Summary:

- Coca-Cola’s enduring brand strength, robust portfolio, and reliable dividends make it an attractive investment, despite a challenging market environment including persistent inflation and global supply chain disruptions.

- The company’s stock price is in a long-term bullish trend, but has hit a significant resistance level; surpassing this could signal further upward trajectory.

- Investors might consider entering the market at the $65 mark, anticipating higher prices, or during a market correction towards the $55 level.

Justin Sullivan/Getty Images News

This article provides an in-depth technical analysis of The Coca-Cola Company (NYSE:KO), a global behemoth in the beverage industry. The objective is to forecast the future trajectory of its stock price and identify viable investment opportunities for individuals interested in long-term investments. The observation reveals that the stock price is encountering long-term resistance and exhibiting wide-range consolidations at these resistance points. Short-term bullish momentum is challenging this resistance area, and any breakthrough beyond these critical points may present another buying opportunity in the market, anticipating a significantly higher price.

Fundamental Outlook

Coca-Cola is a paragon of enduring brand strength. Boasting near-universal global brand recognition, the company holds an impressive portfolio of numerous brands, each of which consistently produces robust annual sales. The beverage giant has even earned the investment confidence of one of the world’s best-known investors, Warren Buffett, whose Berkshire Hathaway holds approximately 9.2% of Coca-Cola’s outstanding shares. However, investors shouldn’t anticipate rapid growth from a well-established company like Coca-Cola. The allure for most shareholders is the stock’s low volatility and attractive dividend.

Indeed, Coca-Cola’s stability is a significant draw for investors seeking a reliable foundation for their portfolios. With a beta of 0.65, the company exhibits less volatility than the broader stock market, representing a haven amidst market fluctuations. Additionally, Coca-Cola has consistently increased its dividend for 61 consecutive years, earning its prestigious title as a Dividend King. The stock’s current dividend yield of 3.02% significantly outpaces the S&P 500’s yield of 1.54%.

Nonetheless, Coca-Cola faced some challenges in the first half of 2023, with shares dipping more than 5%. As the world’s largest beverage company, with strong revenue, Coca-Cola finds itself grappling with an increasingly difficult operating environment as persistent inflation squeezes consumers. The company swiftly restructured its operations and honed its focus on top-performing brands when the pandemic caused sales to plummet. Even though this forward-thinking strategy has resulted in increasing sales and stable profits, the growing issue of inflation and a lethargic retail environment presents considerable obstacles.

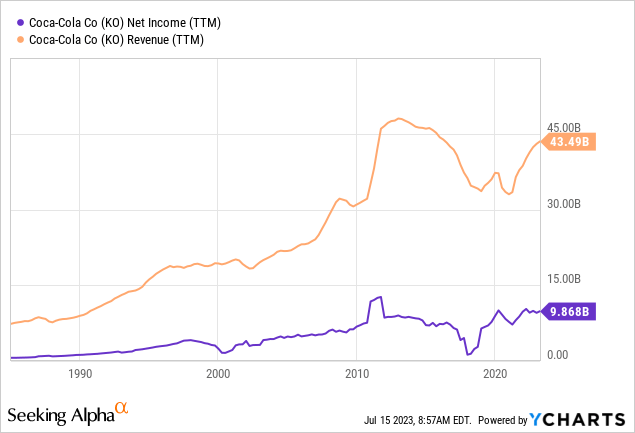

Despite short-term challenges, Coca-Cola is anticipated to harness its robust financial health, globally recognized brands, and potential for long-term growth to sustain stability. Investors in Coca-Cola recognize that the investment provides a steady, albeit moderate, growth over time. Even though it may not be a rapid-growth stock, its status as a Dividend King with a stable 3% yield is attractive to dividend investors. The following chart illustrates the trajectory of Coca-Cola’s revenue and net income over the past thirty years. Notably, the period following the Covid-19 pandemic registered an upward trend for both revenue and net income, with 2022 figures reaching $43.49 billion and $9.868 billion respectively. This encouraging financial performance, particularly the consistent increase in net income, underscores Coca-Cola’s profitability and suggests that it may indeed present a compelling investment opportunity.

