Summary:

- Box Inc. is a leading cloud content management and collaboration platform. Growth has been strong thus far, although looks to be slowing.

- The company faces stiff competition from other cloud storage providers like Dropbox, Microsoft OneDrive, Google Drive, and Adobe. Relative to these businesses, we believe Box’s offering is noticeably inferior.

- Industry tailwinds should keep growth positive, as should its focus on differentiation, but we do not believe this will be a high-growth SaaS company.

- Relative to other software businesses, we believe the business is lacking attractive financials, especially due to its substantial SBC.

- With an EBITDA multiple in excess of 40x, we do not consider this a good investment.

Galeanu Mihai/iStock via Getty Images

Investment thesis

Our current investment thesis is:

- Box Inc. (NYSE:BOX) has managed to achieve strong growth due to its early entry into the market, development of related services, and focus on data protection. Although this has represented value for much of its history, we believe the likes of Microsoft (MSFT) now offer consumers far better value for money, leaving the business as a niche player.

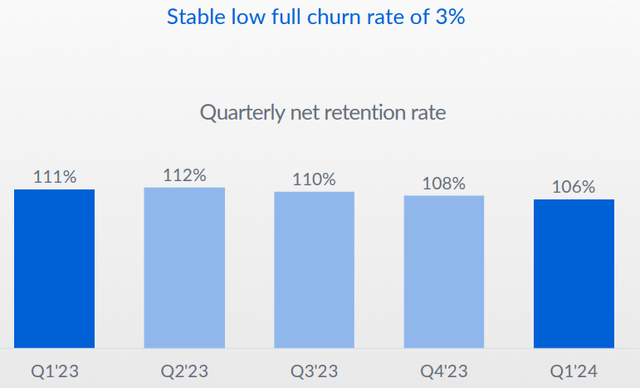

- This is reflected in its growth, which is noticeably declining. With net retention falling toward 100% and billings growth also slowing, we are concerned both commercially and financially.

- High SBC represents an unjustifiable cost to the business and we do not consider its capital allocation optimal.

- BOX stock looks overvalued when adjusting for SBC, although we should note it generates strong cash flows.

Company description

Box Inc. is a leading cloud content management and collaboration platform that enables organizations to securely store, access, and share their files and content. Founded in 2005, Box serves a diverse range of industries, including finance, healthcare, technology, and education.

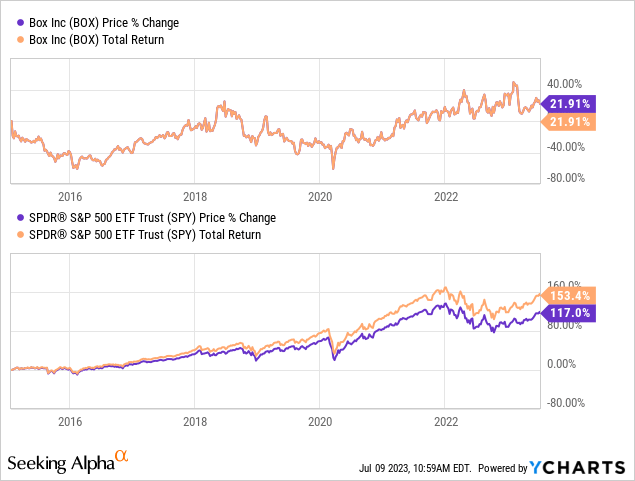

Share price

Box’s share price has underperformed the market since listing, as investors are hesitant about the success of the business model, as well as how the business will financially develop in the coming years.

Financial analysis

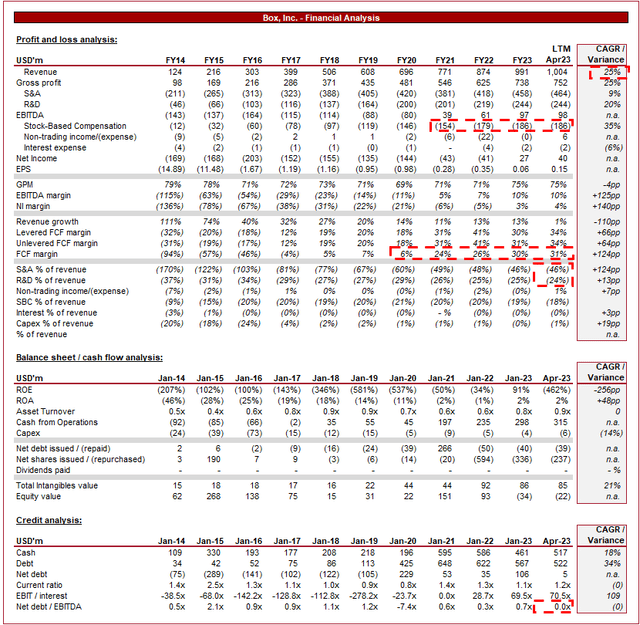

Presented above is Box’s financial performance for the last decade.

