Summary:

- Bank of America reported strong earnings for Q2’23, beating revenue and earnings per share estimates easily.

- The bank’s net interest income, good loan quality, and growing book value make the bank’s shares attractive. Deposit outflows softened in the second quarter.

- Bank of America is still trading at a 7% discount to book value, making it an attractive rebound investment.

Brandon Bell

Bank of America (NYSE:BAC) reported better than expected revenues and earnings for the second-quarter on Tuesday as well as a growing book value per share. America’s second-largest bank by assets also benefited from strong net interest income and saw stable portfolio quality (regarding non-performing loans in the consumer loan portfolio). Considering that the Fed will likely continue to raise interest rates in response to strong employment data earlier this month, I believe Bank of America will also benefit from net interest income tailwinds going forward. With shares still selling below book value, I believe the risk profile remains skewed to the upside and they remain a strong buy!

Bank of America beats revenue and EPS estimates for Q2’23

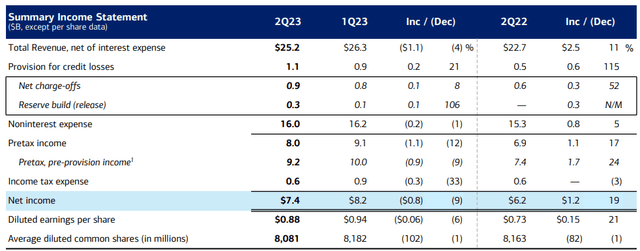

Bank of America beat expectations on both the top and bottom line for its second-quarter on Tuesday: the bank reported revenues of $25.2B which beat the average projection by $260M and it also posted better than expected earnings per share. Bank of America earned an adjusted $0.88 per share in Q2’23, beating the estimate by $0.05 per share, and outperforming last year’s EPS by 21%.

It appears banking remained good in the U.S. in the second-quarter, despite a major regional banking crisis unfolding in Q1’23: Bank of America reported its second quarter of strong net income in FY 2023, with profits totaling $7.4B, showing an increase of 19% year-over-year. Net interest income tailwinds boosted Bank of America’s earnings, as they did in the previous three quarters.

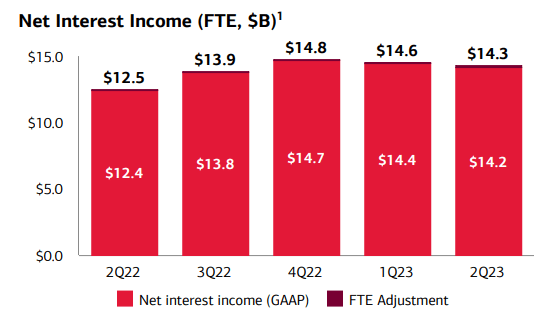

Bank of America’s net interest income soared in the last year, driven by the Fed’s bid to offset the rise in consumer prices by increasing key interest rate levels. Although Bank of America’s NII decreased in Q2’23, quarter over quarter, the bank’s net interest income was still significantly above last year’s level: Bank of America’s Q2’23 net interest income totaled $14.3B, showing an increase of 14% year-over-year. Since employees and job-seekers in the U.S. are seeing solid job growth, the Fed will likely continue to raise interest rates in the second half of the year… which would obviously benefit Bank of America’s net interest income growth.

Source: Bank of America

Deposit trends

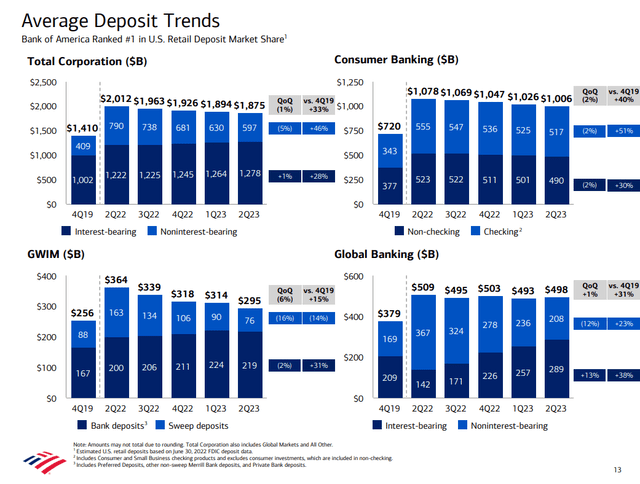

A key issue of interest is the deposit situation at large and regional banks and Bank of America delivered a minor surprise here.

Bank of America’s deposits continued to decline across its different businesses (with the exception of Global Banking), which is a reflection of depositors and savers moving funds into higher-yielding assets, but the deposit base is shrinking much slower than it did in the previous three quarters.

In the second-quarter, Bank of America’s average deposits declined 1% quarter over quarter to $1,875M and it was the fourth consecutive quarterly decline in the bank’s average deposit balance. However, the second-quarter saw the lowest quarter over quarter decline in the last year as Bank of America lost only $19B in deposits compared to $32B in the previous one.

