Summary:

- AbbVie’s flagship drug Humira is facing competition from biosimilars, but the company is expected to offset revenue losses in the segment with Skyrizi & Rinvoq.

- Two real growth drivers for AbbVie are Oncology and Neuroscience segments.

- Oncology and neuroscience should grow through 2030 with CAGRs of 11.38% and 10.79%, respectively.

Irina Vodneva/iStock via Getty Images

Main thesis

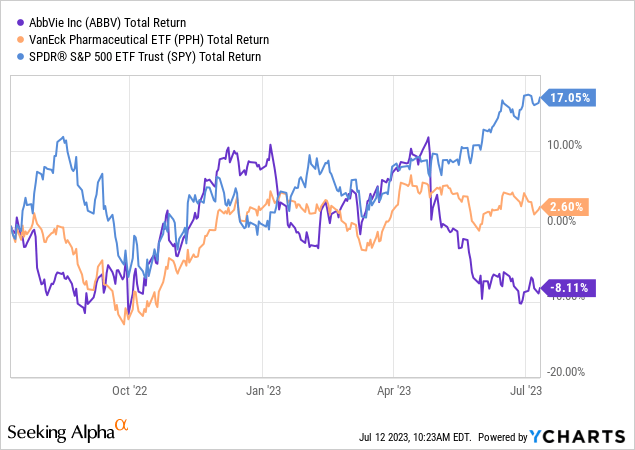

AbbVie (NYSE:ABBV) was left far behind the broader market due to negative sales expectations for Humira, which faced competition from competitors earlier this year. However, I believe Humira’s sales decline is already factored into revenue estimates and other financial metrics, and even with earnings losses, the company looks fundamentally undervalued. The company has a solid pipeline and is able to offset a significant portion of revenue losses in the coming years with new drugs. AbbVie is one of the top dividend investments in the pharma sector and is structurally a very strong player in this market.

Humira’s loss

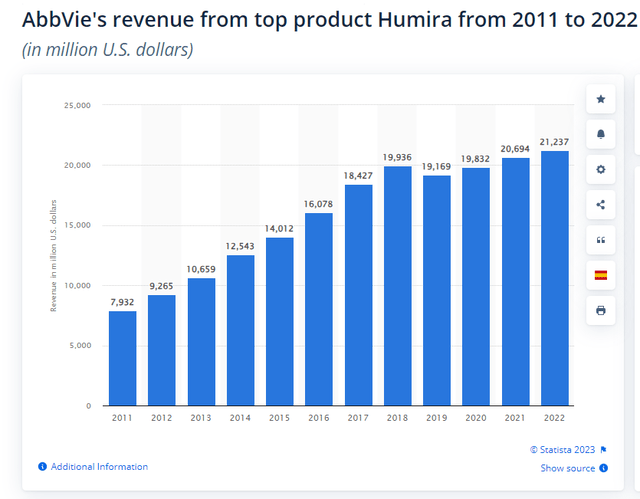

AbbVie’s flagship drug has long been the immunosuppressant drug Humira (adalimumab), once the world’s best-selling drug. Humira was approved in late 2002, initially as a treatment for rheumatoid arthritis. In subsequent years, the indications of the drug expanded, and Humira’s sales grew dynamically, reaching $21 billion in 2022.

In 2023, Humira has been facing biosimilar competition in the US. At the end of January, Amgen (AMGN) launched the first biosimilar Amjevita to the market, with several more analogs to be launched during 2023 (from Samsung Bioepis, Boehringer, Viatris, Sandoz and others). AbbVie’s CEO signaled that they expect Humira’s revenue to fall by 37% this year. A decrease of a similar pace was in the EU a few years ago when biosimilars of the drug were launched there.

Further, the process will accelerate. The Coherus version of Humira, for example, was supposed to appear in July at a list price of $995 (-85% to Humira), but the price was then lowered to $569. At these prices, Humira is almost uncompetitive. There are patients who have certain types of health insurance and reportedly don’t have to pay much for Humira (up to $100 a month) and therefore may be reluctant to switch from a drug they know and trust, so Humira’s revenue is not going to zero anytime soon.

