Summary:

- After I have conducted my analyses, I now understand why Coca-Cola is one of the favorite stocks of Warren Buffett.

- KO’s unmatched brand loyalty enables the company to exercise vast pricing power, which allows it to offset current headwinds.

- My valuation analysis suggests the stock is about 20% undervalued.

Justin Sullivan/Getty Images News

Investment thesis

Warren Buffet, the most significant investor of all time, once said he would never sell his equity ownership in The Coca-Cola Company (NYSE:KO). After I completed my analysis of the company’s financial performance and valuation, I agree that the stock is an excellent investment opportunity. KO currently offers an attractive forward dividend yield of 3% and an upside potential close to 20%. The company has one of the strongest brands on Earth, enabling it to exercise vast pricing power and sustain unmatched profitability metrics. This, in turn, allowed the company to become one of the most famous dividend aristocrats.

Company information

Coca-Cola is a leading producer of soda, juices, juice drinks, and ready-to-drink teas and coffees. The company’s products are sold in more than 200 countries. According to Coca-Cola’s latest 10-K report, approximately 2.2 billion servings of the company’s products are consumed daily.

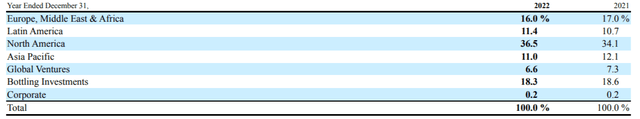

The company’s fiscal year ends on December 31. KO’s operating structure includes six operating segments, four of them distinct by geographical area. More than one-third of the company’s sales are generated in North America.

Coca-Cola’s latest 10-K report

Financials

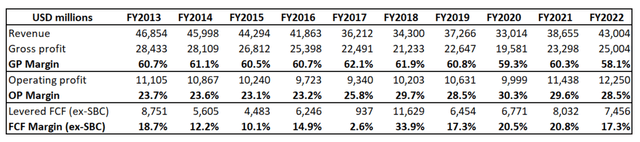

The company’s financial performance is exemplary, especially its profitability metrics. Over the past decade, the gross margin was below 60% only twice, and the operating margin expanded from 24% ten years ago to much closer to 30% in recent years. The free cash flow [FCF] margin looks immense, averaging 16.8% for the last decade.

Author’s calculations

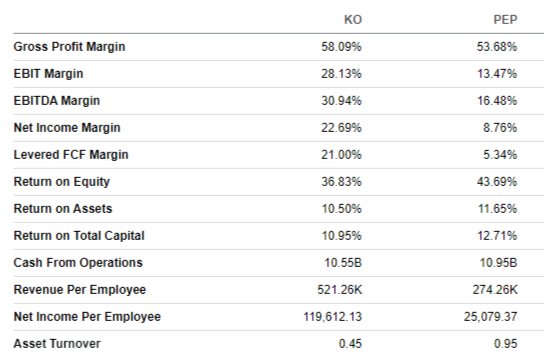

To underline Coca-Cola’s profitability greatness, let me add some context here. We all know that the company’s biggest rival is PepsiCo (PEP), whose revenue is twice higher than KO’s. Despite a massive gap in the business scale, KO still demonstrates much higher profitability metrics than PEP almost across the whole board. It is also genuinely fascinating that despite the massive advantage of PEP in terms of the business scale, both companies generate almost the same amount of cash from operations.

Seeking Alpha

The company’s capital allocation is very shareholder-friendly. Coca-Cola’s stellar profitability allows the company to sustain an “A+” dividend consistency grade from Seeking Alpha Quant. The company has sixty [not a typo] consecutive years of dividend growth, and the current forward dividend yield looks attractive at 3%.

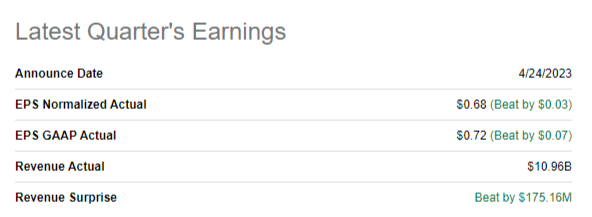

The latest earnings were released on April 24, KO delivered above-the-consensus performance. Revenue grew 4.35% YoY, and EPS expanded from $0.64 to $0.68. The gross margin softened slightly by 32 basis points while the operating margin deteriorated more from 33.39% to 31.76%. The company generated $1.1 billion of the levered FCF in Q1 FY 2023, compared to -$468 million in the previous year.

Seeking Alpha

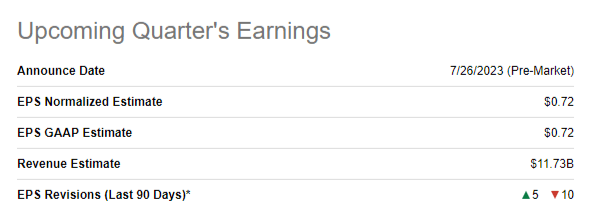

The upcoming quarter’s earnings are expected to be released on July 26. Consensus estimates forecast the second quarter’s revenue at $11.7 billion, which means about 4% YoY growth. The bottom line is expected to expand from $0.7 adjusted EPS to $0.72. I think the company is highly likely to beat consensus estimates because of its strong brand, allowing Coca-Cola to exercise its vast pricing power. This “superpower” helps the company to offset any unfavorable factors in the macro environment whether it is short-term softening in demand or inflationary pressure from the costs side. Moreover, there was a net of five downward earnings revisions, meaning consensus estimates are already conservative.