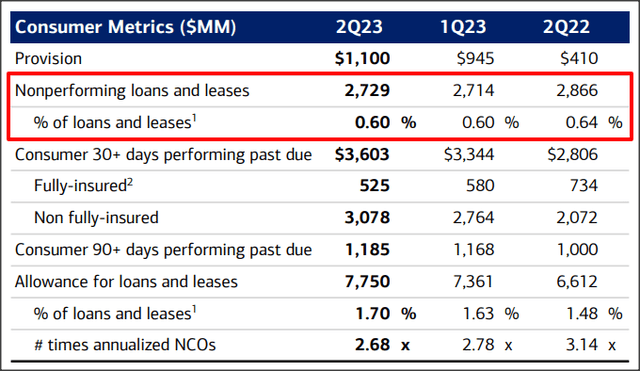

Consumer portfolio shows strong loan quality position

Bank of America’s portfolio quality remained admirable in Q2’23 and although the bank has seen a small increase in its net charge-off ratio (which was up 0.06% quarter over quarter), the overall percentage of non-performing loans/leases remained at just 0.6% of the bank’s total. This means that the bank has healthy loan quality and Bank of America’s consumer metrics do not show a deteriorating trend in loan quality at all.

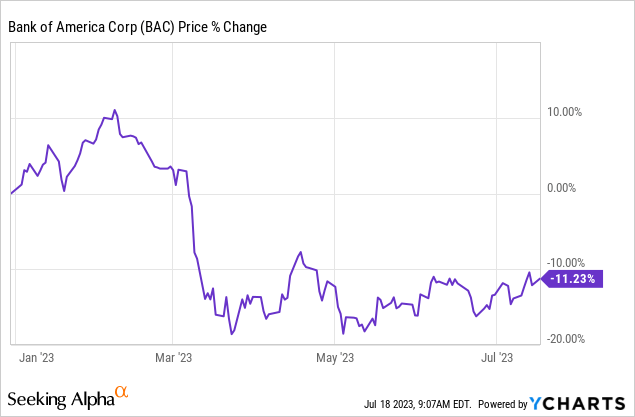

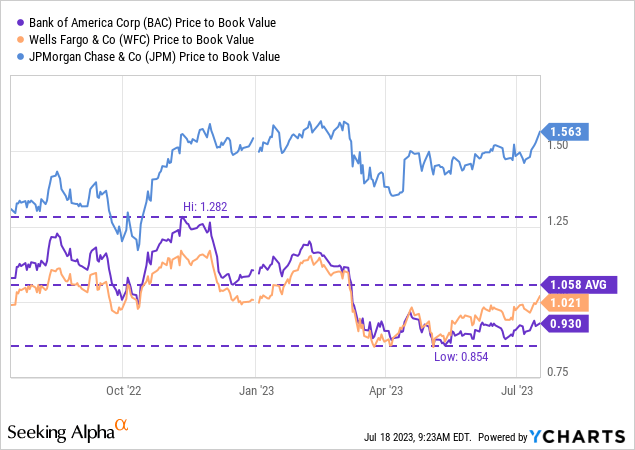

Why I believe Bank of America’s 7% discount to book value is undeserved

Bank of America is currently trading at a 7% discount to book value… making it a cheap top tier bank for investors to buy right now. Bank of America may not be as cheap as some regional banks, some of which are priced at much higher discounts to book value, but the bank’s “systemically-important bank” label is, in my opinion, something that makes Bank of America’s shares especially attractive as a recovery investment.

Bank of America trades approximately 14% below its pre-crisis valuation and the bank disclosed a growing book value in both the first- and the second-quarter of FY 2023 (Bank of America’s Q2’23 book value increased 1.5% Q/Q to $32.05 per share).

I see Bank of America’s fair value in a range of $34-35, so if the bank’s shares revalue to their pre-crisis valuation, then investors are looking at approximately 15% upside potential from here.

Risks with Bank of America

Given the strong situation in the jobs market as well as the possibility for further rate increases, I believe Bank of America continues to face strong net interest income potential. What I don’t see as a risk is the bank’s deposit trajectory, loan quality or the $100B in unrealized loan losses in its bond portfolio. What would change my mind about Bank of America is if the bank saw stronger deposit outflows, an increase in the non-performing loan ratio or declining net interest income.

Final thoughts

Bank of America delivered better than expected second-quarter earnings due to robust net interest income and the bank maintained good loan quality (low non-performing loan ratio) in Q2’23. Bank of America’s book value per share increased Q/Q and the bank overall performed well, with 19% year-over-year net income growth. Considering that the bank continues to have net interest income upside and that Bank of America’s shares are selling at a 7% discount to book value, I see a realistic case for an upside revaluation. If Bank of America’s shares return to their pre-crisis valuation, then investors could potentially secure a 15% return!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.