Revenue & Commercial Factors

Box’s revenue has grown at an impressive CAGR of 25%, reflecting a rapid adoption of its services. This said, growth has slowed relative to the average in the last 4 years, seemingly on a downward trajectory.

Business Model

Box provides a cloud-based platform that allows users to store, manage, and collaborate on files and content from any device, seeking to enhance productivity and collaboration. The utilization of cloud-based services has rapidly increased due to a reduction in costs and an ever-increasing amount of data processing by businesses, allowing employees to efficiently collaborate globally.

Box has expanded beyond its initial storage solution, providing related services that utilize its fundamental cloud infrastructure, such as file collaboration, data security, and signature services. This is a vital development for the business, as the bundling of related services is critical to justifying the value proposition to consumers, as competitors do the same. Further, this allows Box to upsell to customers, improving its average revenue per customer.

Box’s services (Box)

Box generates revenue through subscription fees, offering different pricing tiers based on storage capacity, features, and customer needs. This is considered a highly lucrative revenue source, as subscriptions allow Box to generate recurring revenue from customers for an extended period, while the marginal cost is minimal.

Unlike many of its peers, Box primarily targets enterprise customers, providing them with scalable and secure content management solutions, tailoring their needs into a holistic package. We believe this is a good strategy as it allows Box to access lucrative customers, as enterprise users are more likely to bundle services and enroll the majority of their employees.

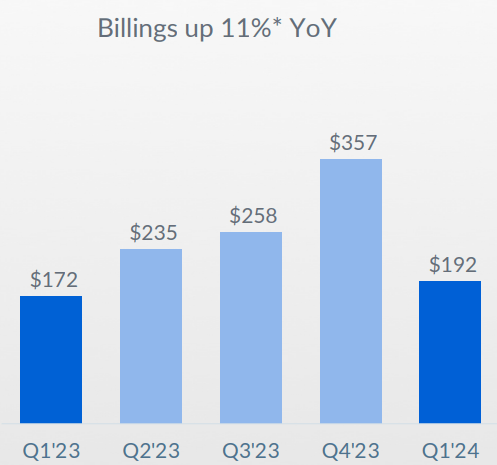

Billings data is more representative of the earnings potential of the business, as the accounting standards understate the growth trajectory of the business (customers who are billed in advance). Billings are currently up 11% YoY, which implies a material slowdown from its prior trajectory. This suggests the forward revenue curve is beginning to decline.

Billings (Box)

In order to assess the reason for this, we must consider the billings bridging drivers. Customer billings will move based on new/lost customers and up/down selling.

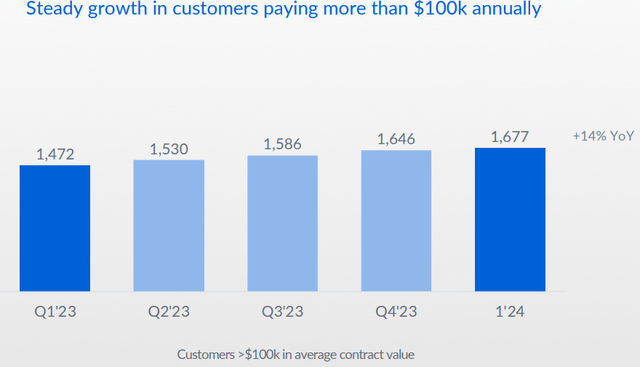

New customer growth continues, although it has materially slowed when considering this QoQ. This further supports the evidence that Box’s revenue will slow further due to commercial weakness.

The contributor to slowing billings looks to be down selling/churn. As the following illustrates, net retention is declining (Value change, which is why net retention can be over 100%), which implies a weakness in the quality of the service. This could be clients reducing their number of users due to economic conditions, or businesses struggling and so canceling their subscriptions, but we do not believe this will be material. This is a concerning trend that has continued for several quarters.

Competitive Positioning

Box’s competitive position revolves around the following factors:

- Box has a strong brand and a loyal customer base, developed through the delivery of reliable and quality services.

- Box has focused on developing its integration capabilities with various third-party applications and platforms (>1000)

- Product development, such as Box Collaboration and Platform, allowing the business to expand its valuation proposition.

- Finally, Box offers enterprise-grade security measures, including encryption, access controls, and compliance certifications, to protect sensitive data. This is a key advertised capability for the business, developed to attract those who deal with highly confidential data, such as the US Air Force. This is likely the reason for its strong performance in Finance, the public sector, and Healthcare.

