Summary:

- AT&T Inc.’s share price has collapsed. Even with very recent strength, the company is still near early 2000s to 90s share prices.

- The company has exciting new businesses. Not only should 5G capital spending go down, but AT&T is building up a strong fiber business.

- AT&T can comfortably afford its dividend and manage its debt, which we expect will lead to long-term shareholder returns.

Brandon Bell

It’s a rough time to be a telecom company. As we discussed in our recent article on Verizon Communications Inc. (VZ), available here, telecom companies continue to hit new lows. AT&T Inc. (NYSE:T) stock, with a 52-week low of ~$14.5 / share (a level it’s 5% above), has not been at these levels since briefly in the early 2000s and the early 1990s. So, what led us here.

Three Things

There are three things that have put AT&T in its current position, in our view.

1. Capital Spending

5G is massively expensive. Even the spectrum from the government cost $10s of billions. AT&T and Verizon didn’t plan ahead here, and they’ve been impacted hard. 5G capital spending will likely start to trend down, but with 6G coming at the end of the decade, that’s not a lot of time before the expenditures will go up again.

2. Competition

New competition is ramping up. T-Mobile (TMUS) is okay with earning no free cash flow, or FCF, and Dish Network (DISH) is backed by Amazon (AMZN). We don’t expect AT&T to lose its dominance, but we do see the risk of margin compression, and clearly the market sees that same risk as well.

3. Interest Rates

Interest rates are going up. It’s looking like they might potentially remain higher for longer. The company has a great 7+% dividend yield, but that’s a lot less interesting when you can get effectively risk-free 2 year treasuries (US2Y) for 5%.

These three things have led us to where we are today, but there’s still lots of upside.

AT&T Market Positioning

Despite continued competition, AT&T is working to maintain a strong market positioning.

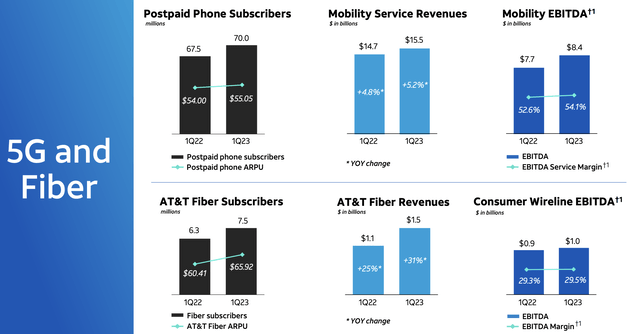

The company saw postpaid phone subscribers increase YoY from 67.5 million to 70 million. That enabled the company’s mobility services revenue to increase by almost $1 billion YoY. More importantly, while the revenue increased by $800 million, the company’s EBITDA increased by a much stronger $700 million, helping overall margins.

The company is also rapidly growing its fiber business and we see strong potential here. The company’s business grew YoY from 6.3 to 7.5 million subscribers. That’s almost 20% growth in fiber subscribers, enabling revenue to increase by more than 30% YoY. The company’s EBITDA didn’t increase substantially, but there’s a substantial and growing business here.

The company is rapidly expanding the new fiber business, which already has 10% of revenue of the mobility business. We expect that to keep growing as not only the potential market but the penetration grows.

Show Me The Money (FCF)

At the end of the day, what matters for investors in AT&T is the money.

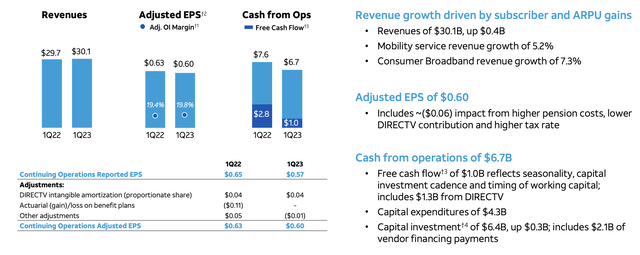

Among AT&T’s problems, besides its massive debt, is a consistent struggle to generate cash flow and always highlighting its cash flow as “coming.” The company does have front-loaded capex, which makes earlier in the year a rougher time. The company did manage to grow its revenue by almost 2% YoY.

The company is continuing to guide for its full year FCF of $16 billion, with $3.5 to $4 billion in 2Q FCF. The company’s 7.3% dividend yield is $8 billion, a number that the company can comfortably afford. That leaves $8 billion in additional FCF on top of what are already substantial returns and continued investments in its business.

AT&T has roughly $140 billion in net debt, and the company pays roughly $6.5 billion in annual interest expenditures for that. At current interest rates, that should likely be more than $10 billion if the company had to fully refinance. Regardless, the company can consistently pay down its debt with extra FCF and save on interest.

As an example, if the company, over the upcoming 7 years before the end of the decade, repays all debt outside of dividends it will have baseline returns of more than 7%. It’ll repay $60 billion in debt as it comes due, and save itself $2.6 billion in annual interest expenditures. It’ll end the decade with >$10 billion in post-dividend FCF assuming no growth.

From that point, it’ll be able to improve its financial position and shareholder returns much faster. All of that together makes AT&T a valuable investment and highlights its strength.

An Option Opportunity

For those looking at another way to invest in AT&T, we recommend looking at the company’s options.

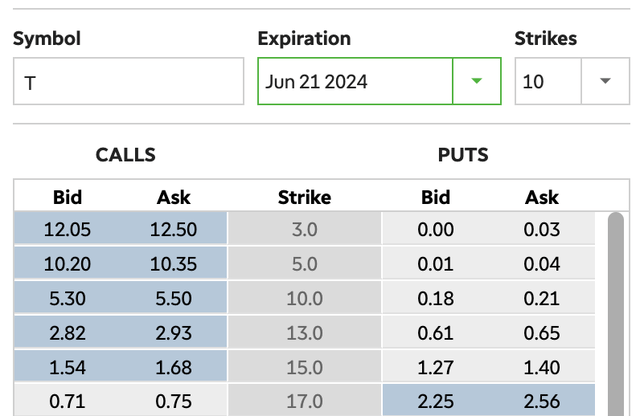

The company’s $13 strike price PUT options for Jun 2024 (11 months from now) is trading at a mid-point of $0.63. That’s a ~5.5% yield annualized for the 12-months on your cash, but most brokerages don’t require you to put the cash up front. So, it’s a strong cash yield potential there, with minimal expenditures, and upfront cash.

At the same time, you only get AT&T stock if it drops 10% below its 52-week lows, where the company is a great investment.

Thesis Risk

The largest risk to our thesis is black swan competition. Dish is becoming a worthwhile competitor, and T-Mobile, which has a strong existing network, is okay with earning minimal FCF. That means they can continue to take customers, impacting AT&T’s ability to continue driving shareholder returns and making it a poor investment.

Conclusion

AT&T is in a rut. The company continues to have grandiose plans that started out with a big slate of acquisitions in recent years. Since then, the company has spun off various components as it’s come to regret them. It’s now reoriented around its cellular and fiber businesses, but who knows how long that’ll last.

However, AT&T’s 1Q woes should be temporary. The company expects FCF to increase dramatically from 1Q to 2Q. Additionally, the company expects $16 billion in FCF for the year. This will enable substantial shareholder returns with the company’s $110 billion market cap and options can help increase that further. Overall, AT&T Inc. stock should be a good investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.