Summary:

- AT&T Inc. stock has been under massive pressure due to an investigative report by the Wall Street Journal on toxic lead cables.

- The telecom giant continues to disagree with the report’s claims and suggests no more than 10% of the network is lead-clad cables.

- AT&T’s stock is due for a rally and offers a 7.7% dividend yield now, but the toxic cable issue adds another long-term headache, suggesting an exit on any rally.

sultancicekgil/iStock via Getty Images

A lot of bullish shareholders have generally brushed off the damning toxic lead cable investigative report by the Wall Street Journal, but AT&T Inc. (NYSE:T) faces a myriad of other problems, too. The telecom giant isn’t likely to face immediate costs from removing lead cables or get hit with legal liabilities anytime soon, but the issue is a major headwind to the stock over time.

My investment thesis remains Bullish on AT&T stock for a rally off the recent dip, but the upside could be more limited now after a bounce following an update on the cable issue from the company.

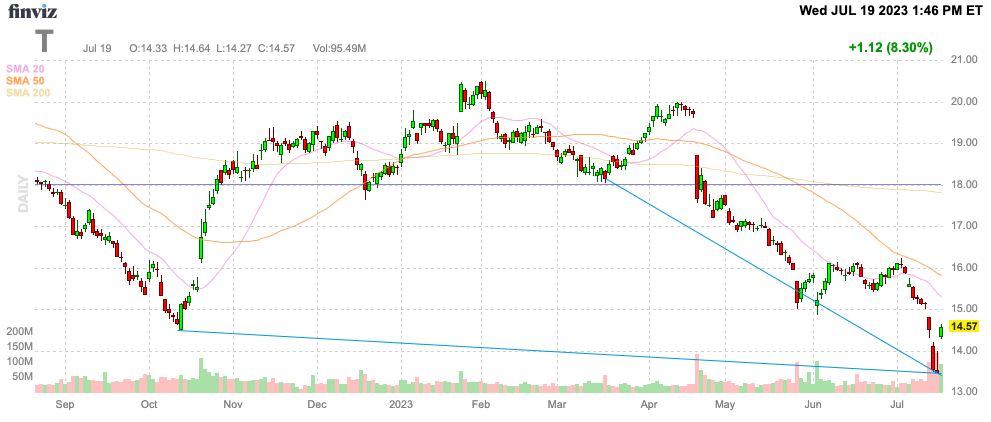

Source: Finviz

Toxic Problems

A lot is still unknown about the toxic lead cable issue facing AT&T and Verizon Communications (VZ). The WSJ investigative report brings up a lot of questions about the liabilities facing AT&T and the telecom doesn’t come across very good in the report.

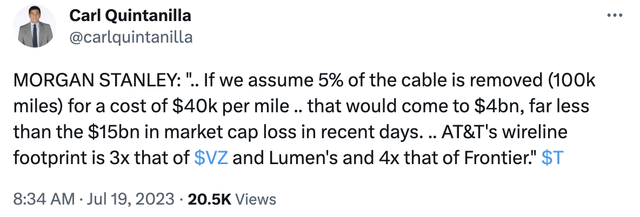

Analysts like J.P. Morgan have already downgraded the stock on worries regarding the wireless and broadband businesses. Phillip Cusick cut targets on the business due to those issues, but the analyst cut the price target to $17, down from $22, due in large part to the toxic lead pipe issues as follows:

We see the potential liability as an unquantifiable, long-term overhang for the stock, which adds to the risk premium and drives much of our PT reduction.

As most probably know, the Journal has uncovered at least 2,000 lead-sheathed cables still circling the country buried in dirt or sitting at the bottom of lakes with potential toxic lead. The most concerning aspect to the case is that AT&T highlighted issues with lead-covered cables over a decade ago.

Former AT&T senior manager John Malone held a presentation discussing this topic back in 2010. The executive apparently cautioned the group of telecom officials that metro areas still have over 50% lead cables with potential health risks to workers and the ability to leach into the nearby soil and water.

The real damning news is that AT&T executives have shown knowledge of the health risks and the company has been cited for violations by regulators, but the company has done little to protect communities. In fact, an AT&T spokesman appears to have initially denied any issue despite the WSJ having up to 200 samples with 80% of those showing elevated levels of lead.

…these are public industry presentations about occupational health procedures to protect employees during the removal or repair, which is in line with our commitment to managing these legacy cables in accordance with relevant laws and regulations. It would be false and misleading for the Journal to imply or state that any industry presentation about worker safety is an acknowledgment that lead-clad cables pose a general public health issue. As reflected in these presentations, we follow best practices to maintain this legacy infrastructure in a way that’s safe for all based on established science.

