Summary:

- Amazon is expected to report strong Q2 2023 earnings on 27 July, potentially beating profit expectations due to increased consumer spending and easing inflation.

- The eCommerce giant’s North American sales rose 11% YoY in Q1, and it’s predicted to see 5% or higher sales growth YoY in Q2, with sales between $127.0 billion and $133.0 billion.

- Despite a 32% increase in AMZN’s valuation since May, there’s potential for further growth if economic conditions remain favourable, with no current indicators of an impending recession.

4kodiak/iStock Unreleased via Getty Images

In less than 10 days (27 July 2023), Amazon.com, Inc. (NASDAQ:AMZN) is going to report quarterly earnings for 2Q-23 and the company has a good shot, in my view, to not only beat profit expectations, but also give investors reasons to remain bullish on the eCommerce company.

Since May, Amazon’s stock price has risen approximately 32% and I think that strength in consumer spending and easing inflation could support Amazon’s ongoing rally well past the earnings date. Since AWS is not as big a problem as investors might think, a comeback of the eCommerce business could be catalyst for Amazon.

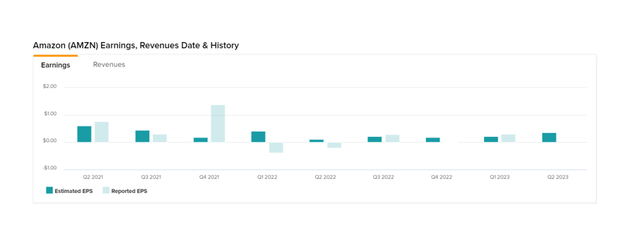

Profit Expectations Could Be Easily Beaten

Amazon is expected to post profits of $0.35 per share for the second quarter (analyst estimates from Tipranks) on 27 July, 2023 compared to a loss of $0.20 per share a year ago. If Amazon beats on profits next week, which I think is probable given the sales and profit drivers discussed in this article, more bears could be converted to bulls, sustaining the present stock price rally.

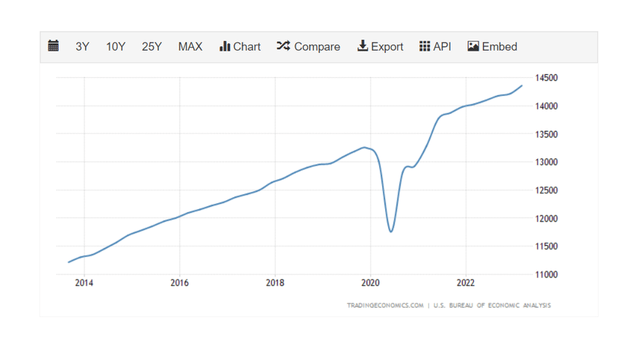

One reason why I think Amazon is set for a robust earnings report is that the company is set to profit from an ongoing recovery in consumer spending after the pandemic.

The eCommerce company obviously was a big beneficiary of the COVID pandemic which accelerated online purchasing trends and lead to record sales growth.

Consumer spending trends profoundly bounced back after the U.S. economy reopened, leading, for example, to Amazon reporting its best Prime Day sales performance in history. While Prime Day, a shopping event that lasted from July 11-12, 2023, falls outside of the reporting period for Amazon’s 2Q, it proves that consumers are opening up their wallets, and Amazon stands to profit.

Consumer Spending (Tradingeconomics.com)

With consumer spending rocking back and consumers willing to spend money, Amazon’s eCommerce business could be up for a sales and operating profit surprise.

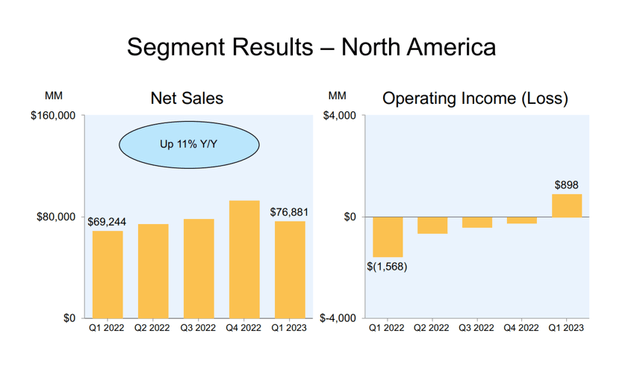

Amazon’s eCommerce sales in North America rose 11% YoY in 1Q and the company finally drove its segment to profitability (positive operating income of $898 million).

Amazon’s guidance called for $127.0 billion to $133.0 billion in 2Q-23 sales and operating profits of between $2.0 billion and $5.5 billion. In terms of sales guidance, investors could see 5% of higher sales growth YoY in 2Q-23.

Furthermore, economic indicators, such as the U.S.’s GDP growth for 1Q, were revised upward recently, an indication that the U.S. economy in the second quarter was also in strong shape. Besides those factors, there are two other reasons why I think Amazon could be set for a strong second quarter sales performance.

