Summary:

- We’re still buy rated on Meta Platforms shares, as we see the stock outperforming in 2H23 and 2024.

- Our buy rating is driven by our belief that the company’s cost reductions this year and A.I. ambitions position it as an outperformer in the FAANG Group.

- We expect Meta will continue to steadily recover from its post-pandemic slump; the stock is up 221% since our buy rating in early November, outperforming the S&P 500 by 202%.

- Still, we don’t think the company is immune to macro headwinds in 2H23 related to digital advertising in specific.

- We continue to see attractive entry points into the stock at current levels. We recommend investors buy into Meta’s future growth.

Leon Neal

We remain buy-rated on Meta Platforms, Inc. (NASDAQ:META). The company’s undergone three rounds of layoffs and reduced spending on Reality Labs after spending a whopping $13.72B in 2022 amid Zuckerberg’s “year of efficiency.” We think the company is not only steadily recovering from the post-pandemic slump in which it dropped 64% last year, but also reaching to fulfill long-awaited A.I. ambitions that are materializing in new developments with Qualcomm (QCOM) and Microsoft (MSFT). We see Meta continuing to outperform in 2H23 and 2024 and believe its valuation is extremely attractive.

Meta reported an unexpected revenue increase in 1Q23, making it the first revenue increase after three straight periods of decline. The company reported revenue of $28.65B, up 2.7%, and GAAP EPS of $2.20, beating top and bottom line estimates. A significant amount of Meta’s revenue is derived from its advertising segment, with Reality Labs reporting an operating loss of $3,992M last quarter.

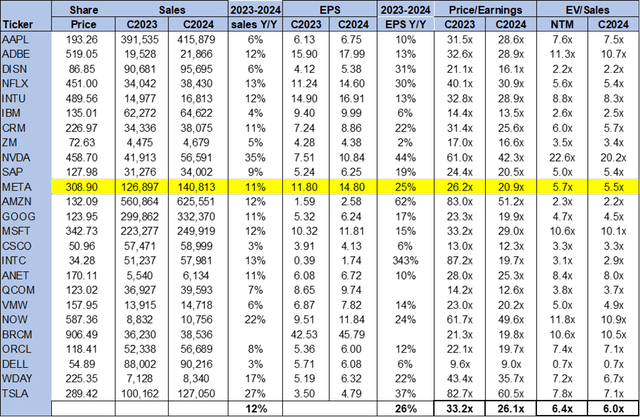

The following table outlines Meta’s segment results for 1Q23.

Meta 1Q23 Earnings Presentation

The concern for Meta is that the worsening economic condition will weigh on ad spending in 2H23; we’ve highlighted this risk in our analysis of Alphabet (GOOGL) and Amazon (AMZN). Meta’s ad impressions for 1Q23 delivered across its Family of Apps (FoA) increased by 26% Y/Y, while the average price per ad dropped by 17% Y/Y. We’re not too worried about slower ad spending impacting Meta due to the wide cast net of its FoA, especially after the company launched its Twitter-like platform, Threads.

The company’s average price per ad will likely drop further Y/Y due to sticky inflation and projections of interest rate hikes; on the 1Q23 earnings call, management attributed the Y/Y decline in pricing to “strong impression growth…and lower advertising demand.” However, we think Meta is more resilient than expected under rough macro headwinds and expect to see Y/Y revenue growth continue into 2H23. Additionally, we expect Meta’s Family Daily Active People (DAP) and Family Monthly Active People (MAP) to increase Y/Y next quarter.

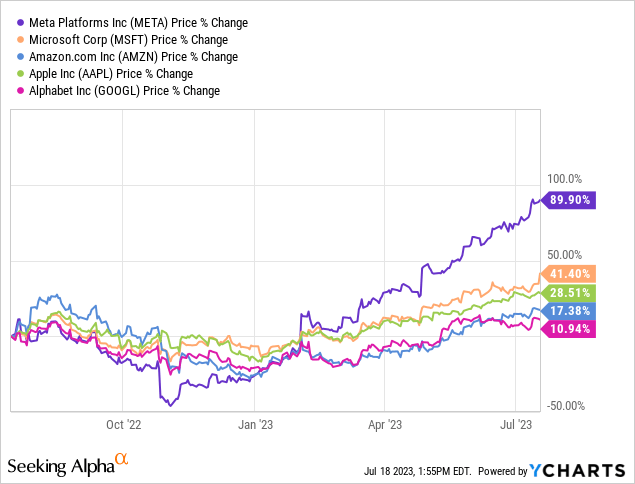

Meta guides for total revenue of around $29.5B versus consensus of $29.47B for 2Q23. The company also notably updated their FY2023 total expenses to be in the range of $86B to $90B, encompassing $3B to $5B of restructuring costs. We’re constructive on Meta’s unchanged capital expenditure of between $30B to $33B, reflecting the build of A.I. capacity for ads, Feed and Reels, and new generative A.I. projects. The stock is up 221% since our buy rating in early November, outperforming the S&P 500 (SP500) by roughly 202%. YTD, the stock is up 151%, outpacing the S&P 500 by around 132%. We recommend investors explore favorable entry points into the stock as we see Meta’s risk-reward profile become more attractive into 2024

The following chart outlines Meta’s stock performance over the past year.

