Summary:

- PepsiCo’s Q2-23 results exceeded expectations, showing signs of easing inflation and enhanced productivity.

- The company continued to demonstrate strong pricing power with both gross margins and operating margins near all-time highs.

- Despite being the largest in most of its operating categories, PepsiCo’s organic growth remains industry-leading, reflecting the strength of its brands and management quality.

- The company’s underperformance compared to the S&P 500 year-to-date is viewed as a buying opportunity, with a reiterated Buy rating and a price target of $201 per share.

kaarsten/iStock Editorial via Getty Images

PepsiCo (NASDAQ:PEP) announced its Q2-23 results that beat expectations, reporting 10.4% revenue growth (13.0% organic) and $2.09 of Adj. EPS, representing 2.7% and 5.5% beats, respectively. The company’s results are showing signs of easing inflation and increased productivity. The PepsiCo brands continue to demonstrate immense pricing power, as gross margins again came near their all-time highs at 54.6%. Despite being the largest in most of its operating categories, PepsiCo’s organic growth remains industry-leading, reflecting the strength of its brands and the quality of its management.

As markets shift to a “risk-on” mode, I view PepsiCo’s underperformance compared to the S&P 500 year-to-date, as a great buying opportunity. I reiterate a Buy rating with a price target of $201 per share.

Background

I started covering PepsiCo on Seeking Alpha in a March article, claiming ‘Exceptional Quality Rarely Comes Cheap, It’s A Buy‘. While the stock continued to underperform the market, the performance in such a short time period shouldn’t worry a PepsiCo shareholder, who invests in this behemoth for its long-term stability and compounding.

I urge you to read that article, in which I explained my investment thesis in detail, and why I find PepsiCo one of the highest-quality consumer staple companies. I described the company’s operating segments and risks, and provided detailed comparisons to the company’s competitors.

In short, my investment thesis is based on PepsiCo’s brand value, pricing power, and ambitious management, demonstrated by the company’s constant market share gains and industry-leading growth despite being the largest in size in most categories. In the May article, I showed that PepsiCo’s organic growth came in either first or second in each of its major segments.

Regarding valuation, I showed that PepsiCo trades around the peers’ average valuation, which I find to be unappreciative of the company’s leading position.

Now, let’s focus on the company’s results to see if it remained a leader in terms of organic growth, and look at how my projections fared compared to the consensus. Then, we’ll update our projections and financial model accordingly.

Q2-23 Highlights

PepsiCo reported consolidated revenues of $22.3B, a 10.4% increase from the prior year period. Based on its historical seasonality, the company is on pace to deliver 8.7% revenue growth for the entire year. I’m glad to see the company is on track to beat my $92.8B estimate, which means it’s on track to beat the initial consensus expectations as well, and by a wide margin.

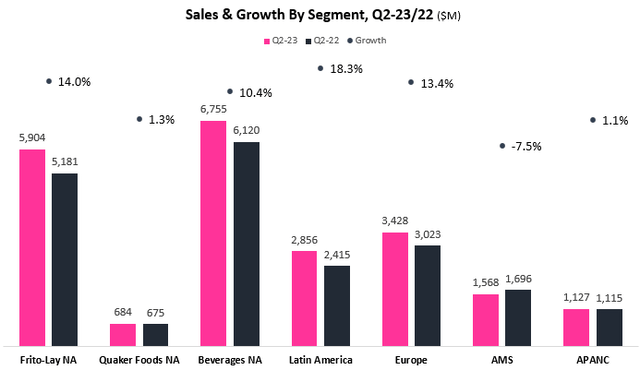

Created and calculated by the author using data from PepsiCo’s financial reports; AMS = Africa, Middle East, South Asia; APANC = Asia Pacific, Australia, New Zealand, China.

As we can see, besides AMS, every segment contributed to revenue growth compared to the prior year period. Frito-Lay North America increased by 14.0%, Quaker Foods North America increased by 1.3%, Beverages North America increased by 10.4%, Latin America increased by 18.3%, Europe increased by 13.4%, AMS decreased by 7.5%, and APANC increased by 1.1%.

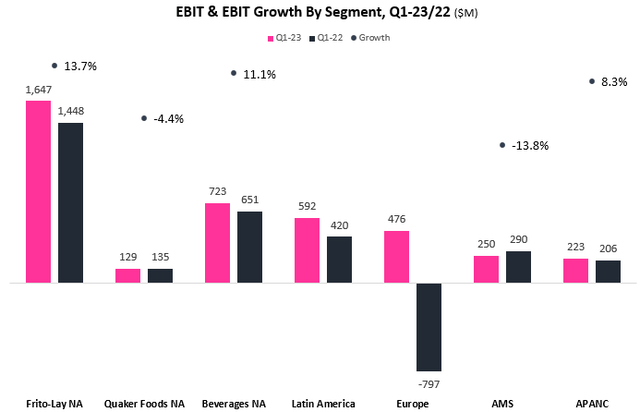

Created by the author using data from PepsiCo’s financial reports.

