Summary:

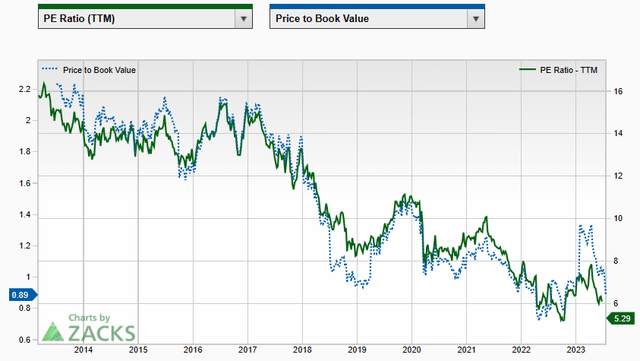

- After the recent headline selloff, AT&T’s stock presents a deep value opportunity with a 7.6% dividend yield and a P/B ratio of 0.9x, which may be attractive to deep value investors.

- The company’s decision not to immediately remove lead cables from Lake Tahoe resulted in an 8% rally in the stock, suggesting a relieve rally ahead.

- After a 32% decline since 1Q FY2023, AT&T’s valuation is near a 30-year low, which I believe has already priced in most of the headwinds.

- The company’s growth is hindered by increased competition in the wireless market and the loss of a significant government contract, raising concerns about a potential value trap for the stock.

felixmizioznikov/iStock Editorial via Getty Images

Investment Thesis

My latest thoughts on AT&T Inc. (NYSE:T) are mixed, primarily due to the tradeoff between a decline in wireless market share and its valuation nearing a three-decade low. However, investors should be cautious that the stock could be a value trap, if the company’s diminished secular growth prospects persist over the long run.

AT&T faced considerable challenges following disappointing 1Q FY2023 earnings, ing to an initial 10% aftermarket selloff. Subsequently, the stock experienced an additional sharp 24% drop, largely due to the negative impact on WSJ’s lead cables news. However, there was an 8% rebound yesterday, providing some relief to the market. Although the stock’s upward momentum is currently facing pressure, I believe AT&T presents a deep value opportunity with an appealing dividend yield of 7.6%.

Additionally, the company’s P/B ratio of 0.9x suggests a strong bullish signal for traditional deep value investors who find a ratio below 1x attractive for buying opportunities. Due to the recent extreme selloff, I think the stock is currently undervalued and present a buying opportunity for income generating investors, because many of the current challenges have already been priced in.

Disappointing Net Adds

The company model

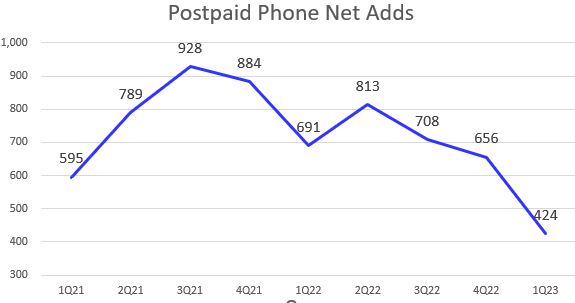

During the recent conference, AT&T reaffirmed its commitment to its strategic goal of building a large customer base focused on 5G and fiber services. However, in the wireless sector, the CFO anticipates that the company would achieve over 300k net adds of postpaid phone subscribers in 2Q FY2023, which falls significantly below the market consensus of 476k. This weak growth can be attributed to two key factors.

Firstly, the industry growth has reached a more stabilized state, making it a relatively mature market. This would create a structural growth headwind for all existing carriers, including AT&T’s, making it challenging to achieve significant subscriber growth.

Secondly, the decline in AT&T’s growth can also be attributed to the effects of competitors, such as T-Mobile (TMUS) and Verizon (VZ), introducing new plans and marketing campaigns during the last quarter, which created a negative impact on its growth.

At Least A Recurring Income Play

In May, the CEO in the shareholders letter addressed that the company had lost a significant government contract, resulting in an anticipated impact of -75k net adds. Although such an event is not recurring, I think this could imply a signal that the commercial wireless market has grown increasingly competitive, largely due to the emergence of a stronger competitor, TMUS. And I expect TMUS to win additional large enterprise contracts over time.

