Summary:

- UnitedHealth released its Q2 2023 earnings earlier today and the market has responded positively.

- Revenues grew by a substantial 16% year-on-year, to $92.9bn, and earnings from operations grew 13%.

- Adjusted earnings of $6.14 per share were up >10% year-on-year – FY23 guidance is for $24.70 to $25.00 per share – a forward PE of ~19x.

- It was not all good news – Optum Health’s net margin fell from 6.3% in Q2 2022, to 5.9%, and was also down sequentially. The medical care ratio was 83.2% compared to 81.5% last year.

- Management dismissed concerns around profitability, pointing to the successful implementation of its Value-Based Care initiatives and growing Medicare Advantage membership. This time, the market is buying it.

milan2099

Investment Overview – Q1 Bad, Q2 Good! Shares Soaring On Revenue And Earnings Beat

UnitedHealth (NYSE:UNH) is a company that had rarely failed for its shareholders – its share price has increased in every year since 2010, gaining by an astonishing 1,350% over the period.

Revenues have increased in every year since at least 2013 – from $122.5bn, to $324bn in 2022 – up >160%, and so has operating income – from $9.6bn, to $28.4bn in 2022 – up 195%. Its quarterly dividend has risen from 3 cents in 2010, to $1.88 announced in June this year – a gain of >6,000%. Current yield is ~1.7%.

It doesn’t get much better than that for investors, across any sector of the stock market, although this incredible run of improvement every year has looked under threat in 2023. Prior to announcing its Q2 2023 earnings today, UnitedHealth stock was down 11% year-on-year, and since the beginning of 2023, the stock had declined in value from ~$520, to ~$448 – a fall of 14%.

I covered United’s Q1 2023 earnings just after they were released in Q1 2023, and they were very strong, with revenues up by 15% year-on-year, and diluted earnings per share up 13% year-on-year, to $5.95.

The market reacted gloomily, however, amid concerns around 2 of United’s biggest revenue drivers – Optum Health’s margins were falling, and United’s Medicare Advantage business was under threat, as the Centers for Medicaid and Medicare Services (“CMS”) appeared to be pushing back against perceived profiteering.

UnitedHealth Q2 2023 Results In Focus – The Good News

Fast forward 3 months however and this time the market is celebrating some outstanding results, even if some of the questions around Optum and MA remain, UnitedHealth appears confident it is answering them emphatically. Let’s take a look at the headline figures.

United’s revenues in Q2 2023 came in at $92.9bn, up 16% year-on-year. Earnings from operations came in at $8.1bn, the same as last quarter, but a $1bn, or 13% increase on Q2 2022. Diluted earnings per share were $5.82, versus $5.34 in the prior year period – up 9%, whilst adjusted earnings per share were $6.14, compared to $5.57 in Q2 2022 – a gain of 10%.

During the quarter, UnitedHealth generated cash flows from operations of $11bn – 2x net income – and returned $4.8bn to shareholders via its dividend – increased by 14% in June – and share buybacks – there are now 940m shares outstanding, versus 950m one year ago.

In trading today so far, shares have risen in value by 7%, to $478. At the beginning of 2022, the share price was ~$502, so if the company continues its streak of beginning each year with its stock trading higher than the beginning of last year, shares ought to grow by at least another 5% this year.

Finally, UnitedHealth “strengthened the range” of its FY23 guidance, forecasting net earnings of $23.45 – $23.75 per share, and adjusted net earnings of $24.7 – $25 per share. At current price, the adjusted forward price to earnings ratio is ~19x – just about ideal for a balanced investment portfolio.