Decoding the Long-term Technical Trends

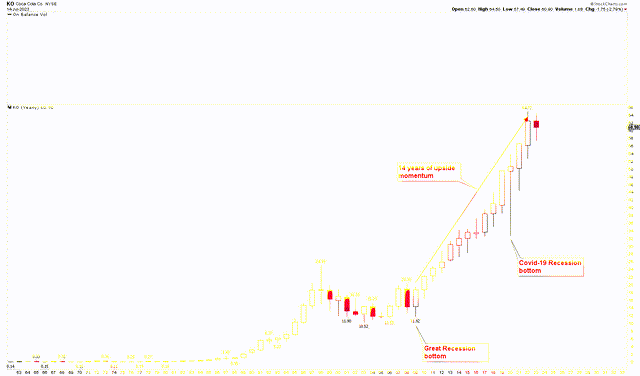

The long-term stock chart for Coca-Cola, as depicted in the yearly chart below, showcases an unmistakable bullish base and a sustained price trend. In the span of the past 14 years, the stock’s price trajectory has steadily ascended, making a powerful recovery from its Great Recession low point of $11.92.

Coca-Cola Yearly Chart (stockcharts.com)

The stock price drop during the Great Recession was a consequence of the global economic downturn, which led to decreased discretionary spending on non-essential goods, including Coca-Cola’s products. The company experienced reduced revenues and profits as a result. Furthermore, the financial crisis triggered fear and uncertainty in the markets, prompting a widespread selloff of stocks. Despite its robust brand and global reach, Coca-Cola’s stocks were not exempt from this trend. However, the company’s stock drop was not as deep as others during the recession, underlining its relative resilience.

In the wake of the Covid-19 recession, the company’s stock price took another dip in 2020. This drop was driven by restrictions and lockdowns implemented worldwide to control the virus’s spread, which led to closures or limited operation of many establishments in the hospitality sector—a substantial revenue stream for Coca-Cola. The pandemic also prompted a consumption shift from on-the-go to at-home, which further hit Coca-Cola’s sales, given its heavy reliance on out-of-home consumption. Additionally, the pandemic-induced disruption in global supply chains posed significant challenges for companies like Coca-Cola in managing their production, distribution, and sales. Despite these hurdles, the stock made a strong recovery, demonstrating a bullish trend for 2020 as seen in the yearly chart above.

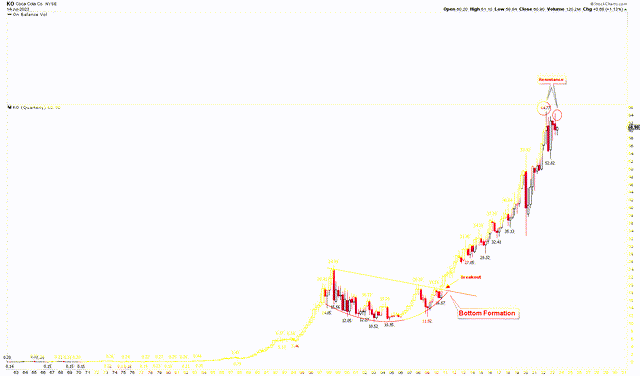

Post the Covid-19 downturn, Coca-Cola’s stock price has followed a bullish trend, hitting a key resistance area in 2023. This resistance is evident from the quarterly chart, which shows a robust bottom formation from 2000 to 2009. The price broke the long-term upward trend after the Great Recession’s low in 2009 and is currently displaying bullish momentum. The Covid-19 recession’s impact was confined to a single quarter, and the price has since maintained its bullish momentum. The significance of the current resistance level at $64.77 is highlighted by the fact that each time the price reaches this level, it corrects lower, hinting at a potentially extended pullback if prices continue to drop.

Coca-Cola Quarterly Chart (stockcharts.com)

