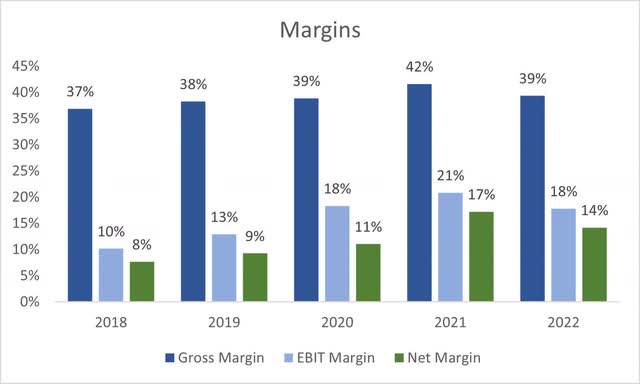

In terms of margins, we can see that 2022 has been a tough year. Margins contracted slightly y-o-y; however, the co-CEOs are guiding 18%-20% for the full year ’23. We’ll have to wait a couple more quarters to see how this will play out, but I would take their words with a grain of salt.

Margins (Author)

Overall, I would say the company’s books are quite healthy and no particular red flags showed up. Maybe just the slight downtick in FY22, but I’ll keep my view more optimistic here and say these will improve over time.

Valuation

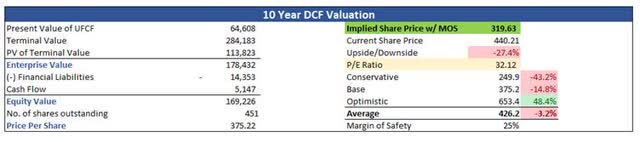

I’m going to approach this valuation with an optimistic outlook. I usually don’t do this but even with solid growth over the next decade, the company is slightly overpriced right now. Spoiler alert.

For the base case on revenues, I decided to go with a 14.5% CAGR over the next decade. I don’t think it can grow much faster given that subscriber counts aren’t growing very quickly any longer. But just in case the ad-supported tier and crack down on password sharing works like a charm and the company sees little churn, for the optimistic case, I went with 18.3% CAGR, while for the conservative case, I went with 12.5%.

In terms of margins, I decided to linearly improve gross and operating margins by around 200bps or 2% because I don’t see how it could improve them by much more than that, seeing that their target operating margins are at around 20% on the upper end. These improvements will bring net margins from around 14% in FY22 to around 20% by FY32 which seems reasonable.

To account for any calculation errors, I will add a 25% margin of safety to the intrinsic value calculation based on the assumptions above. As I said earlier, the company is slightly overpriced right now, and I wouldn’t invest. My intrinsic value calculation of NFLX is $319.63 a share, implying -a 27% downside from the current valuation.

Intrinsic Value (Author)

Closing Comments

I think I’m still being very generous in revenue assumptions here and I believe that for an even better risk profile, I would look to buy the stock below $300 a share. The company is up almost 50% YTD and a whopping 148% in the last year. If the company misses badly on a couple of quarters, I wouldn’t be surprised by a drop of 25% or more in the stock price in one day. The company seems priced to perfection and will be very volatile come earnings.

I’d say there will be some profit-taking after such a run-up and I would stay away for now and wait for some decent pullback. I would also take some of those profits if I was lucky enough to get in last year at those lows and wait for that pullback to enter at a better risk/reward profile.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.