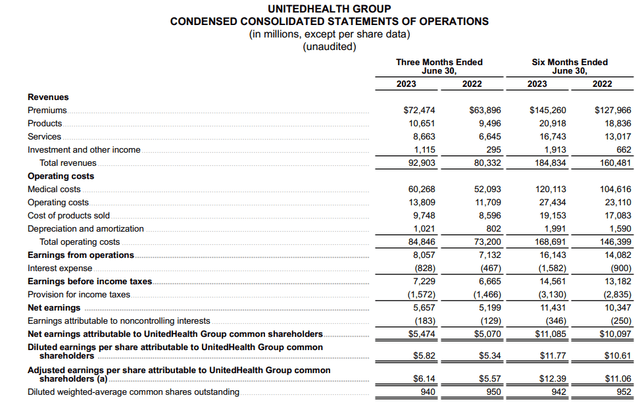

Probably the best illustration of how well UnitedHealth has been performing in 2023 to date – in the face of a falling share price – is to look at the six-monthly figures, as shown below in United’s income statement, accompanying its Q2 2023 earning press release:

UnitedHealth income statement 3m and 6m (UnitedHealth press release)

Revenues are up >$24bn year-on-year on a 6-monthly basis, earnings from operations are up >$2bn, net earning up by nearly $1bn, and adjusted earnings by 12%, to $12.39.

Some Bad News – Sagging Margins And The Medicare Advantage Conundrum

If the market was concerned about Optum Health’s falling profit margins last quarter, then it ought to be equally concerned this quarter, as operating margin dropped once again. As reminder, Optum Health’s business is described as follows by UnitedHealth in its press release:

Optum’s health services businesses serve the global health care marketplace, including payers, care providers, employers, governments, life sciences companies and consumers.

Using market-leading information, analytics and technology to yield clinical insights, Optum helps improve overall health system performance: optimizing care quality, reducing care costs and improving the consumer experience.

This division drove $56.3bn of revenues in Q2 2023 – up from $45.1bn in Q2 2022, and $54.1bn in Q1 2023. Earnings from operations of $3.7bn only matched last quarter however, and beat last year by “just” $400m. Overall, the net profit margin shrank from 7.3% in Q2 2022, to 6.9% in Q1 2023, and now to 6.6% in Q2 2023.

In today’s earnings call, management fielded questions about the shrinking margins, with United’s CEO Andrew Witty stating that he “feels very good” about the state of play within Optum Health, adding that he would prefer to see margins slip and be able to make the internal changes and see revenues grow than the other way around. He also told analysts he looked forward to “years of growth” for Optum’s margins.

UnitedHealthcare is United’s other main business division, and there is plenty of overlap between it and Optum Health, which deals with all of the murky drug pricing and formulary negotiations that are beloved by health insurers, and disliked by the government, particularly where Medicare Advantage is concerned.

As I explained in my last note on United:

Medicare Advantage is a mechanism whereby private health insurers provide health benefits coverage in exchange for a fixed monthly premium per member from the Centers for Medicaid and Medicare (“CMS”), plus a monthly consumer premium. Medicare Advantage plans can offer seniors lower premiums, plus additional advantages such as basic vision and dental coverage, and gym memberships.

In 2022, total US Medicare Advantage enrollment was ~28.4m, 66% of which were individual members, according to research conducted by Kaiser Family Foundation (“KFF”). With 7.1m members as of YE22, UnitedHealth is the most dominant player in this market, its share being >25%. Humana, with an ~18% share, is the next largest, whilst CVS Health (CVS) has an ~11% share.

Not only is Medicare Advantage a huge market today, it has the potential to grow and grow, given that it is estimated ~10,000 members of the “baby-boomer” generation become eligible for Medicare plans every day. Humana has predicted that the market will reach 35m members by 2025, but it could potentially end up at double that figure.

Medicare Advantage is significantly more profitable than any other form of health insurance for health insurers. The Kaiser foundation’s research has indicated that the average gross margins driven by MA enrollees in 2021 were ~$1,730 per patient – more than twice as much as individual market members, Medicaid members, and group market insurance members.

Each year, the CMS sets the rates it is going to pay per member, per region for the following year, and the agency initially suggested it would increase them by just 1% for 2024.

Insurers, led by United, which has the largest exposure to this market, were outraged, claiming that a 1% rate rise translated to a near 2.3% cut when factors such as star ratings (additional bonuses are awarded for plans with higher star ratings) and risk adjustments are factored in.

