Summary:

- Tesla, Inc., the world’s leading electric vehicle manufacturer, is expected to report Q2 2023 revenues of $24.69B, representing YoY growth of around 46%.

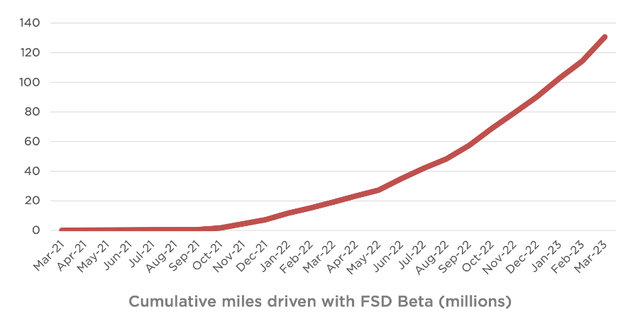

- The company’s strategy of pushing for higher volumes at lower margins may pay off in the future with the development of its full self-driving technology.

- Despite a drop in brand reputation and falling automotive margins, we maintain a “Buy” rating on Tesla stock with a 3+ year time horizon.

- Here is what investors should be keeping an eye on when Tesla reports its Q2 2023 results next week.

AdrianHancu

Investment Thesis

Tesla, Inc. (NASDAQ:TSLA) is the world’s leading electric vehicle (“EV”) manufacturer, with an inspiring mission to “accelerate the world’s transition to sustainable energy.” It has been at the forefront of this industry since its inception almost 20 years ago, but it is in the last five years where Tesla has truly transformed itself from a challenger into an industry behemoth.

I outlined my personal investment case for Tesla in a previous article, but I will summarize my thesis below.

The company has already shown an ability to achieve operational efficiencies and margins that are far greater than its incumbent ICE (internal combustion engine) competitors, but this is only the beginning. According to Statista, the Global Electric Vehicle market is expected to grow to achieve a 10.07% CAGR from 2023 through to 2027, reaching a size of $907 billion, and Tesla is leading the charge.

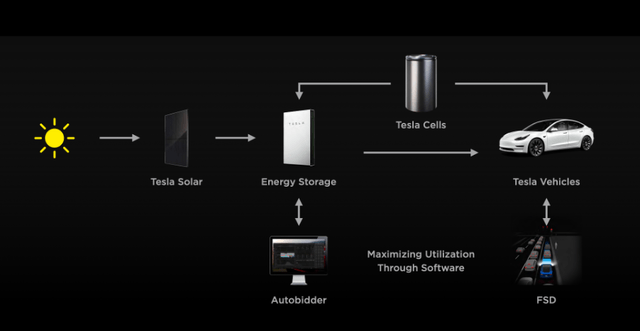

The blessing (or curse) of investing in Tesla is that the company has so many potential areas for future growth outside of electric vehicles, with autonomous driving and energy storage being two avenues with arguably the greatest potential.

Tesla Investor Day 2023 Presentation

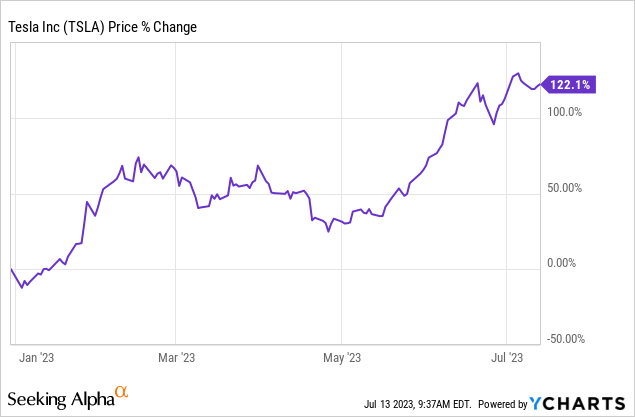

But it hasn’t been all sunshine for Tesla over the past couple of quarters, as the company began cutting prices for its vehicles left, right, and center, which has resulted in automotive margins plummeting and shares initially getting whacked.