Cloud-solution Industry

Competitors differentiate themselves through its features/capabilities, pricing, bundling of related services, and ease of use. Box faces competition from cloud storage and content management providers such as Dropbox (DBX), Microsoft OneDrive (MSFT), Google Drive (GOOG), Adobe (ADBE), and Amazon (AMZN).

Although Box has clearly developed a strong suite of products and competitive position, reflected in its growth and margins, we do not believe the company is competitive long-term, and consider the advantages listed above to be dwindling fast. This is due to the competition it faces. All of the peers listed above, barring Dropbox, have bundled highly valuable services into a single subscription (as opposed to Box’s less significant ones). The best example of this is Microsoft, which provides Microsoft 365 (Excel, Word, etc.), as well as Messaging/conference, Cloud storage, and security solutions under one subscription. It is difficult to then justify paying a similar price for Box when most offices required Microsoft anyway. This is similar to the creative industry. If a firm is going to have a subscription to Adobe’s suite anyway, why pay for a separate storage solution?

We believe this poor value proposition is the primary reason for the slowdown both Dropbox and Box have experienced, as clients increasingly migrate to other services. This said, we should highlight that Box’s “platform” development is positive and at least keeps Box in the game, providing better potential than Dropbox.

We are not necessarily suggesting revenue will decline, however, as we are highly bullish on the industry, and as the saying goes, “a rising tide lifts all boats”.

The increasing trend of remote work, enhanced by the pandemic globally, is increasing the demand for cloud-based solutions, regardless of the industry within which the business operates. We expect this trend to continue in the coming years, as new businesses embrace the technology and new employees are automatically enrolled.

With businesses increasingly collecting data to better target customers, there are heightened concerns about data privacy and compliance with regulations (which are becoming stricter). This necessitates robust security measures and so Box’s positioning as a data protection-focused business could represent a key selling point to capturing customers. We do question how broad this remit is, however, and how comparable it is relative to Microsoft and Co.

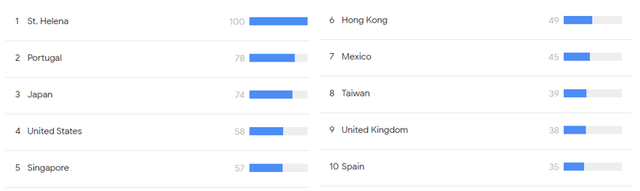

Global expansion represents a key opportunity. Another attractive characteristic of software businesses is their ability to easily migrate their services to new markets. We believe Box could find success by targeting new markets, expanding beyond the lucrative economies that the larger players focus on. This looks to be the case as the following illustrates.

Margins

Box’s margins have improved over the historical period, as the business transitioned from an aggressive investment in growth to a sustainable business model. Further, this reflects a reduction in the cost of servers over time.

Interestingly, Box’s GPM has declined over time, potentially suggesting an aggressive acquisition approach, adjusting prices generously for large customers.

For this reason, much of the cost saving has come from S&A, as the business has reduced relative investment and also materially benefits from operating cost leverage.

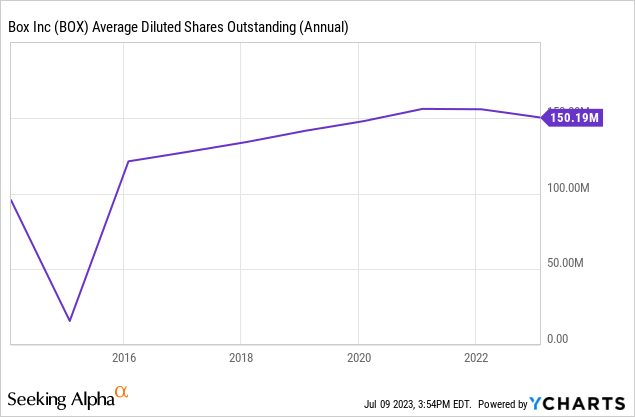

Share-based compensation, as with many other tech businesses, is substantial. In the LTM period, this represented 18% of revenue, which is the reason for the poor EBITDA-M. Given the clear business model weakness, we are not the biggest fan of how large these payments are, given we expect growth to slow.

We are also not a fan of adjusted EBITDA but for the purpose of informing the reader, the LTM FY22 Adj. EBITDA-M was 29.8%.

Balance sheet & Cash Flows

As with other software businesses, Box’s balance sheet is uneventful. The only point of interest is the substantial share buybacks relative to the earnings potential of the business. This implies Management sees no valuable reinvestment opportunity, which is unusual given the glaring issues with the business model, and more recently, growth. Over $1bn has already been distributed, which could have otherwise been allocated to M&A to broaden its service offering.

