Summary:

- Bank of America reported a solid quarter and beat estimates.

- Net deposits saw outflows and net interest income has started contracting.

- These trends should accelerate in the months ahead, and earnings estimates look quite optimistic.

David Trood

In our last coverage of Bank of America Corporation (NYSE:BAC), we highlighted how it was irrational to not buy the bank if you just looked at valuation. We also gave the counterargument that investors needed BAC customers to be irrational over long periods of time, to make the investment case work out.

So if you believe the collective public will act irrationally, indefinitely, then go long and be strong. If not, wait for it or sell defensive cash secured puts to create ring fence around your capital.

Source: “Bank of America: Irrational Investing.”

The stock has meandered around the same level since then, while the S&P 500 (SP500) powered by the two magic words has gone up yet another 6%. It did spike after the results and made up most of the lost ground.

Seeking Alpha

We examine the Q2 2023 numbers and tell you key elements you should focus on.

The Big Picture

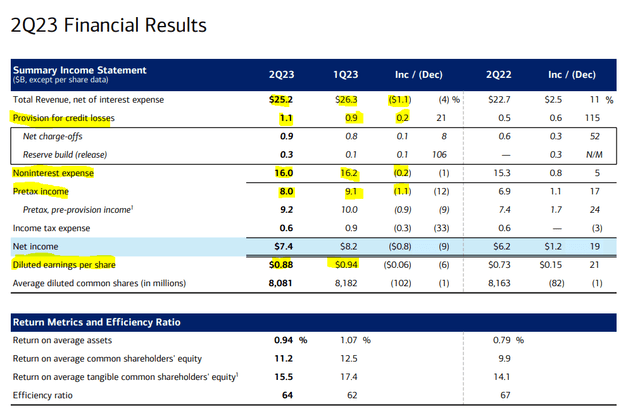

The headline number was a 4 cent beat on the bottom line as BAC delivered 88 cents of earnings per share. Comparisons are always spoken about on a year-on-year basis, and Q2 2023 was 15 cents per share higher than Q2 2022. Of course, we need to see the rate of change that is happening right in front of us, and that showed the 6 cents per share drop quarter-over-quarter. This was despite a 1% reduction in the share count.

The drop can be attributed almost entirely to net revenues, which in turn is derived primarily from net interest revenues. What we will note here is that a 4% drop in revenues translated into a 9% drop in earnings. That was the main transmission mechanism as provision for credit losses and non-interest expense changes basically offset each other.

Outflows Gentle For Now, Expect Acceleration

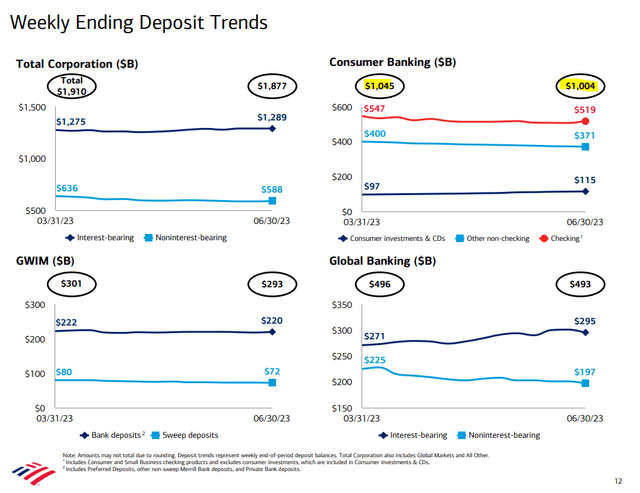

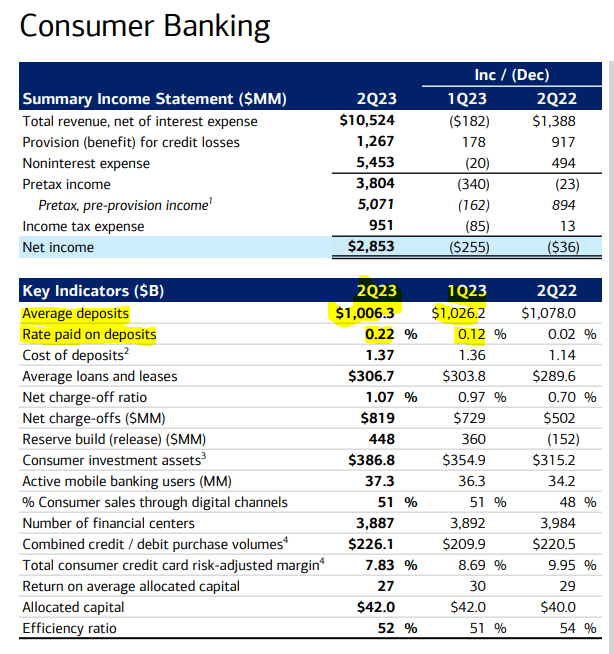

Deposits fell in all 4 major categories, with consumer banking showing the largest drop quarter-over-quarter. We will get to the “why” part later, but for now we want to stress that these numbers dropped right after a quarter that showed peak turmoil in regional banks and a flight to perceived safety.

