Summary:

- Affirm Holdings, a Buy Now Pay Later provider, is facing challenges due to changes in the interest rates environment and may have to limit its low rates exposure by reducing the number of 0% APR loans issued.

- Despite transaction volume remaining flat, the company’s technology and data analytics and sales and marketing costs have increased significantly, impacting operating margins.

- The fair price per share for Affirm Holdings is estimated to be around $13, suggesting that AFRM stock is currently overvalued and does not present a buying opportunity.

Maxxa_Satori/iStock via Getty Images

Company Overview, Evolution, and Thesis

Affirm Holdings (NASDAQ:AFRM) is a Buy Now Pay Later (BNPL) provider, which means that the company makes money in two main ways: (1) they lend the customers to purchase goods and services; (2) they collect fees from the merchants where these transactions are executed. The APR of their loans is computed based on the quality of the FICO score, so that number will range from 0% APR to 36%, with an average of the interest-bearing loans at 24% (source: latest securitizations).

The merchants pay fees to AFRM because the availability of credit will attract more customers, and so AFRM has an interest to keep the turnover of their loans high. This is why the company actually tried to keep very few of these assets in their balance sheet, and instead securitized and sold them in big chunks during the 2020-2021 period.

We now believe that considering the very different nature of the interest rates environment, Affirm Holdings is not positioned well anymore, and its value offering will soon become too skewed to attract any customer. We think that the company will try to limit its low rates exposure by cutting the amount of 0% APR loans issued while boosting the interest-bearing ones. (source: S&P article) This will weigh on their volume and eventually, the fees collected by the merchants, and thus depressing earnings and cash flows.

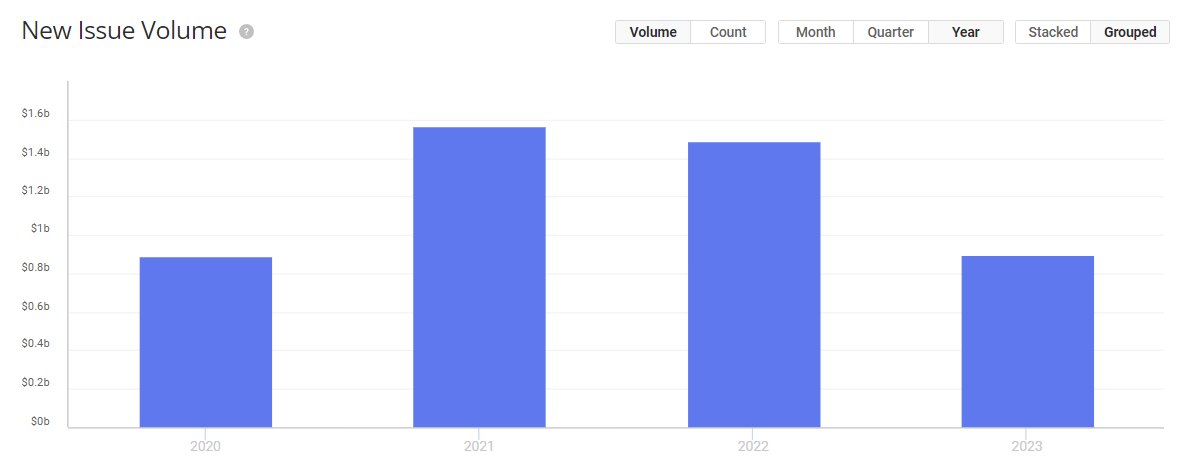

Securitizations Volume (Finsight.com)

This is what the issuance volume looks like between 2020 and 2023. While the contraction has not been great, the cost of funding massively increase (an average of 5 folds across all the tranches), and is impacting AFRM’s ability to put their loans into the market.

