Summary:

- Netflix’s 2Q FY2023 earnings results present a mixed picture. While there were disappointments in terms of revenue and guidance, the company exceeded expectations in net profit and paid net adds.

- The company’s pricing strategy, which includes different price tiers and the potential introduction of advertising, is set to attract a wider range of potential users and improve user engagement.

- The management provides a strong FCF growth outlook, which indicates that Netflix is effectively managing its cash flow and has a positive impact on shareholders in the long run.

- Netflix’s crackdown on account sharing has J-curve effect on revenue and expected to drive growth rebound into FY2024 as users are compelled to subscribe additional members.

Giuliano Benzin/iStock via Getty Images

Investment Thesis

Netflix (NASDAQ:NFLX) has experienced a 62% YTD rally as investors anticipate early success with the implementation of paid sharing and advertising across more than 100 markets. However, the stock triggered a 5% selloff after 2Q FY2023 earnings. While I believe that account sharing is becoming more difficult, which will eventually compel users to subscribe additional members, I don’t anticipate paid sharing to drive a significant revenue growth in the near term, as users may need time to accept this new reality. Therefore, I wouldn’t be surprised to see NFLX’s revenue below the estimates in 2Q FY2023.

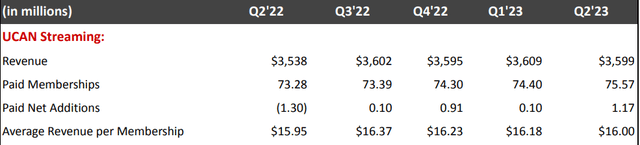

We have observed an early sign of rebound in the company’s Global Paid Net Adds. In 2Q FY2023, it’s very encouraging to see a growth rebound in the United States and Canada category (UCAN). Additionally, despite near-term revenue headwind, NFLX has substantially improved its FCF profile, enhancing the quality of the company. Therefore, I maintain a positive outlook on the stock, considering the company’s recent initiatives such as paid sharing, the introduction of an advertising tier, and the discontinuation of its DVD segment. These measures are expected to provide long-term growth opportunities for the company.

2Q23 Takeaway

2Q23 Shareholder Letter

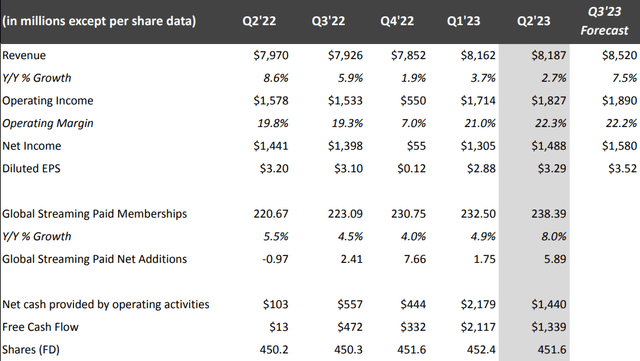

Investors are disappointed with NFLX’s 2Q FY2023 earnings, particularly because the company not only fell short of its revenue consensus for the quarter but also provided a weak 3Q revenue guidance. However, investors should focus more on the company’s operating efficiency and users growth as it exceeded expectations in terms of net profit and net adds, which is encouraging.

Additionally, NFLX raised its FCF guidance for FY2023 to at least $5 billion, up from the previous guidance of $3.5 billion, indicating a triple YoY growth. Furthermore, although the management did not disclose specific numbers in the press release, they have plans to deliver substantial positive FCF in FY2024. Therefore, despite the aftermarket selloff, I believe a significant upside surprise in FCF growth will provide support for the company’s valuation.

