Summary:

- Bank of America delivered a modest earnings beat.

- I think concerns over the state of its balance sheet are overblown.

- The technical outlook for the stock suggests a breakout is imminent.

Brandon Bell

Overview

Bank of America (NYSE:BAC) is up on the day as earnings results come in above expectations.

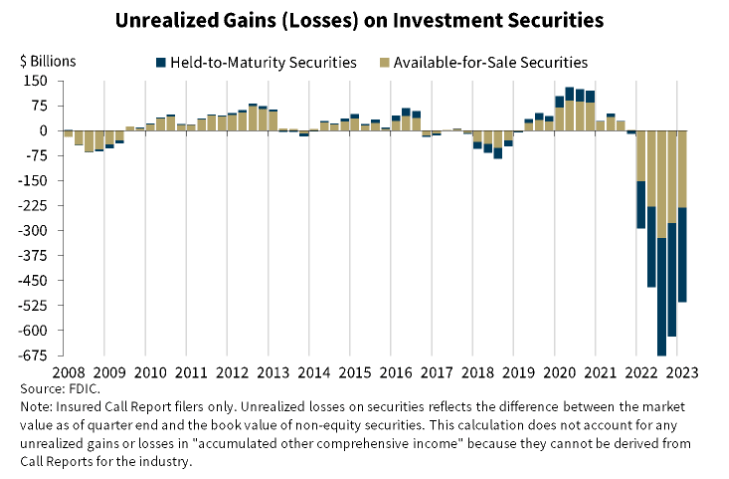

But there are still over $100 billion in unrealized losses in its bond portfolio, unveiled in its Q2 report, catapulting it into the financial spotlight.

In my opinion, the problems brewing at Bank of America are symptomatic of a much larger issue plaguing the industry in my view. The bank is in the news for all the wrong reasons, reporting over $100 billion in unrealized losses. The situation is alarming, to say the least, and has likely left many investors and customers worried.

However, BAC has shown encouraging earnings, and the stock is still heavily discounted.

