Summary:

- Microsoft’s shares have delivered a total return of 109% in two years, outpacing the broader market’s 48%, with the company’s stability and presence across the tech landscape making it a strong choice for growth portfolios.

- Microsoft is well-positioned to benefit from the growth of artificial intelligence, with its Azure platform set to play a pivotal role in future AI systems and potentially generate $150B in annual revenue.

- Despite potential short-term margin contraction due to increased capital expenditure, Microsoft is expected to see significant top-line growth.

David Becker

On March 5th, 2020, Microsoft (NASDAQ:MSFT) shares were valued at $166 each. That same day, I published an article on Seeking Alpha, provocatively titled, “Microsoft: The Cornerstone Of A Portfolio.”

Fast forward to two years later, and Microsoft has delivered an impressive total return of 109%, easily outpacing the broader market’s 48%. Despite this stellar performance, my viewpoint remains unchanged: Microsoft is still the bedrock of any robust growth portfolio. Sure, 100% growth in two years might seem like a tall order, but in the realm of the possible? Absolutely. With exciting developments in AI on the horizon and Microsoft’s formidable presence across the technological landscape, I would never say “impossible”. Let’s delve deeper into this.

As Stable As They Come

First and foremost, the key attribute when selecting a cornerstone for your portfolio — something you can confidently build around — is stability. And Microsoft? It has stability in abundance. While I imagine an exhaustive review of the company’s offerings is unnecessary, allow me to provide a brief rundown:

- Windows (Claiming 68% of Desktop OS market share)

- Office 365 (Holds a virtual monopoly in Office productivity software, with Google’s Suite as the primary alternative)

- Azure (Currently in second place to AWS in the cloud infrastructure arena)

- Xbox & Game Pass

Each of these facets, on their own, would qualify as S&P 500 contenders if they were standalone entities. The beauty of Microsoft lies in its successful conglomerate of these facets, largely expanding them at a pace surpassing market trends.

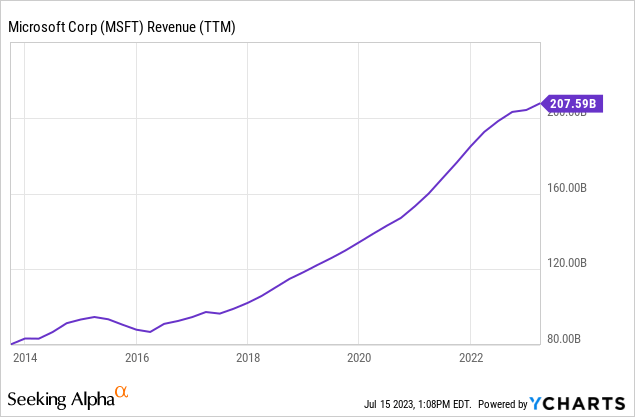

As the data above illustrates, Microsoft boasts $208B in revenue over the past twelve months. In the last decade, it has more than doubled its top line, with no clear indications of hitting a growth ceiling anytime soon. Indeed, the company has shrewdly positioned itself as a market leader in several emerging sectors, which we’ll delve into momentarily.

AI Gains

In addition to its stability, Microsoft is well-positioned to ride the wave of artificial intelligence (AI) growth. Let’s momentarily set aside its investment in OpenAI; Microsoft’s Azure is set to play a pivotal role in the learning and inference stages of future AI systems.

The cloud AI market is projected to be valued at a staggering $650B by 2030, with a promising CAGR of over 40%. As the second-largest cloud services provider and a company that’s been closely collaborating OpenAI, Microsoft is poised to seize a significant market share in this space.

Assuming the estimated $650B market value holds true, and that Microsoft can sustain its 23% slice of the cloud market, Azure’s AI offerings alone could generate a whopping $150B in annual revenue. For comparison, Microsoft’s “Intelligent Cloud” segment reported $84B in revenues over the past twelve months (TTM).

It’s worth mentioning that there are projections suggesting that AI could give a $100B boost to Microsoft’s top line by 2027. So it seems that multiple voices are hinting towards a similar conclusion: a significantly more prosperous Microsoft.