Looking at EBIT per segment, we see broad-based growth as well. Frito-Lay NA grew by 13.7%, due to revenue growth and steady margins. Quaker Foods NA decreased by 4.4%, as revenue growth was offset by a 110 bps margin contraction. Beverages NA grew by 11.1%, as margins expanded by 10 bps. Latin America grew by 41.0%, with its margin expanding by 3.3 percentage points. Europe returned to profit, AMS decreased by 13.8%, and APANC grew by 8.3%, all due to a mix of revenue growth and FX impact.

Overall, PepsiCo’s results were very impressive, as the company continues to improve productivity, while demand remains essentially unaffected and continues to grow despite higher prices.

Revisiting The Investment Thesis – Organic Growth Showdown

In my previous article, I summarized my investment thesis into two measurable aspects:

In an old-timer and a behemoth like PepsiCo, I look for two important attributes to assess whether it’s an attractive long-term investment which will provide compounding shareholder returns – ambition and relevancy.

First, I want to see that the company is still ambitious, meaning it’s still attempting to grow and increase efficiency, as opposed to squeezing what’s left from its old brands. This attribute is reflected in the company’s regular operating metrics.

Second, I want to make sure the company’s brands remain relevant, meaning the company is either keeping or gaining market share. This attribute is best reflected in the company’s organic growth, as it’s a combination of price, mix, and volume of existing brands.

We examined the first aspect in the previous section. Now, let’s turn to the second one.

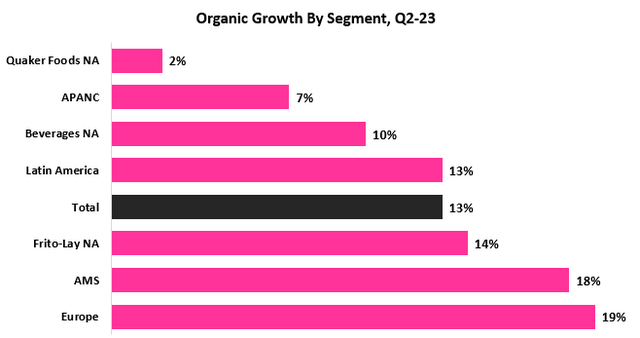

Created by the author using data from PepsiCo’s financial reports.

As we can see, organic growth remained high, coming in at 13% in the second quarter, after growing organically by 14.3% in Q1. Every segment contributed to organic growth, with Europe leading the way, almost notching the 20% threshold.

Because PepsiCo is first among its comparable peers to report second-quarter results, we’ll have to wait until the beginning of August to see how it fared in each of its categories. Clearly, its numbers will be tough to beat, and we’ll provide an update in a future article regarding PepsiCo or one of its peers.

Important Notes From The Call

Like every PepsiCo earnings call, analysts went out of their way to find a possible way to challenge the company’s management. Let’s look at some of the more important remarks.

We are very pleased with our performance for the second quarter as our business delivered 13 percent organic revenue growth – the seventh consecutive quarter in which we have delivered double-digit organic revenue growth – and 15 percent core constant currency earnings per share growth. Given the strength of our business performance, we now expect our full-year 2023 organic revenue to increase 10 percent (previously 8 percent) and our core constant currency earnings per share to increase 12 percent (previously 9 percent).

— Q2-23 Earnings Prepared Management Remarks 07/13/23

PepsiCo is now expecting 2% higher organic growth, primarily due to better-than-expected resiliency in demand despite pricing actions. Furthermore, management increased its EPS guidance by 3 points, citing better-than-expected effects of its productivity initiatives, and supply chain recovery.

The margin improvement that you saw in the quarter 132 bps on gross and 45 on net is entirely driven by productivity, which is reflective of the productivity investments that we’ve made over the last couple of years in things like digitalization and in automation and then leveraging Global Business Services to standardize how we operate that’s actually kind of been a pivot this year. And that’s a pivot that I think you’ll see ongoing, not just in the back half of this year, but actually into ’24 and beyond.