Q2 Overview

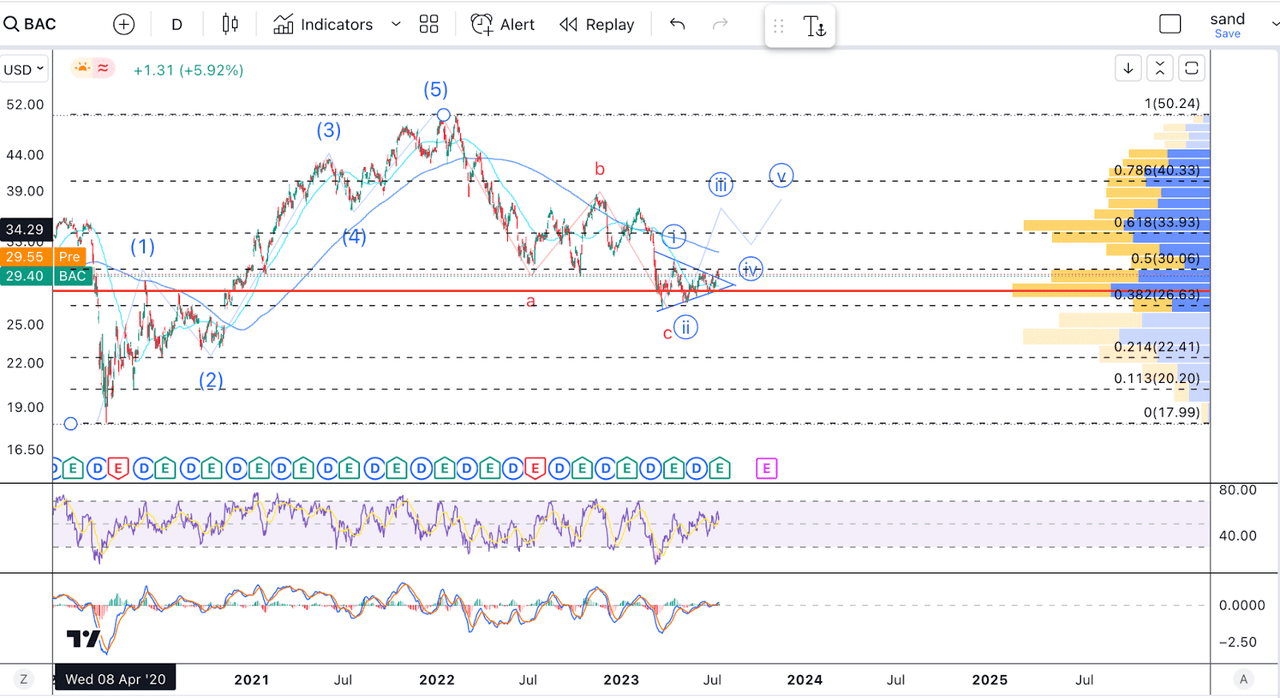

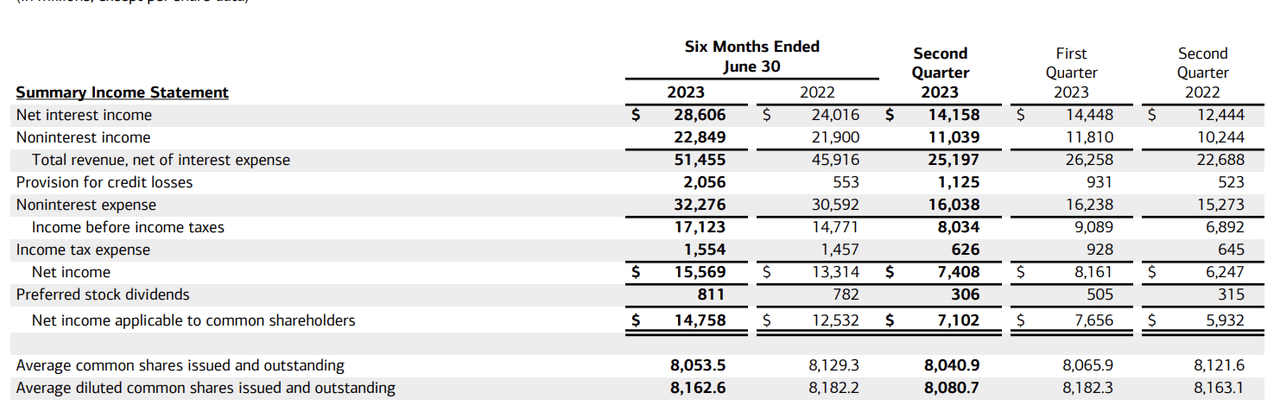

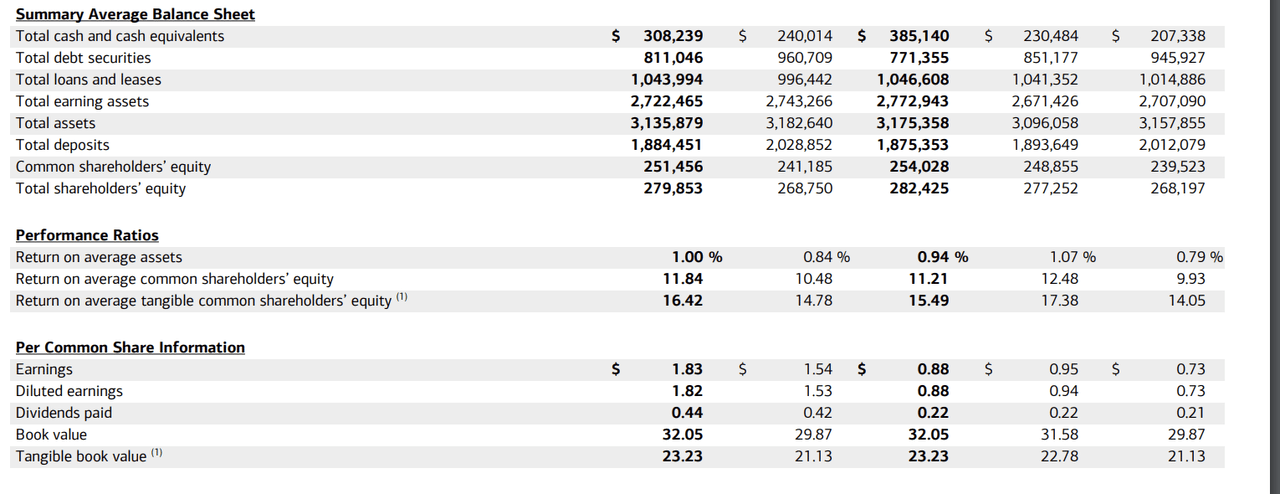

Bank of America has reported Q2 earnings, beating on both EPS and revenue. EPS came in at $0.88, while revenue was $25.2 billion, beating by $260 million:

Financial highlights (BAC earnings release)

Revenues grew by 2.9% YoY, and were down sequentially. The company reduced its non-interest expense, while the provision for credit losses was up by $0.2 billion.

BAC gave us a modest earnings surprise, but what was most notable in my opinion, was the resilience in deposits, which came in at $1.88T, versus the estimated $1.85T.

