Summary:

- Google investors may rest assured about its moat, since new data indicates Google Search’s growing market share at 92.64% by June 2023.

- Despite the fast and furious adoption, app downloads for ChatGPT and Bing have slowed dramatically by -38% MoM in June 2023, suggesting that the AI hype may be over.

- Then again, Google Search’s paid website traffic has declined by -11.9% to 20.39M by June 2023, potentially impacting the FQ2’23 top-line.

- While GOOG has been sending more projects to the Google Graveyard, while further rationalizing its headcounts, it remains to be seen if the management may similarly achieve META’s improved margins.

- Investors must also note the potential impact of GOOG’s backloaded SBC expenses and increased AI R&D/ capex in FY2023.

Justin Sullivan

The GOOG Investment Thesis Remains Unshaken, Post ChatGPT Hype

We previously covered Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) in May 2023, discussing its new accounting methods, which had accelerated Google Cloud’s profitability and boosted the company’s EPS growth in FQ1’23.

However, thanks to the intensifying AI competition offered by Microsoft (MSFT) backed ChatGPT and the refreshed Bing, we had concluded that GOOG’s execution might be uncertain in the near term.

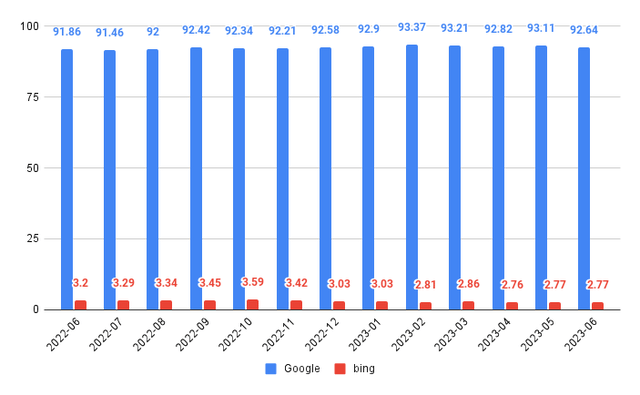

Search Engine Market Share Worldwide

For now, it appears that GOOG investors may rest assured about its leadership in the search engine market, since new data from statcounter suggests Google Search’s growing market share at 92.64% by June 2023 (-0.47 points MoM/ +0.8 YoY), compared to 92.21% in November 2022 prior to ChatGPT’s launch.

Most importantly, this expansion comes at a great cost to MSFT’s Bing, with its market share declining to 2.77% by June 2023 (inline MoM/ -0.43 YoY), compared to 3.42% in November 2022.

This cadence implies the growing stickiness of GOOG’s offerings, especially since app downloads for ChatGPT and Bing have slowed by -38% MoM in June 2023, with ChatGPT visits moderating by -11% MoM to ~51M weekly visitors. It appears that consumers have chosen to return to Google Search, after the hype dies down, with the CEO Sundar Pichai likely breathing a sigh of relief for now.

The same has been hypothesized with Meta’s (META) newly released Threads and Elon Musk’s incumbent Twitter thus far. While adoption has been fast and furious, with 100M of users recorded within five days of launch, it remains to be seen how many may eventually stay, given Twitter’s large and loyal user base.

This may eventually impact how META monetizes its Threads’ user base, despite us being optimistic about the synergistic opportunities within the existing Family Of Apps and its base of advertisers. Only time may tell if the Threads hype may eventually die down the way ChatGPT and Bing have.

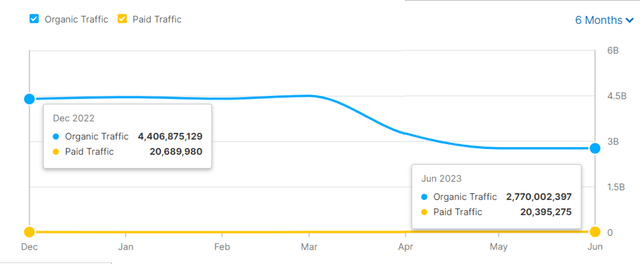

Google Search’s Organic and Paid Website Traffic

Then again, Google Search’s organic total traffic has plunged drastically by -38.5% to 2.77B by June 2023 compared to 4.51B in March 2023, or by -37% compared to 4.4B in December 2022.

Most importantly, its paid website traffic has also notably declined by -11.9% to 20.39M by June 2023 compared to 23.17M in April 2023, or by -1.4% compared to 20.68M in December 2022, suggesting that its FQ2’23 results may be impacted.

These numbers matter, since Google Search comprises $40.35B (-5.3% QoQ/ +1.8% YoY) or the equivalent of 57.8% (+1.8 points QoQ/ -0.4 YoY) of GOOG’s FQ1’23 revenues, potentially impacting its stock prices post FQ2’23 earnings call.

