Summary:

- Meta Platforms has a robust data ecosystem and large user base.

- AI tools may be able to help the company better monetize their data and optimize ad delivery in the future.

- Meta has high margins and a fortress balance sheet, and can outperform investor expectations going forward.

- Despite regulatory risks and potential privacy concerns, we believe Meta stock is undervalued at these levels.

Justin Sullivan

Thesis

Data is becoming more important by the day. Meta Platforms (NASDAQ:META) has a robust ecosystem for collecting user generated data, as well as a large and diversified user base. This will help the company adapt their business and better monetize their data over the coming years. The company has the continued opportunity to optimize ad delivery and conversion rates, as well as a fortress balance sheet. For these reasons, we believe that Meta is reasonably valued and has further upside.

Ad Optimization

Meta has made good progress in improving ad efficiency over the past few months. According to Mark Zuckerberg, AI tools increased monetization efficiency for Reels by 30% on Instagram and 40% on Facebook versus the prior quarter. It’s likely that improvements in efficiency will continue to be made over time as Meta grows more experienced with implementing AI based tools.

It’s worth noting that improvements in the quality of content recommended to users may cause those users to spend more time on the platform, increasing ad impressions without meaningfully degrading the user experience. According to Meta’s Q1 earnings release:

In the first quarter of 2023, ad impressions delivered across our Family of Apps increased by 26% year-over-year and the average price per ad decreased by 17% year-over-year.

The decline in average price per ad is a bit concerning, however it could be simply due to a difficult macroeconomic environment and a corresponding decrease in demand for ad slots. As economic strength and small business confidence begins to improve, it could lead to an increase in demand for ad slots. Investors would do well to keep an eye on the average price per ad going forward, as a continued decline in this metric could be a sign that Meta is offering an inferior solution.

Improvements in efficiency are crucial for Meta to remain competitive in the advertising space. In addition to improving their competitive positioning, efficiency improvements can also increase the margins of their ad business.

Data Ecosystem

Meta has many different revenue segments, and they generally work together to form a robust data ecosystem. Most of the platforms that Meta runs provide an avenue for users to generate data through what they post and what they interact with. Meta stores and analyzes this data in order to improve the quality of their ad delivery.

As the value of data increases, Meta may be able to find new ways to monetize their data trove that go beyond optimizing ad delivery. As time goes on and employees at the company begin to shift their mindsets regarding data, it’s likely that creative uses for their data will emerge. As long as the company fosters a culture of innovation, they should be able to navigate the changing technological climate and take advantage of future data-related opportunities.

Price Action

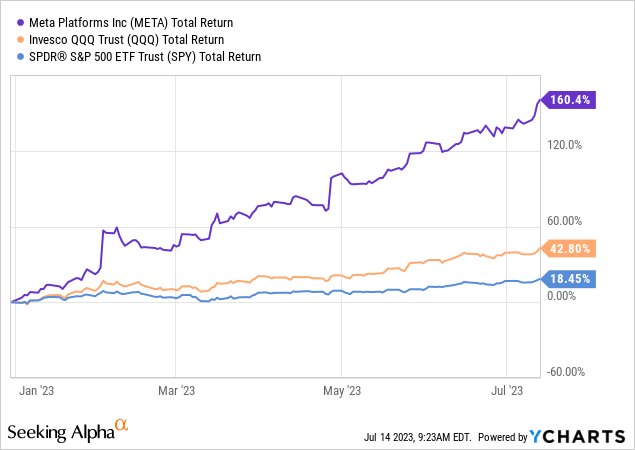

Meta has been on a tear this year, up a whopping 160%. Part of the reason for this gain is due to how hard the stock sold off last year as investors criticized the metaverse focus and threw in the towel. For the time being, it seems that investor confidence is returning to Meta.

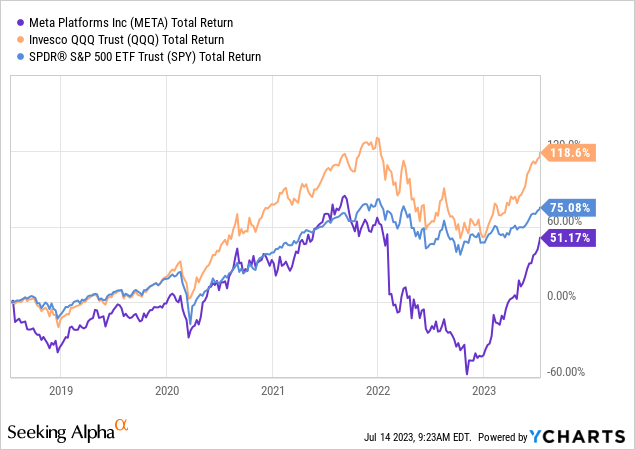

Somewhat surprising is the fact that Meta has underperformed both the Nasdaq 100 and the S&P 500 over the past five years. The company has been rocked by more than a few controversies over that time period, and now may be the time for the company to return to long-term outperformance.

Valuation

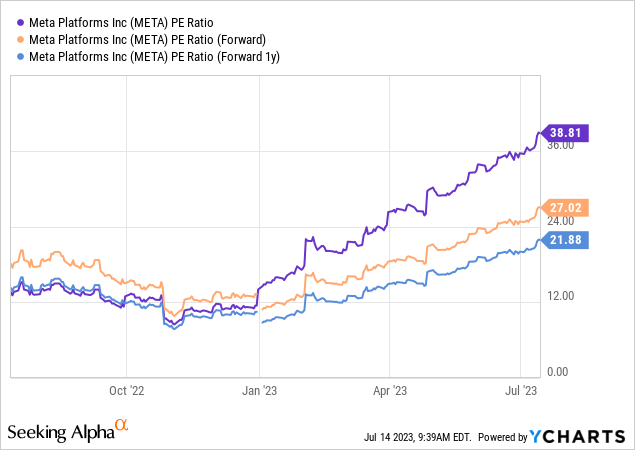

Meta looks a bit expensive relative to their recent history, but this doesn’t take into account the difficult economic environment and opportunities that the company will have in the future. While Meta has a business that is mostly reliant on advertising, they are taking proactive steps to not only remain competitive in advertising, but also to monetize their data in new ways. The company has a fortress balance sheet and low capital intensity. For these reasons, we believe the stock remains a good value despite the run-up. The company has a massive user base and a lot of opportunity for future growth. Given the current circumstances, we would look to lighten up on Meta if it got to around 30 forward 1y PE, but until then the company looks reasonably valued with the potential to outperform expectations.

Risks

Regulatory risks are top of mind for investors in Meta. Regulators around the world have shown disdain for the company and their data collection practices. We believe that over time, Meta will begin to rely less on user activity that occurs off platform and will instead transition to using only user generated data and interactions within the Meta ecosystem, reducing privacy concerns. Another risk is that Meta’s user base begins to shrink. While this is always a possibility, for the time being their user metrics appear to be stable. As the company gets better at monetizing their user base, it could even afford to have a decline in users without meaningfully impacting their operations.

We view the risk/reward as being favorable, but the company will need to do a good job at navigating the regulatory landscape in order to ensure their business can be successful over the long-term.

Key Takeaway

We believe that Meta represents a good value at these levels. The company has a robust data ecosystem, a large user base, and a fortress balance sheet. As the value of data increases, we believe the company will be able to find new ways to monetize their data over time. Continued improvements in advertising efficiency will help to keep them competitive and expand their margins.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

UFD Capital Value Fund, LP has long exposure to META.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.