Summary:

- I have a bullish outlook for Exxon Mobil stock, given a stronger-than-predicted 2023 economy and the improving odds crude oil and natural gas prices will rally from today.

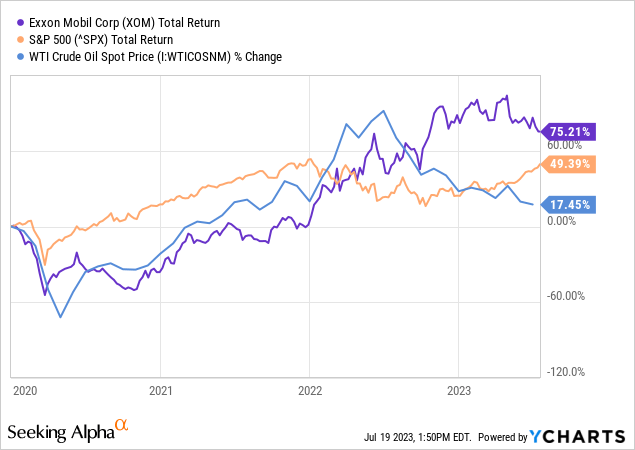

- The stock should continue outperforming the S&P 500, like it has for better than three years running.

- A diversified global asset base and conservative balance sheet, with the company reducing its net-liability position since 2020, are major positives to support the share quote.

- A sustainable dividend yield just under 4% is very desirable for long-term compounding.

Brandon Bell

I have not written about Exxon Mobil (NYSE:XOM) since 2020, when I pushed the contrarian narrative a major rebound in oil/gas prices would play out eventually after the pandemic subsided. The once-in-a-lifetime crude oil bust of early 2020 was something to behold, and I suggested at least 15 different oil/gas names, through 11 articles over the next 12 months. The pandemic collapse in energy demand and pricing argued intelligent investors should be overweight U.S. oil & gas shares into 2021-22, as a market cycle turnaround was almost a sure bet.

My bullish outlook for Exxon has not wavered much. I almost put out a bearish call on XOM in the spring of 2023 when the share price was around $115, but I couldn’t do it. The arguments for a prolonged span of underperformance were not very powerful, as downstream operations historically have allowed profits to hold up well during weak commodity pricing.

Whether you measure from just before the pandemic hit on January 1st, 2020 or the technology-heavy S&P 500 bottom in late March of that year, Exxon has been a fantastic blue-chip total return choice for long-term investors.

j m

I did express, however, bearish calls on Occidental Petroleum (OXY) and Chevron (CVX) in the spring and summer of last year, after crude oil and natural gas prices reached unsustainable levels following the Russian invasion of Ukraine. Neither equity has net gained (or lost) in price over the past year and a few months, despite Warren Buffett pumping confidence into each with large-scale purchases by Berkshire Hathaway (BRK.A) (BRK.B).

Crude Oil Rebound Coming?

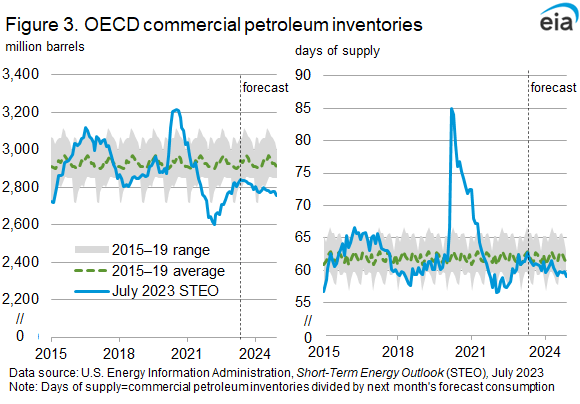

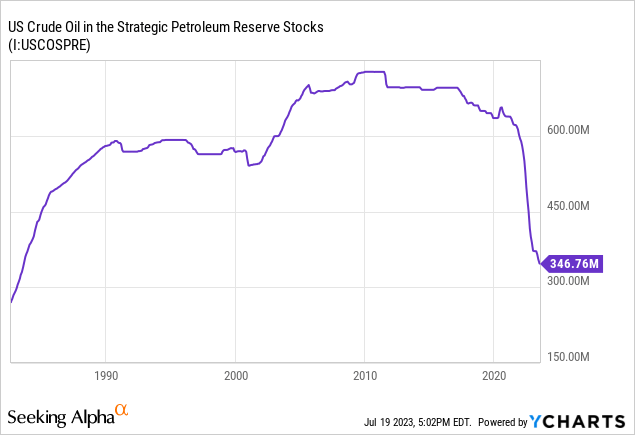

The good news for all of the above integrated and diversified Big Oil investment ideas is crude oil and natural gas prices appear ready to rally again into the summer of 2024, especially if a deep recession is avoided. With the majority of U.S. government SPR emergency reserves emptied over the past several years (back to 1984 levels), OPEC+ aggressively keeping production and supplies in check, and the global economy continuing to beat slack expectations in 2023, our supply/demand balance in crude oil today is projected to veer toward shortages again in 6-12 months by the U.S. EIA.

