Summary:

- Netflix is set to report earnings and could top badly beaten-down estimates.

- Moreover, Netflix is a high-quality, market-leading company well positioned to capitalize in the lucrative global streaming market in the years ahead.

- Also, despite increased competition, Netflix should maintain its leading role in the sector, enabling it to expand revenues and optimize profitability in the coming years.

- Due to Netflix’s unique market condition, substantial growth prospects, and considerable profitability potential, NFLX stock price should move much higher as we advance.

Giuliano Benzin/iStock via Getty Images

Howard Stern may be known as “The King of All Media.” However, Netflix (NASDAQ:NFLX) is the top global streaming network, providing (arguably) the best original content in the world. Therefore, the King of All Media title may go to Netflix.

Also, on Wednesday, July 19, after the bell, Netflix will report earnings, and the results could come in better than expected. While I’ve been an investor in Netflix since about 2011, I sold much of my Netflix stake before the tech top in 2021. Then something remarkable happened, Netflix dropped by around 75% in just several months, creating one of the most compelling buying opportunities ever in its stock.

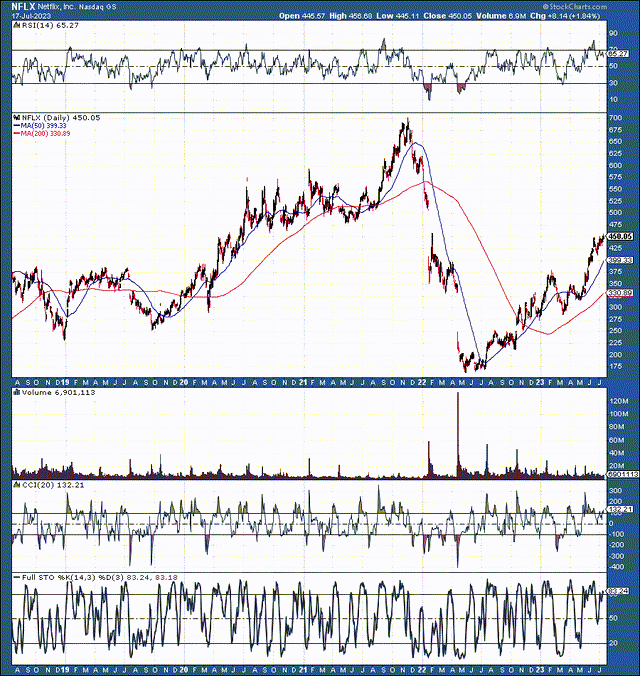

Netflix 5-Year Chart

NFLX (StockCharts.com)

After the epic drop about a year ago, I began pounding the table on Netflix’s stock again. I argued that, fundamentally, nothing had changed at the company. It was going through a transitory slowdown, and its stock would recover and move much higher soon.

Incredibly, Netflix went through one of the most epic sell-offs on Wall Street, with its stock price dropping to approximately $170. Now, Netflix has appreciated by about 165% from my initial strong-buy rating last summer, and more recently I reiterated my buy rating on Netflix’s stock in May. Despite the run-up in its stock, Netflix is a high-quality, market-leading company that should continue expanding revenues and improving profitability as we advance.

Netflix has the most user-friendly and stickiest streaming platform globally (more than 232 million paid users). Moreover, Netflix remains the content king, bringing exciting new series and movies worldwide. Furthermore, Netflix has done a phenomenal job monetizing its business and has successfully incorporated advertising on its platform. Additionally, Netflix continues to deliver high margins and is perpetually improving profitability. Furthermore, Netflix should continue providing compelling growth prospects while delivering significant profitability and EPS growth potential in the coming years, making Netflix’s stock a solid long-term buy for the next five years or longer.

Why Netflix Beats the Rest

Netflix Vs. Disney – No Contest

There was much speculation that Disney’s (DIS) streaming service would take away from Netflix’s business. However, in a 2017 interview, I said that there was a reason why Netflix didn’t build theme parks, and Disney will have a challenging time competing with Netflix on its home turf.

