Summary:

- On July 25, 2023, Visa, one of the leaders in digital payments, will publish its financial report for the fiscal third quarter of 2023.

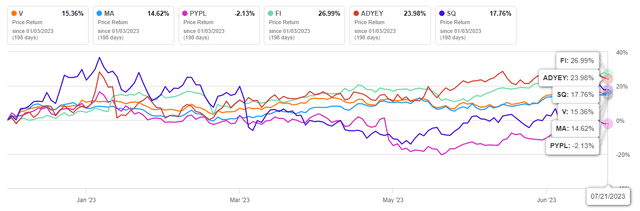

- Since the beginning of 2023, the company’s share price has risen by more than 15%, outperforming competitors in the financial sector, such as PayPal Holdings and Mastercard.

- To continue the geographic expansion of its business, on June 28, Visa announced the acquisition of Pismo, a cloud-native core processing platform.

- We initiate our coverage of Visa with an “outperform” rating for the next 12 months.

zamrznutitonovi/iStock via Getty Images

Post-market on July 25, 2023, Visa Inc. (NYSE:V), one of the leaders in digital payments, will publish its financial report for its fiscal third quarter of 2023. The company has continued actively promoting global trade in over 200 countries, processing hundreds of millions of customer transactions daily.

Visa provides transaction processing services such as authorization, clearing, and settlement to various financial institutions and customers through VisaNet, one of the world’s most innovative transaction processing networks. To continue the geographic expansion of its business, on June 28, it announced the acquisition of Pismo, a cloud-native core processing platform with operations in Europe, Latin America, and the Asia-Pacific region. This transaction cost Visa $1 billion and will allow it to increase the number of services provided to financial institutions and connect customers to Pix, a mobile payment system developed by the Central Bank of Brazil. Given the rapid decline in inflation and the development of digital banking in Brazil, we believe this deal will allow the company to remain a leader in the industry.

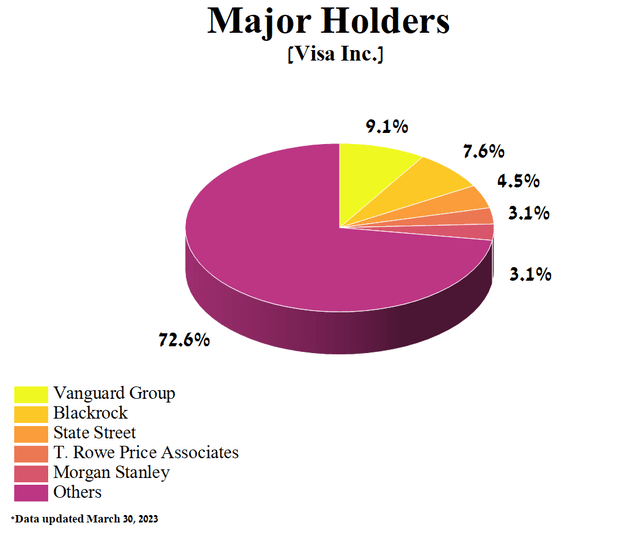

At the same time, Wall Street mastodons such as T. Rowe Price Associates, Vanguard Group, BlackRock, State Street, and Morgan Stanley have long been the five largest shareholders of Visa, with a combined share of 27.42% in the company.

Author’s elaboration, based on Yahoo Finance

Thanks to year-on-year growth in cross-border payments, revenue, and net income, Visa’s share price has grown by more than 15% since the beginning of 2023, outperforming competitors in the financial sector, such as PayPal Holdings, Inc. (PYPL) and Mastercard Incorporated (MA).

Author’s elaboration, based on Seeking Alpha

We initiate our coverage of Visa with an “outperform” rating for the next 12 months.