And let’s not overlook that Microsoft’s potential gains from AI extend beyond just Azure. Its Office 365 toolset will seamlessly incorporate various forms of AI, enhancing user adoption and stickiness. GitHub, a Microsoft-owned platform, features Copilot, a tool that boosts software developers’ performance by 30-50%. Even Windows will soon welcome a co-pilot in the form of an LLM.

Everything Looking Up

In just a few weeks, Microsoft will conclude its 2024 fiscal year, and the outlook has never been more promising.

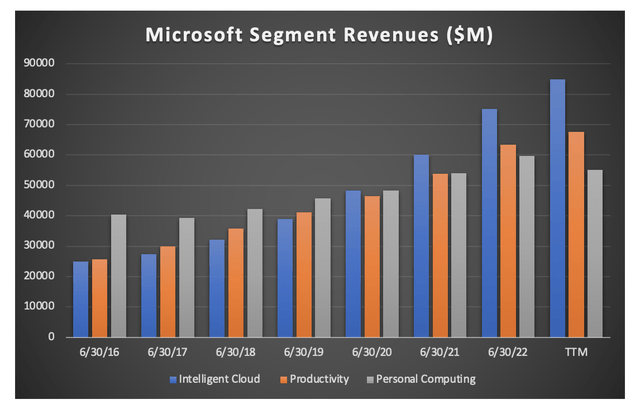

Microsoft revenues by reporting segment (Author created, via company filings)

The chart above delineates Microsoft’s performance over the years, dissected into the company’s three reporting segments. Apart from the “More Personal Computing” category over the past twelve months, every other sector has displayed substantial and consistent growth.

The More Personal Computing segment comprises Windows OEM, Devices, Xbox, and Search. The drag on this segment was primarily due to Windows OEM and Devices, with year-over-year revenues down 28% and 30% respectively. While these figures might not be ideal, remember that hardware is not Microsoft’s primary cash cow, and the decrease in OEM sales can be attributed to Microsoft’s strategic shift in selling Windows. In essence, witnessing a downtrend in this segment is not alarming.

The areas that investors should keep their eyes on are Productivity and Business Processes and the Intelligent Cloud. As noted earlier, both these sectors stand to significantly benefit from AI innovations. Yet, even without this AI-powered boost, their growth trajectories look promising.

Office 365 Commercial saw a 14% year-over-year increase, according to the previous quarter’s earnings report. LinkedIn revenues swelled by 8%. Azure clocked a 27% growth, while server products registered a 17% gain. Even the search segment witnessed a 10% revenue spike. Imagine the potential if Bing manages to secure a larger market share due to AI integrations – the revenue jump could be significant.

Capex Growth, Shareholder Returns

Annually, over $200B is earmarked for updating and maintaining data centers, with a significant chunk of this budget assigned to traditional components like CPUs and memory. AI, however, requires “accelerated computing” chipsets — the kind offered by companies such as NVIDIA (NVDA). We can anticipate that these will augment the already hefty $200B spent in the upcoming years.

With Microsoft planning to retain its edge in the AI landscape, it’s reasonable to expect the company’s capital expenditure (CAPEX) to increase, potentially quite substantially, in the years ahead.

“The age of AI is upon us and Microsoft is powering it.” -Satya Nadella

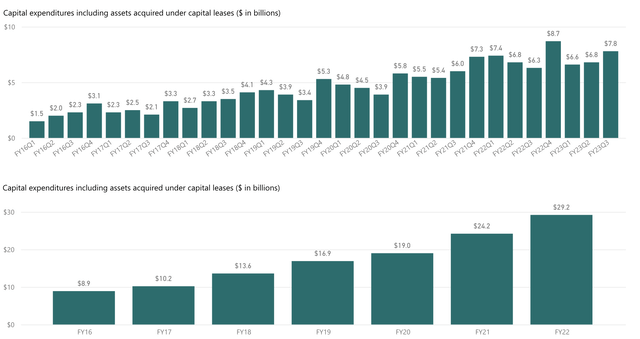

Capex spending at Microsoft (Microsoft filings)

As we approach Q4 earnings, we forecast that Microsoft will close its fiscal year with approximately $30.4B in capex for the year. This figure would mark a modest increase from FY2022, when the company expended $29.2B. In the coming years, necessary investments to maintain their AI lead could push Microsoft to hike this value by 10-15%.