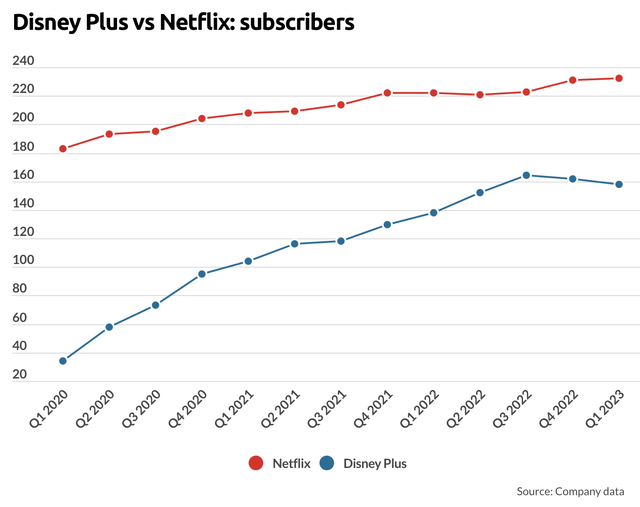

So, fast forward to 2023. Disney Plus has about 158 million users, but at what price? Disney’s subscriber growth has declined sequentially two quarters in a row, so it’s technically in a recession now (down by 4%). In contrast, despite the economic slowdown, Netflix has grown subscribers by about 5% in the last two quarters.

Subscribers (businessofapps.com)

We see a negative subscriber growth trend developing in Disney Plus, and this detrimental dynamic may persist. There are only so many times I can watch Star Wars or Pirates of The Caribbean, and if we put “old content” aside, we see there is no contest between Netflix and Disney. Netflix offers about five times more content with its basic add-free plan. Moreover, Netflix offers a range of plans ranging from $6.99-19.99.

Also, let’s discuss profitability metrics here. Disney Plus generated about $7.4B in revenues last year. Since Disney Plus ended 2022 with about 164M subscribers, its revenue per subscriber was around $45. In comparison, Netflix generated a staggering $31.62B in revenues last year, equating to a much higher $137 per subscriber. While Disney Plus’ revenue per user should rise, the company is now experiencing a decline in its user base. There could be a systemic issue that may continuously plague Disney Plus and limit growth potential advancing from here.

On the other hand, we see Netflix’s subscriber count maintaining growth despite the global slowdown, and we see Netflix generating much more revenue per user, illustrating a much more stable streaming business. Also, Netflix posted a 21% operating margin last quarter. In contrast, Disney only posted a 9.7% operating margin for the same period. Furthermore, Netflix registered a net income margin of 16% last quarter, vs. Disney’s 6%.

Therefore, we see that Netflix has a much more profitable business model in addition to its advantage in content, international expansion, and other crucial aspects. Of course, this is not an apples-to-apples comparison as Disney has a more diversified business model with theme parks and other assets. Nevertheless, comparing the performances of the two media giants’ streaming platforms, Netflix appears to have the edge.

Look at HBO/MAX, owned by Warner Bros. Discovery (WBD). We see severe issues, including substantial debt and other detrimental elements associated with the disastrous AT&T (T) acquisition and subsequent spinoff of Time Warner. Also, its Max streaming service is $16 for the ad-free version and $20 monthly for the four-screen ultimate package. The ad-lite version costs $10, making HBO costlier than Netflix (ad-lite plan $6.99, basic no adds plan $9.99). Moreover, we witnessed HBO/Max growth nearly stall under AT&T, and there’s no guarantee it will improve significantly soon. Also, we see WBD struggling with its international strategy as Netflix’s audience is much more global due to a comprehensive global expansion approach. Netflix will report earnings soon, and I think the company can beat the depressed estimates.

Moreover, Netflix is a high-quality, market-leading company well positioned to capitalize in the lucrative global streaming market in the years ahead. Also, despite increased competition, Netflix should maintain its leading role in the sector, enabling it to expand revenues and optimize profitability in the coming years. Due to Netflix’s unique market condition, substantial growth prospects, and considerable profitability potential, its stock price should increase as we advance.

