Summary:

- Medtronic reported Q1 2023 worldwide revenue of $8.544 billion, a 5.6% increase, with the Cardiovascular division contributing $3.3 billion, a 12% YoY growth.

- The company anticipates organic revenue growth of between 4.0% and 4.5% for FY 2024, with non-GAAP EPS ranging from $5.00 to $5.10.

- Medtronic’s introduction of the MiniMed 780G continuous glucose monitoring system and acquisition of EOFlow Co. Ltd. could inspire growth, but will be subject to fierce competition.

- Medtronic is a “Hold” and may only be attractive to income-focused investors.

Dragoljub Bankovic/iStock via Getty Images

Introduction

Medtronic (NYSE:MDT), founded in 1949 and headquartered in Dublin, is a global healthcare technology leader serving over 150 countries. Built on a mission to alleviate pain, restore health, and extend life, it maintains commitment to dedication, honesty, integrity, and service. It focuses on leveraging innovative technology for growth, serving more patients, creating and disrupting markets, and making their units more competitive. With a patient-first approach, it maximizes AI and data for tailored real-time therapies and remote care. Medtronic’s simplified model since 2021 has enhanced decision-making and commercial execution. Its key divisions include the Cardiovascular, Medical Surgical, Neuroscience portfolios, and Diabetes unit.

Q1 2023 Earnings

In their fourth fiscal quarter, Medtronic reported a worldwide revenue of $8.544 billion, showing a 5.6% increase. The Cardiovascular division contributed $3.3 billion, experiencing an impressive 12% year-on-year growth. The Neuroscience Portfolio also saw growth, although at a slower rate of around 5% year-on-year, generating $2.4 billion in revenue. On the other hand, the Medical Surgical Portfolio and Diabetes segments maintained steady performance, with $2.2 billion and $595 million in revenue respectively, showing no significant changes in growth.

In terms of financials, the fourth quarter GAAP net income and diluted EPS were $1.179 billion and $0.88, respectively, reflecting decreases of 21% and 20%. However, non-GAAP net income and EPS showed positive growth, reaching $2.093 billion and $1.57, representing increases of 3%.

For the full fiscal year 2023, Medtronic reported a worldwide revenue of $31.227 billion, a decrease of 1.4% as reported but an organic growth of 2.1%. The GAAP net income and diluted EPS for FY23 were $3.758 billion and $2.82, down 25% and 24% respectively. Similarly, non-GAAP net income and EPS were $7.045 billion and $5.29, reflecting decreases of 6% and 5% respectively. The company experienced a decline in cash flow from operations by 18% to $6.039 billion and a 23% decrease in free cash flow to $4.580 billion, primarily due to a decline in net earnings.

Looking ahead to fiscal year 2024, the company projects organic revenue growth to be between 4.0% and 4.5%. Additionally, it anticipates non-GAAP EPS to range from $5.00 to $5.10, which contrasts with the consensus estimate of $5.20.

MDT Stock Assessment

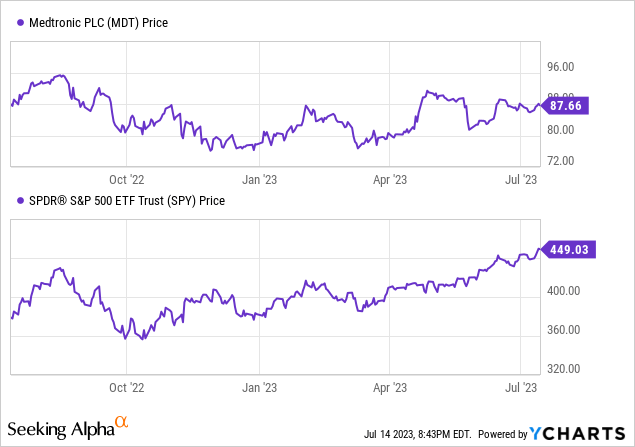

Per Seeking Alpha DATA, Medtronic’s stock shows a mixed picture. The company forecasts a modest annual EPS growth of about 7-8% from 2025 to 2026 and an increase in sales of around 3-4.5%. However, FY1 saw 92% downward earnings revisions compared to 8% upward. The company’s current forward P/E stands at 17.44. Despite a decrease in revenue and diluted EPS year over year, the gross profit margin remains robust at 65.98%. Over the past year, Medtronic’s stock performance trailed the S&P 500, with only 0.16% growth compared to S&P 500’s 18.63%.