The financial position of Visa and its prospects

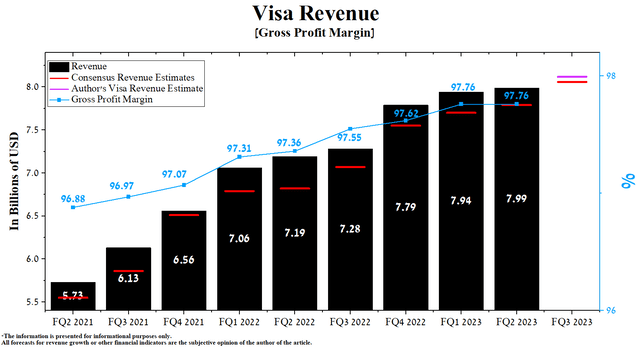

Visa’s revenue for the first three months of 2023 was $7.99 billion, down 0.6% from the previous quarter and up 11.1% from the second quarter of fiscal 2022.

Author’s elaboration, based on Seeking Alpha

Furthermore, the company’s actual revenue has beaten consensus estimates by analysts in the past nine quarters, which could signal to market participants that Wall Street is underestimating Visa.

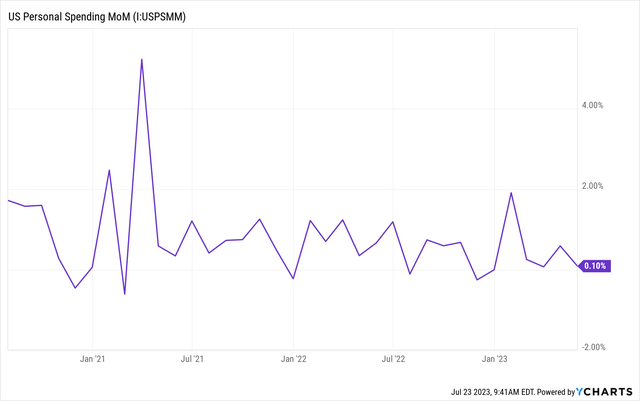

We believe that despite the slowdown in revenue in recent quarters, Ryan McInerney, CEO of Visa, is doing an excellent job of managing it during the current period of slow recovery in consumer spending growth in the U.S. and Europe.

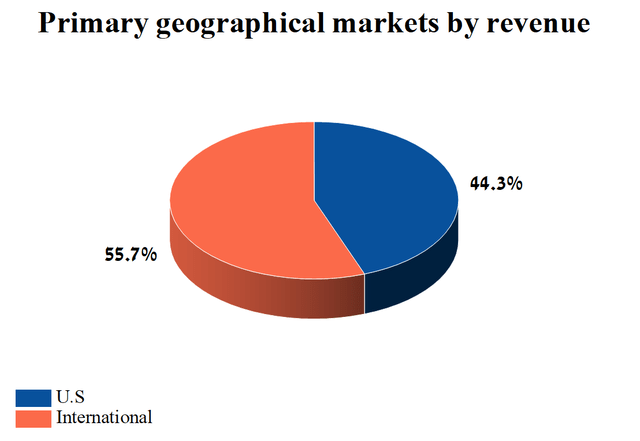

The three primary sources of revenue are service revenues, which depend mainly on the volume of payments, international transaction revenues, and data processing revenues, which depend on the number of processed transactions. Geographically, in the 2nd quarter of the fiscal year 2023, 44.3% of the company’s total revenue comes from operations conducted in the United States, while the remaining 55.7% is generated in various international markets.

Author’s elaboration, based on 10-Q

According to Seeking Alpha, Visa’s revenue for the 3rd quarter of fiscal year 2023 is expected to be $7.86-$8.16 billion, up 3.5% from analysts’ expectations for the first three months of 2023. At the same time, under our model, the total revenue of Visa will be within this range and amount to $8.12 billion.

The company’s revenue will be increased by the recovery of the global economy, despite the continued tight monetary policy of key central banks. Moreover, at the beginning of July 2023, the leading U.S. banks published financial results for the 2nd quarter of 2023, according to which the expenses of U.S. residents on credit cards continue to be high. So, JPMorgan Chase (JPM) reported an increase in sales of debit and credit cards by 7%.

On the other hand, after the end of the COVID-19 pandemic, there has been a further increase in passenger traffic in the world. So, according to the Transportation Security Administration, the total number of passengers was 2.74 million on July 20, 2023, an increase of 12.3% compared to the previous year. We believe this trend will continue, further increasing processed transactions and nominal payments across multiple Visa platforms.

