Summary:

- While BAC may still report $106B of unrealized losses, it is apparent that the Fed is not overly worried for now, thanks to the robust liquidity and depositors’ confidence.

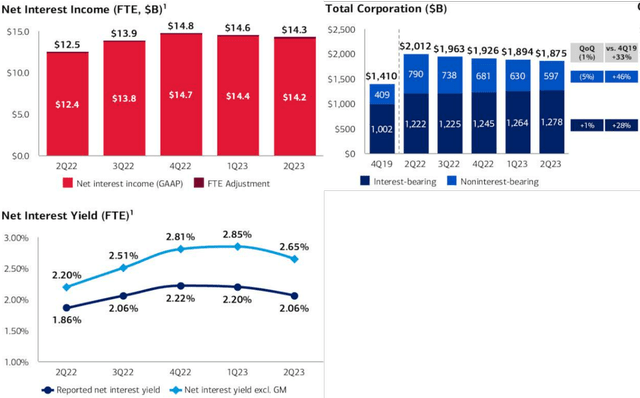

- Due to the rate hikes, the bank reported expanded NII and NIY, attributed to the increase in its interest-bearing deposits to $1.27T.

- The higher treasury yields may also herald the return of trading and investing activities in H2’23, with FQ2’23 only temporarily impacted by the US debt ceiling uncertainties.

- While credit card losses may seem elevated, investors need not fret yet, since the ratio remains well below pre-pandemic averages.

- With a stable ROTCE performance of 15.5% (-1.9 QoQ/ inline YoY) in FQ2’23, compared to FY2019 levels of 15.8%, we remain confident about BAC’s prospects during the uncertain macroeconomic outlook.

alphaspirit/iStock via Getty Images

The Big Bank Investment Thesis Remains Robust In BAC

We previously covered Bank of America (NYSE:BAC) in April, discussing its FQ1’23 performance after the banking crisis in March 2023. Interestingly, it had reported declining deposits QoQ and YoY, with much of the money likely flowing to money market funds at $5.45T by June 12, 2023 (+30.6% YoY).

At that time, we remained optimistic about the bank’s improving Net Interest Income [NII], thanks to the Fed’s sustained hike since March 2022. Its provision for losses appeared to be decent as well, compared to pre-pandemic levels, attributed to the strict FICO scores of over 770 across its loans.

Therefore, we had iterated our Buy rating, since BAC had been well positioned to weather the short-term volatilities.

BAC’s Improved Profitability, Thanks To The Rising Interest Rates

For now, BAC has delivered another impressive quarter in FQ2’23, with revenues of $25.2B (-4% QoQ/ +11% YoY) and GAAP EPS of $0.88 (-6.3% QoQ/ +20.5% YoY).

Most of the profitability outperformance is attributed to the drastic expansion in its FTE NII to $14.3B (-2% QoQ/ +14.4% YoY) and FTE Net Interest Yield to 2.65% (-0.2 points QoQ/ +0.45 YoY) in the latest quarter, partly attributed to the expansion in the bank’s interest bearing deposits to $1.27T (+1.1% QoQ/ +4.5% YoY).

Therefore, investors need not be concerned about BAC’s liquidity as well, despite the notable downward trend in the total deposit growth, especially since it continues to grow its Global Liquidity Sources to $867B (+1.5% QoQ/ -11.8% YoY) in FQ2’23.

Therefore, while it may still report $106B of unrealized losses (+2.9% QoQ/ +21.5% YoY) in the latest quarter, it is apparent that the Fed is not overly worried for now, thanks to the robust liquidity, its safe haven status, and depositors’ confidence in the bank.

Thanks to the higher treasury yields, BAC also reported higher trading activities, triggering the expansion in its sales/ trading revenues to $4.38B (-13.2% QoQ/ +9.7% YoY) in FQ2’23.

While keen eyed investors may be temporarily concerned about the bank’s QoQ moderation, this cadence is mostly attributed to the market fears about the US debt ceiling then, as similarly observed by Citigroup (C).

With market sentiments already normalizing, we believe trading/ investments activities may return to the normal cadence in H2’23, potentially boosting BAC’s non-interest income from the $11.03B (-6.6% QoQ/ +7.7% YoY) reported in the latest quarter.

Nonetheless, BAC still can not escape from the uncertain macroeconomic outlook, since its net charge-offs expanded to $869M (+7.6% QoQ/ +52.1% YoY) with a ratio of 0.33% in FQ2’23 (+0.1 points YoY), compared to FY2022 averages of 0.21% while nearing FY2019 averages of 0.38%.