EIA Website – Global Inventory Data, 2024 Forecast

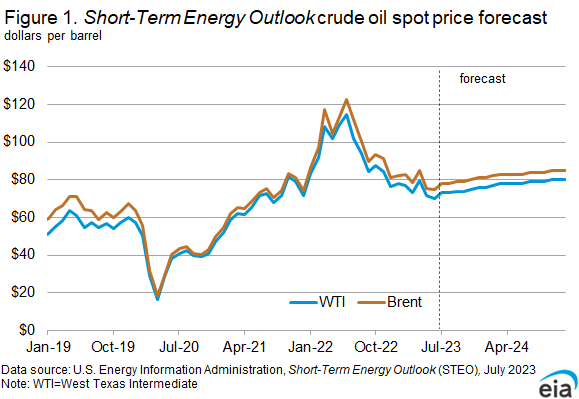

EIA Website – July Price Forecast for 2023-24 YCharts – U.S. Strategic Petroleum Reserves, Since 1983

I wrote about the increasing odds of an unusual spike higher for crude oil soon in an article posted last week here. I am using the EIA forecast for a US$10 per barrel rise into the low-$80s next summer, as my baseline projection. Of course, much greater upside is possible if new geopolitical trouble erupts in the meantime, either in the Middle East, central Europe or Asia.

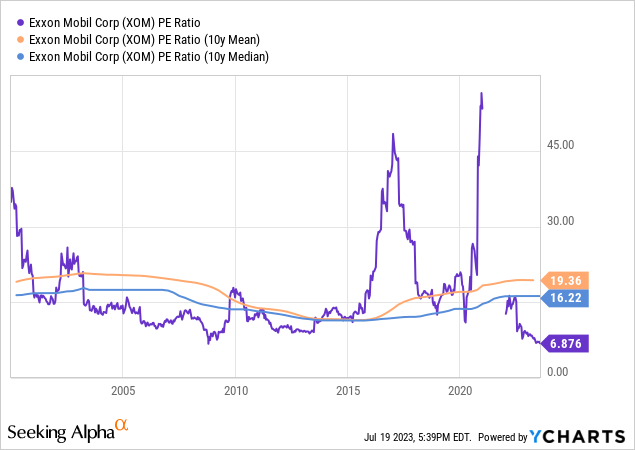

So, if I can capture a 3.6% trailing dividend yield on top of an estimated cash income P/E around 11x from Exxon Mobil, with even better returns on investment approaching next year, what’s not to like? It’s entirely possible a forward 4% cash distribution annually and P/E under 9x are coming in 12-18 months on $101 per XOM share.

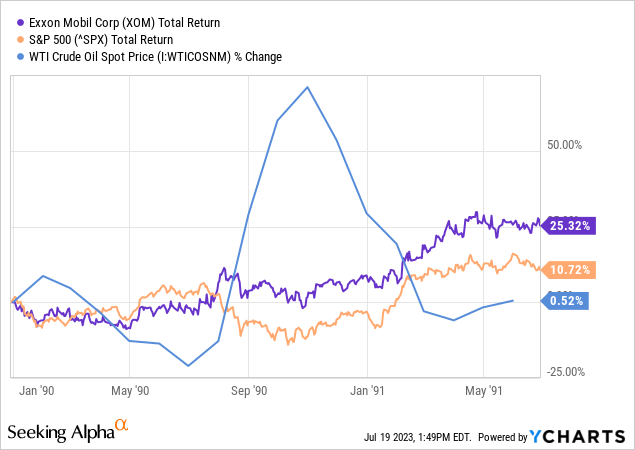

1990-91 Redux?

My personal view is Exxon, the crude oil market, the global economy, the Treasury yield curve, and consumer sentiment/spending are in a very similar setup to the summer of 1990, just before Saddam Hussein invaded Kuwait. First, higher crude oil into the end of the year offset recessionary volumes at the pump. Second, a recession set the stage for stronger investor interest in the company as acceptable rates of investment return declined during 1991 with a big stepdown for inflation and borrowing rates. A picture of that economic period is drawn below.

