Summary:

- After delivering outstanding results, Exxon Mobil’s share price has come under pressure in recent months as investor sentiment shifts.

- It is too early to consider this retracement as an attractive buying opportunity as short-term headwinds are to be expected.

- In the meantime, Exxon’s management continues to make the right moves from a capital allocation point of view.

chitsanupong kathip/iStock via Getty Images

Successful investing in highly cyclical industries often goes against our own intuition. Although every case is nuanced and there are lots of things to be considered, a simple rule of looking for opportunities when the investment community is pessimistic and vice versa is a good starting point.

My history with Exxon Mobil (NYSE:XOM) is a perfect example of what kind of mindset one needs to have in order to achieve high returns, without taking on excessive risk in the process.

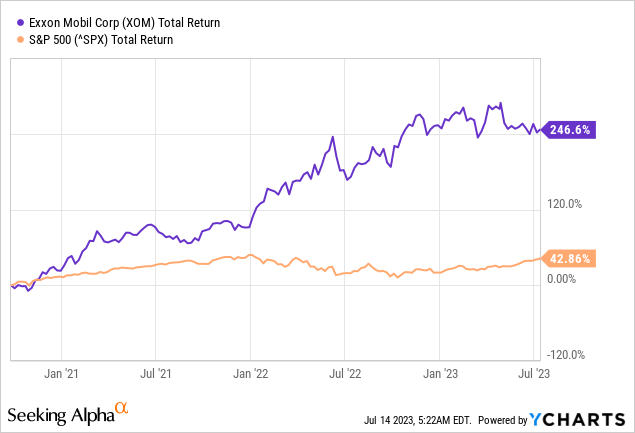

I first turned bullish on the stock back in September 2020, when XOM stock was trading at $35. At the time, there was ample negativity around the stock and the sector more broadly and as a result my thought piece on the pending ‘mean-reversion’ was not well-received by most retail investors.

It wasn’t a smooth sailing since then, the total return achieved speaks for itself.

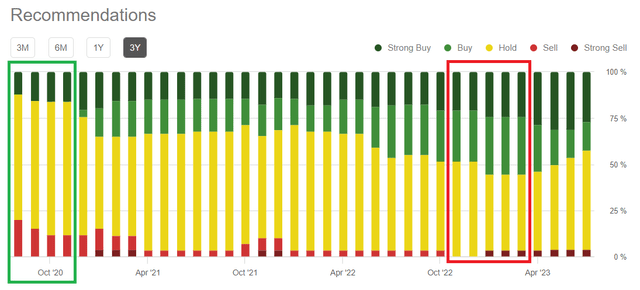

To illustrate how the popular opinion on the stock has changed over the years, we could take a look at the distribution of sell-side analysts’ ratings over time. On the very far left (marked in green) is what Wall Street thought of XOM at the time when I turned bullish – mostly hold ratings with very few buys.

The consensus view has changed dramatically since then and reached the other end of the spectrum at the end of 2022 and the beginning of 2023 – just when Exxon’s share price peaked (see the graph above).

Although I turned neutral on the stock a couple of months before that, at the time when analysts were rushing to recommend XOM as a ‘buy’ I wrote the following thought piece.

Fast forward to today, and we are once again witnessing negativity and pessimism slowly creeping up just as Exxon’s share price is coming off its recent top (see the graph below). We are also seeing an increasing amount of ‘sell’ ratings here on Seeking Alpha.

On itself, this does not warrant a contrarian ‘buy’ signal, and we might be too early in yet another shift in investor opinion. However, it is worth exploring what is exactly happening at Exxon and did the share price run ahead of fundamentals as optimism reached peak levels.

Lower Multiple For A Better Business

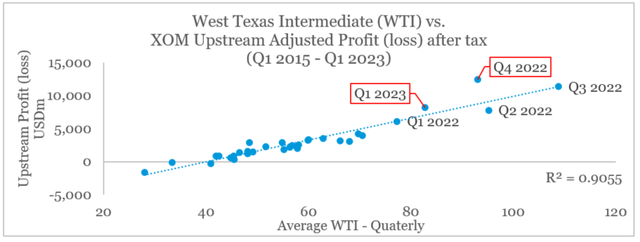

On a quarterly basis, Exxon Mobil’s upstream business is now coming off its peak profitability during Q3 and Q4 of 2022 and unless oil prices recover to their recent highs, FY 2023 is gearing to be a less profitable one.

prepared by the author, using data from SEC Filings and FRED

Increased production from Guyana and the Permian Basin would support earnings going forward and thus keep it above the trend line we see on the previous graph. But as we will see down below capacity investments would also be associated with higher costs going forward.

Guyana, we’re pleased to announce that we reached final investment decisions for Uaru, fifth offshore project, which will bring on even more production from this low-cost, low-carbon intensity resource. Uaru will provide an additional 250,000 barrels a day of gross capacity with start-up targeted for 2026.

