Summary:

- Intel’s OPEX structure is in a better place, and once market conditions pick up in H2 or FY24, lower factory underloading charges should start reflecting well at the gross profit level.

- The company’s shift to an internal foundry model is expected to bring greater cost accountability and reduce expedited requests, contributing to further cost savings of $0.5bn-$1bn over time.

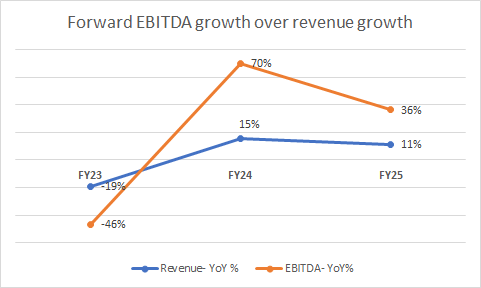

- Intel looks poised to deliver compelling operating leverage with EBITDA growth expected to exceed revenue growth by 3-4.5x over the next 2 years.

- INTC looks like an ideal candidate to benefit from rotation momentum within the large-cap tech universe, and we also like the risk-reward on the weekly chart.

maybefalse

Introduction

Last year, when we wrote about Intel (NASDAQ:INTC), we wondered if Pat Gelsinger could effectively execute the company’s IDM2.0 strategy. Since then, the company has tweaked its distribution policy to make better use of its capital, and whilst a few execution risks still persist, we’re quite encouraged with what we’ve seen and learned about developments on the cost front. If Intel can get its cost structure in a better place, we think that could provide an apt foundation to kick on and make improvements in other areas, even as some of its end markets start recovering in H2 or FY24.

Encouraging Progress On The Cost Front

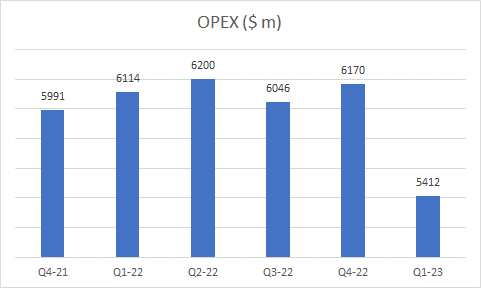

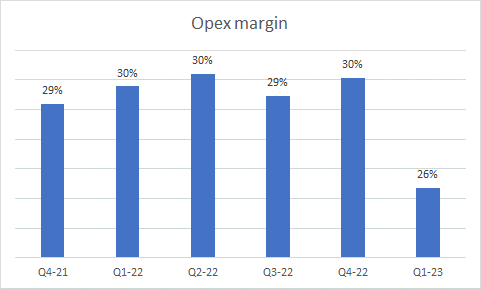

As part of the execution plan, Intel had initially set out a target of bringing through cost savings to the tune of $3bn by the end of FY23, and so far, it appears that they’ve made decent progress on that front. The run-rate of OPEX per quarter which stood at around $6.2bn around a year ago, has been trending lower and came in at $5.4bn in Q1. A further decline in this metric, when they announce Q2 results next week, would only validate their efforts in this area.

Seeking Alpha

Granted, a drop in the absolute OPEX number, even as sales have been trending lower, shouldn’t necessarily make one jump up in joy (Intel was generating over $20bn of sales per quarter at the end of FY21, lately it has been less than $12bn per quarter), but crucially, do also consider that OPEX as a proportion of revenue, is in a much better place now. It traditionally hovered around the 29-30% mark, but now, it’s a lot lower at 26%, providing some semblance of structural progress in the cost base.

Seeking Alpha, Author’s calculation

Admittedly, all the cost savings are unlikely to come from only the OPEX base; we believe progress would likely have been made at the gross margin line as well, but this is harder to ascertain given challenges across the industry.

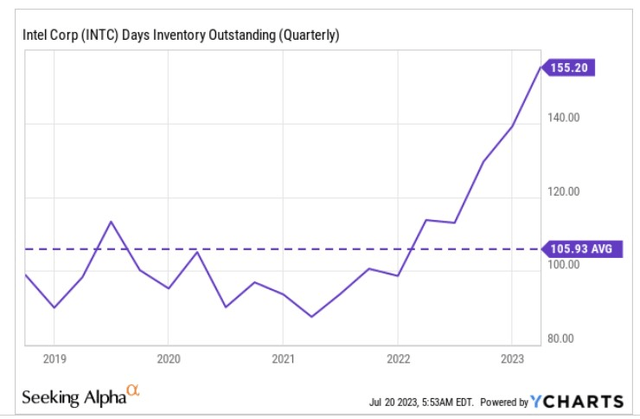

Basically, weak demand conditions across different product segments mean that Intel’s customers are well stocked with inventory, which in turn has also prompted Intel to carry an awful lot of inventory on its books. The last time we checked, this was at a whopping 155 days, 46% higher than what they normally keep.

YCharts

Clearly, this is not sustainable and should trend lower in the coming quarters, thus contributing to operating cash inflows and helping Intel get to a positive FCF position by the year-end (the H2 FCF will also likely be abetted by the fact that gross CAPEX is typically more H1 weighted).

Now, because Intel is already well stocked with inventories there is a factory underloading effect across their networks which has been leaving an adverse mark on the cost of goods line on the P&L. These are not long-standing structural challenges, but more cyclical in nature, and will almost certainly abate in H2 (although it will continue to weigh on the Q2 gross margins yet again).

Thus, we think FY24 will likely be the more appropriate year to gauge the cost savings effect on the GP front. For context, in FY24, and FY25 Intel plans to bring through even more cost savings (eventually the goal is to exit FY25 having delivered $8-10bn of cost savings).

