Summary:

- AT&T is expected to announce its Q2 2023 financial results on July 26th, with analysts predicting a 1.1% YoY increase in revenue to $29.98 billion and profits of $0.61 per share.

- Despite a weak Q1, AT&T is on track to meet or exceed its $16 billion free cash flow target for 2023, which could reduce its net debt to around $128 billion and improve its net leverage ratio.

- The company’s fiber operations and Connected Devices subscriptions have shown significant growth, and the continuance of that trend is very important.

Anne Czichos

Those who follow my work closely know that I have a special place in my heart for telecommunications conglomerate AT&T (NYSE:T). I say this because, at present, the company is the largest holding in my portfolio, accounting for about 17% of my overall assets. This number used to be higher. But because of additional funds coming in and my decision to allocate those toward some additional opportunities, my exposure has dropped some. But I have not sold any of my stake in the firm. This does not mean that I am unwilling to sell. In fact, if the picture changes for the worse, I could very well do so. The next opportunity for this to occur will be when management announces financial results covering the second quarter of the company’s 2023 fiscal year. That is expected to occur on July 26th, prior to the market opening. Leading up to that point, I do believe that there are certain metrics that investors should be prepared to keep a close eye on. After all, these metrics will go a long way toward determining the overall health of the business and, likely, influencing the direction of shares in the near term.

Steady growth expected

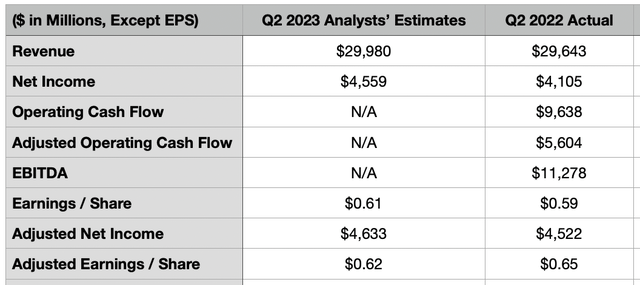

The first thing that we should touch on would be the headline news items that investors are immediately going to gravitate toward. For the second quarter of the 2023 fiscal year, analysts are currently anticipating that the company will generate revenue of $29.98 billion. If this comes to fruition, it would translate to a year over year increase of about 1.1% compared to the $29.64 billion the company generated one year earlier. There is a reason for this sluggish increase besides the fact that the company is a large operator in a mature industry. And that is the fact that management recently guided toward achieving only around 300,000 net additions to its postpaid phone subscriber base. This was something that I wrote about in a prior article about the company. This guidance provided by management fell far short of the 476,000 net additions that analysts were anticipating. And in response to that development, shares of the company took a beating.

On the bottom line, analysts believe that the company would generate profits of $0.61 per share. Adjusted profits should be around $0.62 per share. The earnings per share estimate would translate to net income for the business of $4.56 billion, with adjusted earnings per share translating to profits of $4.63 billion. To put this in perspective, in the second quarter of the 2022 fiscal year, AT&T generated net profits of about $4.11 billion. So if analysts are correct, we are in store for a nice uptick in overall profitability. There are, of course, other profitability metrics that investors should be paying attention to. These are items that analysts have not provided guidance on. For starters, we have operating cash flow. For context, this metric totaled $9.64 billion during the second quarter of 2022. Though if we adjust for changes in working capital, it would have come in significantly lower at $5.60 billion. Meanwhile, EBITDA for the company came in at $11.28 billion.

Cash flows and debt

Outside of these headline items, investors should be paying attention to a slew of other developments. Perhaps the most important thing in the eyes of the investment community will be free cash flow and expectations that management has for the rest of 2023. You see, during the first quarter of the year, the company achieved free cash flow of only $1 billion. While this is a nice chunk of change, it threw into doubt the company’s ability to hit the $16 billion of free cash flow that it has been forecasting for the 2023 fiscal year. In the same announcement that management made regarding net additions to its postpaid phone subscriber base, the firm also stated that it’s on track to meet or exceed the $16 billion target for the year. They chalked up the weak first quarter to the fact that the firm had a great deal of spending to contend with, including $4.3 billion for capital expenditures and another $2.1 billion for vendor financing payments. The latter of these very likely will not be replicated moving forward. At least not in the near term.