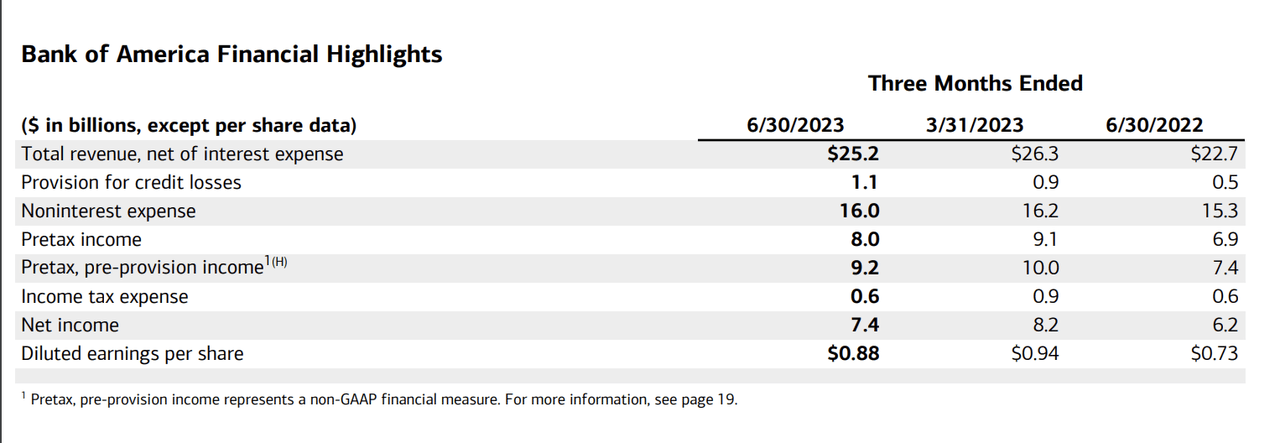

Now, in terms of segment performance, consumer banking stands out, with a 15% growth in revenue:

consumer banking (BAC Earnings)

Despite the higher revenue though, net income was down due to higher provisioning for credit losses. And though deposits were marginally lower, credit and loans still increased marginally in the quarter.

Overall, BAC’s results show quite convincingly that concerns over the bank are overblown. The bank is benefitting from a resilient US economy, and continues to perform well.

But What About The Bank Crisis?