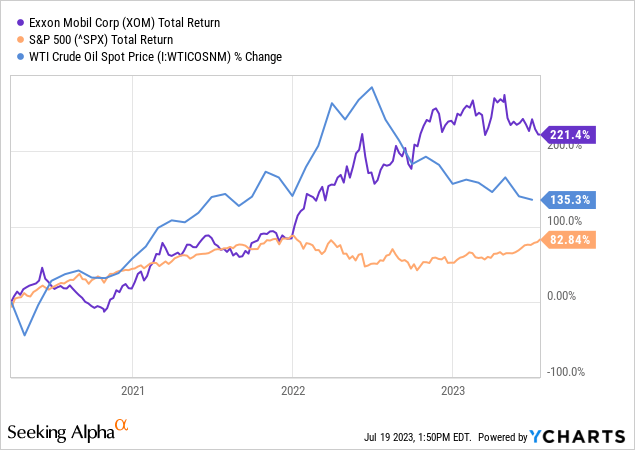

YCharts – Exxon Mobil vs. S&P 500 Total Returns, Crude Oil Prices, January 1990 to June 1991

Looking Ahead

Am I calling for a terrific span of price gains and dividend raises over the next 12-18 months? No, but Exxon should continue to outperform the S&P 500, which seems destined to fall in price from Big Tech overvaluations and overweightings in portfolio construction.

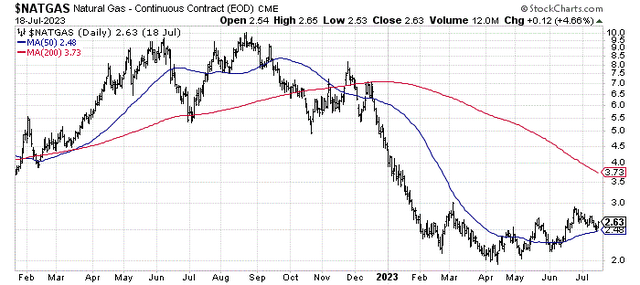

StockCharts.com – Nearby Light Crude Oil Futures, 18 Months of Daily Price Changes StockCharts.com – Nearby Natural Gas Futures, 18 Months of Daily Price Changes

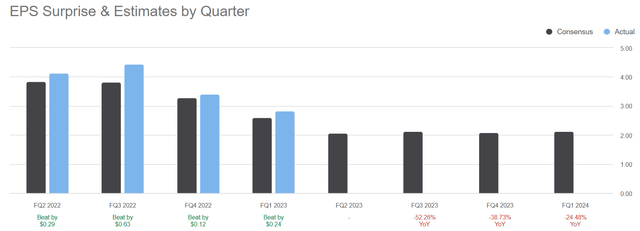

The extra boost to investment performance from integrated oils like Exxon Mobil may come from far better operating results than now anticipated by Wall Street. Crude oil and natural gas prices have stabilized since early summer, and could rapidly rebound if the U.S. dollar’s value takes a hit and/or the economy remains stronger than expected. In either case, I would look for XOM to beat sales and earnings expectations starting in Q3. EPS per quarter could again fall in the $2.50 to $3 range by the end of 2023, if petroleum prices rise 15% to 20%.

Seeking Alpha – Exxon Mobil, Quarterly Earnings & Projections by Analysts for 2022-24, Made July 18th, 2023

