Summary:

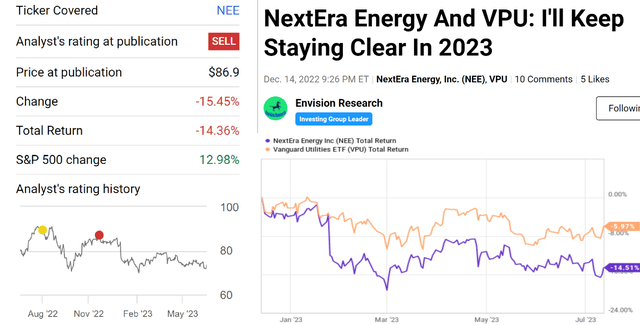

- This is a follow-up to an analysis I published at the end of 2022.

- In that article, I argued for a “SELL” thesis for both the utility sector represented by the Vanguard Utilities ETF and also its leader NextEra Energy.

- The main reasons for the bearish thesis were my expectation for interest rates to further rise and also their elevated valuation at that time.

- This update/upgrade is motivated by two changes since then.

- First, I do not see too much room for further rate hikes anymore. And secondly, the valuation of both VPU and NEE has become more reasonable now.

NoDerog

Thesis

This is a follow-up to an analysis that I published in December 2022. The article was entitled “NextEra Energy And VPU: I’ll Keep Staying Clear In 2023”. The title already gave away my thesis (and also gave another example of my inability to time the market accurately). And the main factors for my bearish thesis at that time were my expectation for further interest rate hikes and also the elevated valuation, both for the whole sector as represented by the Vanguard Utilities ETF (NYSEARCA:VPU) and also its leading stock NextEra Energy (NYSE:NEE). The reason that I examined both a sector fund and also a leading stock is to remove the possibility that the sector is biased by a (or a few) stock(s). Sometimes, a sector is expensive only because a few large holdings are expensive.

And by examining both VPU and NEE, I concluded (the main takeaways are quoted below) that was not the case for utilities at that time.

1. The utility sector’s (represented by VPU) yield spread relative to risk-free rates is among the lowest level in a decade at that time

2. At an individual stock level, its leader NEE is even more expensively valued. The premium of NEE valuation relative to VPU is near the highest level in a decade (and remember that VPU itself is near its highest premium relative to the treasury rates).

Against this backdrop, this update article is to argue for a rating upgrade to “HOLD” for both VPU and NEE. And the upgrade is motivated by two changes since then.

- Treasury rates did increase as I anticipated since December 2022 by quite a bit. And I do not see too much room left for further rate hikes. Utility stocks respond sensitively to rate changes because A) they rely heavily on debt financing and low rates mean low borrowing cost, and B) also interest rates act as the gravity for equity valuation, and lower interest rates correlate with higher valuation multiples in the long term.

- The prices of both VPU and NEE have correctly by a substantial amount (especially by utility standards) since then. Combined with improved economic earnings (as approximated by their dividend payouts), the valuation changes have removed much of the valuation risks that I was concerned about in December 2022. As you can see from the following chart, NEE’s price corrected by more than 15%, against a 13% return from the overall market. And VPU’s price went down by almost 6% too.

In the remainder of this update, I will examine these two changes in more detail and project the implications of them on VPU and NEE’s future returns.

VPU and NEE – Basic Information

Basic information for both VPU and NEE has been detailed in my original article in case there are readers new to them. For ease of reference, here I will quote a few basics:

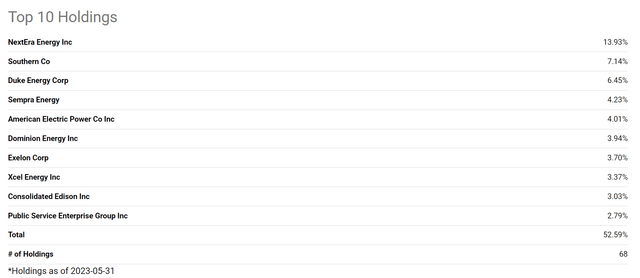

VPU holds 68 stocks, all in the utility space (see the chart below). Also as seen, NEE is its largest holding by far, currently representing 13.93% of VPU’s total assets, almost 2x than its next largest holding (Duke Energy, DUK). As aforementioned, this is a key reason why I want to examine both VPU and NEE, so I can rule out the possibility that the sector average is not biased by NEE.

