Summary:

- United Airlines and Delta Air Lines have posted record earnings, beating analysts’ expectations, with American Airlines expected to follow suit.

- As the demand for air travel increases, this earnings season saw top-performing airline stocks post significant year-over-year growth and robust quant-rated fundamentals.

- Despite risks and the cyclical nature of the airline industry, analysts anticipate it to continue its strong performance due to healthy travel demand.

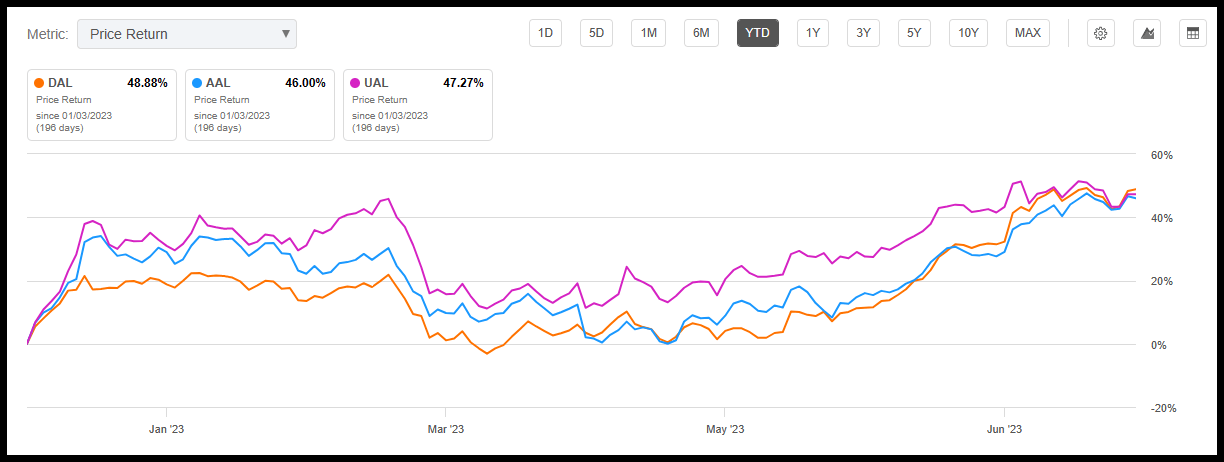

- Undervalued and offering year-over-year revenue growth of +50% and double-digit gross profit margins, my three Strong Buy picks are flying high, up nearly 50% YTD.

smshoot

Top U.S. Airline Stocks Take Flight

United Airlines (NASDAQ:UAL) posted record earnings yesterday, as revenue topped analysts’ expectations, following the same flight path as Delta Air Lines (NYSE:DAL), whose Q2 earnings beat top-and-bottom line results. Two of the top U.S. carriers have reported results for the recent quarter, with American Airlines (NASDAQ:AAL) expected to follow its peers in a Thursday earnings announcement, it’s clear that travel is getting back to pre-pandemic levels with summer vacation and the demand to “fly the friendly skies” in full swing.

Although the cyclical business lost ground during COVID and over the winter holidays amid cancellations and passenger dissatisfaction, airlines are seeing a turnaround in 2023, having reached record levels over the 4th of July. As people return to airlines, two of the biggest U.S. carriers are taking flight, dominating market share.

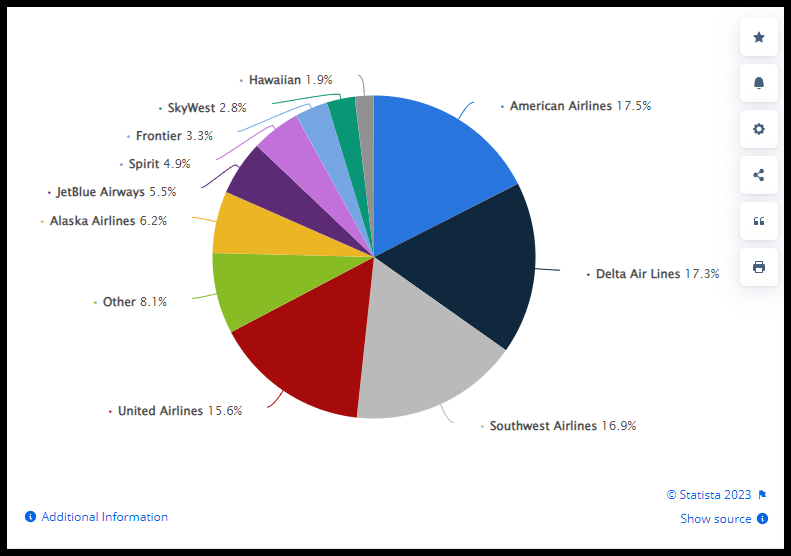

Domestic Market Share of U.S. Airlines (Feb 2022 to Jan 2023)