This is mostly attributed to the bank’s higher credit card losses, with the total US debt hitting $993.51B at the time of writing (+11.7% YoY). Then again, investors need not fret, since the reported delinquency rate of 2.43% in Q1’23 (+0.18 points QoQ/ +0.76 YoY) remains below the 2019 average of 2.58%.

However, with Powell guiding at least two more rate hikes in 2023, there is a growing risk that the delinquency rates may exceed pre-pandemic averages.

Therefore, while the rising interest rate environment may have been a net positive for banks in general, including BAC, attributed to the expanding NII and NIM, investors may want to pay close attention here, due to the acceleration in the credit card account adds of 1.2M (-7.6% QoQ/ +20% YoY) in the latest quarter.

Then again, with a stable ROTCE performance of 15.5% (-1.9 points QoQ/ inline YoY) in FQ2’23, compared to FY2019 levels of 15.8%, we remain confident about BAC’s prospects during the uncertain macroeconomic outlook.

Income investors may remain patient about BAC’s careful dividend increases as well, at an annualized sum of $0.88 (+4.7% YoY) in the latest quarter, compared to the FY2019 cadence of $0.72 (+20% YoY), since capital preservation naturally takes priority for now.

So, Is BAC Stock A Buy, Sell, or Hold?

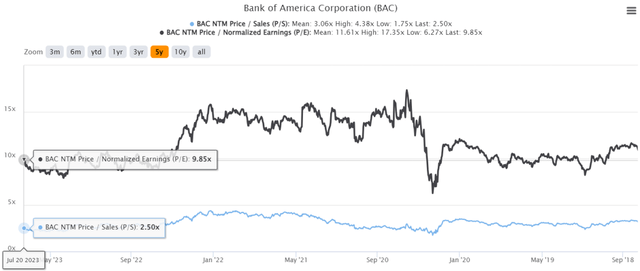

BAC 5Y EV/Revenue and P/E Valuations

For now, BAC’s valuations are still impacted at NTM Price/ Sales of 2.50x and NTM P/E of 9.85x, compared to its 1Y pre-banking crisis mean of 2.89x/ 10.22x and 3Y pre-pandemic mean of 3.00x/ 11.51x, respectively.

Based on this cadence alone, it appears that Mr. Market remains uncertain about the bank’s prospects. With a pivot likely to occur only when the rising inflationary pressure is tamped down, the bank’s gross unrealized losses in debt securities may remain a headwind in the near term.

Then again, we continue to hold the belief that BAC is “almost” too big to fail, with the Fed similarly invested in the perceived stability of the US banking system. With things seemingly quieting down with the failure of First Republic Bank (OTCPK:FRCB), we may see market sentiments improve moving forward from this correction.

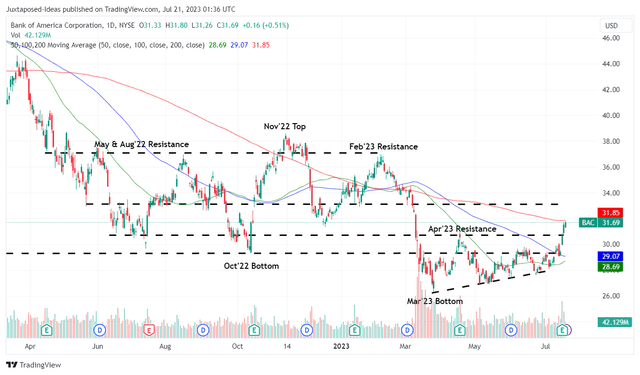

BAC 1Y Stock Price

Combined with the rising support levels from the previous March 2023 bottom, we may see BAC break out of the April 2023 levels to retest its next resistance levels at $33.

Most importantly, the stock continues to trade below its book value per common share of $32.05 (+1.4% QoQ/ +7.2% YoY), suggesting its mild undervaluation, especially compared to the pre-banking-crisis stock prices of $35s.

While its recovery may be slower due to the uncertain macroeconomic outlook, we remain confident about the bank’s long-term prospects, since these headwinds do not last forever.

Therefore, we continue to rate the BAC stock as a Buy here, due to the excellent upside potential to our price target of $40, based on its normalized P/E valuations and the market analysts’ FY2025 adj EPS projection of $3.53.

Income investors may also welcome the stock’s expanded forward dividend yield of 2.99% due to the steep correction, compared to its 4Y average of 2.35%, though still lagging behind the sector median of 3.80%.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.