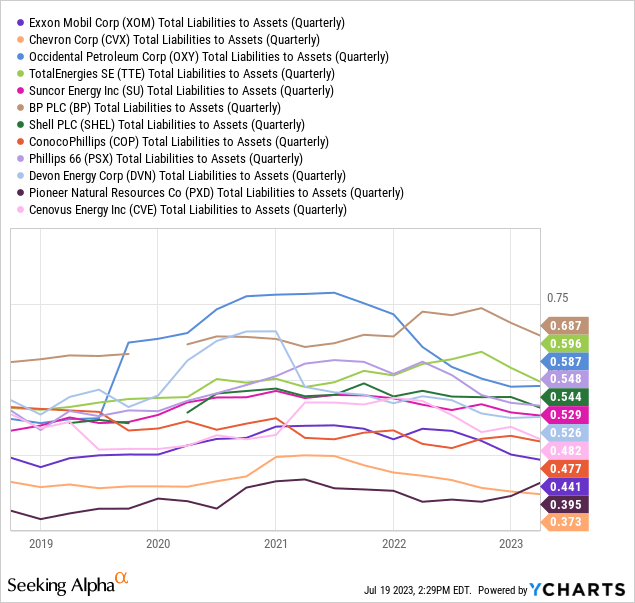

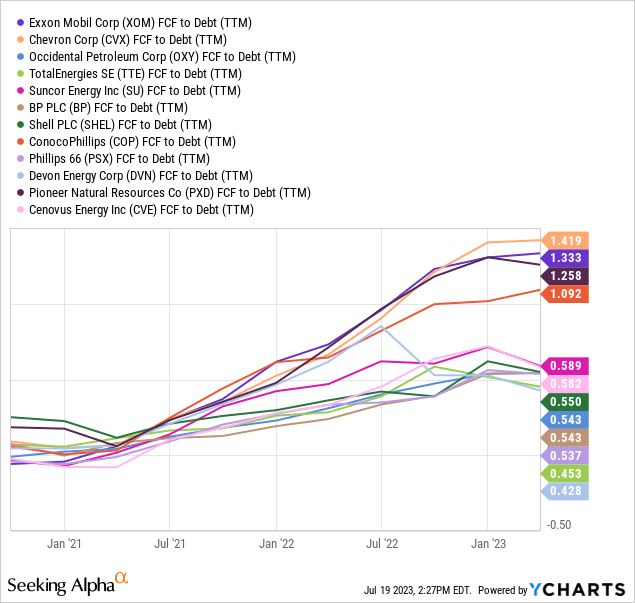

What I like best about Exxon Mobil’s investment proposition is a diversified asset base using little leverage. The company has improved its net-liability position since 2020, and free cash flow vs. debt is superb in 2023. XOM has one of the most conservative balance sheets in the integrated Big Oil space, which won’t change much after the surprise Denbury (DEN) transaction announcement last week for $4.9 billion in an all-stock deal (vs. Exxon’s equity market capitalization of $408 billion at $101 a share).

YCharts – Exxon Mobil vs. Big Oil Peers, Total Liabilities vs. Assets, 5 Years YCharts – Exxon Mobil vs. Big Oil Peers, Free Cash Flow to Debt, 3 Years

From a net-debt peak of $68 billion in 2020 (total debt minus cash held on the balance sheet), just $9 billion remains (the lowest debt total in over a decade). Plus, this minor number does not even count $40 billion in long-term investments (mainly pieces of other businesses) that could be liquidated rather quickly.

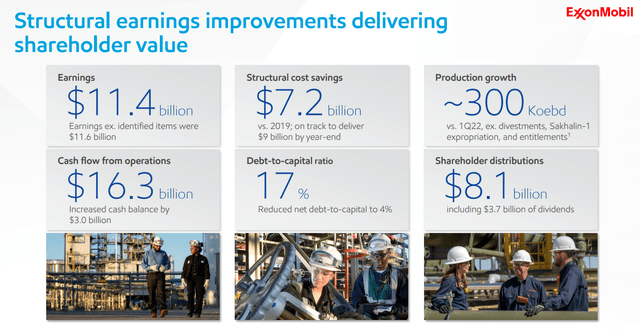

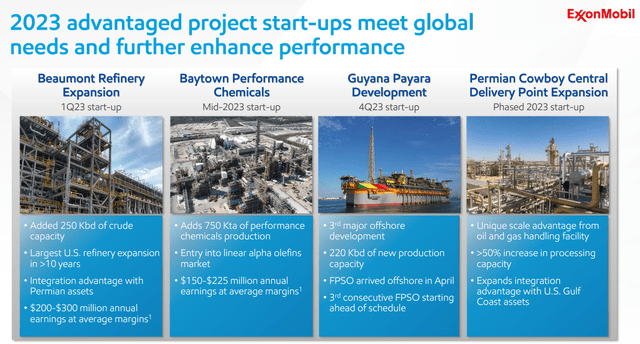

Again, operations are moving in the right direction with moderate production growth in 2023, matched with debts well under control. All the company needs for a sizable jump in sales and profits (above $10 EPS) is a slightly higher oil/gas price regime.

