Summary:

- PayPal’s shares have dropped nearly 80% over the last two years, but the shareholders’ pain may finally be nearing an end.

- PayPal is making a number of strategic moves to drive accounts and payments volume growth.

- This is an opportune time for long-term investors to load up on PayPal stock, before it inevitably rallies.

FG Trade

PayPal (NASDAQ:PYPL) has been a nightmare for its shareholders of late. Its shares have declined in value nearly 80% in the last 2 years as its user accounts growth decelerated and eventually plateaued in recent quarters. Investors are concerned that growing competition in the peer-to-peer space will nab away market share from PayPal and make it harder for it to grow going forward. While these are legitimate concerns, the ground reality is not that dire. In this article, I’ll address these key issues and attempt to explain why PayPal makes for a good buy at current levels. Let’s take a closer look to gain a better understanding of it all.

The Core Issues

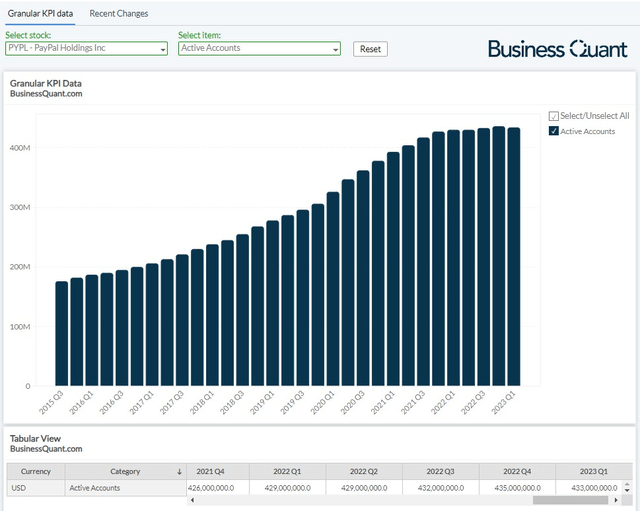

Let me start by saying that the core issue that’s surrounding PayPal is that its user accounts growth has stalled. This is fueling speculation amongst investors that, perhaps, the FinTech firm is no longer a growth company and maybe it’s succumbing to competitive pressures of late.

Now there are a number of reasons for this happening. Competing peer-2-peer money apps have propped up in recent years that offer a better user interface and more flexibility and integrations when it comes to money transferring capabilities. Cash App from Block (SQ) went a step further in 2021, by offering accounts to users who are 13 years or older.

Although PayPal’s Venmo competes directly with Cash App, it has so far onboarded users who were 18 years or older only. To put things in perspective, there were approximately 25.1 million US teens in the age group of 12 to 17 years in 2022. PayPal has been leaving this market so far while its rivals have aggressively tapped this market in recent months.

Besides, we’re in the midst of a recessionary environment, so disposable incomes and discretionary spending are generally strained across the globe. This cyclical factor might very well be another reason why PayPal’s accounts growth has plateaued, at least for the time being. But fortunately for the company’s investors, there is hope for recovery.

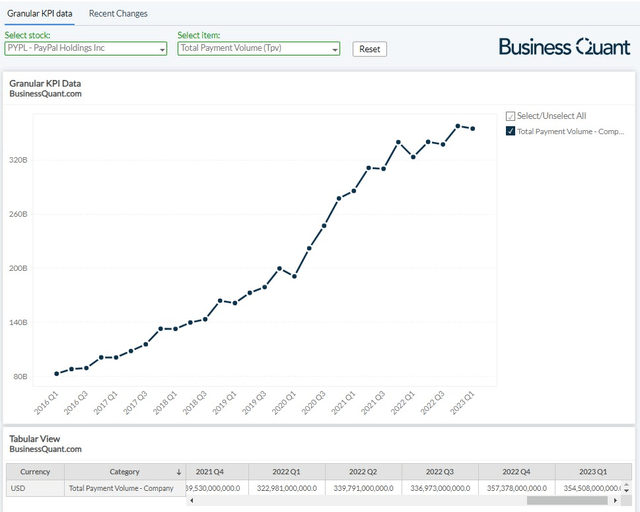

Light At The End of The Tunnel

First of all, it’s important to note that even in the midst of an economic downturn and plateauing accounts growth, PayPal’s Total Payments Volume (or TPV) has continued to grow. For the uninitiated, this metric is the aggregate sum of all the payments that are processed by PayPal’s payments network in a given quarter. This rising figure indicates that PayPal’s user base is sticky, its churn rate is low and its users are gradually increasing their usage over time, rather than switching away to competing apps such as Cash App. I believe this TPV growth is a commendable feat on its own and comes as a reassuring sign that PayPal’s payment network is still very much competitive.