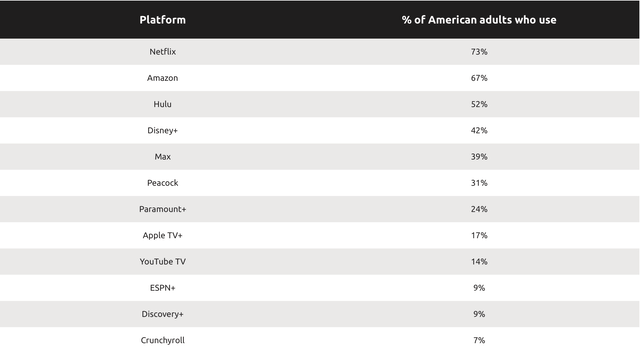

Netflix Remains The Most Popular Platform

Percentage of adult users in U.S. (cordcutting.com)

Around 73% of adult Americans use Netflix, making it America’s most popular streaming platform. Also, we see remarkable resilience during the recession/slowdown phase as the company continues adding subscribers through this ultra-difficult period. Additionally, Netflix’s international subscribers continue climbing due to the company’s ability to implement a comprehensive global strategy incorporating numerous productions/collaborations with many studious around the globe.

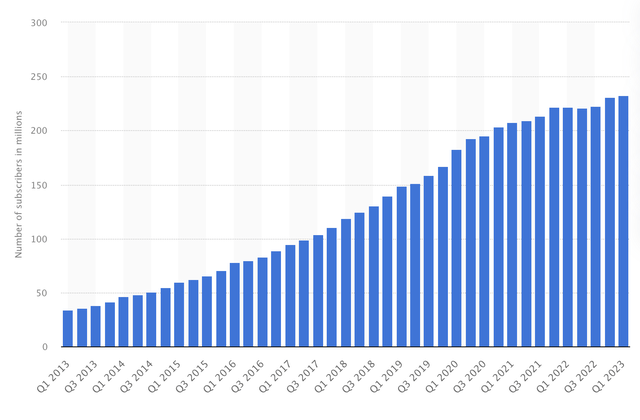

Netflix Subscribers Continue Growing

Subscribers (Statista.com )

Last quarter subscriber numbers came in at 232.5M, a 5% YoY increase. While the growth seems minimal, it’s highly impressive considering the economic slowdown, the lost subs due to the Ukraine/Russia war, and continued competition. Moreover, I noted that Disney Plus lost subscribers in its last two quarters while Netflix continues to grow. Netflix’s subscriber and revenue growth will likely continue expanding in the coming years as it remains the global leader in one of the most lucrative sectors of the internet.

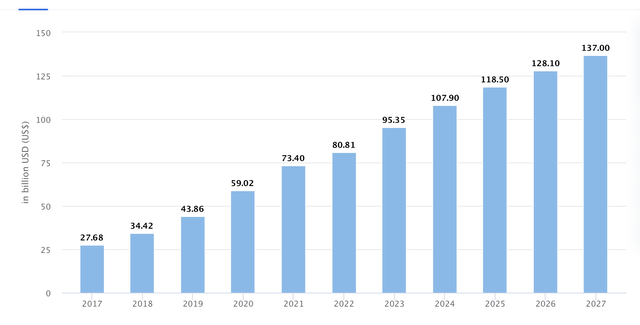

The Global Streaming Market To Grow Immensely

Streaming revenue growth (Statista.com)

Global streaming revenues should continue climbing in the coming years, and Netflix could continue expanding its revenues and improving profitability as we advance. Netflix is the worldwide market leader in streaming and is well positioned to capitalize on growth possibilities in the future. Moreover, Netflix illustrates that it can make money from advertising, further strengthening its business model for future years.

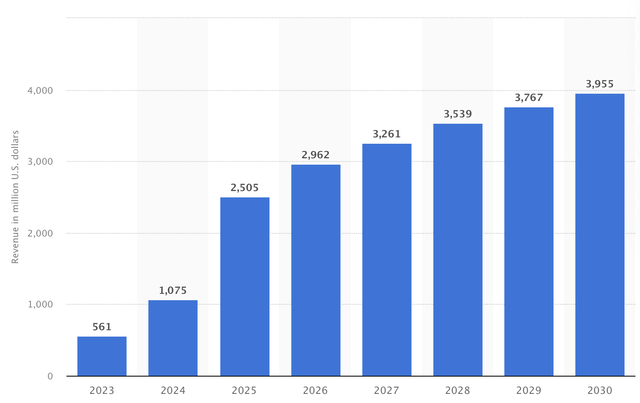

Netflix – Substantial Ad Revenue Growth Prospects

Ad revenue est (Statista.com)

While Netflix’s ad revenues should be relatively limited this year (roughly $560M), we should see significant expansion to more than $1B next year and substantially more in the years ahead. Netflix could add about $4B in ad revenues to its top line by 2030. Furthermore, ad revenues are highly profitable and should filter very nicely to Netflix’s bottom line, increasing its EPS substantially in the coming years.