However, shares have recovered incredibly and are up by over 120% so far in 2023!

Now the focus is shifting to Tesla’s Q2 2023 results expected next week, and here’s what investors should be keeping an eye on.

Tesla’s Q2 Expectations

Tesla is set to report its Q2 2023 results on Wednesday, July 19, after the market closes. There are plenty of things for investors to look out for.

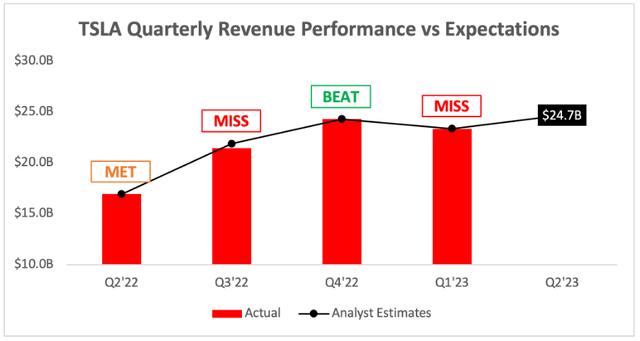

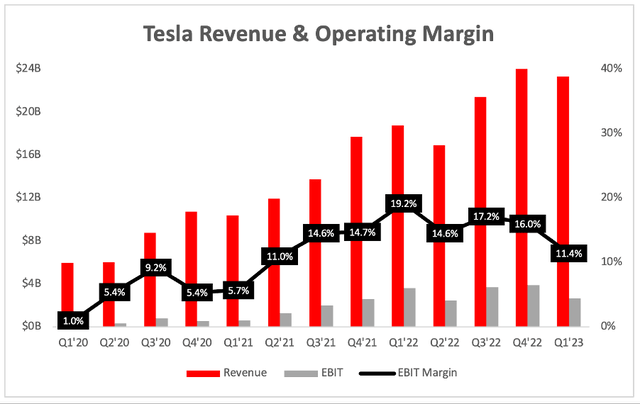

Starting with the headline numbers, analysts are expecting Q2’23 revenue of $24.69B, representing YoY growth of ~46%. Given the difficulties that the global economy has faced over the past year, it would be incredibly impressive to see Tesla pull off such strong top line growth.

Analysts tend to be pretty spot on when it comes to predicting Tesla’s quarterly revenues, as the chart above demonstrates. But it’s not because analysts possess a crystal ball for Tesla – rather, it’s due to Tesla releasing its quarterly vehicle delivery figures in advance, which gives analysts a much clearer picture when trying to forecast quarterly revenue.

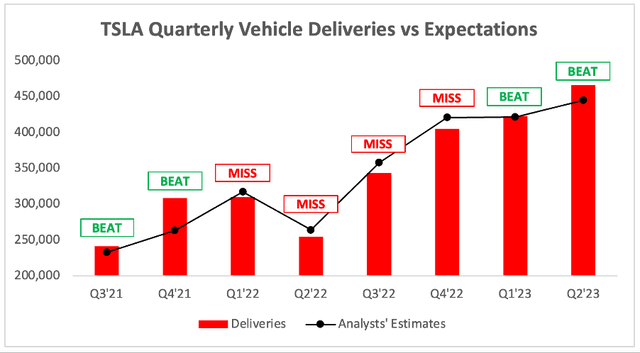

And talking about vehicle deliveries, Tesla had an absolutely brilliant Q2! The company grew its total Q2 deliveries by 83% YoY to 466,140 vehicles, although this time last year Tesla was facing a partial shutdown of its Shanghai factory due to Covid-19 lockdowns, which makes that percentage look a bit better than it really is.

Even so, this delivery figure came in substantially ahead of analysts’ estimates – in fact, this is the biggest beat on deliveries since Q4’21, and it sent shares spiking up 6% earlier this month when the numbers were released.