Seeking Alpha

The company’s strong financial performance in the fiscal year 2022 also gives me much optimism regarding the upcoming earnings. Last year was more challenging than the current with geopolitical shocks, skyrocketing commodity prices, and other unfavorable inflationary factors. But with all the disruptions and headwinds of FY 2022, the company demonstrated double-digit revenue growth, and the profitability metrics did not suffer much. According to the earnings surprise history, the company almost never misses EPS forecasts and very rarely misses revenue.

Valuation

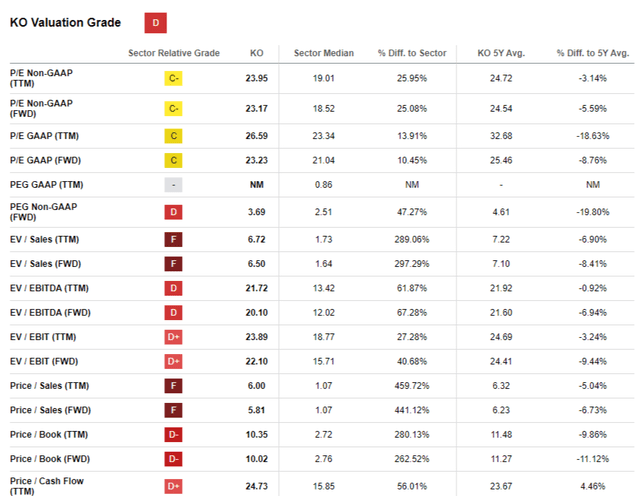

This year, the stock underperformed the broad market with a 3% year-to-date price decline. Seeking Alpha Quant assigns KO a low “D” valuation grade due to high valuation ratios compared to the sector median. On the other hand, the current multiples are mostly lower than KO’s 5-year averages.

Seeking Alpha

Coca-Cola is a unique company with one of the most recognizable brands worldwide and unmatched profitability. Therefore, it is not surprising for me that the multiples of such a company are substantially higher than the sector median. Therefore, I would instead consider the stock undervalued in the context of historically low multiples.

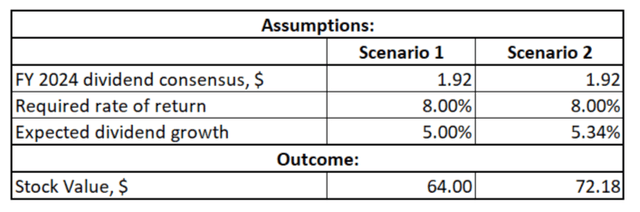

I would like to extend my valuation analysis with one more approach to get more evidence. Coca-Cola is a dividend aristocrat, so I think the discounted dividend model [DDM] approach would best fit the valuation. I use an 8% WACC, a round-up of the estimate from valueinvesting.io. I also have consensus dividend estimates forecasting a $1.92 in FY 2024. The dividend growth rate is always tricky because it is never constant, but I think using the company’s historical long-term CAGR would be a good choice. The 10-year CAGR of KO’s dividend growth is 5.34%. I want to demonstrate that the DDM is very sensitive to the change in dividend growth rate, so below I simulate two scenarios. The first one is more conservative since it is a round-down of 5.34%.

Author’s calculations

I simulate the more conservative scenario to demonstrate that the margin of safety is comfortable because even with a slower dividend growth rate, the stock is still slightly undervalued. In a scenario where KO sustains its past decade’s dividend CAGR, the fair value of the stock is $72. That said, the upside potential is close to 20%. Looks very attractive, especially if we also consider a 3% forward dividend yield.

Risks to consider

While Coca-Cola’s financial performance is staggering and the valuation looks attractive, investing in KO is not without risks. The company faces high inflationary pressure, including unfavorable fluctuations in commodity prices, transportation costs, and labor expenses. While I have mentioned earlier that the company’s vast pricing power allows it to offset inflationary pressure by increasing selling prices, the pricing power is not infinite. At some point in the future, the company will start losing its “superpower”. Recent news suggests there were strikes of Coca-Cola workers in West Virginia and Lower Mainland. The company has to react by improving working conditions and employee pay, meaning additional costs and downward pressure on profitability metrics.

The company generates about 65% of its sales outside North America, meaning that KO is vulnerable to risks related to global trade. Primarily, earnings can be adversely affected by unfavorable fluctuations in foreign exchange rates. The risk of unfavorable changes in international trade legislation and tariffs can also disrupt the company’s operations and lead to unexpected costs.

Another substantial risk for Coca-Cola, which I see, is the perceived health risks for consumers of the company’s core products. The growing awareness of the health issues related to obesity may lead to a decline in demand for sugar-sweetened beverages. Public sentiment and regulatory actions addressing the health impact of sugary drinks could also result in reputational damage.

Bottom line

To conclude, Coca-Cola stock is a “Strong Buy” for investors seeking a value company with predictable returns. I will add the stock to my portfolio at the current price level to diversify my portfolio, which is relatively aggressive. The company is “printing” cash, enabling it to increase dividends yearly. The current forward dividend yield of 3% looks attractive in the context of the substantial upside analysis, which I figured out with the help of the DDM approach.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in KO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.