Summary:

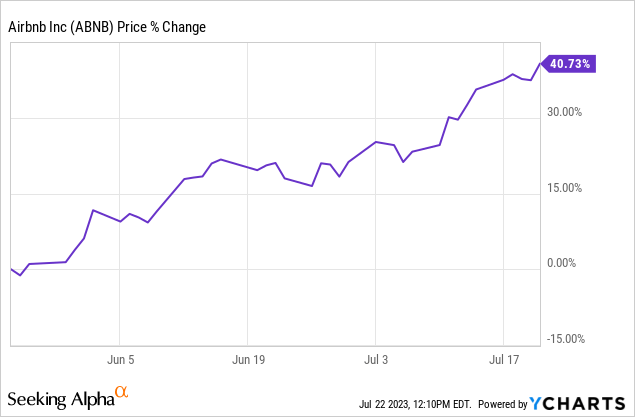

- Airbnb’s stock has risen 40% in two months due to impressive metrics and a bullish market.

- Despite this, the stock looks significantly overvalued.

- With investors overconfident and the fear and greed index pointing to danger, is it time to book profits?

Ирина Мещерякова/iStock via Getty Images

The travel industry has rebounded nicely from the COVID-19 disaster, and Airbnb (NASDAQ:ABNB) has benefitted in many ways. However, several indications that economic trouble is brewing make the consumer discretionary sector dangerous.

After its impressive recent run, it is time to take profits in Airbnb.

What Happened

When I first covered Airbnb here, with a buy rating, I wrote that my target entry point was $102 per share while it was trading at $118. The stock swooned as I began to pick up shares on the way. Although it never quite dropped to $102 (it briefly touched $104), I was content with an average basis of $108.

The stock rocketed 40% in two months as investors did an about-face, focusing on artificial intelligence (AI) and talking about reaching new all-time highs rather than a potential recession and concern over consumer spending.

Airbnb has a tremendous business model. The company went lean during the pandemic and maintained that even as things returned to normal. It found that having a small cohesive team of excellent employees outperforms a larger fragmented group. We can all relate from our own career experiences.

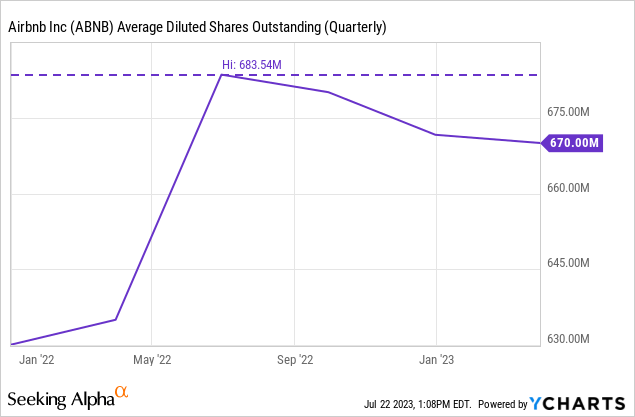

Revenues grew 75% from 2019 to 2022, reaching $8.4 billion, and Airbnb became net profitable for the first time in a BIG way: a 23% net income margin and a fantastic 40% free cash margin. The cash inflows led the company to begin a share buyback program, and the diluted shares outstanding are now dropping, as shown below, and should continue to do so.

Airbnb’s capital-light business deserves more attention.

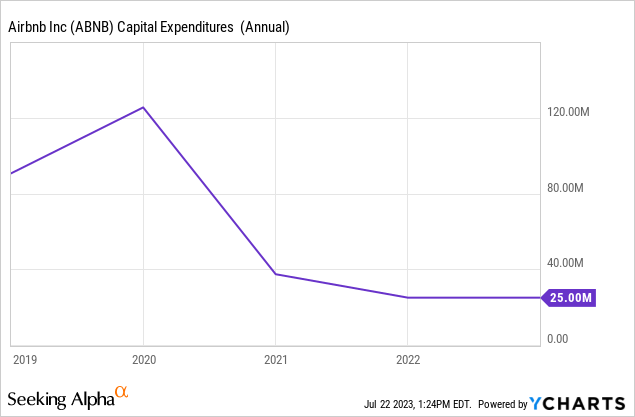

Capital expenditures, or CapEx, occur when a business uses cash to purchase property (like offices, buildings, and factories) and equipment (machines, servers, and the like). These cash outlays don’t appear on the income statement, only in the investing section of the statement of cash flows. For this reason, many investors overlook it. But it is critically important.

Take companies A and B, which make the same net income. But A needs factories, trucks, and intense capital outlays for logistics to run the business, and B doesn’t. The latter has much more cash left over to buy back shares, make acquisitions, pay dividends, or invest back into the business.

At its core, Airbnb is a software company. And the platform has been built. So we see CapEx needs declining precipitously below.