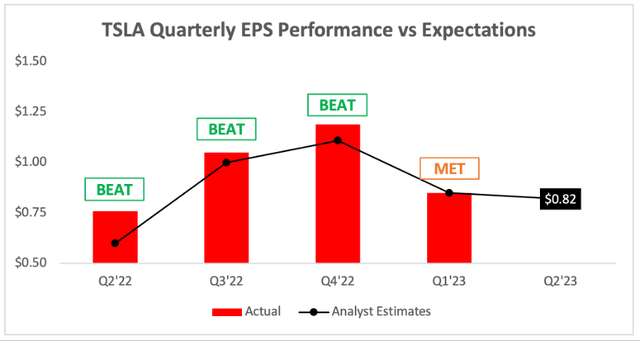

But it’s not all good news, as a lot of this revenue growth has been driven by price cuts and resulted in lower profitability, which is why analysts are only expecting Tesla’s Q2 2023 EPS to grow 8% YoY to $0.82.

Despite Tesla being a growth story, I think margins and profitability are going to be very much in the spotlight once again when Tesla reports next week, and it might not be a pretty picture.

From Growth Story To Growth And Margin Story And Back To Just A Growth Story

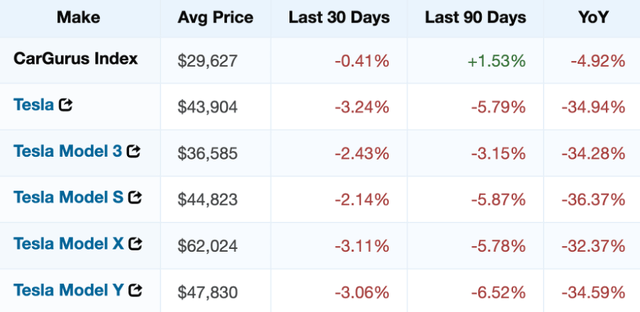

It’s no secret that Tesla has been slashing the prices of its cars aggressively over the past year. Add in some overall deflation in the car market, and it paints quite a staggering picture; according to CarGurus (CARG), the prices for all Tesla models have dropped by more than 30% in the past twelve months, compared to an average fall of 5% for all cars in the CarGurus Index.

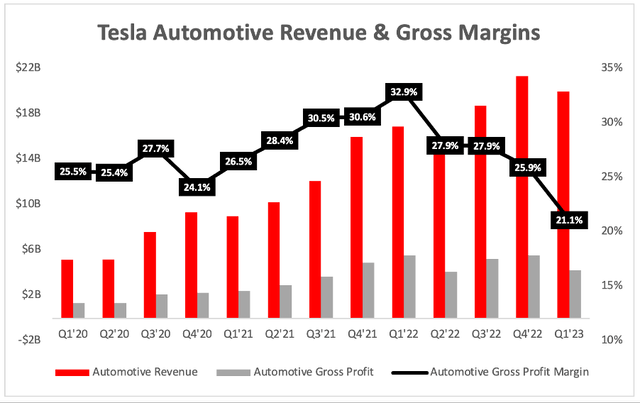

Unsurprisingly, this has seen Tesla’s automotive gross margins tank – falling from 32.9% in Q1’22 to just 22.1% in Q1’23.

It looks like investors should get used to this new normal, with Tesla’s impressively high margins being a thing of the past (at least for now), as CEO Elon Musk spoke on the Q1’23 earnings call about the approach Tesla will take (emphasis added):

We’ve taken a view that pushing for higher volumes and a larger fleet is the right choice here versus a lower volume and higher margin. However, we expect our vehicles, over time, will be able to generate significant profit through autonomy. So we do believe we’re like laying the groundwork here, and then it’s better to ship a large number of cars at a lower margin, and subsequently, harvest that margin in the future as we perfect autonomy. This is an extremely important point.

This approach will make a lot of sense if Full Self-Driving (“FSD”) comes to fruition. Tesla cars are more like computers, so I completely agree that it’s a good idea to get as many of these cars out there as possible, and then drive further profitability through high margin software.

