Summary:

- LCID continues to face major cash flow issues, though with the PIF backing the automaker, we suppose it may just survive over the next few years.

- We are also seeing a widening gap in its production and deliveries, with approximately 4.76K units undelivered, with a growing inventory value of $1.01B (+21.9% QoQ/ +205.4% YoY).

- LCID’s resale value appears to be drastically impacted, with one recently auctioned for $85K, compared to the base model MSRP of $107.4K or up to $180.65K.

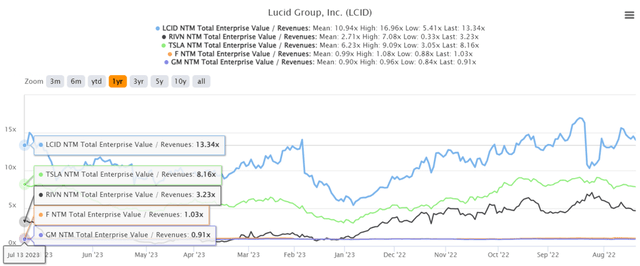

- LCID also trades overly optimistically at NTMEV/ Revenues of 13.34x, compared to TSLA at 8.16x, F at 1.03x, GM at 0.91x, and RIVN at 3.23x, suggesting a baked in premium.

- Due to its mixed prospects, we are uncertain if retail investors may be ableto keep up with the volatile investment thesis moving forward.

Daniel Megias

The LCID Investment Thesis Remains Highly Speculative

We previously covered Lucid Group, Inc. (NASDAQ:NASDAQ:LCID) on May 30, 2023, suggesting its immense volatility, due to the stock’s elevated short interest, sustained cash burn, lumpy production/ delivery numbers, and lowered 2023 guidance at that time.

We had concluded that a retracement to $6s was very likely, due to the deteriorating balance sheet triggering further dilutive capital raise, with the macroeconomic outlook still pessimistic and capital funding tight.

True enough, the LCID management had announced another round of Public Offering of Common Stock on May 31, 2023, bring the PIF’s stake to 60.49%. The additional liquidity of $3B was necessary indeed, due to the quarterly cash burn rate of -$0.94B and dwindling cash/ short-term investments of $2.97B (-24% QoQ/ -44.8% YoY) in FQ1’23.

While it is clear that the automaker has a clear backer in the PIF, with the latter likely hedging its bet on the EV manufacturing business against the existing oil/gas production, we are uncertain if retail investors may be able to keep up with the volatile investment thesis moving forward.

While LCID may have won the battery competition through its longest driving range and market leading design, the management’s choice to go premium has clearly alienated the mass market. This is a segment that fellow automakers, such as Tesla (TSLA) and BYD (OTCPK:BYDDF), have invested great efforts, while improving their supply chain and pricing strategies.

This alone suggests LCID’s highly niche market segment based on the hefty price tag of $150K per unit, compared to TSLA at $40K and BYD between $20K to $30K (in China), naturally elevating its cash burn due to the lack of economy of scale.

For now, LCID has not achieved break even, selling every EV at a loss. Even its FQ2’23 production output are impacted at 2.17K (-6% QoQ/ +55% YoY) and deliveries at 1.4K (inline QoQ/ +106% YoY), despite the installed annual production capacity of 34K (prior to Gravity expansion to 90K).

Based on its 2021, 2022, and YTD numbers, we are also seeing a widening gap in its production and deliveries, with approximately 4.76K units undelivered. This is based on 275 units undelivered in 2021, 2.81K in 2022, 908 in FQ1’23, and 769 in FQ2’23, with a growing inventory value of $1.01B (+21.9% QoQ/ +205.4% YoY) in its balance sheet in FQ1’23.

LCID’s resale value appears to be drastically impacted as well, with a Lucid Air recently auctioned for $85K, with other resale websites highlighting a similar price range, implying a drastic gap of -20.5%, compared to its base model MSRP of $107.4K or -52.9% to the premium model at $180.65K.

This is a stark comparison against a resale Tesla Model 3 at an average price of $37K, indicating a minimal gap of -7.5% compared to MSRP of $40K.

This cadence confirms our suspicion that the consumer demand for LCID remains weak, with its deliveries and top-line likely to be further impacted as the Fed sustains their hawkish tone, with the projected two rate hikes in 2023.

With a projected terminal rate of 5.6%, we may see borrowing costs further increase from the average interest rate for auto loans on new cars at 6.87% in May 2023, compared to 2019 averages of 4.63%. Things do not look good indeed.

So, Is LCID Stock A Buy, Sell, or Hold?

LCID 1Y EV/Revenue Valuations

LCID also trades overly optimistically at NTM EV/ Revenues of 13.34x, compared to its 1Y mean of 10.94x. This valuation is even more surprising, compared to its automaker/ EV peers such as TSLA at 8.16x, Ford (F) at 1.03x, General Motors (GM) at 0.91x, and Rivian (RIVN) at 3.23x.

Perhaps this may be attributed to the market analysts expecting LCID to survive through the impacted deliveries and uncertain macroeconomic outlook, thanks to the continuous capital injection from the PIF.

Assuming so, we suppose the market analysts’ FY2025 projection of a top-line expansion to $4.91B, expanding at a CAGR of +100.7%, to be somewhat possible after all. This is based on the automaker’s expanded annualized production capacity of up to 90K vehicles in the AMP-1 facility and up to 155K in the Saudi Arabia facility.

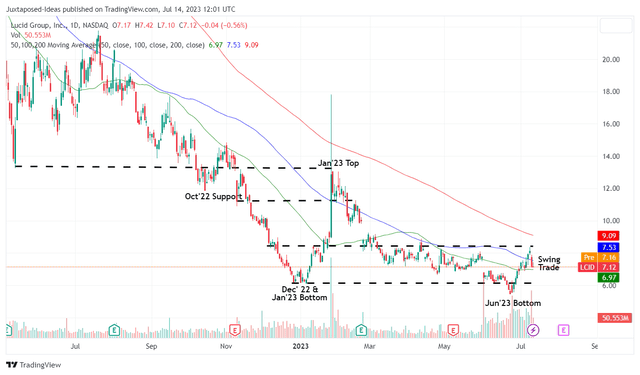

LCID 1Y Stock Price

Based on this wildly optimistic outlook, we suppose LCID may just survive through the uncertainties, with the stock currently forming a sustainable floor between $5 and $6.

It is also important to note that the PIF has previously supported the management’s capital raise efforts at an average purchase price of $10.67 in December 2022 and, most recently, at $6.77 in May 2023.

As a result, traders with higher risk tolerance may consider adding LCID at those levels for an improved margin of safety, especially due to the elevated short interest of 20.90% at the time of writing.

Naturally, the portfolio must be appropriately sized, since share dilution appears to be the norm until either the automaker achieves positive cash flow, or PIF takes the automaker private. Only time may tell.

Anyone looking to add must also be very patient, since the stock may continue trading sideways between $6 and $7.50 in the near term, with an eventual recovery and GAAP profitability remaining a far-fetch possibility for now.

Given the mixed prospects, we prefer to rate the LCID stock as a Hold (Neutral) here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.