Domestic Market Share of U.S. Airlines (Feb 2022 to Jan 2023) (Statista)

Four airlines dominate domestic market share, but only three possess the most robust quant-rated fundamentals. Delta Air Lines has advanced +49% over the last year. United Airlines is up 32%. American Airlines is up 23%. Consider these top airline stocks for a portfolio.

Top U.S. airlines are flying high (DAL, AAL, UAL)

Top U.S. airlines are flying high (DAL, AAL, UAL) (SA Premium)

1. Delta Air Lines, Inc.

-

Market Capitalization (as of 7/19/23): $30.97B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 7/19/23): 12 out of 654

-

Quant Industry Ranking (as of 7/19/23): 3 out of 27

The premier carrier of passenger airlines, offering air transport for passengers and cargo, Delta Air Lines is a top-ranked U.S. carrier and a Morgan Stanley favorite. With elite experiences, including advanced technologies, amenities, and personalized experiences, Delta has been among the top-rated airlines by Forbes, Fortune, and the Wall Street Journal.

Delta reported second-quarter earnings on July 13th that capitalized on its new fleet and scheduled to deliver an increase of 7% overall capacity. Robust near-term expectations that included record revenue and profits, Delta had a Q2 EPS of $2.68 that beat by $0.28 and revenue of $15.58B that beat by nearly 13%.

Attracting and rewarding brand-loyal frequent flyers, Delta’s premium experiences are showcased in its per-unit revenue premiums compared to its competitors. Delta’s price-competitive ability and offerings, including a five-cabin segmentation strategy, commanded an industry-leading $0.0409 spread between passenger revenue and costs per mile from 2015 through 2019. With one of the most extensive frequent flyer programs in the U.S., Delta brings high-margin revenue streams from banks and credit card rewards and expects to let the good times roll.

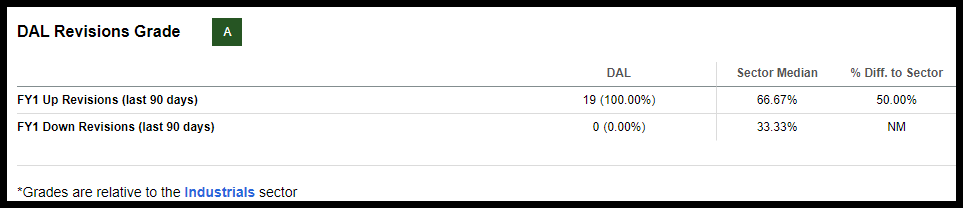

DAL Stock Revisions Grade (SA Premium)

Nineteen Wall Street analysts revised estimates up with zero downward revisions in the last 90 days, and with the company booking an average of 85.4% of its capacity over the five years before the pandemic, its business is in full swing, topping 88% in average bookings for Q2. Strong growth metrics include Delta’s EPS FWD (3-5 year CAGR) of 33.51%, year-over-year forward EBITDA growth more than a 700% difference to the sector, and industry-leading profitability in 2022 allowed them to pay more than $550M in profit sharing.

“Delta produced record June quarter revenue of $14.6 billion, up 19% over last year. Revenues were ahead of our initial expectations, with momentum in June. June 30 was a new record for industry volume and our highest summer revenue day in history,” said Glen Hauensten, Delta President.

In addition to excellent growth and profitability, Delta is undervalued with bullish momentum, offering room for upside.

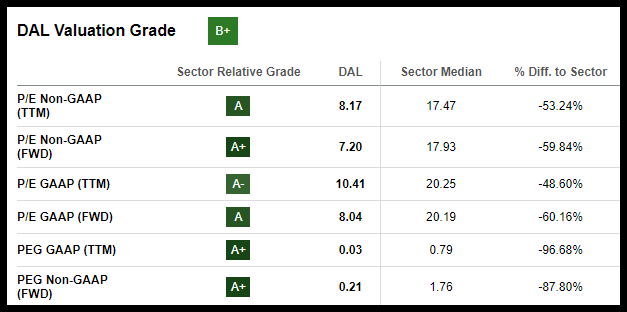

DAL Stock Valuation Grade (SA Premium)

Showcased above, DAL’s forward P/E ratio of 8.04x compared to the sector median of 20.19x is more than a 60% discount to the sector. Additionally, its forward PEG is an 88% difference. Although the stock is trading near its 52-week high, its quarterly price performance is rising as investors continue to buy it. Consider this strong buy airline for a portfolio, along with my next pick that captured headlines yesterday.