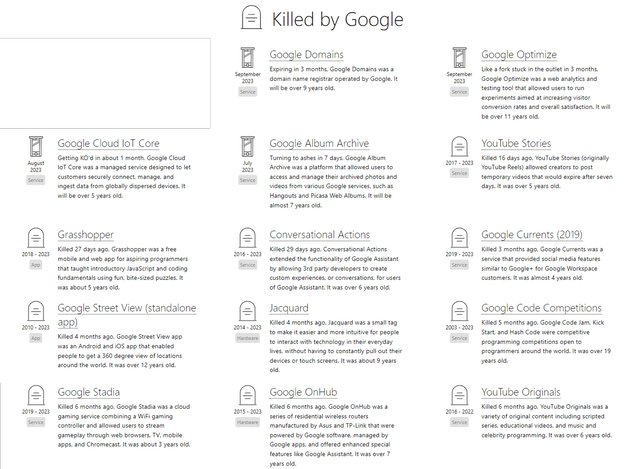

Google Graveyard

While GOOG has been expediently sending more projects to the Google Graveyard, while further rationalizing its headcounts, it remains to be seen if these efforts may eventually be translated to its bottom line, compared to META’s immense success thus far.

We must also remind investors that its SBC expenses have been backloaded to the upcoming three quarters, on top of the increased AI R&D and capex in FY2023, potentially impacting the advertising giant’s profit margins and FCF generation.

GOOG’s execution may be further impacted by the notable deceleration of advertising spend at a time of peak recessionary fears as well.

The market analysts already expect the global advertising spend in 2023 to further moderate to +5.9% YoY, suggesting a notable decline from 2022 YoY expansion of 6.4%, 2019 levels of 24.8%, and 2019 levels of +10.2%. This number is also based on the assumption that things may pick up in H2’23.

If not, based on GOOG’s FQ1’23 advertising revenues of $54.54B (-7.6% QoQ/ inline YoY) and META’s advertising revenues of $28.1B (-10.1% QoQ/ +4.1% YoY), we are already seeing hints of normalization in the two advertising giants’ results. This is a similar cadence observed by Vincent Létang, EVP of global market research at Magna:

Advertising spending slowed down to a halt in the first quarter of 2023 (+1.5% globally, flat in most Western markets) due to economic uncertainty and the lack of cyclical drivers. (Adweek)

With GOOG and META commanding 49.3% of the digital ad share, we believe their upcoming FQ2’23 results and forward guidance may offer better clarity in the health of the global advertising market.

So, Is GOOG Stock A Buy, Sell, or Hold?

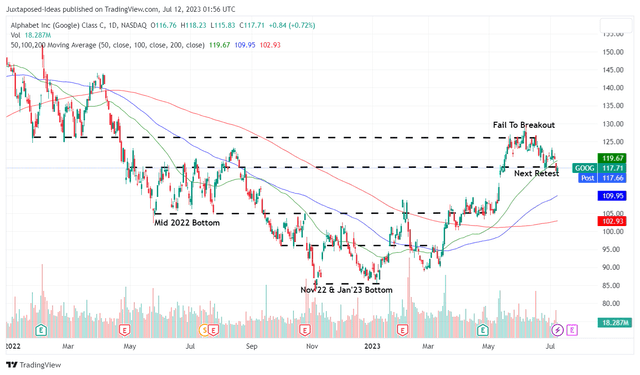

GOOG 1Y Stock Price

For now, the GOOG stock has already recorded an impressive recovery of +39% since the November 2022 bottom, otherwise, +12% since the FQ1’23 earnings call in April 2023.

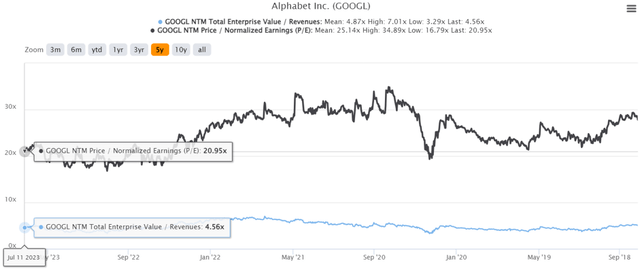

GOOG 5Y EV/Revenue and P/E Valuations

Then again, there appears to be a decent upside potential from current levels to our price target of $153.98, based on its NTM P/E of 20.95x and the market analysts’ FY2025 adj EPS projection of $7.35. This valuation is by no means elevated as well, compared to its 5Y mean of 25.15x and pre-pandemic mean of 25.06x.

As a result, we are cautiously rating the GOOG stock as a Buy here, if the exercise consequently matches investors’ dollar cost averages.

Otherwise, bottom fishing investors may consider waiting for a moderate retracement to its April 2023 support level of $105 for an improved margin of safety, with the Fed’s upcoming meeting in July 2023 potentially triggering further volatility.

Investors may want to weigh their portfolios appropriately, since we are uncertain if the exuberance surrounding the current bull run may last through the supposed potential H2’23 recession.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, MSFT, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.