Musk also points out that Tesla still has an industry-leading operating margin (which it does), but this also collapsed over the past few quarters, from 19.2% in Q1’22 to 11.4% in Q1’23.

Tesla had been moving from a growth story to a growth and margin story, but now it looks like we’re moving back to solely a growth story for the time being. However, as the company continues to ramp up production, and if it manages to one day deliver FSD software as a meaningful revenue driver, then I wouldn’t be surprised if these strong margins return in the future.

Is Tesla’s Brand Suffering?

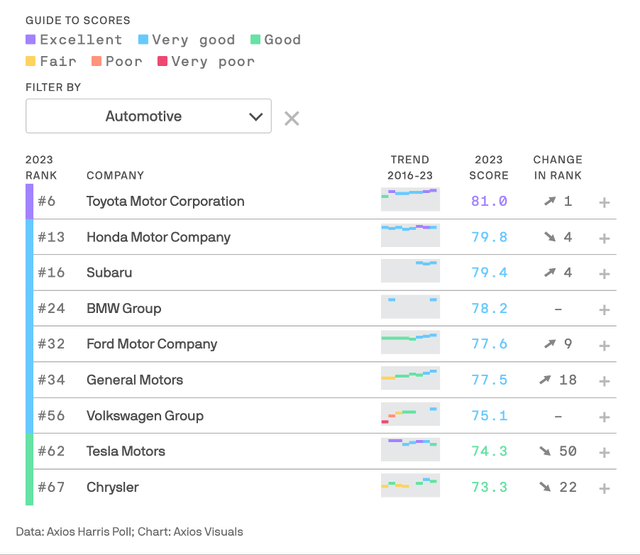

I spoke a bit in a previous article about the risk that Tesla CEO Elon Musk and his antics on Twitter pose to Tesla’s long-term story. My overall fear is that Musk is wading into culture wars and splitting opinions, and given that he is so strongly associated with Tesla, any unnecessary controversy for Musk may lead to a deterioration of Tesla’s brand and harm any potential investment in the business.

For example, I’d always thought that Tesla’s strong brand gave it a level of pricing power – so I am left wondering now if Tesla is making the choice to cut prices because of its long-term software strategy (makes sense), to make up for a weak economy (makes sense), or if its cutting prices in order to boost demand due to a deterioration of brand strength (also makes sense).

A recent article by Axios takes a look at the brand scores of certain companies, and Tesla plunged from being ranked at #11 in 2022 to #62 in 2023, seeing one of the biggest falls in reputation over the past year.

Whether you agree or disagree with Musk’s views, any investor taking a look at Tesla should be able to recognize that unnecessary controversy leading to brand deterioration is not a good thing.

The Future Looks Bright

There remains a lot of reasons to be optimistic as a Tesla shareholder, but two of the most exciting future opportunities include Full Self-Driving and Energy Storage.

As with every Tesla earnings call, I’ll be keeping my ears peeled to hear any update that management offer on autonomous driving. With the company’s new approach of selling its cars for less in order to boost sales and then drive profitability through software, FSD is arguably more important than ever.

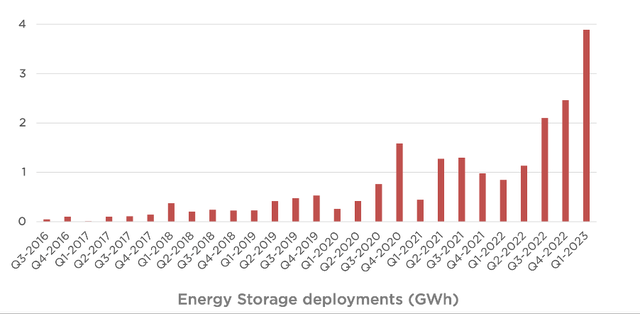

I’m also particularly excited about the Energy Storage business, which has had a fantastic year so far.

