Summary:

- Microsoft Corporation is set to report its Q4 results for the period ending June 30th, 2023, after hours on Thursday, July 27th.

- The company has consistently beaten EPS estimates 11 times and revenue estimates 10 times, indicating strong performance.

- Despite strong earnings history and technical strength, it is hard to recommend buying the stock heading into earnings.

- Guidance and tone towards AI initiatives are likely to determine the stock’s direction post earnings.

jewhyte

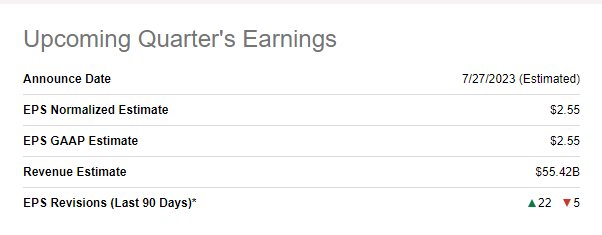

Microsoft Corporation (NASDAQ:MSFT) is set to report results for its Q4 that ended June 30th, 2023 after hours on Thursday, July 27th. Analysts expect Microsoft to report an EPS of $2.55 on revenue of $55.42 billion. Should Microsoft meet these numbers, that would represent an EPS growth of 14.34% and revenue growth of 6.86%.

MSFT Q4 Earnings Preview (Seekingalpha.com)

My last coverage on Microsoft was about its (likely) upcoming dividend increase. And the one before that was reviewing the company’s Q3 earnings. I had rated the stock a “Hold” after Q3, despite sizzling numbers from the giant. My primary reason for this rating was the stock’s run up and as if to make a mockery of it, the stock has run up a further 16.36% since my Q3 review as opposed to the market’s 10.24%.

With that background out of the way, let’s preview Microsoft’s Q4 without any further ado.

Steadily Increasing Expectations

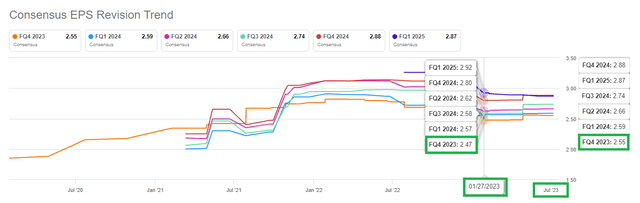

At the beginning of the year, analysts expected Microsoft to report $2.47/share in FQ3 2023. Obviously, forecasting 6 months out is tricky, but since then, this quarter’s expectations have steadily crept up to $2.55. A large part of this has to do with the excitement around AI and ChatGPT, which has slowly been released to various aspects of Microsoft’s ecosystem.

MSFT Earnings Snippet (Seekingalpha.com) MSFT Estimates (SeekingAlpha.Com)

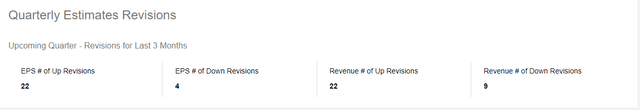

As an extension, 85% of EPS revisions for this upcoming quarter have been to the upside while 71% of revenue revisions have been to the upside as well.

MSFT Revisions (Seekingalpha.com)

Beat or Miss? I’d Bet On A Beat

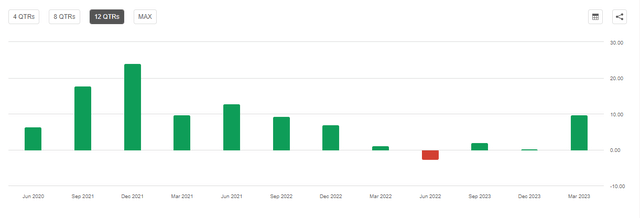

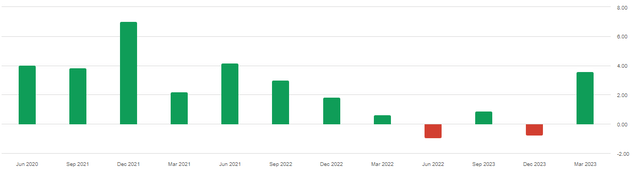

In the last 12 quarters, Microsoft has beaten EPS estimates 11 times and revenue estimates 10 times. That’s quite an impressive feat for a company of this size, especially on the revenue side. A company of Microsoft’s size is likely to have fat to be trimmed almost at any given time. Hence, beating EPS by cutting corners does not impress me as much as beating on revenue.