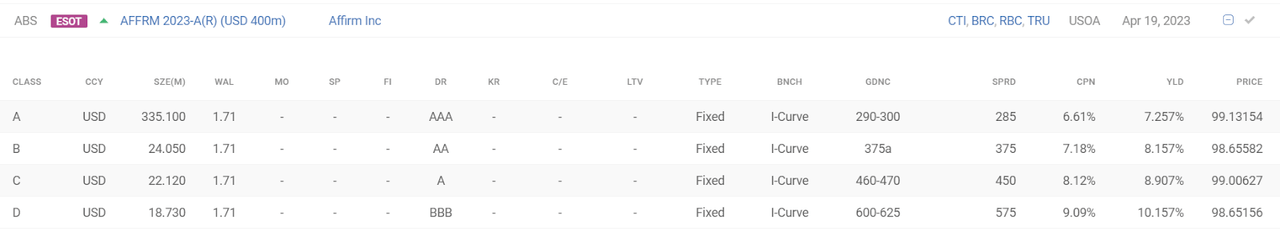

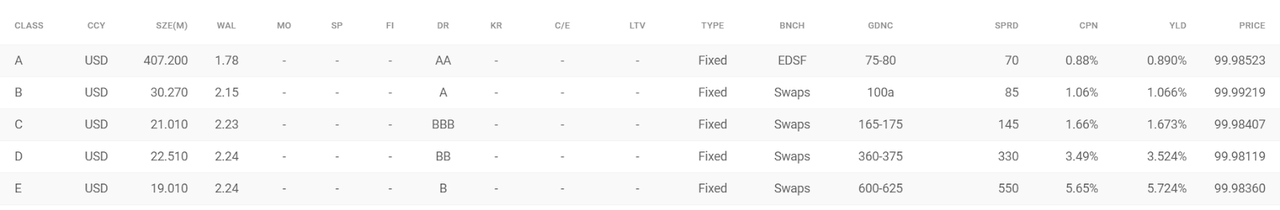

For comparison this is what a securitization from 2023 looks like:

Securitization structure (Finsight.com)

The coupon paid at the AAA tranche is above 7%, and the lowest tranche is even paying a whopping 10%.

And this is what it looked like securitizing in 2021:

Securitization Structure (Finsight.com)

No AAA tranche as they were even able to get sub 1% yield at the AA tranche, so no need to push the ratings. And the BBB tranche is not the lowest anymore, and the yield is 1.7% compared to the 10% today. This massive difference has two effects: AFRM likely has to bear the assets for a longer period, leading to more liquidity needs to fund their loans; and an overall reduction in turnover throughout the year (meaning lower merchant fees!).

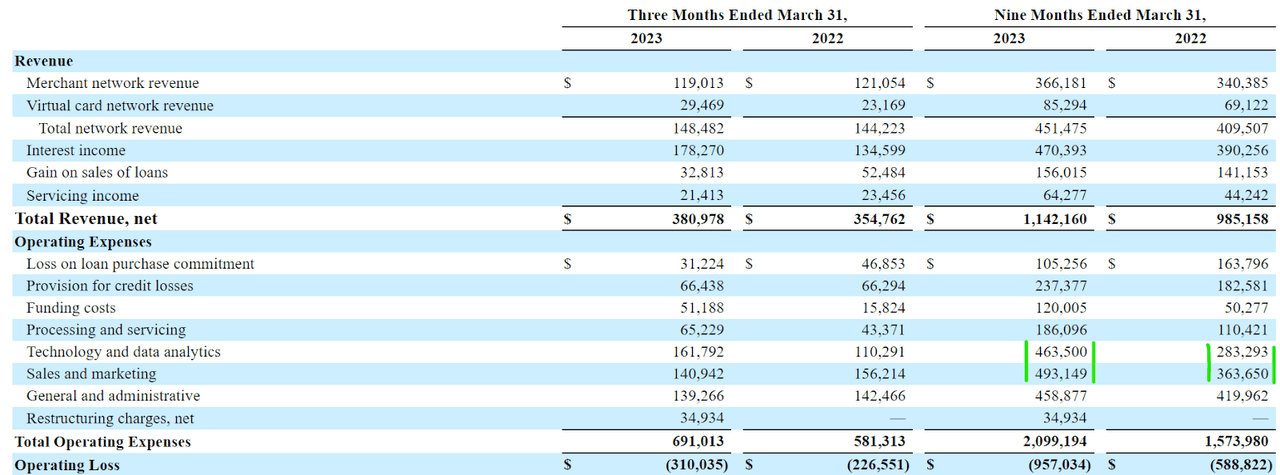

A closer look at the cost structure and the profitability

After a strong focus on the topline developments, it is also important to look below, at the cost structure and the margins. Indeed, the company is spending a whopping amount on its “tech” and marketing costs.

This is what the cost base looks like for the Nine months ending March 31, 2023. Despite total transaction volume remaining flat to modestly increasing, the “Technology and data analytics” and “Sales and marketing” increased by more than 60% and 30% respectively. This weights on the net operating loss which passed from $588 million to more than $950 million (for just nine months!).