AbbVie’s portfolio includes the ABBV-154 antibody-drug conjugate, which includes the active ingredient of Humira (adalimumab) and a specially developed selective glucocorticoid receptor modulators (SEGRMs). This experimental combination drug is being considered for the treatment of polymyalgia rheumatic, rheumatoid arthritis, and Crohn’s disease, all three studies are in phase II. In the near future, there is a chance to get good news about the progress of ABBV-154 clinical trials, and under the most favorable scenario, an improved continuation of the blockbuster Humira may appear in the company’s product line.

Rinvoq & Skyrizi will shine through

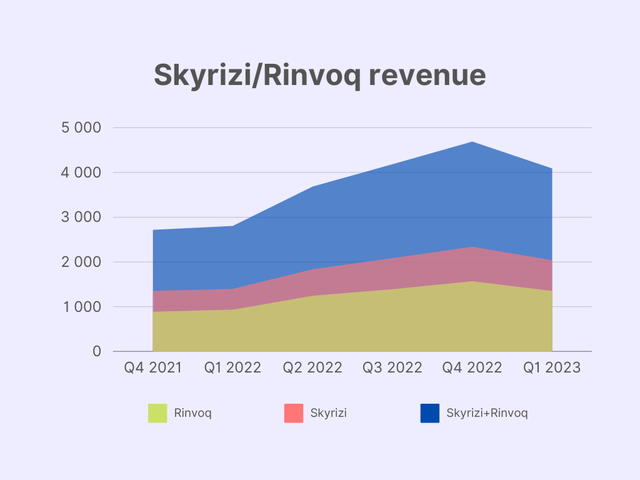

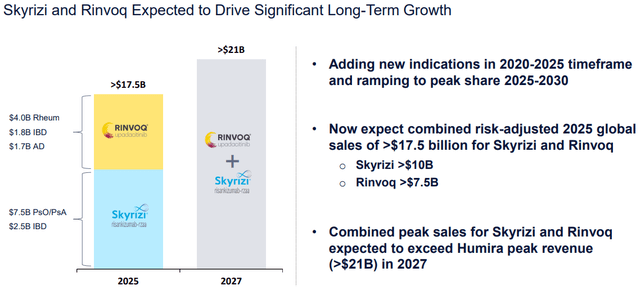

Two real bestsellers now are Skyrizi and Rinvoq, which are designed to treat the same severe diseases as Humira. In fact, these are kind of like Humira’s improved replacements but with an excellent safety and efficiency profile.

The management is currently focused on expanding the list of indications and approvals to begin commercialization of both Skyrizi and Rinvoq for emerging diseases, and they are currently showing high efficacy across all approved indications. This includes the US approval of Rinvoq for Crohn’s disease, severe rheumatoid arthritis, active psoriatic arthritis, moderate to severe ulcerative colitis, ankylosing spondylitis, and non-radiological axial spondyloarthritis, moderate to severe atopic dermatitis. Skyrizi is approved for the treatment of plaque psoriasis, active psoriatic arthritis, moderate to severe Crohn’s disease, and ulcerative colitis. AbbVie has a very aggressive exclusivity strategy that will keep Rinvoq and Skyrizi in the market for years to come. The blockbuster Humira would have faced the competition much sooner if not for the top management’s legal strategy.

Of course, it will not be possible to fully compensate for the loss of part of the revenue of the main blockbuster in one year, and the resumption of the positive dynamics of the company’s revenue is expected only in 2025.

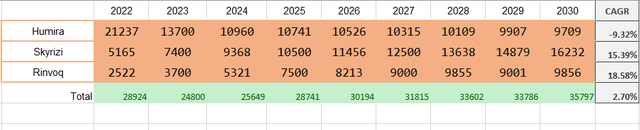

I modeled the immunology sector revenue structure through 2030. According to AbbVie’s 2023 guidance, it expects $7.4 billion in sales of Skyrizi and $3.7 billion in sales of Rinvoq. Given that they projected combined revenue of these two of $17.5 billion in 2025, 2023-2025 CAGR rounds up to 26.6% and 43.8% respectively. In 2027, the sales are expected to exceed $21 billion, meaning 9.1% CAGR in 2025-2027 for Skyrizi and 9.5% for Rinvoq. I expect sales to grow at the same pace through 2030.