The CMS relented – after intense lobbying from UnitedHealth and the rest of the industry – and eventually proposed a raise of 3.3%. Nevertheless, when UnitedHealth cautioned about its medical care cost ratio increasing in 2023 owing to a higher number of patients receiving in-person care post-pandemic, at a conference in June this year, its share price – and share prices of most other insurers with MA exposure – dropped substantially, in United’s case from ~$500, to ~$450.

Value Based Care To The Rescue!

There was nothing gloomy about today’s earnings call, however, as CEO Witty and the rest of the management sang the praises of its “Value Based Care” initiatives.

Health insurers used to use a “Fee For Service” model in which hospitals and physicians billed them for their work, and the health insurer settled the bills. Value based care is very different, however, with payments and reimbursement based on a patients’ outcomes, not services received.

In other words, the health insurer is rewarded if the patient remains healthy, and it is also rewarded if it can keep patients away from hospitals and physicians offices because they charge high fees for their services that the health insurers must still reimburse.

This is the thinking behind the “Value Based Care” revolution. Health insurers are turning to private clinics and ambulatory surgery centers they can negotiate expenses with privately as opposed to paying whatever a hospital or physician decides to charge.

Insurers can create networks of physicians and surgery centers and direct its patients directly to them – although this is perceived as a potential weakness of Medicare Advantage, since patients may be prevented from visiting the physician or hospital closest to them as they are not included in their plan – it is much better for the health insurers’ finances.

At-home visits are another form of value based care – on the earnings call today UnitedHealth discussed research it has conducted with Yale University, revealing that patients who receive in-home visits are less likely to spend time in hospital with conditions such as depression, hypertension, or diabetes.

Theoretically, it is a “win win” situation, with healthier patients leading to lower costs – the corollary to that argument however is that patients may be discouraged from seeing a qualified physician or visiting a hospital when that is what they really need.

What is not in doubt is that UnitedHealth is “all-in” on Medicare Advantage and Value Based Care. Management discussed adding 900k new MA members in the near future, and dismissed concerns about “over-utilization” of MA services by some members leading to increasing costs.

Behavioral healthcare is also apparently a major area of focus for United, across all age groups, again based on the (persuasive) assumption that healthier minds lead to healthier bodies, and, completing the virtuous circle, a lower benefit cost ratio for United!

The medical care ratio did increase in Q2 2023 – to 83.2%, compared to 81.5% in the prior year quarter, driven by, according to UnitedHealth “previously noted outpatient care activity, primarily among seniors, and business mix.” Operating cost ratio also increased, to 14.9%, from 14.6% in the prior year.

Concluding Thoughts: UnitedHealth Wins Over The Doubters – Its Cup Runneth Over Once Again

To summarize Q2 2023 earnings and their positive interpretation by the market, it really came down to a single argument, in my view. Would you prefer rising revenues, or higher margins?

UnitedHealth is effectively saying – look at our revenue growth – primarily driven by growing Medicare Advantage membership – and trust us, with the introduction of value based care, we are putting the wheels in motion to slash costs and increase profits longer term.

The squeezed margins are simply a result of short term pain – tweaks to the business model to adjust to the Value Based Care model – for long term gain. With 10k “Baby Boomers” turning 65 every day in the US, it is estimated, the market seems to have decided it is on board for the ride.

Previously, with the CMS pushing back on MA rate rises, and attempting to claw back billions of dollars of tax-payer money paid to health insurers to settle costs it says the insurers should have settled themselves, the MA model and concept of Value Based Care looked under threat.

But in the last 3 months, UnitedHealth has shown how powerful are its lobbies, and how persuasive it can be, and forced the CMS to raise rates by >3%. UnitedHealth is saying that customers are satisfied with its approach, and that its ambulatory surgeries have net promoted scores “approaching 90”, according to management. It is promising that margins will rise again, “year after year”, and dismissing concerns that over-utilization of plan benefits by patients is harming the business model.

This time, the market is buying it. After Q1 2023, it looked like it could be the first down year in a decade for United, its revenues, profitability, and share price, in more than a decade. Now it seems more likely that this healthcare behemoth will beat on most, if not all fronts, once again in 2023. That makes the company a pretty solid buy, in my view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in UNH over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.