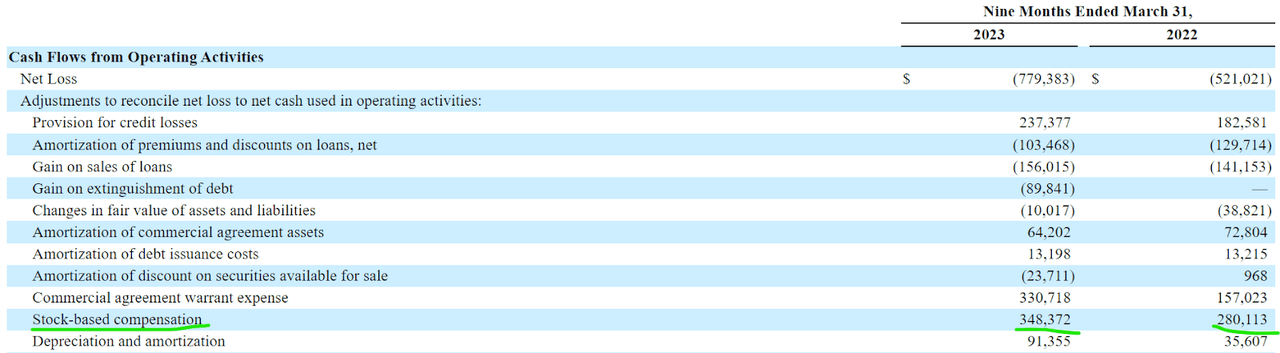

But there is another big red flag when discussing profitability. We think the company is using SBC more and more to shield the negative impacts of these cash costs on their cash from operations.

SBC passed from $280 million to $348 million, a 24% increase, and this allowed a big offset of CFO which ended up being negative of $30 million compared to a negative $100 million the year before. However, if we exclude this change in SBC we would end up exactly at $100 million again. So we believe that this change was somehow structured by the company to keep the results looking good, despite this being a tangible cost for shareholders (in dilution terms).

The upside case: looking at possible positive developments

The market has clearly kept a different view in recent months compared to ours. The stock is up more than 87% YTD and no one seems very concerned about the loan-level data deteriorating, or profitability issues affecting the bottom line. So we think that in light of this view by the market, positive developments are still possible for AFRM.

First of all, management can decide to aggressively cut costs (mostly related to sales and marketing) and favor cash generation over revenue growth. This will be definitely appreciated by a high-interest rates market.

The other important development is more of a systemic one rather than directly related to Affirm: the FED aggressively cutting rates. Like many other theses in 2023, a re-rate could be possible if we rapidly go back to a low rates environment. AFRM in particular will benefit both from a re-rate of its valuation, but also its fundamental unit economics will improve as funding becomes cheaper.

The take: assessing Affirm’s fair value

After discussing many of these weak points, we will try to assess the fair price for Affirm Holdings. This should be a good indicator for the positioning that might be taken. As Affirm is a financial company, the valuation is not easy, and looking at FCF metrics is not advisable as they will likely re-invest much of the cash generated to scale the business.

To assess a fair price for Affirm Holdings, we decided to deploy different scenarios and use a P/E multiple that will be applied at levels of earnings that will differ in each case:

- Best case scenario: AFRM will transform its business model and move towards interest-bearing loans while substantially cutting Opex. This will benefit both cash generation (to re-invest in the business), and distributable earnings. We would expect net earnings to become positive by 2025 and stabilize at a level around $300 million (20% net margin of estimated $1.5 billion in revenues). With a P/E of 25 which would be justified by a mix of growth and profitability gains, the fair value would be around $25 per share. Or a 60% upside. Probability assigned to this case would be around 10%.

- Moderate case scenario: AFRM is able to contain expenses in 2024 and thus move towards a profitability path that may be reached in 2026. At this point, still assuming the same margins as the best case, the P/E multiple applied must be lower because of the longer time span (time value of earnings). Still using the same $300 million in profits and a multiple of 15, the fair value would be around $15 per share, or roughly a 20% upside case. The probability for this scenario would be 60%.

- Worst case scenario: The company is not able to find a good balance of interest and non-interest bearing loans, and the bad value proposition will drive away customers. Securitizations will continue to be a very expensive funding source, and the merchant fees will come lower and lower. If the company doesn’t enter an aggressive restructuring, and that point we would expect a breakeven no sooner than 2026 or 2027 at depressed margins. $100 million of profits on the same $1.5 billion in revenues, and a multiple not greater than 15, given the very late profitability point. This means a fair price per share of just $5, and a downside scenario of more than 60%. The probability for this is then 30%.

So at this point by just doing the weighted average, we end up with a fair price per share is around $13. This represents a downside case of roughly 13%, which suggests that the stock is overvalued at the moment and presents no buying opportunity, but no attractive short entry too.

Conclusion

It is clear that Affirm has many challenges in front of it. From a structural change to its business model to simply some efficiency gains that have to be made in their cost structure. Their ability to achieve these successes will determine their future, but for now the stock is definitely not a buy at any price above $13 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.