This is something investors should be cognizant of. While we’ll witness significant top-line growth, it’s likely to be accompanied by some margin contraction as the company expands its essential infrastructure. However, similar to Amazon’s (AMZN) trajectory, we can anticipate this as a short-term surge promising long-term returns.

On a brighter note for prospective investors, Microsoft excels at capital return. While it may not match Apple’s (AAPL) performance in this respect, investors can still expect substantial dividends during this AI expansion era.

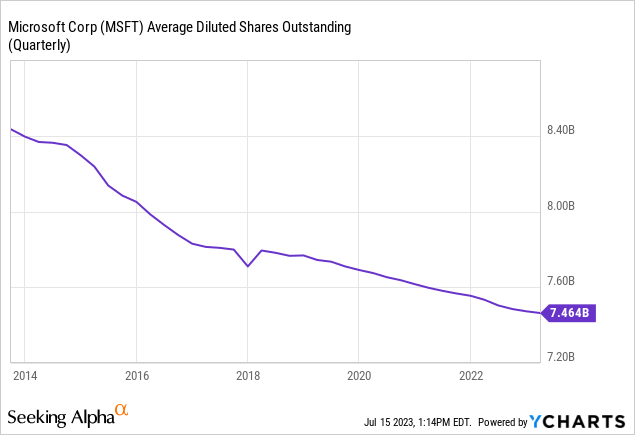

The chart above illustrates that Microsoft has retired over 1 billion shares over the last decade. Just in the previous quarter, the company returned $9.7 billion to shareholders via share repurchases and dividends.

Unlike most companies, Microsoft demonstrates remarkable consistency in its buyback approach, repurchasing $4.6B in equity per quarter. This strategy led to the repurchase of 55 million shares during fiscal year 2023, and we can anticipate this trend to continue given the company’s remaining $26.9 billion authorized for share buybacks.

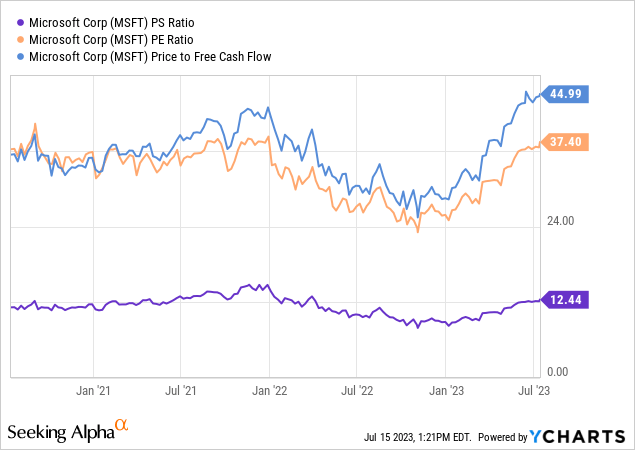

Valuation

It should be clear that Microsoft currently trades at a significant premium to the broader market. This article is not aimed at value investors. Microsoft commands such a premium due to its remarkable stability and future potential.

The decision to buy Microsoft shares now or await a possible wider market pullback largely depends on your investment horizon. As a long-term investor, I habitually dollar-cost average into positions, and I have been supplementing my decade-long Microsoft holding more frequently in recent months.