One of the fundamental cogs in helping Intel bring through a better cost structure is the shift to an Internal foundry model (IFS). Besides helping bring greater accountability on the cost front, what we particularly like about this new IFS set-up is that it will bring down expedited requests in a big way.

Previously Intel’s business units had the laxity to make wafer expedite requests from the manufacturing units without thinking about the consequences of how this was disrupting the efficiency of the factory network. Intel management believes that these expedited requests were 2-3x higher than the industry norm, consequently disrupting the overall output of its manufacturing units by 8-10%.

Going forward, under the new model, Intel’s business units are likely to be more judicious and meticulous in their wafer loading plans, as internal expedite requests will now cost them 1.5-3x the price of a wafer. Intel now expects changes on its expedited requests front, to help contribute another $0.5bn-$1bn of cost savings over time.

All in all, one can get some sense of the likely improvement in Intel’s overall cost base by gauging the degree of implied operating leverage reflected by sell-side estimates through FY25. After a challenging FY23, note that the pace of EBITDA growth over the next 2 years is poised to come in at 3-4.5x the level of sales growth.

YCharts

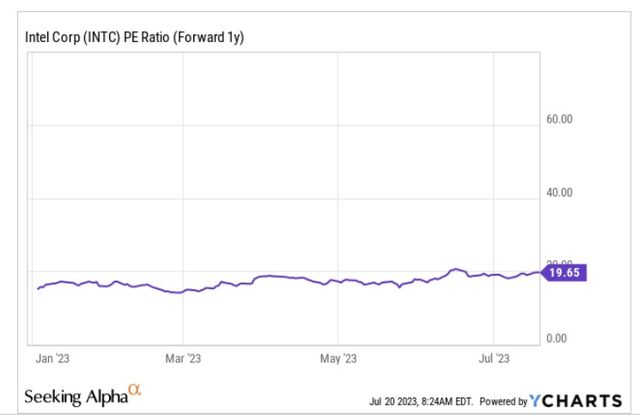

Given the strong degree of operating leverage that will likely be seen over the next two years, a sub-20 Price-to-earnings ratio (P/E) does not feel too dear (based on an expected FY24 EPS of $1.87).

YCharts

Closing Thoughts – Technical Commentary

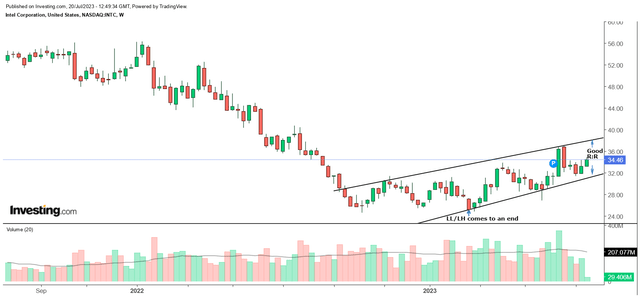

The last time we wrote about INTC’s technicals, we’d stated that we’d like to see the stock defend the $25 levels and help negate the series of lower-lows (LL), and lower-highs (LH) that have been in place since April 2021.

Investing

In Feb. this year, we saw the stock exhibit some decent rear-guard action defending those $25 levels in the process. After bottoming out there, we’ve seen the stock trend up in the shape of a faint ascending channel, with the series of lower-lows and lower-highs, no longer present.

If you want to contemplate a long position within this channel, the risk-reward looks fairly promising at 1.65x.

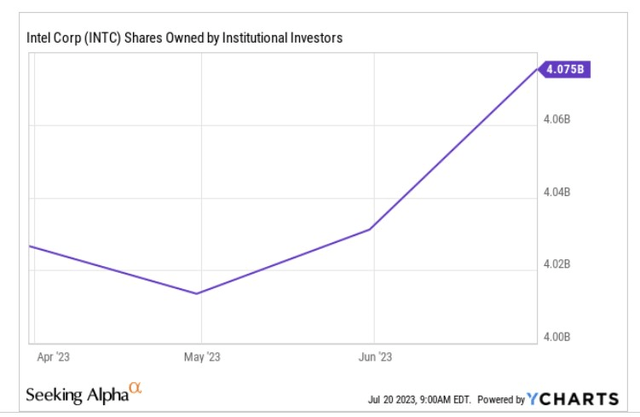

Interestingly enough, it’s also encouraging to note that after months of offloading their INTC shares, the institutions have started buying shares once again.

YCharts

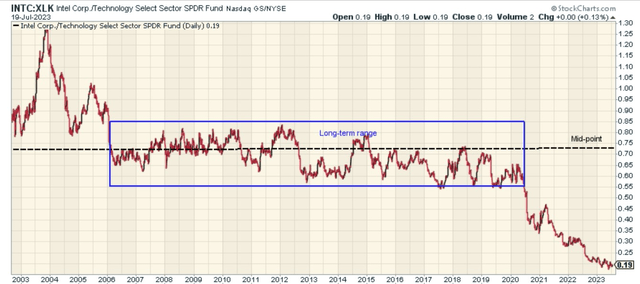

Finally, we’d also like to highlight how the Intel stock remains one of the most promising options for a potential mean-reversion trade within large-cap tech. The chart below highlights how oversold the Intel large-cap tech ratio looks, trading well below its mid-point and away from the comfort range of 0.55x-0.85x. After the recent AI surge, a lot of tech names look overbought, and we think there’s potential for something like an INTC to benefit from rotation interest within the large-cap tech universe.

StockCharts

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.