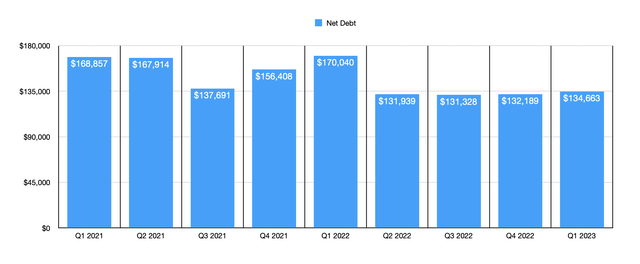

Meeting or exceeding this guidance will be incredibly important because it will also play a role in whether the company can get its leverage down considerably. After seeing net debt peak at $170.04 billion during the first quarter of 2022, the company has been working to get it down, successfully reducing it to $131.94 billion at the end of the second quarter of 2022 due to a major divestiture. Unfortunately, the number ultimately increased over the ensuing three quarters, totaling $134.66 billion most recently. However, if the company can achieve its target for free cash flow for the rest of the year, it should be able to get this number down to roughly $128 billion. That would imply a net leverage ratio of 3.

Watch the growth areas

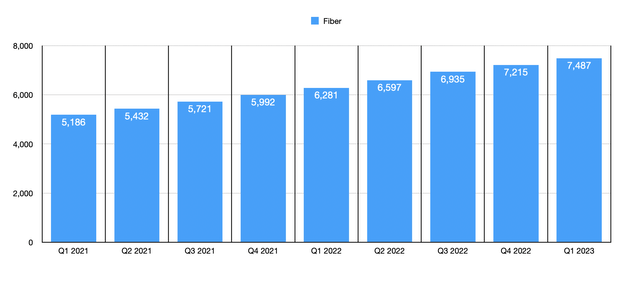

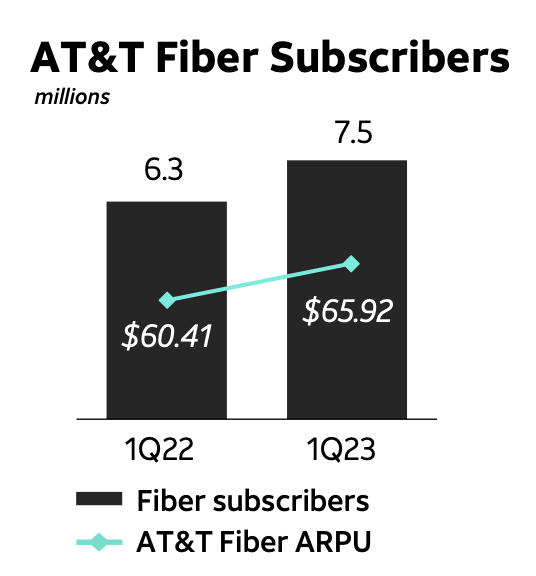

Even though AT&T is not a growth company by any means, there are parts of the business that have exhibited attractive growth in recent years. One good example would be its fiber operations. As of the end of the most recent quarter, the company had 7.49 million fiber subscribers. That is up from the 6.28 million that the company had as of the end of the same quarter one year earlier. Monthly ARPU (Average Revenue Per User) also jumped during this time, climbing from $60.41 to $65.92. The company’s current goal is to hit at least 30 million residential and business locations for fiber by the end of 2025. This compares to the 22.7 million it had as of the end of the most recent quarter. So it is likely we will see the number of subscribers continued to increase during this time. Along this vein, it will also be interesting to see if the company is still on track take the 200 million people mark for the mid-band spectrum that the company plans to roll out to by the end of this year.

AT&T

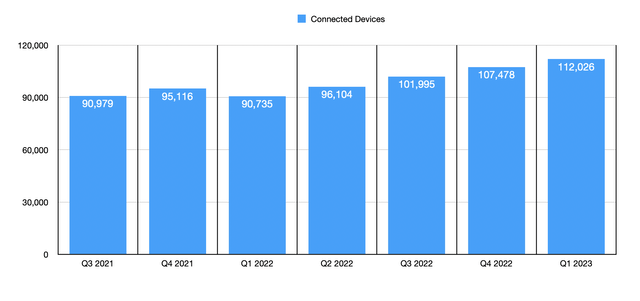

Another part of the company that is often overlooked involves the Connected Devices subscribers that the company has. As of the end of the most recent quarter, the company had 112.03 million Connected Devices subscriptions that it was catering too. This was up from the 107.48 million reported only one quarter earlier and it is significantly above the 90.74 million that it had as of the end of the first quarter of 2022. It is highly probable that this growth trend will continue. But if we see a significant slowing of it, or if we see the absence of growth, that would obviously not bode well for the business.

Takeaway

Fundamentally speaking, I believe that AT&T Is one of the healthiest companies on the market today. I also think it is attractively underpriced and that the business offers tremendous upside potential. That picture could definitely change based on new data that comes to light. But in all likelihood, I believe that upside is much more probable. Due to my overall assessment of the company, I have no problem rating it a ‘strong buy’ at this time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!