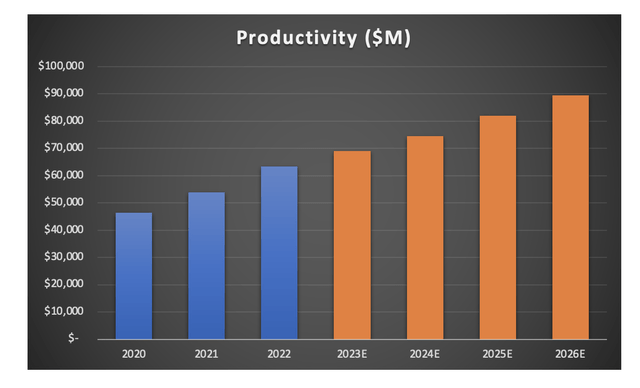

Let’s now focus on the two most significant sectors, and the ones most likely to be impacted by AI: Productivity and Intelligent Cloud.

In the Productivity segment, Microsoft can anticipate continued double-digit growth thanks to user expansion and rising costs. Increases in costs can, and indeed will, arise due to productivity improvements facilitated by AI.

Productivity at Microsoft Growth (Author created, company filings)

Maintaining approximately 10% growth in this area will steer Microsoft towards $90B in revenue in this sector by FY 2026 (or ~$93B if the company maintains exactly 10% growth annually).

With roughly 46% operating margins in this sector, that equates to $41.4B in operating income derived solely from the Productivity segment for Microsoft.

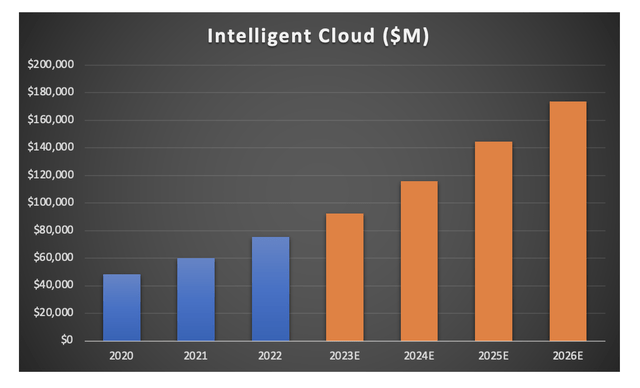

Intelligent Cloud at Microsoft (Author created, company filings)

The Intelligent Cloud segment, the current home of Azure, is set to see the most significant gains. The sector experiences growth in the 25% range, and I don’t foresee this momentum abating in the near future. With 23% growth this year, 25% in 2024 and 2025, followed by 20% growth in 2026, Microsoft’s Intelligent Cloud could achieve $173B in annual revenue. This aligns with the previously cited potential addition of $100B to the top line from AI alone.

Following a period of reduced capex, Microsoft’s operating margins in this area are projected to rise from the 43.4% seen in 2022 to 46% by 2026. This would deliver the company $80B in operating income.

Assuming the “More Personal Computing” sector remains static, Microsoft could be looking at $141.4B in operating income in FY26. Given consistent net margins, this would translate to roughly $120B in net income. At a 25x PE ratio, this would grant us a valuation of $3T.

A $3T valuation could be reached with a share price around $405, and one could cogently argue that a Microsoft as dominant as we’ve described would command an even higher premium. Should the company trade at a 30x PE, that would translate to approximately $490 per share.

However, choosing a conservative approach – and I do consider this a conservative estimate – Microsoft holds a fair value today of $405. This suggests a 17% gain over the current share price.

Risks

By now, it should be abundantly clear that AI is poised to be a prevailing force in the coming years, possibly even decades. Although I expect Microsoft to be a key beneficiary of infrastructure spending, it’s possible that such spending might not materialize to the extent anticipated.

Additionally, market sentiment may fluctuate, leading to multiple compression for Microsoft. This stock unquestionably trades at a premium, and in my view, rightly so. However, the market’s perspective could diverge from this stance at some future juncture.

Final Thoughts

Undeniably, Microsoft is set to become a formidable player in the AI sphere, and investors have much to gain by integrating Microsoft into the core of their portfolio.

While there will be challenges along the way that could present more favorable entry points, for those looking to initiate a position now, I consider Microsoft to be undervalued by approximately 17%, on the conservative end of the spectrum. Given the predicted surge in AI spending, continued share buybacks, and growth in other segments, I would not be in the least bit taken aback if Microsoft were to double its present valuation in the years to come.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.