Earnings Preview – Netflix Could Beat Estimates

Netflix’s earnings report is coming up, and the consensus EPS estimate is $2.86 on $8.28B in revenues. However, the most critical number will be Q2 subscriber adds and the company’s H2 guidance. There’s a high probability that Netflix will beat the lowballed consensus estimates and may guide higher than the market expects for future quarters. However, the stock is priced for perfection here. Thus, Netflix will need to deliver a significant beat on Q2 subs to propel its stock even higher in the near term. Longer term, the trend is clear, and it’s higher for Netflix from here. My Q2 estimate is $3.02 in EPS and $8.42B in revenues.

Valuation Perspective – Much More Growth Ahead

Revenue estimates (SeekingAlpha.com )

Consensus estimates are for about $34B in revenues this year, but Netflix can probably come close to $35B. We could also see steady 10-15% YoY revenue growth in the next several years. International and ad revenue growth should persist in the future and may enable Netflix to achieve higher-end revenue estimates in the coming years.

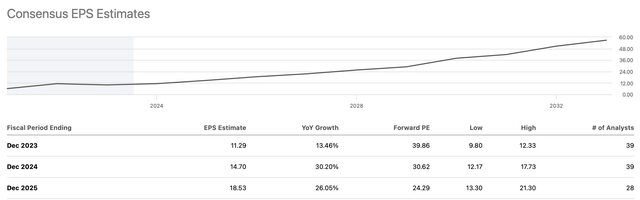

EPS to Continue Healthy Expansion

EPS estimates (SeekingAlpha.com )

EPS should continue expanding substantially due to Netflix’s high-margin business model and increased ad revenue gains. Therefore, this year’s EPS could come in at about $12, maintaining a robust 20%-30% EPS growth rate in the years ahead. While the consensus EPS estimate is close to $15 for next year, Netflix could earn toward the upper range of analysts’ estimates, delivering approximately $17 in EPS next year. This dynamic implies that Netflix could be trading around 26.5 times forward EPS estimates. This valuation is relatively inexpensive for a high-quality, market-leading company in Netflix’s position, and its forward P/E multiple may fluctuate in the 25-30 range as we advance.

Where Netflix Could Be in the Future

| The year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Revenue Bs | $35 | $40 | $45 | $50 | $56 | $61 | $67 |

| Revenue growth | 11% | 14% | 13% | 12% | 11% | 10% | 9% |

| EPS | $12 | $17 | $21 | $26 | $32 | $39 | $46 |

| EPS growth | 20% | 42% | 24% | 25% | 22% | 21% | 20% |

| Forward P/E | 26.5 | 27 | 28 | 29 | 30 | 29 | 28 |

| Stock price | $450 | $567 | $728 | $928 | $1170 | $1334 | $1500 |

Source: The Financial Prophet

Risks to Netflix

Despite my bullish outlook, various risks exist associated with an investment in Netflix. A disruption in subscriber growth or a worse-than-expected reading would likely cause a significant selloff in Netflix’s stock. Also, signs of worsening growth or lower-than-expected profitability could lead to significant declines in its stock. Additionally, increased competition and other factors could impact Netflix’s performance negatively in the coming quarters. Also, I’m using relatively robust growth projections, and a slower pace of growth (revenues or EPS) could enable the stock to rise slower than expected or cause the stock multiple to contract, possibly leading to a lower stock price in certain instances. Investors should carefully scrutinize these and other risks before committing capital to a Netflix investment.

Disclosure: I held some Netflix stock throughout parts of 2021 and much of 2022. I have not had a position in Netflix this year, but I want to enter the stock at a favorable buy-in level.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NFLX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!