Source: Exxon Mobil Q1 2023 Earnings Transcript

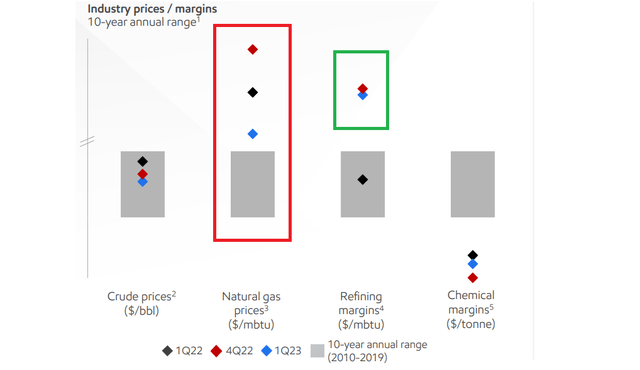

Margins for natural gas are also coming down from their Q4 2022 highs and are now close to the 10-year average range.

Exxon Mobil Investor Presentation

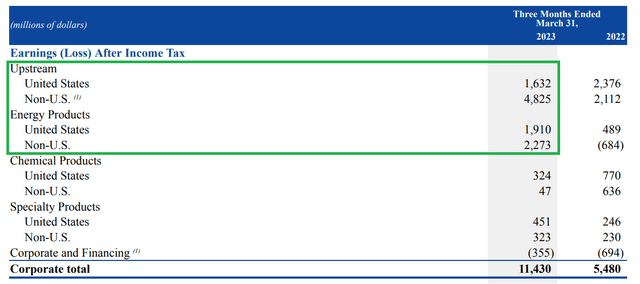

As we see above, however, refining margins remain elevated which is the reason why earnings at the other major part of Exxon Mobil (the Energy Products segment) are experiencing a more sustained tailwind.

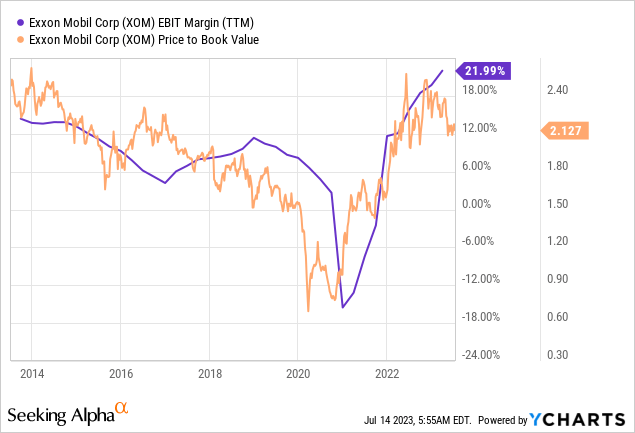

This is now resulting in record high margins for XOM, in spite of the falling oil prices, thus leading to a wide gap between the company’s profitability and its price-to-book ratio.

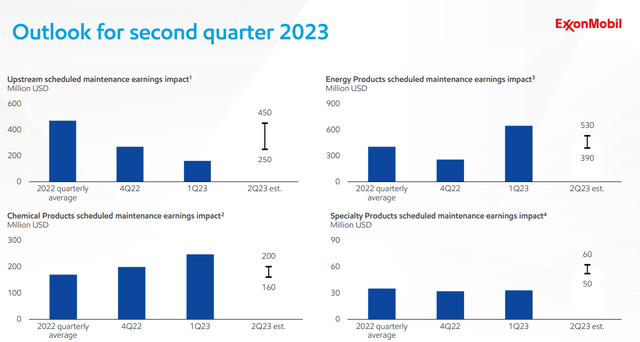

At the same time, the outlook for Q2 remains optimistic which makes XOM far more attractive now than it was just a couple of months ago.

Exxon Mobil Investor Presentation

What The Future Holds?

Overall, the long-term tailwinds for Oil & Gas remain as demand remains robust, and energy security becomes paramount in a deglobalizing world.

That is why, to get an idea of where is Exxon Mobil’s share price is headed in the medium to long term, we should take a closer look at the company’s capital allocation decisions and how these reflect the new reality.

As I mentioned before, oil majors like Exxon Mobil and Chevron (CVX) are now faced with higher returns on capital projects as competition in the sector has been reduced, and they fully capitalize on their existing competitive advantages.