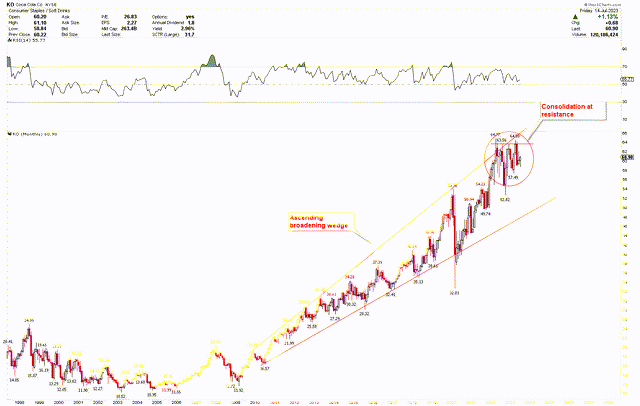

The monthly chart further emphasizes the current level’s significance through a strong consolidation at the resistance point. Interestingly, this resistance is also confirmed by an ascending broadening wedge pattern formed from the 2010 low of $16.57 to the all-time high of $64.77. The consolidation at this level and the emergence of this pattern underscores the need for investor caution. If prices surpass all-time highs, it may suggest the continuation of Coca-Cola’s upward price trajectory.

Coca-Cola Monthly Chart (stockcharts.com)

Key Action for Investors

From the above analysis, it’s clear that Coca-Cola’s stock price is in a long-term uptrend and poised to trade higher. However, the presence of critical resistance suggests a potential pause in the market for a longer period. But, if the market surpasses all-time highs, it could indicate further upward acceleration.

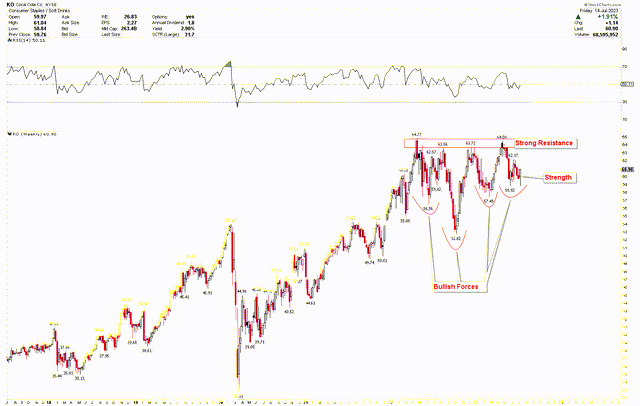

The weekly chart below reveals an inverted head and shoulders pattern, with the head found at $52.82 and the shoulders at $56.56 and $57.49. The neckline of this pattern is around the $65 mark. Each time the price corrects lower, it rebounds higher, indicating bullish market forces at play. The bullish hammer emerging from this week’s candle underscores market strength. Investors could consider entering the market if prices exceed $65, anticipating higher prices. Conversely, they may add positions during a market correction towards the $52.82 region. However, a break below $50 could signal further market downward pressure.

Coca-Cola Weekly Chart (stockcharts.com)

Market Risk

While Coca-Cola’s robust brand strength, low volatility, and attractive dividends create an appealing investment proposition, certain market risks can’t be overlooked. Firstly, the persistent inflation, coupled with a sluggish retail climate, places considerable pressure on consumer spending. If this trend continues, Coca-Cola’s sales and profitability could be adversely affected. The company has already witnessed a 5% dip in shares in the first half of 2023, which is indicative of the effects of the challenging economic environment. Secondly, Coca-Cola could face further complications from global supply chain disruptions.

On a technical level, Coca-Cola’s stock price has hit a key resistance area. If the price doesn’t surpass the current all-time highs, it could lead to an extended pullback or even a reversal of the bullish trend. Moreover, the emergence of an ascending broadening wedge pattern calls for investor caution as it often precedes a significant price decline. A break below the $50 mark could signal further market downward pressure, highlighting a potential risk for investors.

Bottom Line

In conclusion, Coca-Cola’s enduring brand strength, robust portfolio of successful brands, and reliable dividends make it an attractive proposition for investors seeking stability and long-term returns. Despite challenging market conditions, such as persistent inflation and global supply chain disruptions, the company has demonstrated resilience and an ability to maintain steady performance. The technical analysis suggests a long-term bullish trend for Coca-Cola’s stock price, yet with the stock hitting a significant resistance level and the emergence of ascending broadening wedge, investors must proceed with caution. Breaking this resistance could signal an ongoing upward trajectory, yet failure to do so might result in an extended pullback. Ultimately, while Coca-Cola may not promise rapid growth, it offers a potentially rewarding investment for those seeking steady, modest growth and appealing dividends. Investors might contemplate initiating their entry at the $65 mark, with the prospect of seeking higher prices. Alternatively, they could also consider entering the market if a correction occurs, bringing the price down to the $55 level.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.