— Hugh Johnston, Vice Chairman, EVP & CFO, Q2-23 Earnings Call

As I discussed in previous articles, PepsiCo’s management is extremely focused on incremental margin improvements. By focusing on digitalization and better automation, management is expecting gradual improvements for the foreseeable future. Let me remind you that PepsiCo used to have operating margins above the 16.0% threshold, but that was a time of slow growth. The major difference is that during these times, the company didn’t invest as much as it does in advertising and marketing, whereas today, the margin expansion isn’t coming at the expense of A&M.

We’re investing in advertising and marketing and A&M was up 50 bps in the second quarter. You’re going to continue to see us invest in A&M. You’re going to continue to see us invest in capabilities. And our investment cycles tend to be more back half oriented than they are front half oriented when we have a sense as to how the year is going to turn out.

— Hugh Johnston, Vice Chairman, EVP & CFO, Q2-23 Earnings Call

Historically, PepsiCo generates more than 50% of its profits in the first half of the year, whereas it makes more than 55% of its revenues in the second half of the year. As quoted above, this is the normal cycle of investment during the year. Thus, don’t expect another quarter of 16.4% operating margins. However, on a full-year basis, there should be at least a 100 bps expansion compared to the prior year.

Updated Projections

In my previous article, I detailed my Q1-23 projections as follows:

I now expect Q2-23 revenues of $22.5B (consensus is $21.7B), Operating Profit of $3.5B, EBITDA of $4.2B, and Net Income of $2.6B (consensus is $2.7B).

As we can see, I was closer than the consensus but was a little bit too optimistic on the revenue side. In contrast, Net Income came in above my expectations, reflecting continued margin expansion. Based on the Q2 results, I expect Q3-23 revenues of $23.6B (consensus is $23.0B), Operating Profit of $3.7B, EBITDA of $4.4B, and Net Income of $2.5B (consensus is $2.6B).

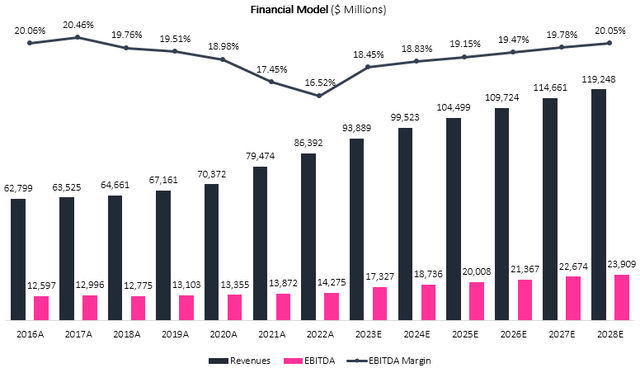

For the year, I expect revenues of $93.9B (consensus is $90.9B), Operating Profit of $14.4B, EBITDA of $17.3B, and Net Income of $10.0B (consensus is $10.0B).

Valuation

As a consequence of the quarterly adjustment, I need to update my long-term model as well. I continue to project PepsiCo will grow revenues at a CAGR of 4.9% between 2023-2028, which is according to the company’s long-term growth targets. I believe revenues will grow at that pace due to constant capacity enhancements, steady price increases, and the company’s ability to continue to bring in new products with a focus on new trends like healthier snacks or zero-sugar drinks. I find this growth rate to be conservative, as it assumes PepsiCo will grow at the pace of the convenient foods and beverage markets, although historically PepsiCo outperforms the market and its peers as it constantly gains more market share.

I project PepsiCo’s EBITDA margins to increase incrementally up to 20.1%, as inflation eases and the supply chain continues to recover, along with new manufacturing lines finishing their ramp-up stage and productivity initiatives materialize.

Overall, my assumptions result in EBITDA growth higher than revenues, reflecting operational leverage and cost-efficiencies. This is according to management’s guidance of sequential operating margin expansion at a rate of 20-30 bps per year.

Created and calculated by the author based on PepsiCo’s financial reports and the author’s projections.

Taking a WACC of 7.4%, I estimate PepsiCo’s fair value at $279.2B or $201 per share, which reflects a 9.1% upside compared to the market value at the time of writing. This represents a 25.6x P/E multiple on my 2024 EPS projection, which is in line with the company’s 5-year average.

Conclusion

Once again, PepsiCo demonstrated brand value, unparalleled pricing power, and significant productivity in Q2-23. The company’s management remains impressively ambitious and isn’t resting on past success, as PepsiCo continues to grow at an industry-leading pace despite being the largest player in most of its categories. As markets shift to a “risk-on” mode, I view PepsiCo’s underperformance YTD as a great buying opportunity. Thus, I reiterate the stock as a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.