The biggest fear for shareholders is a scenario where AT&T faces more scrutiny due to a cover-up versus a company that works to resolve the toxic lead issues. New Street Research analysts only forecast a $59 billion cost to remove the cables with AT&T having the most exposure, but this initial number was a very rough estimate.

After a few days, AT&T came out firing on the toxic lead issue today. The telecom giant announced plans to pause a cable removal plan on Lake Tahoe and suggested less than 10% of total copper footprint of ~2 million sheathed miles were lead-clad cables.

According to Morgan Stanley (MS), the removal costs for 100K miles would be $4 billion. AT&T suggests a total approaching 200K for an $8 billion cost to remove the toxic lead cables.

Even the U.S. Telecom lobby group appears very cavalier about the issue in a statement from a spokesperson:

We have not seen, nor have regulators identified, evidence that legacy lead-sheathed telecom cables are a leading cause of lead exposure or the cause of a public health issue.

The company hasn’t had an investor conference to face questions from analysts, but we’ll quickly get the CEO and CFO takes with the Q2’23 earnings call on July 26. My guess is that AT&T executives don’t have much of a statement on the issue outside of the above comments by the industry.

The biggest fear in the sector is that the black swan risk has the door opened further for T-Mobile US (TMUS) and DISH Networks (DISH), via a partnership with Amazon (AMZN), to attack the wireless market and place cash flows for AT&T and T-Mobile under pressure. Neither of these 2 wireless players should have legacy lead cable issues with focuses on modern wireless networks.

Short-Term Trade

The opportunity in AT&T remains very short-term in nature. The stock hit a low below $15 back in October 2022 and the stock has already crashed below this level.

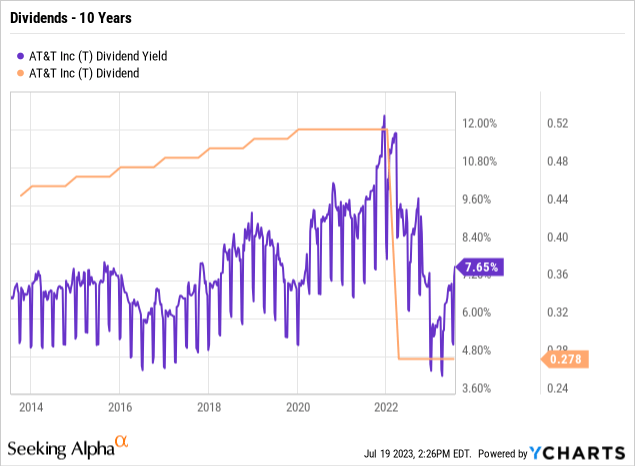

Currently, AT&T has plenty of positive cash flow to pay the large 7.7% dividend here. The wireless giant even has $6 billion excess free cash flow after paying the dividend to repay debt, or even cover several billion in annual expenses to remove or replace these lead cables.

When the dividend yield last ticked up above 8% in 2021, AT&T ended up cutting the dividend payout by nearly 50% in the next year. Though, the stock initially rallied all the way back to $21 before the cut.

For this reason, the stock is likely to rally once some of the headlines shift to earnings and the legal issues fall to the back burner. Ultimately though, AT&T will face the constant risk of the toxic lead cable issue creeping back into the headlines.

Just about every regulator and politician is now forming a task force to determine the health risks to lead cables in their district. The WSJ emphatically detailed issues in multiple areas like Bayou Teche in Louisiana, and those areas almost certainly have to act to remove cables.

For this reason, AT&T is likely to rebound as the company pays a few very large dividend payouts the rest of the year, but the issue will ultimately return. The large telecom not acting to get in front of this issue could turn into a major headache, if additional tests prove cables are leaking lead in excess of EPS standards.

The stock traded at $20 at the end of April and $16 in early July providing some targets for a rebound. AT&T has already rallied 8% on the Lake Tahoe news today limiting some of the initial upside here, but investors should look at these levels as places to unload shares knowing this toxic cable issue will continue to pop up in the future.

Takeaway

The key investor takeaway is that AT&T, Inc. already has plenty of logs on the fire with slow growth and 5G competition leaving the toxic lead cable issue as just another log thrown on a big fire. The company has constantly cut numbers recently, and the consensus analyst estimates only have revenues growing 1.1% this year with EPS down over 5%.

Regardless, T stock has gotten too cheap here at $14.50 with a 7.7% dividend yield, even after the rally today. The company just paid a quarterly dividend, but AT&T will likely pay out several dividends that, combined with a rally back to prior support levels around $16 and $20, should provide some solid gains from where to sell the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.