Summary:

- Intel has seen its share of headwinds over the past year.

- However, it’s transforming itself into an essential infrastructure company through its IDM 2.0 strategy.

- The recent drop in share price has pushed its dividend yield well above 5% and presents an attractive buying opportunity.

JasonDoiy

As a value investor, I love a good market drubbing, as we are seeing after the Federal Reserve hiked interest rates by 50 basis points this week. This was a well-telegraphed move, and yet the market was seemingly ill-prepared for it.

This is why I don’t subscribe to the efficient market theory (or EMT), as what legions of finance professors are teaching their students every semester in college. An inefficient market is actually good for long-term investors, who are able to apply second-level thinking, as it gives ample opportunities to pick up quality stocks on the cheap.

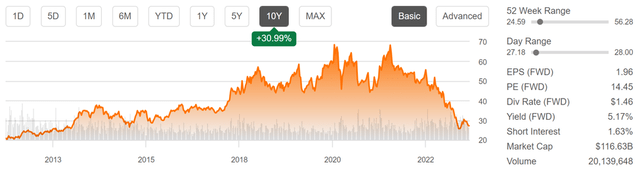

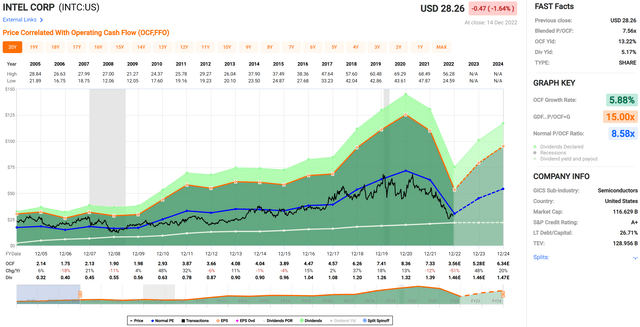

This brings me to Intel Corp. (NASDAQ:INTC), which, at the current price of $27, is now back to the low end of its trading range in recent months. To get a sense for how cheap Intel has gotten, it’s now trading at a multi-year low. As shown below, Intel hasn’t been this cheap since 2014. In this article, I highlight why Intel is worth a hard look for value and income investors alike.

Why INTC?

For those unfamiliar with the company, the name Intel is nearly synonymous with semiconductors, as the world’s largest manufacturer of microprocessors for the global PC and data center markets. It pioneered the x86 architecture for microprocessors, and in recent years has made moves beyond its core market to expand into areas such as AI, automotive, and IoT, with acquisitions including Altera and Mobileye, with which it recently issued some shares through a re-IPO.

It’s no secret that Intel has seen plenty of challenges since the start of the year. This includes a tough environment for the PC market, with tough comparable sales versus 2021, at the height of the work-from-home boom. Moreover, it’s also losing share to AMD in the data center space. Recently, weaker results during the third quarter caused a reduction in its 2022 revenue outlook to $63.5 billion at the midpoint, down $3 billion from $66.5 billion previously.

However, management, led by long-term veteran Pat Gelsinger, isn’t just sitting idly by, as it aims to right-size its operations. This includes an expected $3 billion in cost savings next year, and $8 to $10 billion in savings by the end of 2025. While management is naturally bullish on the company’s ability to transform and adapt, what’s more telling is their willingness to put money where their mouth is.

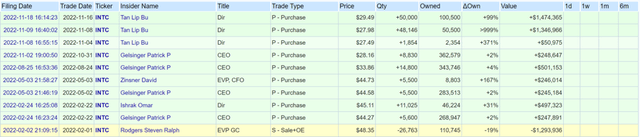

Intel Directors and Executives have been large net purchasers of their own stock, as shown below, outside of getting RSU grants as part of their compensation. While insider purchases shouldn’t be taken in a vacuum as a bullish signal, it is encouraging to see these purchases. As the saying goes: “there are many reasons for why one would sell a stock, but only one reason for why one would buy.”

Intel Insider Transactions (OpenInsider)

Moreover, Intel is transforming into more of an essential infrastructure company through its foundry business and the IDM 2.0 strategy. Through funds provided by the CHIPS Act and a smart capital arrangement with Brookfield Capital, Intel should be able to see a faster payback on its investment. In addition, by designing and manufacturing chips for other companies, Intel seeks to unlock untapped opportunities as noted by management during the recent conference call:

A key benefit of IDM 2.0 is to unlock our full financial potential by capturing multiple profit pools not available to any one of our peers across architecture, design, wafer manufacturing, advanced packaging, supply chain and software.

Simple math would suggest there is meaningful upside to those targets as we execute and exploit the margin-stacking potential IDM 2.0 provides best-in-class semiconductor companies achieved gross margin in the 60s and operating margins in the 40s. And we aim to be best-in-class. This next phase of IDM 2.0 is a significant evolution in how we think and operate as a company.

While TSMC (TSM) presents a credible threat to Intel’s positioning, fellow SA contributor Arne Verheyde expects Intel to be the “king of the hill”, as highlighted in his recent article:

When it comes to who is best positioned for semiconductor leadership going forward, my analysis has indicated it is Intel, not TSMC. The reason for this is simply that Intel has its 2nm node (called 20A, followed by 18A six months later) lined up for production to start in the first half of 2024, which compares to TSMC’s equivalent node (called N2) which is scheduled for the second half of 2025, a non-insignificant 12- to 18-month lag compared to Intel.

Meanwhile, Intel maintains a strong A+ rated balance sheet, and at the current price of $27.16 as of writing, pays an attractive 5.4% dividend yield, one of its highest yields in history, that’s covered by a 51% payout ratio.

Lastly, INTC is attractive after the recent drop at the current forward PE of 13.9. While Intel isn’t expected to see meaningful EPS growth next year, analysts expect earnings to significantly ramp up in 2024 as capital investments come online. Sell-side analysts have an average price target of $31 and Morningstar, which tends to have a longer-term view, has a $45 fair value estimate. Both estimates translate to the potential for double-digit total returns.

Investor Takeaway

Intel has seen a significant drop since March, and while there are still some challenges to overcome, the company is taking meaningful steps to adapt to changes in the industry. It’s been investing heavily in its IDM 2.0 strategy, which should enable it to unlock more profitable opportunities.

The insider buying activity along with the attractive dividend yield and forward PE suggests that Intel could be an attractive opportunity for investors looking for value in the tech sector. Considering all the above, I view Intel as being a solid long-term buy while the market sentiment is working against it.

Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

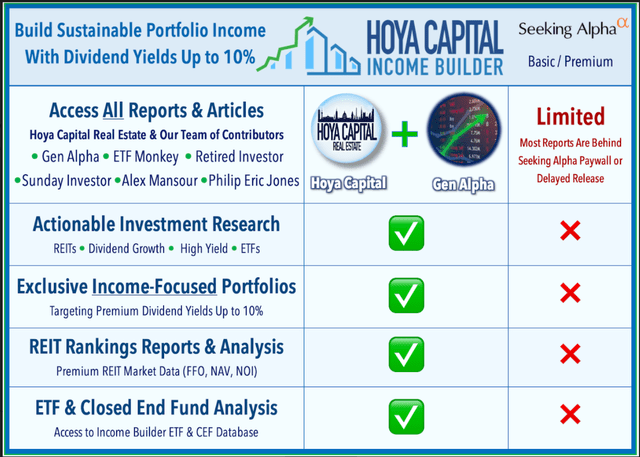

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!