Furthermore, considering the near-term sentiment, the negative impact stemming from the lead cables news is putting pressure on the stock as well. Even though the company doesn’t have immediate plans to remove cables from Lake Tahoe, I believe this will limit the stock’s potential for significant upside growth.

The company model

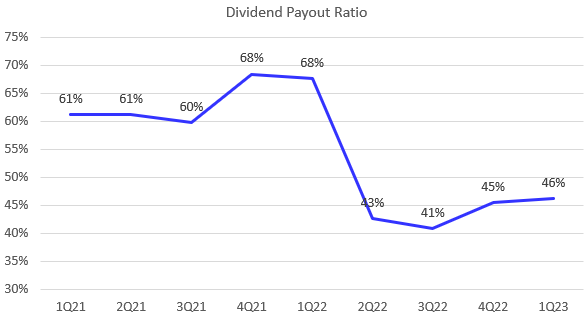

Despite a limited upside potential in the near term, some deep value or income-generating investors are targeting AT&T’s 7.6% dividend yield. However, some investors may be concerned that the company’s dividend payout ratio dropped from 68% in 1Q FY2022 to 43% in 2Q FY2022, primarily due to a -46% dividend cut. But I believe the company is unlikely to make further dividend cuts as its balance sheet still remains healthy.

The fact that AT&T maintains a low net debt/adjusted EBITDA TTM ratio of 3.2x indicates a reasonably stable financial position. Additionally, the company’s net debt in 1Q FY2023 decreased by 20% YoY, which is also a positive sign of its debt management.

FCF Trough Is Behind Us

According to the shareholders’ letter, the CEO reiterated the company’s target of achieving $16 billion or better in FCF for FY2023, indicating a YoY growth of 16%. However, in 1Q FY2023, the stock experienced a 10% drop in aftermarket due to a lower-than-expected FCF of $1 billion. Despite this, it is implied that the company aims to generate at least $15 billion in FCF over the following three quarters to meet its annual target.

The recent comments and guidance from AT&T’s management show their efforts to inform investors about the upcoming 2Q earnings, which would lower the market expectations. This approach can be seen as a positive development for the stock, especially considering that the current FCF consensus falls within the $3.5 to $4.0 billion range.

No Amazon At The Moment

Last month, a rumor circulated that Amazon (AMZN) was considering expanding into the wireless carrier business by offering low-cost or free mobile phone service to its Prime subscribers. This news led to a selloff of the major carriers, including AT&T, as it indicated a growing competition from a well-capitalized competitor like AMZN.

In response to investors’ concerns, all three carriers issued public statements to dispel the rumors and downplay the headlines. AMZN also denied any plans to enter the wireless business in the near term. This should be a relief for AT&T, as the company has been facing increased competition from existing players, and the potential entry of a giant like AMZN could have posed significant challenges to its market share.

“Dirt Cheap” Valuation

Before the 1Q FY2023 earnings, AT&T’s Non-GAAP P/E TTM was trading at 7.8x, which was considered a bargain for investors. However, following the earnings report, the stock experienced a significant decline of 32%, reaching to its current P/E ratio of 5.3x. This valuation is near a 30-year low, which I believe is overdone.

Moreover, the stock is currently trading at 0.9x of its P/B TTM, a level normally perceived as “dirt cheap” and attractive to value investors. A P/B ratio below 1 suggests that the market value is below the company’s book value. However, it’s possible that an extremely low valuation could also signal a potential value trap if the company’s fundamentals continue to deteriorate in the long run.

Conclusion

In sum, I admit that investors may face a dilemma in terms of investing in AT&T, with declining growth potential and a valuation nearing a three-decade low. The stock experienced significant drops following disappointing 1Q FY2023 earnings and negative impacts from WSJ’s cables news. Despite the current pressure on its upward momentum, the stock presents an opportunity for deep value and income generating investors with its appealing 7.6% dividend yield and healthy balance sheet. However, investors should be cautious to avoid a potential value trap, despite the extreme selloff in this year. Nevertheless, the downside risk is that the competition from TMUS and other major players could significantly impact AT&T’s long-term growth trajectory, possibly justifying the stock’s current cheap valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.