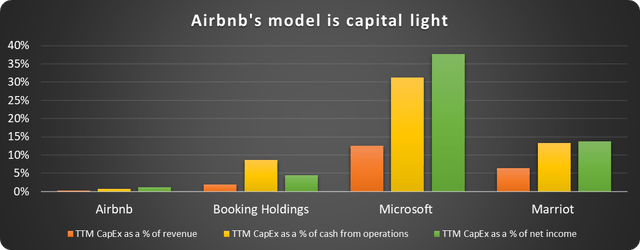

Finally, here is Airbnb’s CapEx outlays compared to other software and travel companies:

Data source: Seeking Alpha. Chart by author.

This model means the market will assign Airbnb a higher price-to-earnings (P/E) ratio than peers.

Management needs to defend the brand, laser-focus on customer service and reputation, and the business will be lucrative.

However, the price is too rich now, and a pullback is needed for the stock to become a Buy again.

Two reasons to sell Airbnb (for now)

Let’s start with the valuation.

There is no need to chase growth stocks. There are no dividends to miss, so sometimes it’s best to take profits and wait for an attractive price.

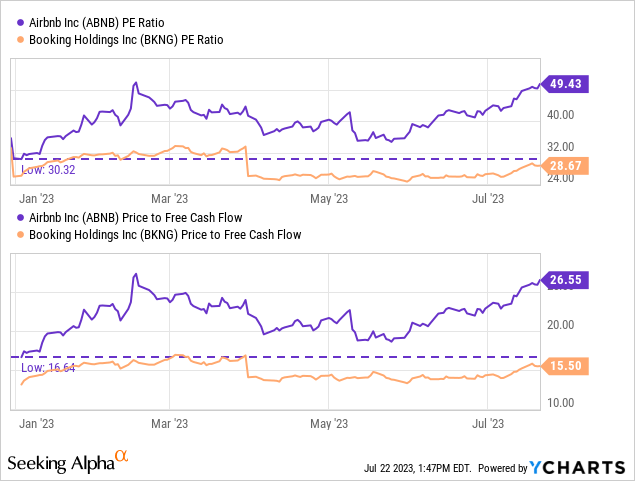

As mentioned above, Airbnb deserves a higher P/E than its peers; however, it has grown from 30x to 50x YTD, far outpacing competitors like Booking Holdings (BKNG), as depicted below.

The price-to-free cash flow ratio is also at a zenith. In my article linked above, I wrote that I was a buyer at a P/E of 30 and under, but it’s not attractive at 50.

Three reasons the near-term picture is murky for consumer discretionary stocks.

I am typically not big on investing based on macroeconomic indicators. I prefer to choose terrific companies and hold for the long haul. However, being too rigid isn’t good practice. Booking a 38% gain that took under two months is the right move here. The consumer discretionary industry is about to feel intense pressure – even if investors are singing a happy tune now.

#1. Job numbers are smaller than they appear.

Many in the media are singing the praises of recent job reports. The reported numbers have been impressive. But many people do not realize that the first reports are just estimates. The Bureau of Labor Statistics (BLS) reports the prior month’s numbers just days after the month ends. Then the figures are revised in later reports and reported in the last paragraph. Here is an excerpt from the report released in May:

The change in total nonfarm payroll employment for February was revised down by 78,000, from +326,000 to +248,000, and the change for March was revised down by 71,000, from +236,000 to +165,000. With these revisions, employment in February and March combined is 149,000 lower than previously reported.

The reported numbers have been revised downward every month in 2023 by an average of around 20%. If the same happens to the June figure, it will mark a low point for the year.

#2. Investors are greedy and flat-footed.

The fear and greed index measures investor sentiment in several ways and rates them from extreme fear to extreme greed. Extreme greed often signals that stocks are irrationally high and a correction is coming. Extreme fear is when we want to be buyers, as it shows that stocks are oversold.

Six of seven factors are now in the greed range, with four being firmly in the extreme greed range.

At the same time, the VIX (VIX), which measures volatility, is extremely low, suggesting investors are too complacent. It’s a bad combination.

#3. Consumer spending will be affected.

American consumer spending is the bedrock of the economy, and it has been extraordinarily resilient in the face of inflation and rising interest rates – but this cannot last forever. The effect of rising interest rates takes many months to be fully realized. After all, we don’t all go out and buy cars or apply for credit right after they are raised. Consumers have yet to feel the full effect of the Federal Reserve’s inflation fight.

CNBC reports that American credit card debt is at an all-time high (and don’t forget about Buy Now Pay Later debt), and the number of people who spend everything they make each pay period (over 50%) is a recipe for disaster.

If things go South, consumer spending on vacations and other luxuries could plummet.

The bottom line: It’s time to book gains.

We don’t have to exit an entire position when headwinds are coming, but it’s wide to cement profits by reducing it until the stock is compelling again.

Airbnb is an excellent business, now profitable and creating terrific free cash flow. But the sky-high valuation, excessive greed in the market, and ugly picture for consumer discretionary spending make it a sell for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors' goals, financial situations, timelines, and risk tolerances vary widely. The stocks mentioned may not be suitable for all. As such, the article is not meant to suggest action on the part of the reader. Each investor should consider their unique situation and perform their own due diligence.

The author may exit the position above at any time.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.