Outlook

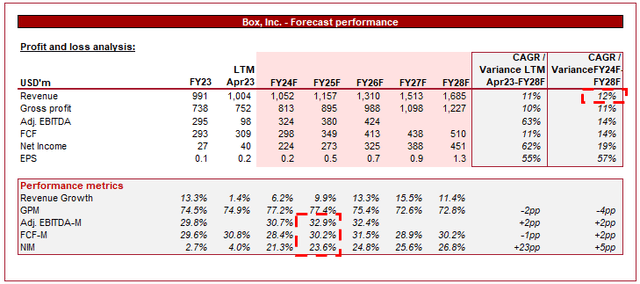

Presented above is Wall Street’s consensus view on the coming 5 years.

Analysts are forecasting growth in line with recent years, with a CAGR of 12%. It is interesting that Management is forecasting 6% growth in FY24, suggesting they are expecting a continuation of this trend, with analysts in agreement.

We do not see any reason to suggest a 12% rate is possible, given the downward trajectory. The business is in the process of developing an AI solution, but we are not convinced. Beyond this, the scope for improvement looks limited.

Margins are expected to improve but are likely a reflection of declining SBC as a % of revenue, as margin improvement beyond this has not been materially achieved for several years.

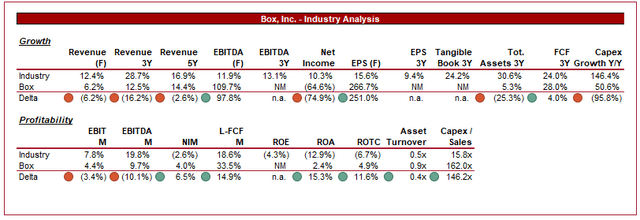

Industry analysis

Presented above is a comparison of Box’s growth and profitability to the average of its industry, as defined by Seeking Alpha (84 companies). We have compared the business to all profitable (EBITDA level) software businesses listed by Seeking Alpha, as comparing Box to the likes of Microsoft will not provide any further information beyond what we already know.

Box looks unimpressive relative to the pack. It is growing at an inferior rate while producing significantly lower margins. SBC is contributing to this but it’s likely many of the industry participants are paying this, also.

The only attractive quality of the business is its FCF, enhanced by a small balance sheet and recognition of deferred commissions paid to staff.

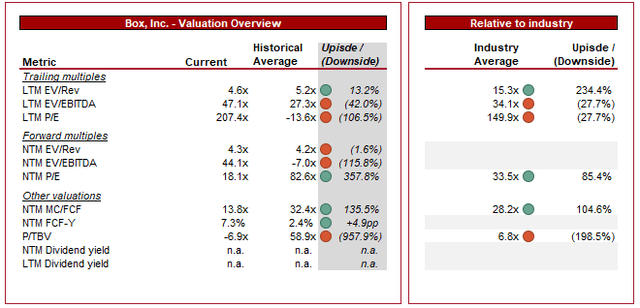

Valuation

Box is currently trading at 47x LTM EBITDA and 44x NTM EBITDA.

Note, in order to calculate NTM EBITDA, we have applied the current EBITDA margin, which is the ballpark of where the company will land, to the analyst forecast. Currently, Box’s NTM EBITDA is being quoted at 14x by data sources, this is based on adjusted EBITDA. We are in the “SBC is a genuine expense so expense it” camp, and so believe it should be priced in.

At this level, the company is wholly unattractive in our view. To justify such margins, the business must be able to achieve consistent strong growth, alongside attractive margins. This is not the case. If growth was rapid, the SBC would be sufficiently diluted, this is not the case.

Key risks with our thesis

The risks to our current thesis are:

- Box AI and Platform. Although we are not overly convinced by AI, especially when Microsoft have OpenAI and Google have Bard, this does represent the scope for significant value add. Currently, the use of AI at an enterprise level is limited due to data concerns. Box is providing this locked within its encryption, allowing businesses to obtain the value of AI without the risk of it learning said information. Platform equally represents an opportunity to disrupt the content development space.

- M&A. Although we think Box as a standalone business is unattractive, it represents a quality offering as part of a wider group for the same reason. A larger peer targeting office-based enterprises would be a perfect option. SAP? (SAP), Intuit? (INTU), Salesforce? (CRM), there are certainly a few good options. At an EV of $4.6bn, it does not represent a large purchase.

Final thoughts

We recently covered Dropbox (here) and believed the business to be highly unattractive due to its poor value proposition and high SBC. Box looks to be following in its footsteps, implying slow growth and no price action ahead. Although we have been harsh, it is not to say Box’s services are bad. I have used it personally alongside OneDrive and attest to it being fairly good. The issue is that it is not good value for most enterprises, limiting its growth potential.

We do not believe the business is attractively priced despite its high FCF. This said, its FCF alongside industry tailwinds should keep revenue growth positive.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, AMZN, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.