Net Interest Income Definitely Past Peak

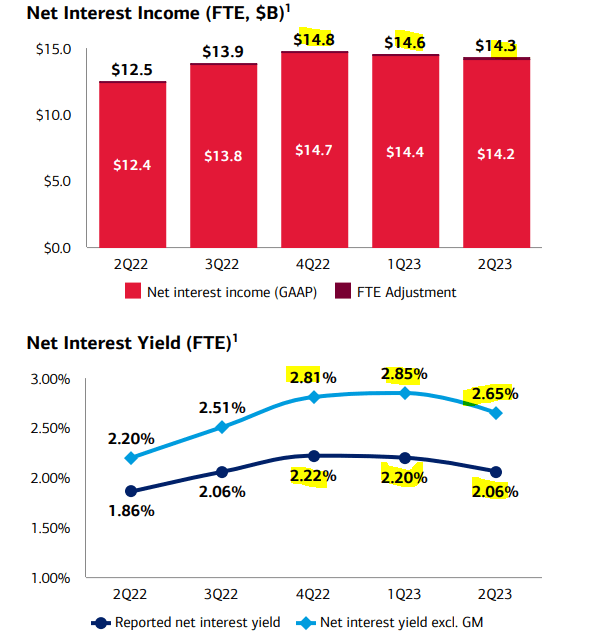

What we want to focus on next is the trend in the net interest income. We saw this indirectly while visualizing net revenues, but the picture below makes things even clearer.

BAC Q1-2023 Presentation

Net interest yield flatlined from Q4 2022 to Q1 2023, and now we are seeing a full-scale retreat. We expect that the next 4 quarters will see a significant shift down, and we should go under Q2 2022 numbers shown on the left hand side of the picture above.

Pay Nothing & You Will Hold On To Nothing

Consume banking division, which is showing the most flight in deposits, is being paid 0.22% on average. BAC is not even trying to retain these at present, and the key question becomes what will need to be paid here eventually.

BAC Q1-2023 Presentation

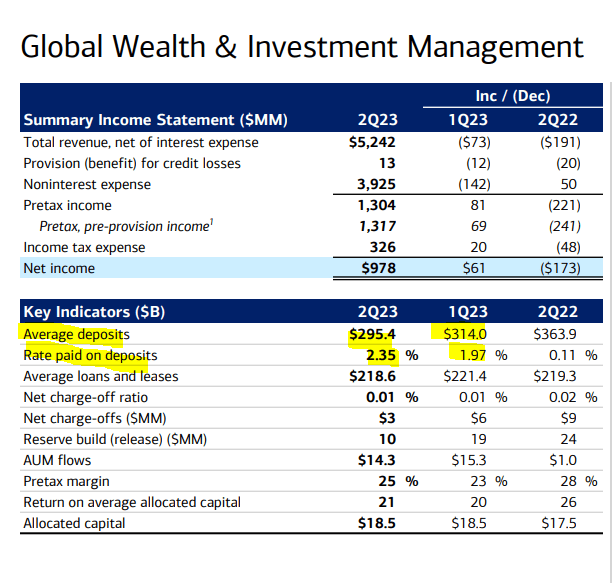

Sophisticated Clients Already Demanding More

The consumer banking segment could not be more different than the Global Wealth & Investment Management side. Average deposits here fell sharply even though BAC bumped up rates by 38 basis points during the quarter.

BAC Q1-2023 Presentation

Sophisticated clients are likely increasingly migrating to money market funds, Treasuries, or cash-like ETFs. Rates here will climb very quickly for the rest of the year in our opinion, further compressing earnings power.

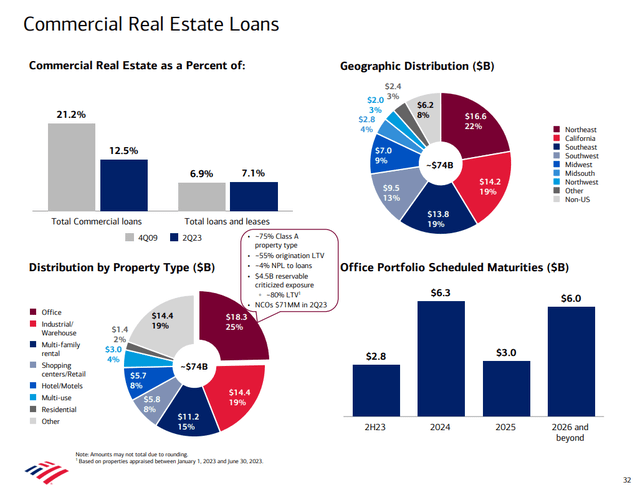

CRE Is Small, But Will Still Impact Profits In 2024

While the attention has been on BAC’s hold to maturity loans, and the losses on them, the bigger issue will likely be Commercial Real Estate or CRE. The loans are small as a percentage of the total portfolio but still substantial in relation to tangible equity. Office loans have a good buffer in terms of loan to value, but we still expect losses to hit over the next 24 months.