Post-Humira AbbVie is not even about immunology

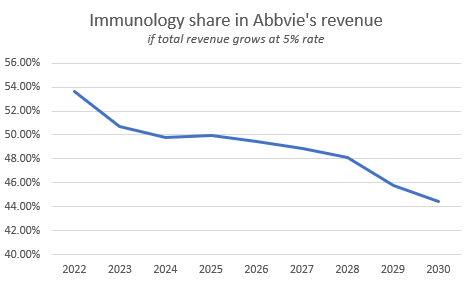

At the same time, even with the rapid growth of Skyrizi & Rinvoq, total Immunology revenue is only growing at a CAGR of 2.7%. However, I think that’s fine since 2030 AbbVie won’t rely on this segment this much.

Author

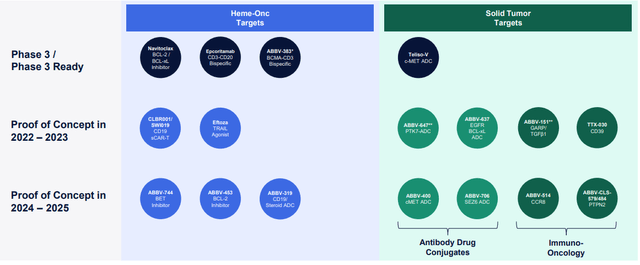

Oncology

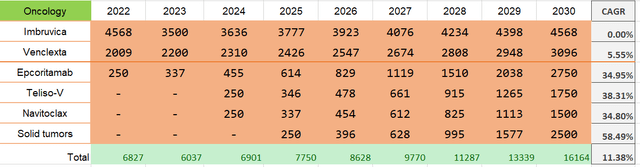

I believe that one of the pillars of AbbVie’s future success is hematologic oncology. At the same time, I don’t even expect the segment’s key drug, Imbruvica, to exceed current volumes as the company blames competition and doesn’t see Imbruvica showing results after 2026.

And so by the time you get to 2026, you have to think about what’s the size of IMBRUVICA even if it is subject to negotiation.

New competitive entrants have significantly lowered our sales expectations for Imbruvica.

Venclexta, on the other hand, should offset Imbruvica’s decline due to regulatory submissions. I project average organic growth at a pace of 5%.

But the real growth drivers are new drugs, which studies are now at stage III.

- Epcoritamab has “the potential to become a core therapy for B-cell malignancies.” AbbVie expects it to be approved this year for relapsed/refractory large B-cell lymphoma. Jeffries projects peak sales of $2.75 billion.

- Teliso-V, a c-Met ADC, which awaits approval for treating Non-small-cell lung cancer (NSCLC) in 2024.

- Navitoclax, a novel BCL-2/BCL-xL inhibitor, is set for approval for treating Myelofibrosis (‘MF’) in 2024.

These drugs, according to Richard Gonzalez (AbbVie’s CEO), could become an “almost $6 billion kind of franchise.” I modeled this happening in 2030.

Moreover, AbbVie is targeting the solid tumors market, which is expected to reach $900 billion in 2029.

We’ve begun to see some very exciting data from several solid tumor programs, including our anti-GARP antibody ABBV-151, and our PTK7 ADC, ABBV-647. We expect proof-of-concept data from roughly a dozen additional early stage oncology opportunities over the next couple of years.

Thus, I added another $2.5 billion to the oncology segment as other solid tumors since AbbVie only has to take 8.46% of $13 billion ADC market and 0.9% of $120 billion Immuno-Oncology market. So, hematologic oncology revenues tend to look something like this.

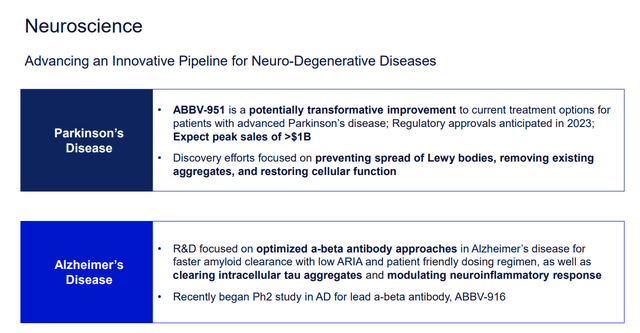

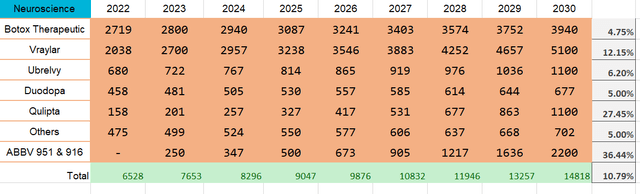

Neuroscience

Another pillar is, in my opinion, a neuroscience segment. Here, drugs for migraine treatments and prevention look promising.