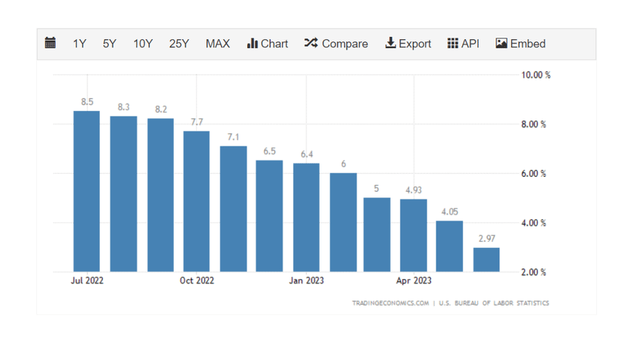

Firstly, consumers have experienced relief in terms of inflation. In the second quarter in particular, inflation has decelerated drastically, resulting in less pressure on consumer’s wallets and reducing anxiety over the rate of consumer price increases. A lot of dollars could have been freed up in 2Q-23 that consumers ultimately spend on Amazon’s eCommerce website.

Inflation Rates (Tradingeconomics.com)

Secondly, the U.S. economy does not appear to lose any steam soon. The U.S. economy created 209K jobs in June and the U.S. unemployment rate was 3.6%. Based on ADP’s pay insights for the month of June, employees staying with their employer since last year, enjoyed 6.4% YoY earnings growth, adding another catalyst for Amazon’s sales growth in the second quarter.

AWS is probably set for a decent quarter as well. The business unit produced $21.4 billion in sales in 1Q-23 and 16% YoY growth, and AWS could be set to profit from the adoption of AI tools offering companies scaling and productivity advantages.

My general opinion on AWS is favorable, as I highlighted in my article Amazon: There Is No AWS Problem. Amazon does not break down its sales guidance by segment, but my conservative estimate is for 13-15% AWS sales growth for 2Q-23.

Amazon’s Opportunities And Threats

In addition to eCommerce, Amazon has an opportunity to grow in multiple fields including digital advertising, Prime, cloud, autonomous vehicles etc. The biggest opportunities that I see relate to AWS, however. Amazon’s cloud business is likely going to expand its service offering and scale its infrastructure footprint moving forward, a move that would be welcomed by investors as it further opens the door to international growth.

Amazon already announced that it is going to open up new AWS regions in Malaysia and Australia and it would be reasonably to expect Amazon to make some new announcements in this regard when it reports earnings next week.

In terms of threats, eCommerce competition is likely to remain fierce which means overall margins may remain low, as is typical for the eCommerce industry.

Furthermore, threats include a potential recession and a strengthening U.S. Dollar.

Amazon’s Sales Potential May Be Undervalued

The market models $560.8 billion in sales for Amazon for 2023 and $131.4 billion for 2Q-23, but the eCommerce company is already seeing growing optimism from analysts with respect to its sales growth.

The market now expects an acceleration of sales growth next year, 2024, with the sales growth rate improving 2.4 percentage points YoY. If the consumer spending recovery (as indicated by Amazon’s Prime Day sales as well as other economic indicators discussed above) continues into the second half of 2023, I would not be surprised to a see a substantial revision of sales estimates moving forward.

Revenue Estimate (Yahoo Finance)

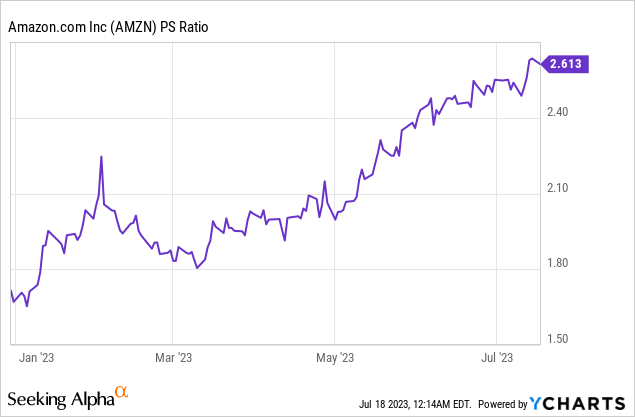

Despite Amazon’s valuation growing by 32% since the beginning of May, I think that Amazon sales multiple of 2.61x has room for expansion. Amazon was valued at more than 3.0x sales in 2021 and though growth rates may not be comparable due to the end of the pandemic, Amazon is still expected to grow at double-digits. If the economy remains in good shape, consumer spending tailwinds could allow Amazon to grow even faster than the expected 9% growth rate this year.

Why Amazon Could See A Higher/Lower Valuation

Amazon is a cyclical consumer spending play. Rising consumer spending means more dollars are spent on the company’s website while falling spending indicates growing sales pressure. As negative as the market was at the beginning of the year with respect to a recession, the economic backdrop is surprisingly supportive and no indicator really shows a recession.

As the U.S.’s largest eCommerce company, Amazon could be set to experience potent tailwinds that give its eCommerce business a lift. A change in these conditions, on the other hand, could change the outlook for Amazon’s sales and operating profit growth moving forward.

My Conclusion

The themes of decelerating inflation in the second quarter, an ongoing consumer spending recovery and a resilient jobs situation (low unemployment rate) strongly tilt the odds in favor of a strong earnings report on 27 July 2023.

That the stock has rallied 32% since May is not a reason for me to dial down my optimism. Amazon has likely profited from a spending recovery, easing inflation and higher disposable incomes in 2Q-23 which will likely been reflected in robust spending on the Amazon platform in the second quarter.

As such, I think Amazon could easily beat profit expectations when its earnings are due next week.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.