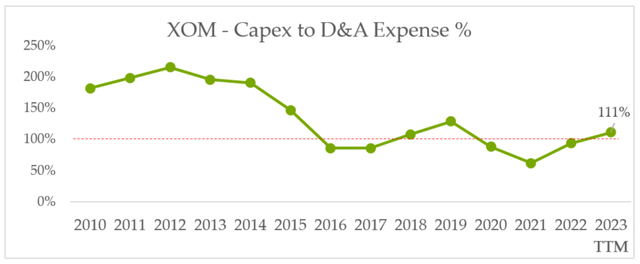

That is why, XOM is now dialling up its Capital Expenditures and the ratio of Capex to Depreciation & Amortization expense has just passed the 100% mark, which indicates expansion.

prepared by the author, using data from Seeking Alpha

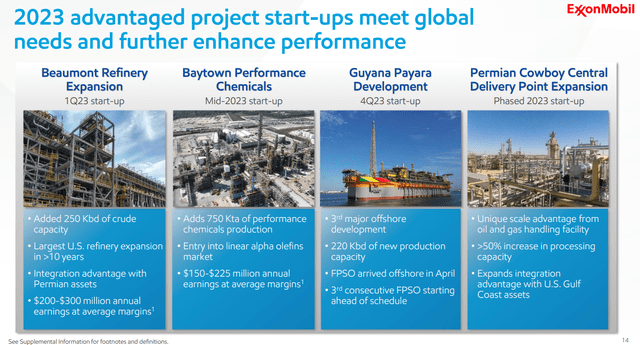

This includes significant expansion projects in upstream within Guyana and the Permian Basin, as well as increased refinery capacity and chemicals production.

Exxon Mobil Investor Presentation

Although this bodes well for long-term shareholders, more pressure on free cash flow is to be expected as Exxon’s management is prioritizing investments in future growth at the expense of more immediate rewards for shareholders.

In addition to these organic growth opportunities, Exxon is also very aggressive in the M&A field. In my last article I talked more about the potential takeover of Pioneer Natural Resources Company (PXD), which would add significant scale in the Permian Basin.

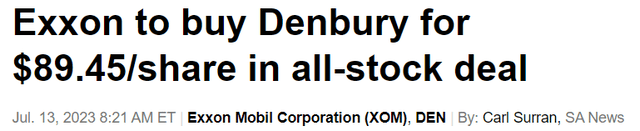

Just yesterday, Exxon announced yet another large deal, but this time for a company that operates in the field of carbon capture and storage.

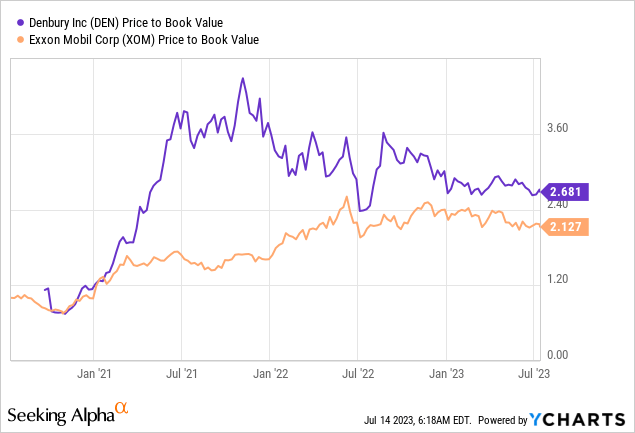

The nearly $5bn deal would be an all-stock deal which means that it will be dilutive to Exxon shareholders.

The acquisition is an all-stock transaction valued at $4.9 billion, or $89.45 per share based on ExxonMobil’s closing price on July 12, 2023.

Source: Exxon Mobil Earnings Release

It was made, however, at a relatively low multiple that is also very close to Exxon’s current P/B ratio.

In a nutshell, Exxon’s management is taking a very aggressive stance when it comes to future growth by utilizing both organic and inorganic growth opportunities. Even though this makes sense in the current geopolitical environment and the need to reduce emissions, it would likely be associated with higher costs and capital expenditures in the coming months and even years.

Investor Takeaway

Investor sentiment around Exxon is declining and this could once again create a very attractive opportunity for those who are patient enough. As management remains focused on long-term opportunities, profitability, and cash flow could come under pressure in the short-term and thus feed investor pessimism in the coming months. In the meantime, my investment thesis for XOM remains intact, and the company is well-positioned to deliver on its long-term strategy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CVX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses?

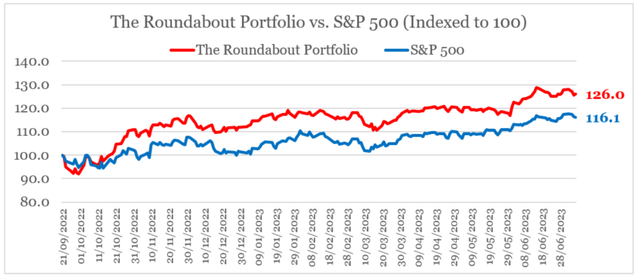

You can gain access to my highest conviction ideas by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.