Summary:

- AT&T investors panicked over the potential liabilities from the company’s lead-covered cables network, with estimates of up to $60B.

- Despite these concerns, research suggests AT&T can sustain its dividend payouts due to robust free cash flow, and the company has objected to the adverse reporting.

- I gleaned significant dip buying sentiments has returned this week, helping to defend against the panic experienced earlier in the week.

- With T’s valuation at highly attractive levels, the risk/reward profile is skewed favorably toward buyers.

Brandon Bell

AT&T Inc. (NYSE:T) investors suffered a massive hammering over the past two weeks as dip buyers who bought its lows in early June likely gave up, worried about the potential liabilities that emanated from AT&T’s lead-covered cables network.

Analysts have been mixed about the possibilities. Significant possible liabilities of nearly $60B have been touted, with AT&T expected to take the lion’s share of the fallout, given its more substantial exposure. The Wall Street Journal’s or WSJ’s reporting also identified AT&T as the leading player that could see a more significant impact.

New Street Research attempted to frame the headwinds for AT&T, suggesting that the company could be “responsible for $35 billion and Verizon (VZ) for $8 billion.” As such, I assessed that the capitulation by buyers, which sent T to new lows this week, was likely an attempt to reflect these challenges.

Despite that, the research firm’s analysis suggests that T still has the wherewithal to sustain its dividend payouts, given its still robust free cash flow or FCF estimates. While the potential additional interest burden of $2.1B could saddle AT&T and hurt its ability to improve its FCF projections, it isn’t expected to impair its ability to continue its well-covered dividend payouts.

Moreover, New Street Research’s thesis could also have been overstated, as the developments are still ongoing, with AT&T far from needing to assume such liabilities. In addition, Morningstar updated that it sees the potential “total replacement cost [in AT&T’s network ranging] from $2.2 billion to $4.5 billion.” In addition, the research firm highlighted that the costs are not expected to be significant, as they could be “spread over several years.”

I concur that the market is justified to price in significant pessimism to reflect these headwinds. However, I believe it’s still too early for investors to be hobbled by fear from the broad range of possible scenarios that AT&T could be forced to undertake.

The company has also objected to the findings by the WSJ. CEO John Stankey stressed that the report “conflicts with what independent experts have stated about the safety of lead-clad telecom cables.”

Furthermore, the company has decided to “pause the removal of two lead-clad cables in Lake Tahoe,” halting the progress of a previous settlement in 2021. AT&T’s move suggests that the company seems confident of its claim, as it intends to “conduct additional testing for lead levels.” In addition, it will allow AT&T to work more closely with regulators on the WSJ’s report and potentially work out a global settlement framework to resolve these issues.

However, a near-term settlement is not anticipated, given the scale of the network and number of companies involved. As such, I believe the opportunity for investors to consider buying the near-term capitulation in T remains viable if dip buying sentiments are favorable.

Hence, can we assess whether AT&T buyers have returned to defend the recent selloff, as they anticipate that the fear has likely been overstated?

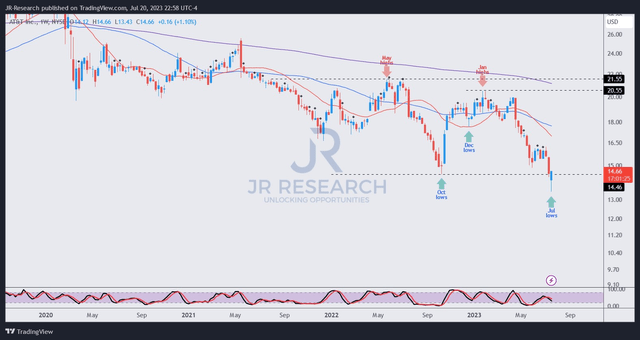

T price chart (weekly) (TradingView)

As seen above, dip-buying sentiments returned robustly this week after the early-week capitulation. If T buyers could hold the $14.6 levels and refuse to allow sellers to hammer it down further over the next two to four weeks, I assessed that it should consolidate constructively. As such, it could open up more opportunities for more risk-averse and income investors still waiting on the sidelines to return and bolster T’s critical support zone.

Moreover, with T priced at a forward EBITDA multiple of 6.5x and a forward dividend yield of 7.7%, it seems attractive enough to appeal to more buyers waiting to gain more exposure to the embattled telco leader.

Rating: Maintain Strong Buy.

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!