Summary:

- Merck is a top performer in the healthcare sector, with steady growth, high profitability metrics, and a robust pipeline of potential drugs.

- Despite a recent decrease in revenue due to reduced demand for COVID-19 treatment, the company’s profitability remains resilient, and it continues to invest in R&D.

- The stock is currently undervalued, making it a “Strong Buy”, despite risks associated with patent expiration and potential regulatory issues.

Marko Georgiev

Investment thesis

Merck (NYSE:MRK) is a superstar in the Healthcare sector. The stock is highly ranked by Seeking Alpha Quant due to the steady growth with unmatched profitability metrics, which are still expanding even during the decrease in revenue due to decreased demand for COVID-related products. The company has a robust pipeline with promising strategic partnerships. Moreover, according to my valuation analysis, the stock is very attractively valued. To sum up, I believe the stock is a “Strong Buy”.

Company information

Merck is a global pharmaceutical company with major drugs, primarily including the treatment of oncology and diabetes. MRK is an S&P500 member.

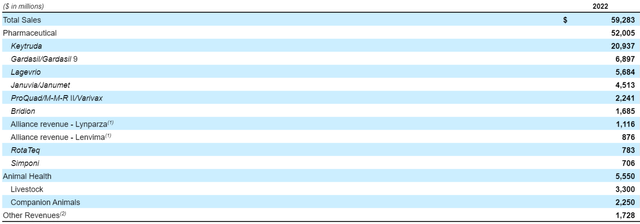

The company’s fiscal year ends on December 31 with two operating segments: Pharmaceutical and Animal Health. According to the latest 10-K report, the company’s oncology product “Keytruda” represented more than 30% of the total.

Financials

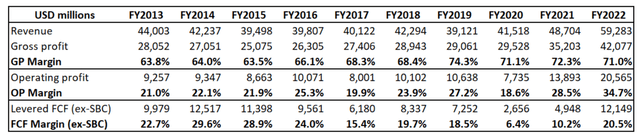

The company demonstrated steady revenue growth over the past decade with a 3% CAGR. MRK significantly improved its profitability metrics over the decade, while the free cash flow [FCF] margin deteriorated from about 30% in FY 2014-2015 closer to 20%.

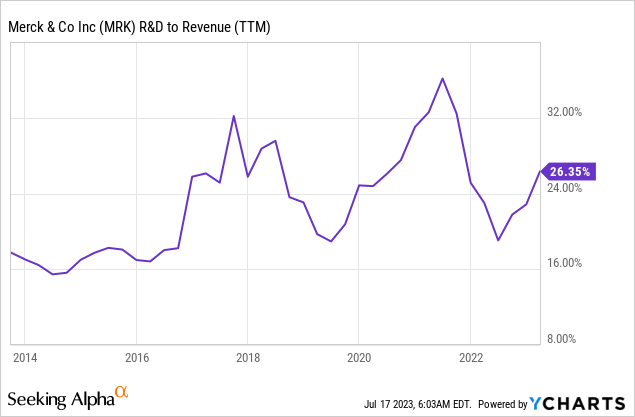

Innovating is the most important for pharmaceutical companies since their products have a competitive advantage for a limited time, while patents are in force before exclusivity is lost. Therefore, the company’s substantial R&D to revenue ratio is a positive sign to me.

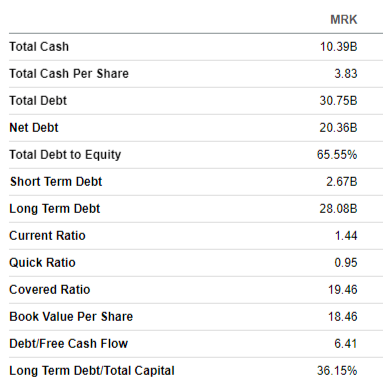

Merck is implementing a very shareholder-friendly capital allocation policy, with significant amounts returned via stock buyback and dividends. The company has a stellar dividend track record with 33 consecutive years of payouts and 12 consecutive years of dividend hikes. The balance sheet is in good shape, with moderate leverage ratios and solid liquidity metrics.

Seeking Alpha

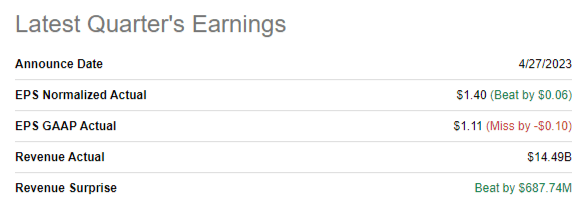

The latest quarter’s earnings were released on April 27. MRK outperformed the consensus revenue and adjusted EPS estimates. Revenue declined 9% YoY, and the bottom line followed the decline. The gross profit demonstrated resilience, with an expansion from 66.5% to 73.1%. The operating margin could have expanded significantly as well, but MRK reinvested a substantial portion of sales [30%] into R&D. For comparison, in Q1 2022, the R&D to revenue ratio was at 16%. I like the resilience of profitability metrics to the decreased revenue.

Seeking Alpha

The revenue drop was predominantly attributed to the company’s Pharmaceutical division. The reduced demand for the company’s COVID-19 treatment and increased competition from generic alternatives in the diabetes product market undermined the top-line dynamic. The growth in the oncology sector partially offset unfavorable factors.