2. United Airlines Holdings, Inc.

-

Market Capitalization (as of 7/19/23): $17.97B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 7/19/23): 15 out of 654

-

Quant Industry Ranking (as of 7/19/23): 4 out of 27

“Good leads the way” is United Airlines’ tagline, and boy, are its Q2 earnings results good! Topping analysts’ expectations with top-and-bottom-line beats, United rose more than 2.7% on Wednesday, posting record Non-GAAP EPS of $5.03, which beat by $0.98; revenue of $14.18 billion beat by $250M; and net income was $1.08B compared to the $329M for the same period last year.

Decreases in fuel prices aided United’s bottom line. The carrier’s focused cost-cutting measures to expand margins and focus on boosting capacity drove stronger profitability, as its investment in better planes has been successful.

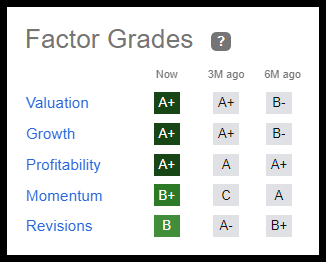

UAL Stock Factor Grades

UAL Stock Factor Grades (SA Premium)

Seeking Alpha’s Factor Grades, which rate investment characteristics on a sector-relative basis, highlight UAL’s stellar grades. With a ‘B’ Revisions grade and A+ Growth and Profitability, UAL is one of the most profitable Passenger Airlines in the industry. United’s revenue growth (YoY) is +68%, forward EPS (3-5Y CAGR) is +59%, and strong operating cash flows plus $7.73B in cash offer cushion towards payback of its fleet investment plan.

“United’s financial performance in the second quarter and our outlook for the remainder of the year and beyond make it clear that United Next is working and is the right strategy at the right time,” said Scott Kirby, United CEO. “Our focus now is on executing that strategy well – because we know it will deliver huge benefits for our customers, our employees, and our owners.”

To complement its strong financial performance, United is also undervalued. With a forward P/E ratio of more than a 70% difference to the sector, and PEG (fwd) of 0.10x versus the sector 1.76x is -94.57%, the stock comes at an extreme discount and has strong momentum. Up 47% YTD and +32% over the last year, United expects to increase capacity over the next few months. As United’s executive team plans to hold a call with analysts on July 20th at 10:30 a.m. EST, strong profits and UAL’s strong buy rating are shaping up for a great summer for airlines, with American Airlines expected to follow suit.

3. American Airlines Group Inc.

-

Market Capitalization (as of 7/19/23): $12.20B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 7/19/23): 11 out of 654

-

Quant Industry Ranking (as of 7/19/23): 2 out of 27

American Airlines Group Inc. reports earnings Thursday, July 20th. Highly anticipated following its competitors Delta and United crushing earnings, the Fort-Worth-based airline has an attractive valuation despite a 46% YTD price-performance.

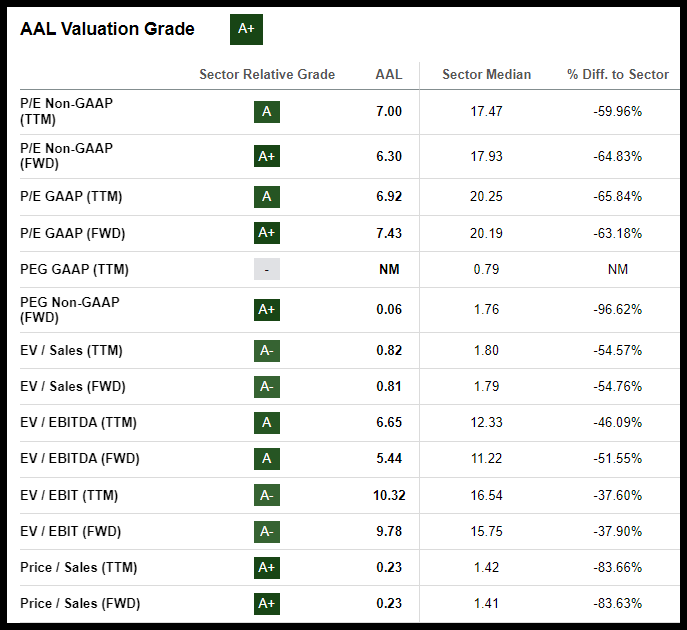

AAL Stock Valuation Grade (SA Premium)

The table above highlights American’s A+ Valuation grade. A forward P/E ratio of 7.43x compared to the sector 20.19x is a -63% difference. Its PEG (fwd) is a -96% discount, complementing the remaining metrics that showcase its extreme discount. American also possesses strong momentum, allowing it to outperform many of its peers.