YCharts

Kicking Off 2H23 Strong: A.I. & Threads

There’s been a fear that Meta fell behind in the A.I. race earlier this year, but we don’t believe this is true, especially not in 2H23. This week, Meta announced it’d be working with Qualcomm to optimize the execution of Meta’s Llama 2 large language models directly on-device, meaning users won’t have to rely solely on cloud services. Meta’s new LLM, Llama 2, will be able to run on Qualcomm chips for smartphones and PCs while previously functioning primarily on complex servers in the cloud and using processors from Nvidia (NVDA) and Advanced Micro Devices (AMD).

We’re constructive on Meta kicking off 2H23 strong as it claims a more serious role in scaling generative A.I. into the mainstream; Qualcomm management touched on this, noting, “implementing AI on devices not only helps boost privacy and security concerns, but it does so at a ‘significantly lower’ cost for developers than cloud-based measures.” Llama 2 should begin running on Qualcomm chips on smartphones and PCs starting in 2024, enabling applications like intelligent virtual assistants.

Microsoft is also expanding its A.I. shop beyond OpenAI, announcing at its Inspire Conference that it will make Meta’s Llama 2 available on its Azure cloud-computing service. Microsoft’s management noted that the two companies “share a commitment to democratizing A.I. and its benefits, and we are excited that Meta is taking an open approach with Llama 2.” Granted, Meta won’t be making money through the deal with Microsoft, we believe it’s a strategic move to get more homegrown A.I. software in the hands of the public user and developer.

Aside from its rapidly developing A.I. ambitions, Meta launched Threads, a new competitor for Twitter built by the Instagram team. The text-based social media platform experienced a record 100M sign-ups in its first five days. The advantage Meta has in its launch of Threads is its existing customer base on Instagram, which further boosted sign-ups. The record sign-up numbers also suggest a potential boost for Meta’s advertising revenue as it attracts digital advertising firms.

Similar to Llama 2, the company has yet to monetize Threads, but we think the company is opting to build a foundation for the app before shifting focus to turning a profit from it. More recently, however, Sensor Tower data suggested Threads is experiencing “a significant pullback in user engagement.” We believe it’ll be an uphill climb for Meta’s Threads to achieve mainstream adoption, but we see the platform gaining more popularity in 2H23. Our bullish sentiment on Meta is the company’s increased focus on profitability through cost reductions in Zuckerberg’s “year of efficiency” and new innovations; if Thread successfully cements itself as the new Twitter, the company is looking at 2018-2019 Twitter-like profitability.

Valuation

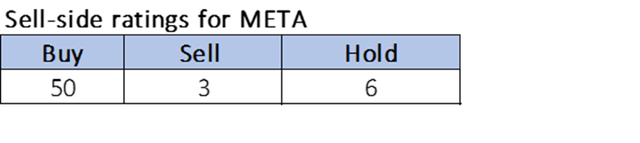

The stock is undervalued, trading well below the peer group average. On a P/E basis, the stock is trading at 20.9 C2024 EPS $14.80 compared to the peer group average of 26.1x. The stock is trading at 5.5x EV/C2024 sales versus the peer group average of 6.0x. Using a 2-stage discounted cash flow method, Meta’s estimated to be 28% undervalued based on the current share price; this number may be contested. However, comparing the stock to its peer group on various metrics, it appears to be undervalued for the growth prospects ahead.

The following chart outlines Meta’s valuation against the peer group.

Word On Wall Street

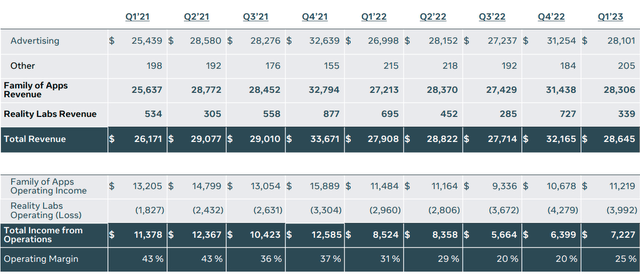

Wall Street shares our bullish sentiment on the stock. Of the 59 analysts covering the stock, 50 are buy rated, six are hold rated, and the remaining are sell rated.

The following chart outlines Meta’s sell-side ratings and price targets.

What To Do With The Stocks

We’re bullish on Meta; we continue to believe the stock will outperform into 2024 and maintain Y/Y revenue growth as it reels in spending on Reality Labs and discovers A.I. ambitions in the “year of efficiency.” We also believe the company’s recovering from a shrinking revenue base in the past after the softer ad spending and the lingering effects of Apple’s (AAPL) 2021 iOS privacy update.

The company is scheduled to report 2Q23 earning results later this month, on July 26th post-market. Last quarter, company shares climbed nearly 14% after a strong earnings report, and we see the company beating estimates again next quarter. We’ll continue to monitor the stock to see how macro headwinds impact 2Q23 advertising revenue. We recommend investors buy the stock at current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Appreciate your interest in our tech coverage. If you want first-hand access to our analysis of software/hardware and semiconductor spaces, best ideas within the current macro backdrop, and our coveted research process, we hope you’ll take a 2-week free trial of Tech Contrarians, our Investing Group service. The first wave of subscribers gets a significant lifetime discount on annual subscriptions after the 2-week free trial, so we hope to see you in our group soon.