Verdict

The current thinking is that Bank of America Corporation earnings will move just a tad lower and then stabilize.

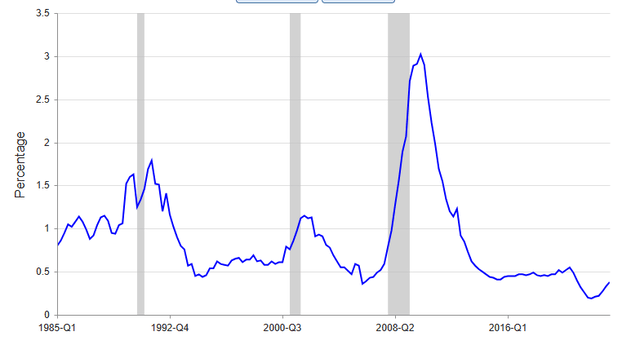

The idea is based on continued irrational behavior by customers of the entire consumer banking division for BAC. We don’t see it that way. We are at peak margins, and contraction likely gets us to under 65 cents by itself. This is excluding the charge-offs during a recession. The current levels for all banks are shown below, and even in a mild recession (think 2001) we can expect charge-offs to triple.

We rate Bank of America Corporation stock a hold and continue to favor defensive cash secured puts or covered calls to play it.

Preferred Shares

BAC has a legion of preferred shares that offer the income investor a better dividend stream than what the common delivers. There are a couple we want to touch on today.

Bank of America Corporation 7.25%CNV PFD L (BAC.PL)

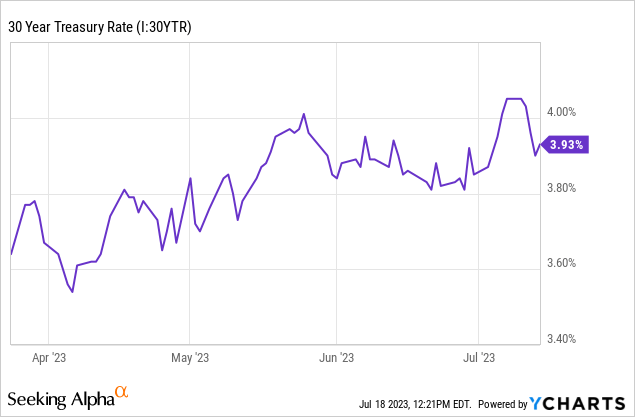

This is one we have covered before a few times. As a “busted preferred,” it offers a locked-in income stream that is very unlikely to be disrupted. At present it yields 6.2%. When we wrote about in March 2023, they were yielding 6.4%. Since these are extremely long-duration securities, they are best compared relative to the 30-year Treasury rate (US30Y). That rate has gone up about 25 basis points, and the yield on BAC.PL has dropped 20 basis points.

We this as relatively less attractive in the market, and it does not offer anything special today. We would wait for a greater than 6.6% yield on this before diving in.

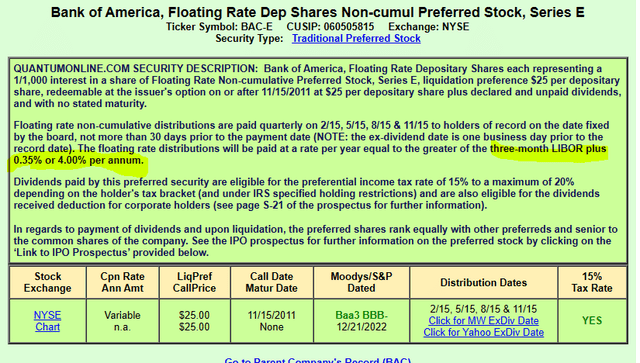

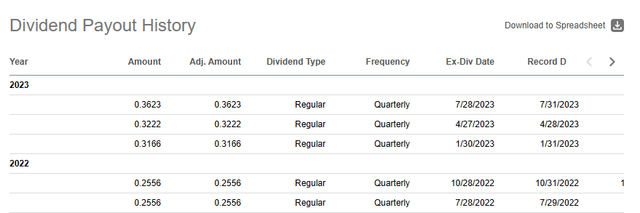

Bank of America Corporation PFD PER1/1000E (BAC.PE)

This one is interesting, as it offers a floating rate of three-month LIBOR plus 4%.

The dividends have been moving up slowly as the Fed rate hikes have started to flow through.

This is good for those expecting the Fed to stay pat for a long time, and also for those that expect the next rate cutting cycle to be shallow. We have our eye on this and might buy it under $20.00 per share.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Covered Call Portfolio is designed to reduce volatility while generating 7-9% yields. We focus on being the house and take the opposite side of the gambler.

Learn more about our method & why it might be right for your portfolio.

Stanley Druckenmiller on mental flexibility and the ability to be both bearish and bullish.

Stanley Druckenmiller on mental flexibility and the ability to be both bearish and bullish.