Prior to the pandemic, AAL suffered like most airlines. However, its goal of expanding margins and realizing costs from its 2013 U.S. Airways merger did not go as expected. However, there have been some improvements in operating margin as the industry rebounds and business and leisure travel tick up, with American Airlines having the youngest fleet among the major U.S. carriers, offering greater efficiency by limiting fuel and maintenance expenses, AAL should also be able to expand capacity. Sixteen analysts have revised their estimates up over the last 90 days, and with Revenue Growth (YoY) +50%, strong year-over-year operating cash flow, and $4.32B in cash, AAL, like my two other picks, is looking to the future, in hopes of strong tailwinds for long-term growth. Although there are risks to the industry, consider my top three airline stocks for a portfolio.

Risks of Investing in Airline Stocks

The airline industry is very cyclical and can experience pullbacks in discretionary spending and the demand for leisure travel amid economic slowdowns and downturns. In an inflationary environment where costs have gone up, despite fuel prices coming down, the cost of jet fuel has impacted the industry as many of these costs were passed onto consumers.

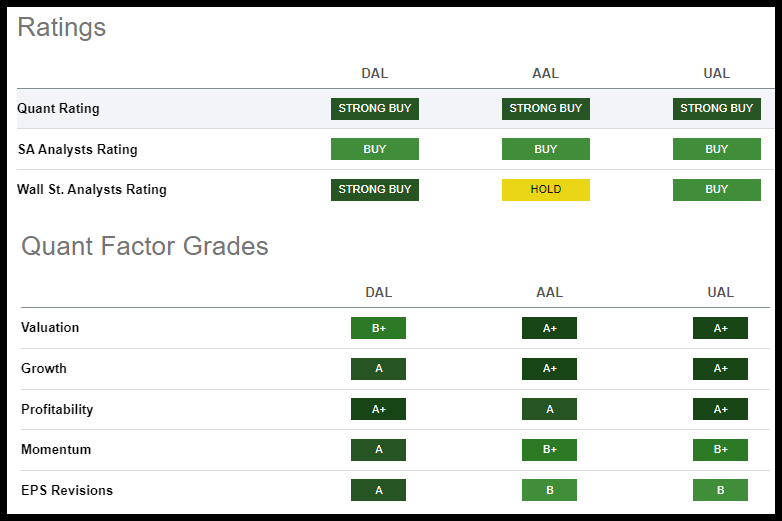

Although airlines are making a comeback since the pandemic impacted travel, overcrowded cabins, labor shortages, and costs still pose risks. Each of my airlines has also been the subject of strikes, as pilots and airline staff have sought improved conditions and better pay. While the industry is working to reach labor deals and negotiate terms, despite these risks, each of my picks is fundamentally strong, as evidenced by the below Quant Ratings and Factor Grades. Consider these Top Airline Stocks for 2023.

Quant Ratings & Factor Grades – Top Airline Stocks (DAL, AAL, UAL)

Quant Ratings & Factor Grades – Top Airline Stocks (DAL, AAL, UAL) (SA Premium)

Airline Stocks Primed to Take Flight: Onward and Upward

The airline industry is cyclical, and despite the risks and headwinds they have faced, forward analysts’ earnings estimates are optimistic, revising up over the last 90 days for each of the picks that have crushed earnings. Top Industrial Stocks, including Delta, United, and American Airlines, are rated strong buys. While they have seen their share of cuts and worker shortages, their yields remain solid amid healthy travel demand.

Two of my picks have reported record revenues, with American anticipated to follow suit this week. My three picks possess a track record of cost controls, have strong financials, excellent growth, and forward revenue growth of +20%. Likewise, each trades at extreme discounts, with forward PEG trading at more than an 85% discount to the sector. Consider my top airline stocks for 2023 for a portfolio, or if you’re interested in Top Rated Stocks, equip yourself with our tools to help ensure your portfolio contains substantial investments that stand to increase over time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.