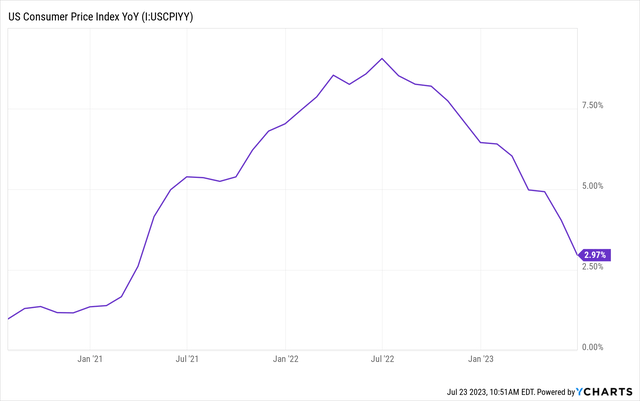

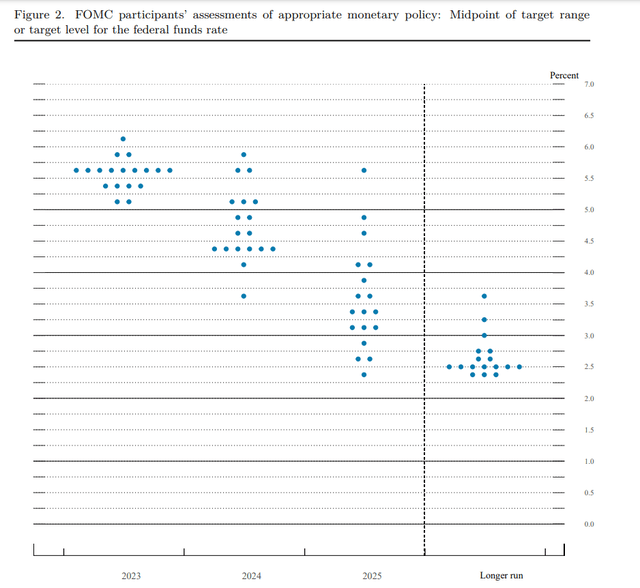

On a larger scale, we believe that the company’s revenue growth will be supported by a reduction in the Fed’s interest rate. Annual inflation in the U.S. continues to slow down and has fallen to its lowest levels since March 2021.

Based on our model, from Q3 2023, the Fed will start increasingly dovish rhetoric, followed by a reduction in its interest rate from late 2023 – early 2024. Thus, according to the FOMC, the median expectation for the funds rate will decrease from 5.6% in 2023 to 4.6% by 2024. This will lower the cost of borrowing and ultimately positively impact the volume of debit and credit card transactions. The reason for this is the transition of the population from a savings behavior to one in which there will be more active spending of personal savings and the reserve line of credits.

Federal Open Market Committee (FOMC)

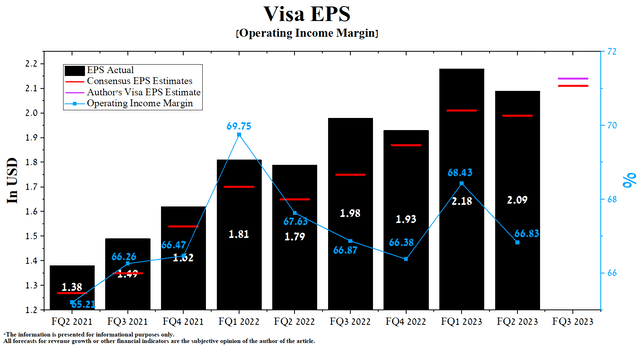

Visa’s Q2 FY 2023 operating income margin was 66.83%, down slightly from the prior year and slightly below its median of 67.09% between January 1, 2021, and the end of March 2023. At the same time, we forecast that by 2023 the company’s operating income margin will remain stable at 67.5%, and by 2024 this value will increase to 68.2%, thanks to a faster global economic recovery, lower inflation, and the launch of new products.

