Summary:

- Netflix is nearing the top of its 52-week range, currently valued at over $450 and continues to grow its user base.

- The company is considered a must-have in the streaming space, with a strong market perception among cord-cutters.

- Netflix reportedly has shown past interest in acquiring film assets from Paramount Global and the MGM library; This may indicate future strategies for the streamer.

- For me, the stock is a long-term buy-and-hold on pullbacks, with a practical fair-value buy range between $360 and $405.

Jamie McCarthy/Getty Images Entertainment

I last wrote about Netflix (NASDAQ:NFLX) back in October 2022. I discussed the company’s theatrical strategy (or essentially lack thereof) for the Knives Out project. While the company’s buy thesis centers on the continued growth of subscribers, I believe expansion into new revenue opportunities will ultimately take the stock to the next level in its lifespan on Wall Street. One of these opportunities, perhaps the most significant one, is theatrical distribution. In the case of the Knives film, there was only a short theatrical run followed by a window before placement on the Netflix service itself; that just simply wasn’t aggressive enough in my opinion, but I believe the company will evolve over time on this issue.

There is a very telling recent news item, reported in June 2023, that seems to favor Netflix management steering the company toward that very goal. At some point in the past, the streamer expressed an interest in purchasing the film assets of Paramount Global (PARA) (PARAA), and additionally, it studied the idea of acquiring Metro-Goldwyn-Mayer, which Amazon (AMZN) eventually bought out.

The market has put its support behind Netflix since I last covered the company/stock: Shares have beaten the S&P 500 since that time.

The long-term thesis is this in a nutshell: Now that the company has over 230 million subscribers, and now that it seems interested in participating in media consolidation (at some future point, and as evidenced by the Paramount report), management is motivated to pursue further growth initiatives that will allow the stock to continue to seek capital appreciation and delay even further out the possibility that it will become a mature equity which starts to look at cash flow merely for the benefit of income investors.

With that, I will examine some current news on the Netflix front and place it in a perspective that takes into account this latest stage of the streaming wars.

Netflix, Consolidation, And Content

A couple of things upfront: The company is seeing progress in its quest to end password sharing, and it continues to exploit its first-mover advantage to grow (and to keep) its user base. The same might not be said for other streamers, who now have to switch gears and focus on profitability over gathering more paying viewers.

Beyond this, there are some interesting things to cover concerning Netflix, some news items from the recent past that convey a new perspective for shareholders.

Here are the bullet points:

- The company was said to have been interested in acquiring the film assets of Paramount Global, according to this news item

- That same news item mentioned that Netflix kicked the tires of the MGM library

- Netflix is not above licensing content from streaming competitor HBO

The Paramount news is fascinating to me. The only conclusion I could draw from the streamer’s interest in the Paramount side of the CBS conglomerate is that contrary to statements made by management, Netflix does want to eventually get into the theatrical-exhibition business (and by eventually, I mean sooner rather than later).

This would be a smart move, even if it is the obvious move as well; co-CEOS Ted Sarandos and Greg Peters might have downplayed theatrical in the past, but that doesn’t mean they are serious in that antithetical stance. Let’s briefly, though, consider a quote from Sarandos in the earnings-call transcript from April (Q1):

Driving folks to a theater is just not our business.”

This was in answer to an analyst question on the film strategy. Sarandos went on further to talk up how the service itself is where the distribution action is; taking a cut of ticket sales to auditoriums is something that, apparently to Netflix, with its 230 million+ subscriber count, is beneath it.

That might be a grave miscalculation over time because multiple revenue streams always serve as a diversifying hedge against eventual slowdowns of the core business model. We all know how the aversion to advertising on Netflix evolved into obsolescence; management should strive to be ahead of the curve on theatrical.