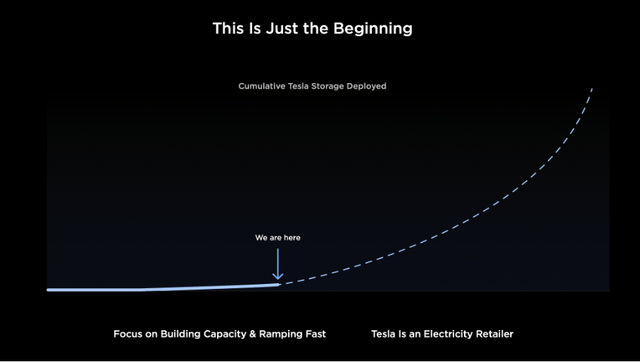

Energy Storage revenues grew 148% YoY in Q1’23 to reach ~$1.53B and are starting to positively impact gross profits. Per the below slide from Tesla’s Investor Day 2023 presentation, this area of the business still has potential to see growth explode.

Tesla Investor Day 2023 Presentation

TSLA Stock Valuation

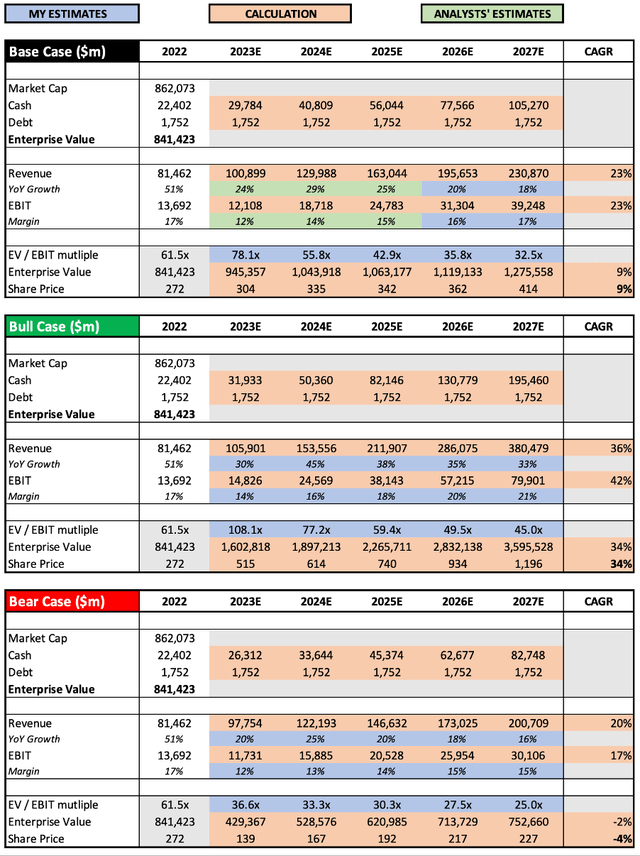

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Tesla is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

The assumptions made in this article have changed very little from my previous article. The main tweaks have been to slightly reduce margins (for the reasons mentioned) and to reduce growth very slightly in the bull case – although let’s be honest; given all the huge market opportunities that Tesla is pursuing, the company has the potential to exceed even the most optimistic growth expectations as it has done in the past.

Putting all that together, I can see Tesla shares achieving a CAGR of -4%, 9%, and 34% in my respective bear, base, and bull case scenarios.

Bottom Line

Tesla is never going to be a straightforward investment, because it is a company that seeks to tackle some of the most difficult but most substantial issues of our generation – and if it fails, it will be painful for shareholders, but if it succeeds… well, it should be pretty incredible.

Talking about the here and now, I think investors should continue to watch the automotive margins this quarter. These margins have fallen so sharply recently, and I will start to feel uncomfortable as a shareholder if the margins continue to tumble; personally I’m hoping to see them stabilize.

All things considered, I will reiterate my previous “Buy” rating on Tesla. Shares will rarely be cheap for a company such as this, but they are at a level now which I’m just about comfortable buying, as always with a time horizon of 3+ years.

Time to wait and see what happens next week!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.