The company’s EPS for the second quarter of fiscal 2023 was $2.09, up 4.1% quarter-on-quarter, and just as importantly, it beat analyst consensus estimates in nine of the last nine quarters. According to Seeking Alpha, Visa’s Q3 EPS is expected to be in the $2.02-$2.16 range, up 6% from the Q2 2023 consensus estimate. While we believe these are low expectations, our model puts Visa’s EPS at $2.14.

At the same time, Visa’s Non-GAAP P/E (TTM) is 29.35x, 225.23% higher than the average for the sector and 15.24% less than the average over the past five years. On the other hand, Non-GAAP (FWD) P/E is 27.85x, which is one of the factors indicating that the company is slightly overvalued ahead of the publication of financial results for the 3rd quarter of the 2023 financial year.

Author’s elaboration, based on Seeking Alpha

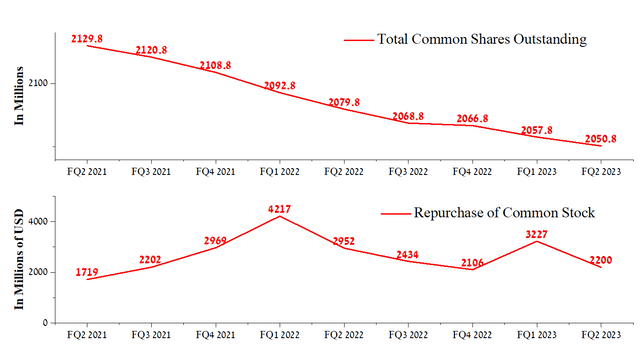

The key reason for Visa beating consensus EPS is not only to maintain its high margins but also to the share buyback program. For the second quarter of fiscal year 2023, Visa repurchased about $2.2 billion of its shares. At the same time, at the end of March 2023, the remaining authorization to buy back Visa shares amounted to $11.9 billion. We believe that given the company’s stable cash flow, Ryan McInerney will continue to actively use the share buyback program to minimize the impact of stock market volatility on Visa’s share price.

Author’s elaboration, based on Seeking Alpha

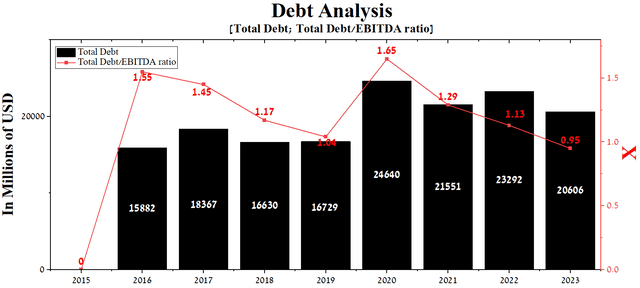

At the end of March 2023, Visa’s total debt was about $20.61 billion, down $945 million from 2021. Moreover, thanks to the growth in EBITDA in recent years, the total debt/EBITDA ratio has dropped from 1.29x to a record low of 0.95x for the company.

Author’s elaboration, based on Seeking Alpha

With the senior notes’ maturity dates and year-on-year net income growth, we don’t expect Visa to have any problems redeeming them. As a result, the company’s management will continue to pursue an active M&A policy to maintain its leading position in the global electronic funds transfer market.

Conclusion

On July 25, 2023, Visa, one of the leaders in digital payments, will publish its financial report for the third quarter of fiscal year 2023.

As leaders in the industry, we expect the company’s year-over-year revenue growth trend to continue. One of the key reasons for this is the recovery of the global economy, despite central banks’ continued tight monetary policy. Furthermore, at the beginning of July 2023, the leading U.S. banks published financial results for the 2nd quarter of 2023, according to which the expenses of US residents on credit cards continue to be high. So, JPMorgan Chase reported an increase in sales of debit and credit cards by 7%.

In addition, stable cash flow and an active M&A policy allow the company to expand and offer customers new products to improve their quality of life. Long-term investors find Visa, Inc. attractive due to its 0.72% dividend yield and the company’s remaining $11.9 billion buyback authorization, factors that are only part of its strengths.

We initiate our coverage of Visa with an “outperform” rating for the next 12 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.