Given this type of history, I am inclined to bet that Microsoft will beat both EPS and revenue in Q4 as well. But will the beat be big enough to push the stock higher? That remains to be seen even as guidance is likely to have a bigger impact than Q4’s results.

MSFT EPS Surprise (Seekingalpha.com) MSFT Rev Surprise (Seekingalpha.com)

Move Aside, Azure

It wasn’t long ago that analysts and investors were looking up to the cloud (pun intended) to save the day for Microsoft. But in a short few months, it appears like Azure has become yesterday’s news and all the focus is on ChatGPT and AI. Satya Nadella had no qualms in letting Wall Street know where his focus was when he opened the Q3 earnings report with the statement below:

“The world’s most advanced AI models are coming together with the world’s most universal user interface – natural language – to create a new era of computing.”

It is too early to expect ChatGPT to have the kind of impact it is predicted to have on Microsoft’s revenue and earnings but the company’s tone on its AI initiatives is likely to set the tone about how investors digest the result and guidance.

Valuation

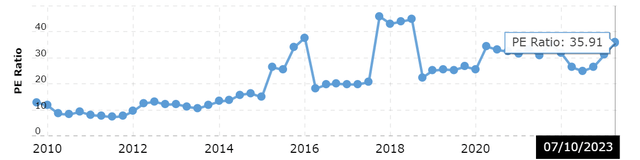

Except for a brief period in 2018, the stock’s current PE of 36 is the highest it has been in the last five years. The current valuation is also richer than the 5-year average by 12.50%. At an expected earnings growth rate of 12%/year over the next five years, Microsoft’s stock is treading a price-earnings/growth (“PEG”) ratio of 3. That’s too rich for my taste even for a company like Microsoft. I won’t be surprised if the stock sells off after reporting good earnings because at this valuation level, the market is likely expecting significant surprises.

Technical Strength

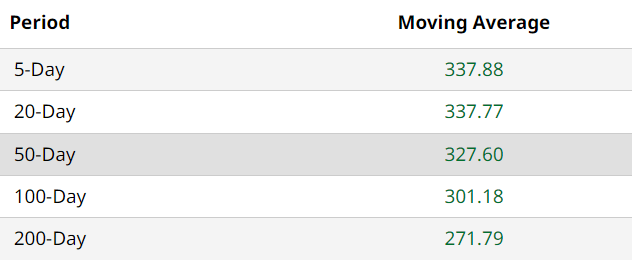

As we head into Q4 earnings, Microsoft’s stock is firing on all cylinders as the stock is solidly ahead of both 100-Day and 200-Day moving averages. Each of the averages shown below are progressively higher, meaning the stock has been gathering momentum each passing day.

MSFT Moving Avgs (Barchart.com)

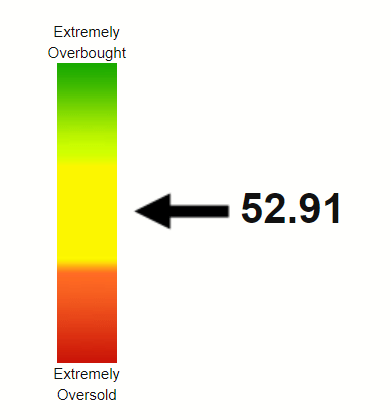

And despite that, it is not overbought technically as shown by a Relative Strength Index (“RSI”) of 53.

MSFT RSI (Stockrsi.com)

Overall, from a technical perspective, the stock has momentum in its favor already and decent Q4 numbers coupled with encouraging guidance may take the stock to further dazzling highs.

Conclusion

So, will Microsoft beat its Q4 estimates? No one knows for sure but if history is any guidance, chances are high that the company beats on both revenue and EPS. However, the more important question is, what will the earnings mean for the stock?

I believe the earnings by and of itself may not move the needle much but guidance and the company’s tone towards AI and to a lesser extent Azure growth will determine the stock’s direction post-earnings. Guidance is so critical that in the recent past, Microsoft’s stock soared higher on strong guidance despite missing estimates.

The safest thing to do is to hold the stock if you have a position already. If you do not have exposure to the stock or would like to add to your existing position, I believe this is not the best time to do so heading into earnings when you factor in (a) increasing expectations (b) valuation concerns and (c) a near 45% increase in stock price YTD.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.