And perhaps it wants to be. Make no mistake: Netflix doesn’t want to be in the linear business, the broadcasting business, or the owned/operated television station business – all it wanted from National Amusements CEO Shari Redstone was the moving pictures side. While I don’t necessarily agree that Netflix shouldn’t want to own some cable channels and perhaps create its own vertically-integrated ecosystem to enhance monetization opportunities for its content, as well as to synthesize a Disney (DIS)-like engine of synergy, I’m all-in on theatrical as a new business line for the streamer.

Steve Cahall of Wells Fargo wrote in a note that the film assets of Paramount Global might be worth $30 billion. Well, the first thing that comes to mind is, if that is even remotely close to a true valuation, then a company like Netflix would be better off buying everything and then selling off what it didn’t want, considering Paramount Global currently sports a market capitalization of roughly $10 billion, with around $15 billion of long-term debt (as of this writing; even with a premium, a buyer could get away with the asset for less than the analyst’s valuation if the sum of the parts truly is bigger than the whole). For Paramount Global shareholders like me, yes – you can consider your stock undervalued.

Strategically, Netflix could use the Paramount system to take its content and throw it onto silver screens across the globe to make money before streaming; it would essentially be investing in the window strategy of distribution.

It wouldn’t need to be just feature-length, either. Perhaps some synergy between the silver and smaller screens could happen for episodic: when the final episode of Stranger Things airs – and let’s imagine it is a three-hour event – it could first be released in theaters, then on Netflix.

But what else does this interest in Paramount tell us? In addition to the famous film studio’s distribution system for new product, the company obviously has a big movie library attached with quite a bit of premium IP ready for reboots and sequels, and other derivative creative products. Netflix was also taken, it seems, by the Metro-Goldwyn-Mayer library, which eventually went to Amazon.

Netflix is a streamer that so far hasn’t been bullied by Wall Street to forget about subscriber counts at all costs, so management probably still views libraries of older content as important to its growth and its ongoing battle against churn. A company like Disney might not be as enamored by libraries at the moment; add to that Warner Bros. Discovery (WBD), since both are looking to remove content more aggressively than Netflix, it seems. That isn’t to say Netflix won’t look to optimize content availability, it’s just to point out that the news flow seems to favor the other two in that particular regard. Disney and WBD will clearly sit out the volume game, while Netflix is more likely in my opinion to embrace it because of its first-mover advantage and its desire to serve subscribers who have decided that this streaming service is a must-have over many of the others.

This leads me to, of course, Lions Gate Entertainment (LGF.A) (LGF.B). Those who read my articles know media consolidation, and LGF, are never far from mind. Acquiring Lions Gate after the spin-out of the Starz service would be even cheaper, with the current enterprise value standing at a little over $6 billion (again, though, the spin-out will knock that number down). If Netflix considered Paramount’s creative ecosystem, and Metro-Goldwyn-Mayer’s, then it is hard for me to fathom that the company’s boardroom hasn’t knocked around the idea of a Lions Gate purchase. In fact, one would have to now consider the streamer as a potential buyer (I still, however, think private equity may be the more likely genre of capital to take LGF off the public markets, but when the Starz asset is ultimately divested, the dynamic may change radically and quickly).

Question is, to reiterate: Does Netflix want a library mostly for the service, or for IP that can be expanded at theaters? Something else comes to mind: What about locking up a bunch of IP that will be expanded, not to theaters, but instead to the company’s service itself? In other words, Netflix could double down on exclusivity in the digital distribution sphere and make sequels to something like The Godfather only for streaming.

How would that work, though? If Netflix had acquired Paramount, do you think Tom Cruise would be amenable to such thinking for future entries in the Top Gun/Mission: Impossible properties?

In my opinion: no, not quite. And this is why one has to circle back around to the thesis that Netflix wants to be in theaters, at least for the top-tier IP. We all may find out differently later, that Sarandos/Peters really do want to allocate capital toward an acquisition strategy that favors smaller-screen exclusivity, but for now, imagining a fight with talent over such an issue (especially as we go through the recent guild strike) is challenging at best (and considering what buying out the backend of someone like Cruise would likely cost, it almost certainly would stretch the limits of financial sense).