NEE is a holding company for Florida Power & Light Company (FPL), which provides electricity to roughly 5.8 million customers in eastern, southern, and northwestern FL. NEE, through its subsidiaries, engages in a multitude of operations in the generation of electricity through wind, solar, nuclear, coal, and natural gas facilities.

Interest Rates and Utility Valuations

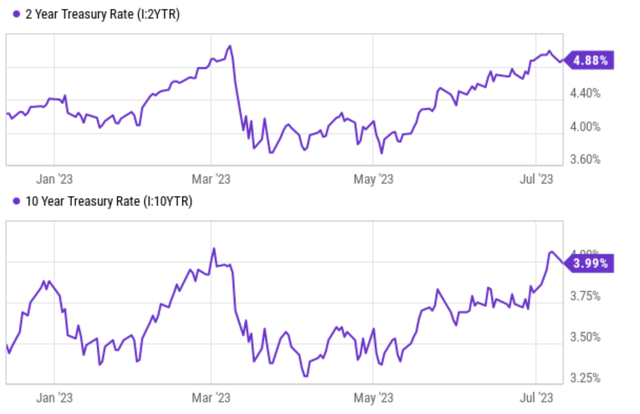

In this part, I will use the 2-year treasury yield to represent short-term interest rates and the 10-year treasury yield to represent the long-term interest rates. And for the utility sector and NEE, which are both famous for their stable dividend payouts, I will use their dividends to represent their true economic earnings. And consequently, I will use their dividend yields as the main valuation metric.

As seen in the chart below, both short-term and long-term interest rates did rise substantially since my last writing. To wit, two-year treasury rates rose from about 4.2% in December 2022 to the current level of 4.88%. And the long-term interest rate rose from about 3.5% to the current level of 4.0%.

Going forward, I see little room for further rate hikes for several key reasons. First, inflation pressure seems to be abating now, giving the Fed less pressure to further increase rates. The latest inflation data shows that the core consumer prices fell below 5% for the first time since 2021. Secondly, note that the yield curve remains inverted. The 10-year rates are below the 2-year rates by almost 90 basis points. Thus, going forward, the Fed needs to be really cautious about further rate hikes and not triggering a recession. The Fed only controls the short end of the rates. My view is that further hikes from here are likely to move up short-term rates only and leave long-term rates unchanged, thus further invert the yield curve.

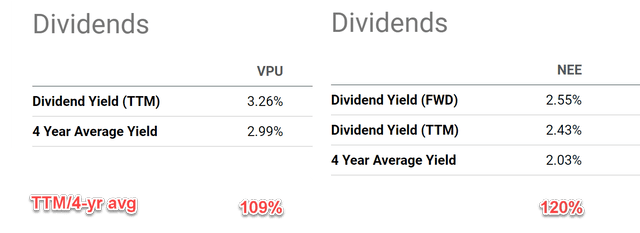

In the meantime, the valuation of VPU and NEE have both become much more reasonable since my last writing from a combination of price decreases and dividend increases. As seen from the first chart below, the dividend yields of NEE have risen from 2.02% back in December 2022 to 2.43% currently. And the yields for VPU have risen from 3.01% to 3.26%. Actually, their current yields are near an attractive multi-year level as you can see from the second chart below compared to historical averages. To wit, VPU’s current TTM yield is about 9% above its four-year average. The current TTM dividend yield for NEE is 20% above its four-year average and its FWD yield is even higher, signaling a substantial valuation discount.