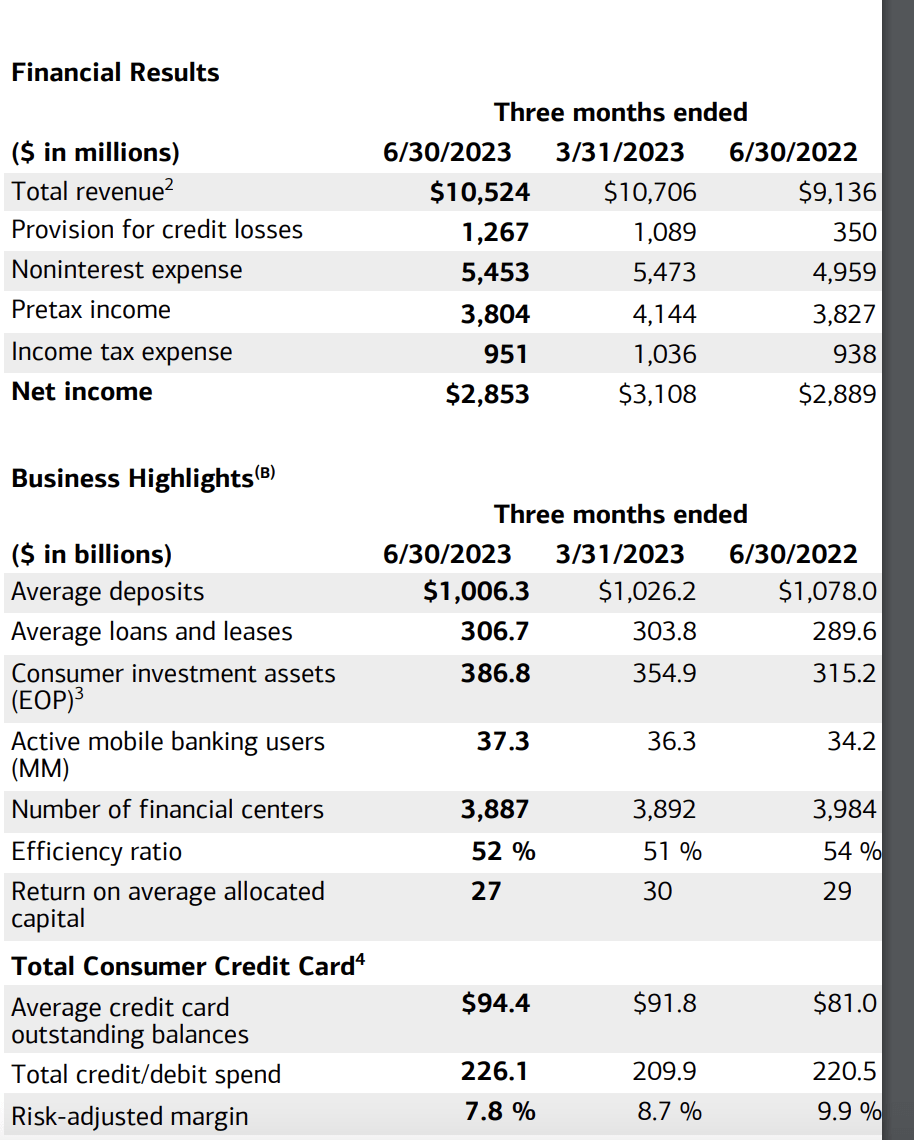

This crisis is not confined to Bank of America alone; it’s symptomatic of an industry-wide issue. Several other banks are facing similar predicaments, including JPMorgan Chase (JPM) with $36 billion, Citibank (C) with $24 billion, and Wells Fargo (WFC) with $41 billion in unrealized losses. This systemic problem underscores the financial vulnerability of the entire banking sector.

Asset Size Banks (kobeissi letter)

Why Are U.S. Banks Collapsing?

The major contributing factor to these gargantuan unrealized losses lies in the interest rates and the decisions banks made in 2020 and 2021. Banks loaned vast sums at rock-bottom rates, likely believing that they could reap substantial rewards. However, the opposite has occurred, and now these banks, including Bank of America, are sitting on massive losses.

Unrealized gains/losses (FDIC)

Silicon Valley Bank and First Republic both fell prey to this miscalculation. They were probably banking on their assets appreciating in value, but when the opposite happened, they found themselves unable to meet their depositors’ demands. As a result, they were compelled to liquidate their assets at a loss to repay their depositors, a move that ultimately led to their downfall.

Why BAC Will Be Fine

In my opinion, it seems unlikely that the Bank of America will meet a similar fate. Despite the grim circumstances, several factors at play could shield it from collapse. Now, let’s delve into why I think so.