The company has to carefully evaluate how it wants to play the Hollywood game long term, if it wants to get into the Bob-Iger-acquisition-business or not, and why it would want to do that – this is because the company spends a lot on content each year (2024 should see around $17 billion, give or take) and has $14 billion of long debt on its balance sheet. Of course, the company’s streaming model is profitable and its cash-flow sheet is improving significantly…this fiscal year, for instance, the company expects to generate $3.5 billion in free cash (free cash is very variable for the company, but reduced content spend helped the Q1 stat to jump to over $2 billion).

At a current market capitalization of $195 billion, the company’s debt is in check, and it could use its stock currency to partially fund an acquisition as well. Being cautious nevertheless makes sense, as many are now arguing that even a company like Disney may have too much debt considering the new inflection point in the streaming wars – i.e., volume of content and its relationship to subscriber growth don’t always win the day: it’s black ink over red ink in media-streaming divisions now. Yes, I am repeating myself, but it’s notable because things can change quickly as eras of media disruption evolve.

This brings me to the idea of Netflix licensing content from HBO. Netflix is clearly interested in library content from other competing studios…as opposed to Apple (AAPL) that seems basically desirous only of jumpstarting its own studio (for now, anyway, until the tech giant eventually becomes enamored with consolidation). Granted, subscribers aren’t going to suddenly see Game of Thrones on the service. I would argue, however, that WBD should consider making money off aging content, even the big IP; licensing terms could be for short periods, and content could make the rounds among the different streamers on different months throughout the year. For the time being, examples such as Insecure and True Blood show that HBO wants to be careful about how it expands its revenue opportunities; for Netflix, it’s a sound strategy that may eventually lead to securing some of the higher-profile material down the line. If Netflix can’t strike a deal for another studio in the marketplace, then the next best thing is to rent content from others. And as I’ve been saying, it fits the volume proposition for Netflix and WBD – the latter wants to cut, while the former can absorb more content under its successful model.

It makes one wonder, too – if Netflix wanted to place a Hollywood studio in its portfolio, then – what about WBD once its lockup period ends? That company can’t sell itself until well into 2024 because of terms attached to its spin-out, but consider this thought experiment: Netflix buys out Warner Bros. Discovery, sells everything but the studio portion/library itself (that would be the Turner Networks, HBO/Max, etc.). Or, what if it was even more simplified: sell everything but DC. That would be very interesting, because that would then make the streamer uniquely qualified to compete against Disney. All of these consolidation scenarios in the current streaming wars boil down to how much money a buyer wants to spend versus the cheaper utility of simply renting content. If you do the latter, then you don’t have control over the underlying IP. That’s why libraries and trademarks are important, because it goes beyond even those elements. What’s truly exciting are the rights to make new content; this was the thesis behind the Lucasfilm purchase by Disney. (All of this makes me wonder: If Disney did some serious deleveraging, would it want to make an attempt to buy Marvel’s competitor?)

Putting all of this together, I see the report of a previous interest in Paramount as a good sign that Netflix is thinking about its future and attempting to be ahead of the curve in terms of diversifying out into various revenue streams. If you ask me, the company should have already been releasing films to theaters in a true, comprehensive multiplex strategy; owning Paramount would be a step toward that.

Valuation

Netflix is near the top of its 52-week range at the time of this writing – coming in at $450.

Netflix is indeed a name you have to own in the space, in my opinion; it’s no different than consumers – you can have other streamers on your device, but you must have Netflix as a constant. That seems certainly the perception in the marketplace of cord-cutters (i.e., start with Netflix and go from there). Netflix to me is serious about keeping relevant and chasing growth, so I want to be in the stock long-term to take advantage of its eventual role in media consolidation; transactions can act as catalysts, and Wall Street loves catalysts.