Qulipta is currently the one and only drug for treating both episodic and chronic migraines. The closest competitor, Pfizer’s Nurtec (PFE) only has approval for episodic Ubrelvy, on the other hand, is a “leading treatment for migraine attacks providing rapid and sustained pain relief”. AbbVie expects both drugs’ peak sales to exceed $1 billion in sales.

At the same time, the real blockbuster is Vraylar, which AbbVie describes as a “Versatile atypical antipsychotic that provides strong efficacy across multiple symptoms, with minimal impact on weight, lipids, and fasting blood glucose”. It was recently approved for treatment of major depressive disorder (MMD) and management expects >$5 billion in peak sales.

Moreover, AbbVie’s pipeline has ABBV-951 for advanced Parkinson’s disease, which is set for FDA approval in 2023, and ABBV-916 for Alzheimer’s treatment in stage II, I am targeting its approval for 2025. The company expects peak sales of both to exceed $1 billion.

With that being said, the neuroscience segment structure looks like this:

Valuations

I made a comparison of AbbVie with peers in the sector. It showed that AbbVie was left somewhat undervalued after a recent sell-off.

| P/E TTM | P/S 2023E | P/E 2023E | EV/EBITDA 2023E | |

| AbbVie Inc | 10.39 | 4.55 | 10.86 | 11.45 |

| Pfizer Inc | 5.87 | 3.03 | 10.91 | 8.94 |

| Merck & Co Inc | 15.93 | 4.64 | 15.36 | 12.98 |

| Regeneron Pharmaceuticals Inc | 16.49 | 6.11 | 17.52 | 11.48 |

| Johnson & Johnson | 15.72 | 4.2 | 15.02 | 12.55 |

| Eli Lilly and Co | 64.76 | 13.59 | 51.75 | 42.4 |

| Abbott Laboratories | 23.26 | 4.74 | 24.53 | 19.12 |

| Amgen Inc | 13.06 | 4.38 | 12.63 | 8.5 |

| Median | 15.825 | 4.595 | 15.19 | 12.015 |

| Median vs AbbVie | -52.31% | -0.99% | -39.87% | -4.93% |

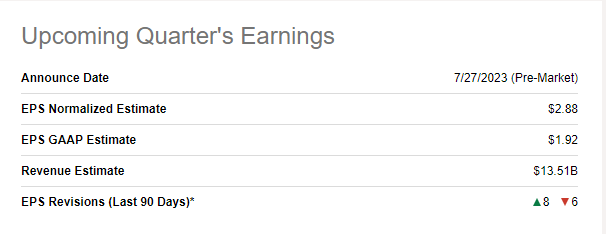

Q2 expectations

As for the second quarter, AbbVie is set to publish earnings on July 27. The analysts expect $13.5 billion in net revenue and $2.88 in non-GAAP EPS.

Seeking Alpha

The company revised its Q2 guidance to $2.75 to $2.85 in EPS citing higher R&D expenses.

I believe Humira had a big impact on April-June revenue as it still accounts for 29% of revenue (as of Q1). AbbVie said they project 27% erosion for Humira in the second quarter. That leaves us with the blockbuster drug sales of $3.91 billion. If the prediction turns out to be correct, then this means that the management’s prediction was correct and biosimilars have a limited effect on Humira within the guidance lines.

I recommend watching Skyrizi & Rinvoq closely, as AbbVie didn’t provide guidance.

So, I believe the company is going to have challenging 2023-2024, but it won’t affect the longer term success story, in my opinion.

Conclusion

Despite Humira’s LoE concerns, I think Skyrizi and Rinvoq will be able to support the immunology segment. However, I believe that AbbVie’s dependence on this segment will decrease during this decade.

Oncology and neuroscience should be strong growth drivers for AbbVie through 2030, with CAGRs of 11.38% and 10.79%, respectively.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ABBV over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.