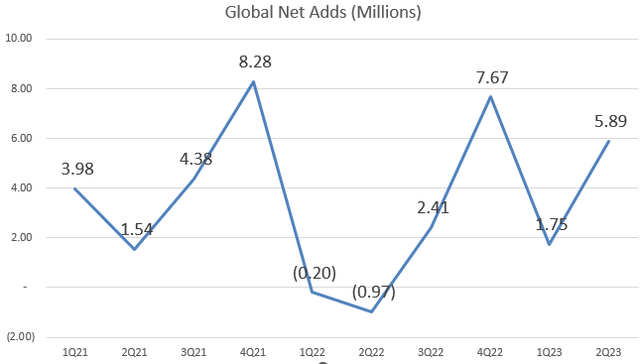

Let’s shift our focus to the paid memberships. The paid net adds in 2Q were 5.89 million, surpassing market consensus of 2 million. As we can see from the table, the YoY growth was 8%, which is the highest over the past four quarters. The management also indicated that the paid net adds in 3Q FY2023 is expected to be similar to 2Q, but they anticipate a significant acceleration in revenue growth starting from 4Q and beyond. I believe the company is employing a strategy of capturing users initially and then providing them with the flexibility to upgrade or downgrade their subscription plans. Additionally, we also should not be surprised that the crackdown on paid sharing will have a J-curve effect on revenue growth. I can discuss this trend based on my own experience.

Driving Incremental Revenue Through Paid Sharing

As a loyal Netflix subscriber, I used to share my account with my family members and friends. However, recently they told me that they were unable to log in using my credentials, even after multiple password changes. It is evident that NFLX has started cracking down on password sharing.

Initially, my family members and friends were hesitant to pay for an additional membership, but eventually, they had to compromise and started paying $7.99 per month. Drawing from my personal experience, I anticipate some churn reaction in the market as a result of this crackdown on sharing. However, I believe that the resistance to paid sharing is temporary, and this transition will ultimately help the company generate incremental revenue in the long run.

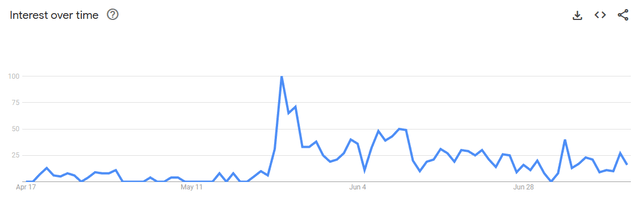

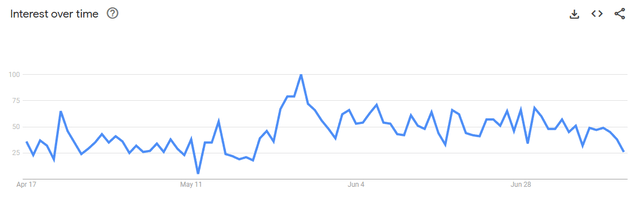

Google Trends – “Netflix Account Sharing”

According to Google Trends, we observed a peak interest of 100 in “Netflix Account Sharing” on May 24th, 2023. This coincided with the company’s widespread implementation of paid sharing initiatives, including in the United States. I believe that the interest will subside as we move into the next quarters, as the management mentioned that revenue growth will start to accelerate in 4Q FY2023.

Rebound On Revenue Growth Takes Time

The company model

Looking at the chart, we can see that Netflix’s global paid net additions have experienced a rebound compared to the previous year. In 2Q FY2023, the net adds have begun to reaccelerate. Notably, in the UCAN region, the net adds have returned to positive territory and grew 3.1% YoY.

2Q23 Shareholder Letter

In the near term, I believe that the growth in revenue will remain subdued due to the ongoing crackdown on account sharing. However, over time, we can anticipate a positive impact in FY 2024 and beyond as the effects of the crackdown on sharing gradually take hold.

Google Trends – “Cancel Netflix”

Additionally, we also have observed a decline in the keyword “Cancel Netflix” from its recent peak. This suggests that initial concerns regarding the crackdown on account sharing are gradually subsiding. As the market leader in online streaming, Netflix has the ability to influence and shape user behavior. Over time, it is likely that most loyal users will come to accept the new reality and choose to subscribe to the Extra Members service, even with a modest cost associated with it.