The potential for a bank run at Bank of America is highly unlikely in light of recent Federal Reserve interventions to bail out depositors from the last few bank failures. Bank of America, as a Globally Systemically Important Bank (G-SIB), stands under the protective umbrella of the Federal Reserve’s Bank Term Funding Program (BTFP). This program enables stressed banks to temporarily exchange their potentially loss-making assets for cash instead of having to offload them on the open market at a loss.

Thus, even if Bank of America comes under pressure due to these unrealized losses, it’s unlikely to fail in my opinion. Instead, it would likely offload these “toxic assets” – which are primarily government treasuries – to the Federal Reserve, at least temporarily. The utilization of such facilities led to a noticeable spike in the Federal Reserve’s balance sheet in March of this year, illustrating their effectiveness in preventing bank failure.

Bank of America’s situation contrasts significantly with Silicon Valley Bank and First Republic, which had to sell assets due to bank runs. In my opinion, there’s no pressing need for Bank of America to liquidate its bonds in the upcoming quarters. Why? Because it boasts over $850 billion in global liquidity sources, providing a substantial financial cushion.

Additionally, the bank’s net interest income has increased to $14.8 billion, a positive outcome of the Federal Reserve’s interest rate hikes. This increment indicates growth amidst the crisis, defying the economic turbulence around it. The bank’s book value’s rise from $30.61 to $31.58 further validates this growth trajectory.

Despite the tempest of financial uncertainties, Bank of America’s Q2 2023 financial report showcases the bank’s resilience and growth. The robust Return on Equity (ROE) of 11.84 % and Return on Tangible Common Equity (ROTCE) of 16.42% illustrate the bank’s efficiency in generating profits.

Summary Income Statement (BAC Earnings) Summary Balance Sheet (BAC Earnings)

Given these positive signs, I argue that Bank of America doesn’t have to sell its bonds; instead, holding them to maturity will prevent the realization of these losses. This strategic hold coupled with the bank’s strong financials and growth, should reinforce investors’ confidence.

In my view, these elements cement Bank of America’s status as a strong buy in the upcoming quarters. Despite the paper losses reflected in the Q2 report, the bank’s broader financial health and strategic safeguards against the crisis put it in a resilient position. The headlines shouldn’t deter investors in my view, but rather should help them see the potential for growth and return that lies beneath.

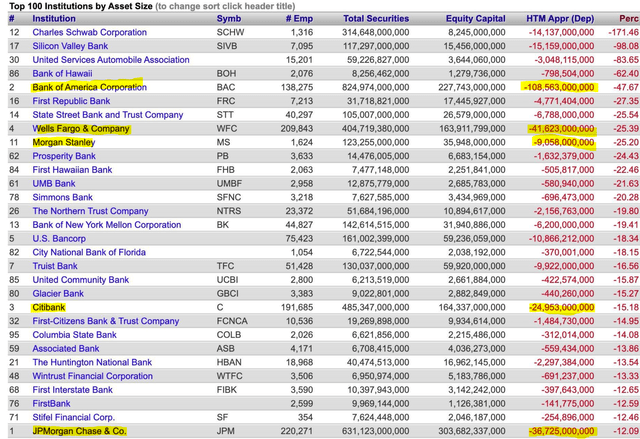

Technical Analysis

Looking at BAC’s technical chart, we can see that it could be near a break-out. After rallying in five waves through 2021 and 2022, we have now reached the key area of the 61.8% retracement. In the last few weeks, BAC has been moving sideways inside a triangle, but we have now successfully escaped it. The target for the next move up should be close to $40, and we have strong support below, as shown by the Visible Range Volume Profile and the 50-day MA.

Final Thoughts

I believe BAC is a good investment right now, given the technical setup. I think the fears over banking are overblown, and I expect this stock to perform well in the coming year as the economy continues to show resilience.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Macro moves markets, and this is what I do at The Pragmatic Investor

Join today and enjoy:

– Weekly Macro Newsletter

– Access to our Portfolio

– Deep dive reports on stocks.

– Regular news updates

Start your free trial right now!