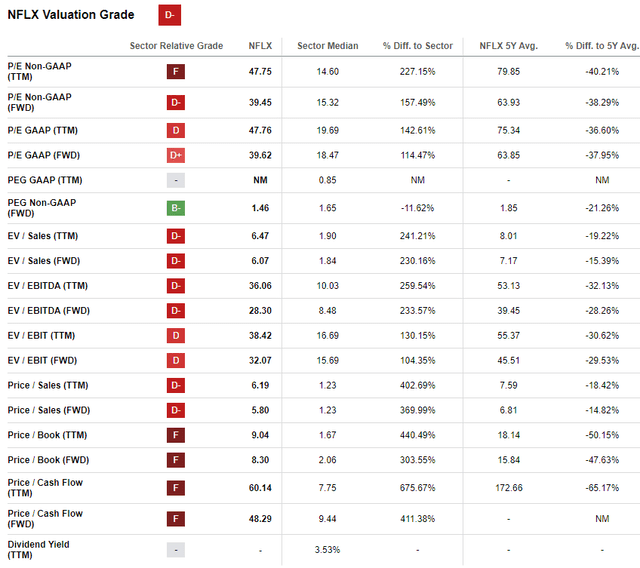

I see continued momentum for Netflix, and it definitely isn’t a sell. But it isn’t cheap, either. Pullbacks are especially recommended here, considering SA’s survey of valuation metrics.

Let’s look at some of those metrics:

As can be seen, the notable positive metric is the forward adjusted-PEG ratio, which is less than the sector median. That’s a good metric to be in the green since this is a growth company – the Growth Factor Grade from SA is rated very highly – but the rest are in the red, and yes, that’s quite notable, too.

Let’s think about fair value for a moment. We’ve all been here when talking about growth stocks like this, especially ones coming out of a bearish moment. When you have a growth story, you can come up with some crazy numbers that just don’t take into account the technical momentum of a good company. As an example, given the current P/E, adjusted and forward-looking, of roughly 40, I would, ideally, rather buy closer to half that, which would be around $225. That would be a lot closer, too, to the 52-week low of $170. But Netflix is simply way off that price, and if one waits for too significant of a pullback, then there is the risk of missing out.

Let’s move to the PEG. At 1.5, let’s say we’d ideally want to be in closer to 1.0. That would knock a third off the current price, giving us a more justified share price of $300. Interestingly, that line of thinking seems to agree with the conclusion to this SA piece. While that author’s analysis, a very solid and respectable one, rates the stock as a sell, and while I can see those who have rode the recent price momentum as a trade taking profits right now, I am still in the bull camp because of the company’s best-of-breed position. You’re going to pay a premium for Netflix, the arguable leader in the space, one with a great story and potential future opportunities.

However, I do concede price can be an issue. Considering the stock’s placement on the 52-week range, you’ve got to buy on down days, and patiently average into this name. Once you establish a position, hold on for the longer term. I think the momentum will be there for traders looking to take advantage of a market that will eventually turn for good (I’m still cautious on the timing of the macro turn), but dollar-cost-averaging and buy/holding will work here as well (and with less risk for the individual investor). Having said that, I would propose a more practical fair-value buy range as a guide: downturns between 10% and 20%. That would translate to (at the time of writing) between $360 and $405.

What are the risks? Here are some bullet points on that subject:

- Technical downturn of the market

- Netflix ignores the value of entering the theatrical market

- Netflix decides not to play the consolidation game

- Perception on interest rates worsens

- Fed signals justification of such perception

- Netflix makes content no one wants to see, either on the service or for theaters

- Churn worsens, subscriber counts contract

What do these risks tell us? I’ll say it again: opportunistically buy this media leader on drops in price, and use averaging to improve costs basis. It’s what I have been doing, and in my portfolio, it is firmly in the green.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, AMZN, DIS, LGF.A, LGF.B, NFLX, PARA, WBD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I may add to some of these positions at any time around publication of article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.