Secondly, economic downturns are only cyclical. Per Morgan Stanley, US will enter a mild recession in 2023 but the economy will eventually rebound next year. This should ideally bring along another cycle of rising disposable incomes, growing discretionary spending and heightened adoption of PayPal’s payment processing network. So, I’m optimistic that the inevitable economic recovery will also contribute to PayPal’s TPV and user accounts growth.

Third, PayPal has made a strategic move recently which seems to have gone largely unnoticed by many investors. The company unveiled Teen accounts for its Venmo platform in the second half of May, which allows 13 to 17 year olds to open accounts, bringing it at par with competing Cash App from Block. We saw earlier in this article that there are roughly 25.1 million teens in the 12 to 17 year old age bracket, most of which PayPal can now cater to. These new teen users may not have the spending propensity of adults so their TPV contribution is likely to be minimal. However, these user additions will at least contribute to PayPal’s accounts growth and dissuade slowdown-related bearish concerns.

Besides, PayPal is adding more payout options to its peer-to-peer Venmo platform. This is likely to have a two-fold effect. First, it’ll make Venmo more appealing to users who are comparing it with Cash App and are likely to contribute to the former’s accounts growth. Secondly, more integrations and payout options stand to boost PayPal’s TPV eventually.

The FinTech firm may have ceded some business to rival apps but it’s making the right moves now to kickstart its growth momentum. I believe that with teen accounts and more payout options, PayPal’s user accounts and total payment volume will continue to grow in the quarters ahead.

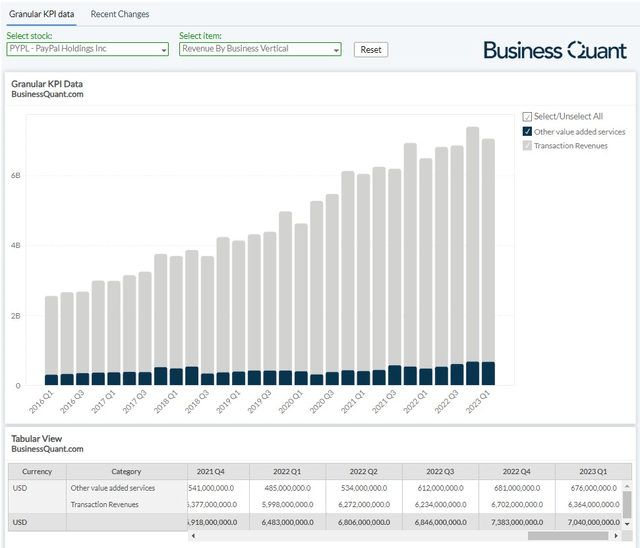

As far as the whole company is concerned, PayPal is doing rather well and it registered its second-highest revenue last quarter. This stellar performance comes at a time when the company’s shares have been hammered down due to slowdown-related bearish narratives. This highlights a stark difference between bleak market sentiment and improving ground reality.

Final Thoughts

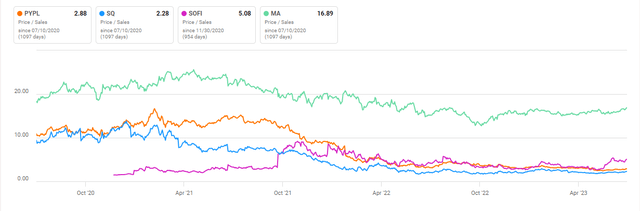

I’d like to point to readers that PayPal’s shares are trading at 2.8-times the company’s trailing twelve-month sales, which is quite low on a standalone basis. Besides, the chart below highlights that its P/S multiple is also hovering at its multi-year lows and is much lower than some of its other FinTech comparables. This suggests that PayPal’s shares are undervalued on a standalone, historic as well as on a relative basis, implying that its shares are likely to rally on the slightest of positive developments.

As far as price estimates go, I believe PayPal deserves to trade at least at 3.9-times its trailing twelve month sales in light of its improving fundamentals. This is the median value of its P/S multiple in the last 2 years and it implies a 42% upside to PayPal’s stock price from its current levels.

The risk to our thesis here is if PayPal botches up on its execution and isn’t able to gain user traction with the teen accounts. This could happen due to clunky user-interface or limited payout options. This would mean PayPal’s accounts growth will stall for good and the stock would remain distressed. Only time will tell if this risk factor has any merit to it.

Besides, I had last covered PayPal almost 13 months ago and warned investors that the stock is likely to languish due to the absence of any growth catalysts. The scenario is drastically different now. The stock is trading at a lower P/S multiple now and the management has a tangible plan to reinvigorate growth. So, I’m changing my rating for PayPal from “Hold” to “Buy”.

It seems like the market is already pricing in the risk of business stagnation, even though PayPal is on the cusp of kickstarting its growth engine. This presents a favorable risk-reward ratio for PayPal investors – there may be limited downside potential, but ample headroom for stock appreciation from its current levels. I believe it’s an opportune time for investors with a multi-year time horizon to accumulate the company’s shares while they’re still discounted. Good Luck!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.