Source: Seeking Alpha Source: Seeking Alpha

Profitability Remains Stable

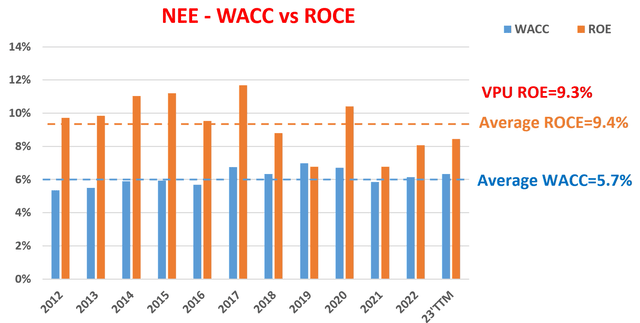

Despite the significantly lower valuation, I do not see any signs of profitability deterioration for both VPU and NEE. As seen in the chart below, NEE has been maintaining a robust ROCE (return on capital employed) over the long term, and its current profitability is very in-line with its long-term average (about 9.4% in the past 10 years). Its current ROCE is also well above the average WACC (weight average cost of capital), leaving a good margin for profit.

For the whole sector as represented by VPU, the average ROE (return on equity) is about 9.3%, essentially on par with NEE’s ROCE (the subtle differences between ROCE and ROE are detailed in our earlier writings).

Source: Author based on Seeking Alpha data

NEE and VPU: Projected Returns

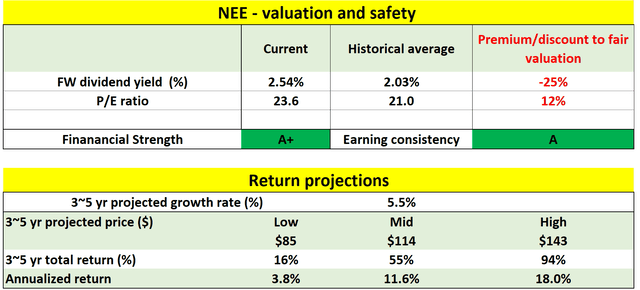

Thanks to a more reasonable valuation and stable profitability, I now see much better return profiles for both VPU and NEE compared to the time of my last writing. My projected returns for both are summarized in the two charts below.

To wit, as aforementioned, NEE is at a substantial discount in terms of dividend yields compared to its historical averages. In terms of P/E, it is currently priced at 23.6x, slightly above its historical average of 21x. And also as aforementioned, I see dividend yields as a more reliable valuation metric here. Also, even if the stock is at a premium now as the P/E suggested, I see good odds that its growth in the next 3~5 years will totally offset the premium and deliver a healthy return.

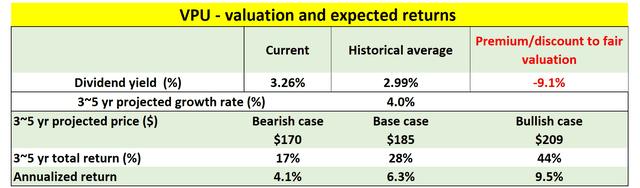

For VPU, the picture is very similar. The difference is a small variance in the return scenarios because of its ETF nature. Also, note that I am assuming a slower earnings growth rate for VPU (assumed to be 4%) than NEE due to NEE’s leading scale and superior profitability mentioned above in the sector.

Source: Author based on Seeking Alpha data Source: Author based on Seeking Alpha data

Risks and Summary

The risks facing VPU are ultimately macroeconomic. For example, an economic recession could hurt the entire sector. Inflation could surge again, and future Fed policies are ultimately uncertain. For NEE, there are a few specific risks worth mentioning besides these macroeconomic factors. NEE is located in the State of Florida and therefore subject to regulatory policies in the state. Such policies could impact the return on how it deploys its regulatory capital, its allowable return on equity, and also the electric rate pricing mechanisms. A good portion of its transmission and distribution network is also subject to natural risks such as hurricanes in the storm-challenged state.

All told, I now see a much more favorable return/risk profile for both the utility sector and its leader NEE for the next few years. Thus, this article upgrades both VPU and NEE from my earlier bearish thesis. And my upgrade is mainly based on the projection of stable rates, discounted valuation, and stable profitability.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.