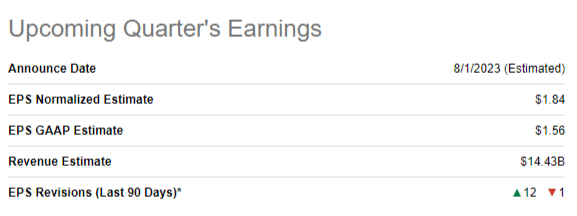

The upcoming quarter’s earnings are expected to decrease insignificantly by 2% YoY. The adjusted EPS is also projected to be almost flat with a slight contraction. The upcoming earnings release is scheduled on August 1.

Seeking Alpha

The company continues to receive approvals for additional applications and combinations of its products, which will drive the demand for them. For example, in April FDA approved the Padcev-Keytruda combo for advanced bladder cancer. Recently, the FDA also approved Lynparza in combination with abiraterone and prednisone or prednisolone to treat advanced prostate cancer. Merck’s PREVYMIS received approval from FDA for a new indication to prevent cytomegalovirus [CMV] disease in high-risk adult kidney transplant recipients.

The company has a strong pipeline of new potential drugs, which will also drive revenue growth in the longer term. Apart from the organic growth generated by in-house science, Merck also makes steps in terms of strategic acquisitions. On June 16, MRK completed the acquisition of Prometheus Biosciences. According to the company’s website, the acquisition will unlock the industry-leading research capability and strengthen the pipeline with a novel candidate for ulcerative colitis, Crohn’s disease, and other autoimmune conditions.

To sum up, I think that MRK is well-positioned to sustain long-term revenue growth and profitability. The current quarterly decline in sales is due to the last year’s spike in revenue due to COVID-related drugs but not due to the weakness of the company’s products portfolio.

Valuation

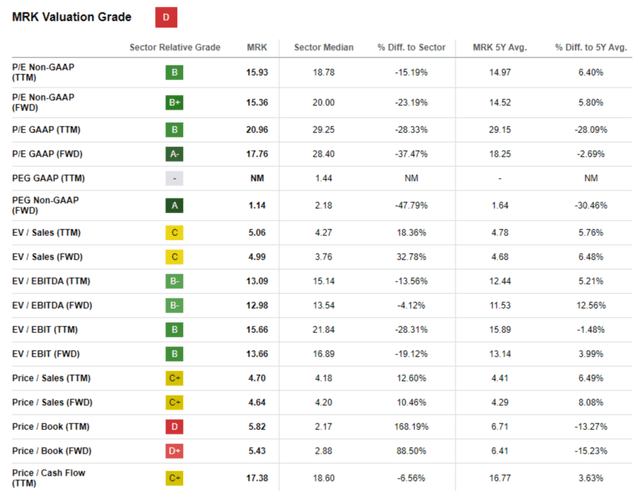

This year, the stock significantly underperformed the broad market, with a 3% share price decline. Seeking Alpha Quant assigned the stock a low “D” valuation grade, mainly due to high price-to-book ratios, both TTM and FWD. On the other hand, many other multiples, including the forward P/E, look attractive. Therefore, I would not say that the stock is overvalued based on valuation ratios.

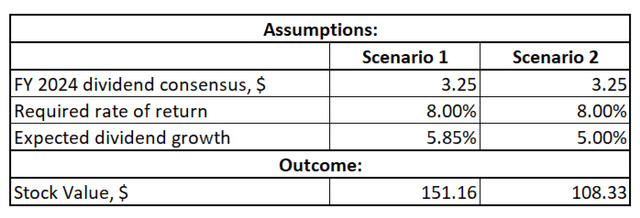

It is challenging to project reliable future long-term earnings and revenue growth for pharmaceutical companies due to the high level of uncertainty about the new patents and potential moonshots. Therefore, I want to proceed with my valuation analysis with the discounted dividend model [DDM]. I use the 8% WACC as the required rate of return, which is close to the projection from valueinvesting.io. I have dividend consensus estimates expecting FY 2024 dividend at $3.25. The dividend growth is also difficult to forecast, but the 10-year CAGR of 5.85% is reliable enough to incorporate into my DDM formula. To demonstrate the susceptibility of the DDM model, I simulate two scenarios. The second scenario has a much more conservative dividend growth rate of 5%.

As you can see, the stock is massively undervalued under the base case scenario with a 5.85% dividend growth with about 40% upside potential. With a 5% dividend growth rate, the fair price is very close to the current market share price.

Risks to consider

Like any pharmaceutical company, Merck faces risks of failing to replace its most successful patents with new offerings. The regulatory risk from the Food and Drug Administration [FDA] is high due to the probability of product delays or non-approvals. Price regulation from the U.S. government can also reduce the company’s pricing power.

As we saw in the “Company Information” section, Keytruda represents about one-third of the total sales. MRK’s bestseller faces patent expiration in five years, i.e., in 2028. That said, MRK needs to ensure that other products will be able to fill in the gap once Keytruda starts facing competition from generics.

Very high concentration related to Keytruda also poses risks of the image deterioration of the bestseller. If any hazardous side effects related to Keytruda are revealed, the demand for this drug will likely deteriorate significantly and undermine the company’s financial performance.

Bottom line

To conclude, the stock is a “Strong Buy”. The upside potential is massive and outweighs the risks and uncertainties. Despite significant risks associated with Keytruda patent expiration in 2028, I believe that the company’s track record of success suggests that the new revenue growth drivers will be unlocked. The company has a strong portfolio of oncology and cardiovascular drugs and a strong pipeline with promising partnerships.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.