Exxon Mobil Website – Q1 Earnings Presentation Exxon Mobil Website – Q1 Earnings Presentation

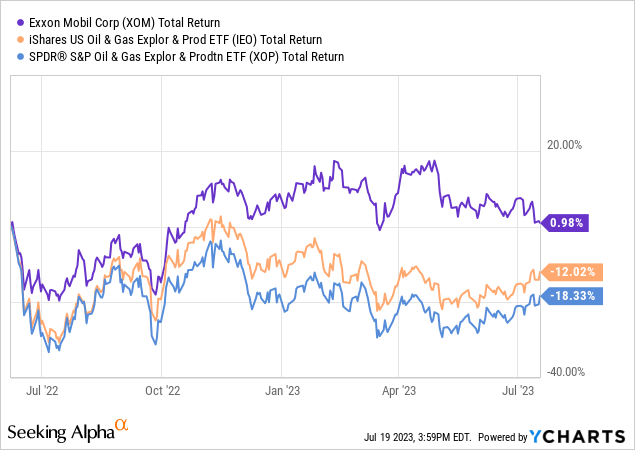

Lastly, the technical trading picture remains constructive. Exxon’s share price has declined far less than the average U.S. exploration & production name since June of 2022 (the post Russia/Ukraine conflict peak), with its downstream and midstream assets performing for owners.

YCharts – Exxon Mobil vs. Major U.S. E&P ETFs, Total Returns, Since June 2022

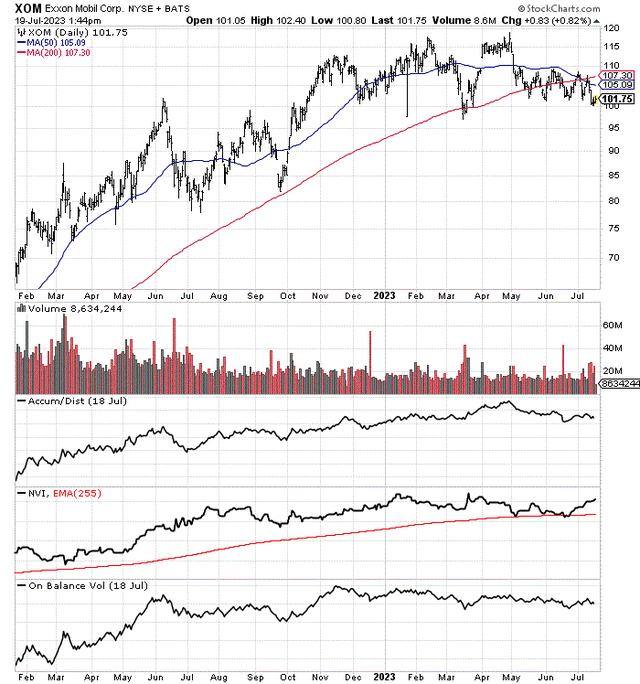

My favorite momentum indicators have been trending flat to bullish since the beginning of the year, regarding action in the Accumulation/Distribution Line, Negative Volume Index, and On Balance Volume calculations. My view is the stage is set for another run to all-time highs above $120.

StockCharts.com – Exxon Mobil, 18 Months of Daily Price & Volume Changes

Final Thoughts

My comprehensive readout is Exxon Mobil remains a top choice in the integrated Big Oil sector of the market. Meaningful gains are likely, but not guaranteed over the coming 12-18 months.

Of course, the primary risk investing in XOM revolves around a recession slashing short-term energy demand, with oil/gas prices slipping alongside company revenues and income. I am still leaning toward an eventual recession for both the U.S. and world before the end of 2024. The open question is how severe will a contraction be?

One of the catalysts for a recession might be an “unexpected” sharp rise in base oil/gas prices. Much like 1990, dramatically higher commodity selling prices (with Exxon one of the largest producers of such) would easily offset a minor dip in volumes sold. Exxon could benefit first from better commodity pricing, then again from far lower inflation and interest rates caused by a recession.

I have a worst-case scenario of a deep recession forcing oil/gas prices down another 20%, with a general bear market on Wall Street compounding XOM’s potential slide in value. A bearish potential, $80 share price in 12-18 months would outline a total return loss of -20%, depending on the dividend, using EPS of $4 to $5 yearly as my estimate.

A best-case scenario with a spike in crude oil above $100 a barrel and natural gas quotes back to $4 per MMBtu could support shares above $130 in time, generating a +30% total return advance. With a long-term P/E ratio average close to 15x over many decades, EPS of $9 to $10 going forward should support prices between $135 and $150 several years out.

YCharts – Exxon Mobil, Long-term P/E Averages, Since 2000

Nothing spectacular mind you, but worth considering for a steady almost 4% dividend yield, hedging long-term inflation in your portfolio. I do, nevertheless, feel strongly Exxon Mobil will “outperform” the S&P 500, given my forecast for a price drop in the main U.S. equity index over the next 12-18 months to the tune of -15% to -20%.

If you believe hard-asset inflation is the new investment paradigm like I do (similar to the 1970s), with Big Tech on its last leg (from overvaluations and the end of cheap to free money for the economy), Exxon should be part of a well-designed portfolio.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in XOM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.