The company has a solid dividend yield of 3.13% with a payout ratio of 51.32% and a 5-year growth rate of 7.75%. Finally, Medtronic’s market cap stands at $117.14 billion, with total debt at $25.41 billion and cash of $7.96 billion.

Medtronic’s MiniMed 780G and EOFlow Acquisition: Revolutionizing Glucose Monitoring and Insulin Delivery

Medtronic’s introduction of the MiniMed 780G continuous glucose monitoring system and acquisition of EOFlow Co. Ltd., a producer of tubeless insulin delivery devices, could bring significant revenue diversification and growth opportunities.

According to Straits Research, the continuous glucose monitoring (CGM) market is expected to reach $14.9 billion by 2030, growing at a CAGR of 12.3%. The MiniMed 780G’s cutting-edge automation features cater to the increasing demand for easier and more effective glucose control methods. Besides serving the sizable Type 1 diabetes market, this product could find traction among insulin-dependent Type 2 diabetes patients, further expanding the addressable market.

The acquisition of EOFlow enhances Medtronic’s reach in the insulin pump market, expected to reach $5.6 billion by 2026. EOFlow’s tubeless device caters to an increasingly consumer-driven demand for convenience and discreetness, appealing to younger, active patients in particular.

However, competition remains fierce. In the CGM market, companies like Dexcom and Abbott are key competitors, while Insulet dominates the tubeless insulin pump segment. Medtronic’s unique proposition lies in its ability to provide integrated solutions for both CGM and insulin delivery, potentially positioning it favorably to capitalize on the growing patient need for seamless, comprehensive diabetes management.

My Analysis & Recommendation

As I conclude, I commend Medtronic’s market position and diversification efforts, especially when it comes to expanding its diabetes product portfolio. The strategic acquisitions and innovative product launches aim at high-growth markets, suggesting potentially rewarding opportunities. The continuous glucose monitoring (CGM) and tubeless insulin pump markets, which are expected to witness substantial growth in the coming years, present enticing avenues for expansion. Particularly given Medtronic’s ability to provide integrated solutions.

However, delving into the financials reveals a somewhat mixed picture. Despite some segments such as Cardiovascular showing year-on-year growth, the overall revenue has experienced a slight dip. There’s also been a notable decrease in the company’s net income and EPS, both GAAP and non-GAAP. While Medtronic foresees modest growth in the next fiscal year, the downward earnings revisions and the stock’s underperformance against the S&P 500 suggest potential headwinds. However, a healthy gross profit margin and a solid dividend yield do offer some level of reassurance.

In my view, the stock could appeal to income-focused investors given its robust dividend yield and payout ratio. Moreover, long-term growth investors might find Medtronic’s commitment to infiltrate high-growth markets such as the CGM and insulin pump sectors intriguing. However, competition is stiff, with formidable players like Dexcom, Abbott, and Insulet on the scene. Medtronic’s unique offering of integrated solutions will need to find a significant resonance with patients to gain meaningful market share.

Taking all these factors into consideration, my recommendation would be a ‘Hold’ for Medtronic. This is based on the mixed financial performance, intense competition, and the uncertainty surrounding the success of their expansion into the diabetes sector. A hold position seems advisable until there are clearer indications of a successful integration and market acceptance of their new diabetes offerings, as well as signs of stabilization or improvement in their financial performance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content only and should not be construed as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. Any predictions made in this article regarding clinical, regulatory, and market outcomes are the author's opinions and are based on probabilities, not certainties. While the information provided aims to be factual, errors may occur, and readers should verify the information for themselves. Investing in biotech is highly volatile, risky, and speculative, so readers should conduct their own research and consider their financial situation before making any investment decisions. The author cannot be held responsible for any financial losses resulting from reliance on the information presented in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.