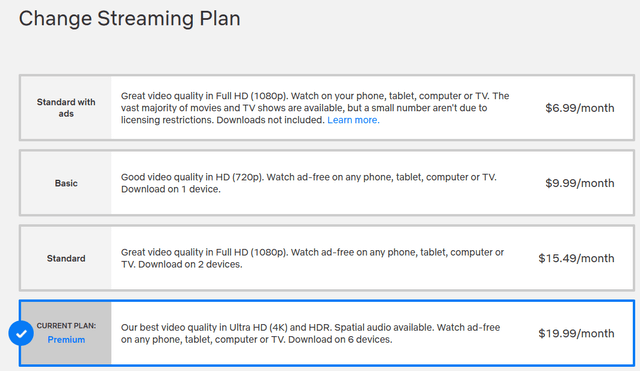

Change Streaming Plan Will Catch More Users

Netflix website

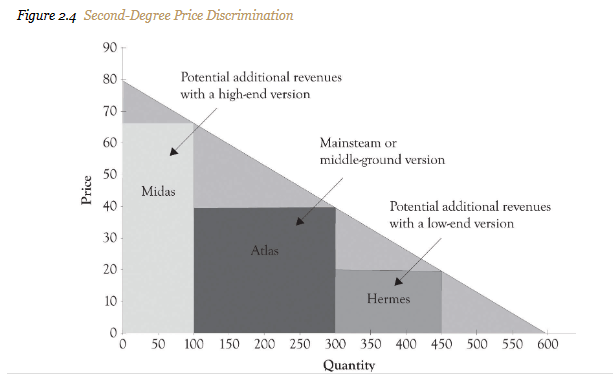

NFLX’s pricing strategy, which includes different price tiers and the potential introduction of advertising, aligns with the concept of three degrees of price discrimination. Specifically, this pricing decision reflects second-degree price discrimination, where NFLX sets prices for different streaming plans based on the level of demand they can capture. By offering various plans, Netflix can target a wider range of potential users and subsequently improve its profit margins.

This approach allows NFLX to cater to different segments of the market with varying willingness to pay. Users who are willing to pay more can pick higher-priced plans, while those seeking a more budget-friendly option can choose lower-priced plans. By implementing this pricing strategy, NFLX can effectively extract additional value from its customer base and optimize its revenue generation.

saylordotorg.github.io

In this hypothetical example (you can ignore the price and quantity on the chart), the chart demonstrates how NFLX is able to increase its total revenue by offering different price tiers targeted at different types of users. The “Hermes” plan represents Netflix’s “Standard with ads” offering, priced at $6.99 per month. This pricing strategy is expected to attract and retain a broad user base in the long run.

Furthermore, Netflix’s flexibility in allowing users to easily upgrade or downgrade their current plan within seconds enhances user engagement. This feature provides users with the discretion to adjust their subscription based on their preferences and needs, fostering a positive user experience and potentially enhancing customer loyalty.

Valuation

Seeking Alpha

Although I believe that NFLX’s growth reacceleration narrative is still intact, it appears that the market has already factored in many of its near-term tailwinds. By examining the chart, we can see that its P/E GAAP TTM has more than tripled over the past year, rising from 15x to the current value of 51x. This suggests that the company’s earnings have not yet caught up to its current valuation. If we factor in the adjusted EPS consensus in FY2023, the stock is still trading at 40x of P/E FY2023E. As a profitable company, this valuation multiple is a little overstretched.

Conclusion

In sum, Netflix’s recent performance and earnings report present a mixed picture. While revenue fell short and guidance was weak, the company exceeded expectations in net profit and net additions. Revised FCF guidance for 2023 and plans for a significant FCF growth in 2024 can support the current high valuation. We also see a rebound in its paid net adds, indicating an early success in capturing users and allowing plan flexibility. However, while the crackdown on sharing will impact revenue growth in the near term, I anticipate a growth rebound starting later this year and in FY2024. Despite a high valuation, Netflix’s long-term growth outlook and FCF profile are encouraging. Therefore, the pullback can present a potential buying opportunity, and I remain bullish on NFLX stock for the long term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.