Summary:

- Visa continues to deliver as the company fully capitalizes on recent macroeconomic and industry-wide tailwinds.

- The expectations for the upcoming quarter are high and the second half of the fiscal year is also likely to be more challenging.

- This creates certain risks for the share price that are not necessarily priced in at the moment.

- Even though a strong quarter is to be expected on Tuesday, investors should be cautious when buying at current levels.

Justin Sullivan

As Visa Inc. (NYSE:V) continues to deliver on its long-term strategy and macroeconomic tailwinds are slowly subsiding, the pressure to deliver on its quarterly results is rising.

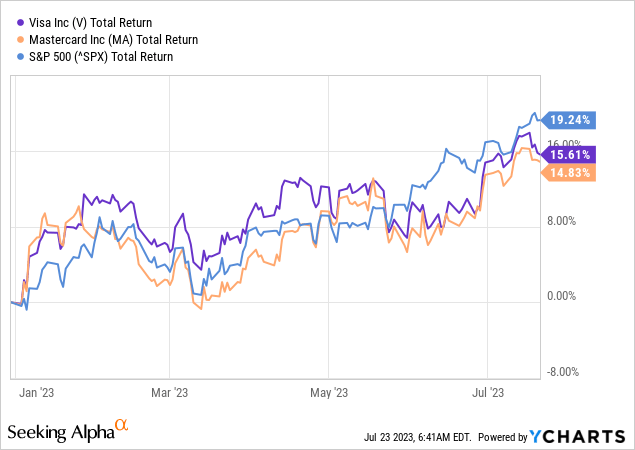

Since the start of the year, Visa’s stock price has largely tracked the performance of its main peer – Mastercard Incorporated (NYSE:MA) and the S&P 500.

Usually, this is not considered an unusual event given Visa’s beta of around 1, but as of late the high concentration of high growth and momentum stocks within the S&P 500 has been a major driver for returns. As a result, Visa’s nearly 16% total return since the start of the year puts enormous pressure on the company to continue delivering on its quarterly results.

The Current Setup

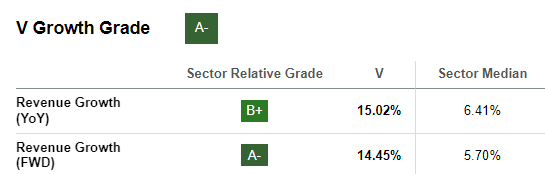

Topline estimates remain in the teens and well-above the sector median growth rates which as we’ll see later might be harder to sustain given the macroeconomic environment.

Seeking Alpha

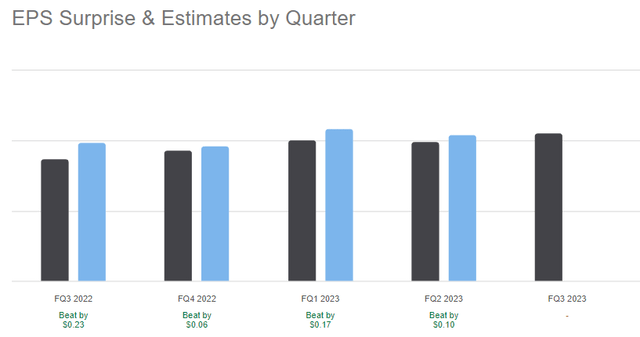

On the bottomline, Visa has beaten the consensus estimates in each of the last four quarters which has justified the extremely optimistic stance of sell-side analysts.

Seeking Alpha

During the latest conference call, Visa’s management also made the following remarks:

- The international growth trajectory remained unchanged with recent tailwinds expected to remain in place.

- On the cross-border front, management expects that the growth rate will be sustained for the time being.

- At the same time, client incentives are expected to increase during the second half of the fiscal year which will put pressure on net revenue growth.

Overall, investors are not given any reason to believe that the rest of 2023 would be anything different from the first half of the fiscal year. Nevertheless, however, client incentives will be a headwind and the outside macroeconomic environment would also offer some challenges to the business.

Is Slowdown Coming?

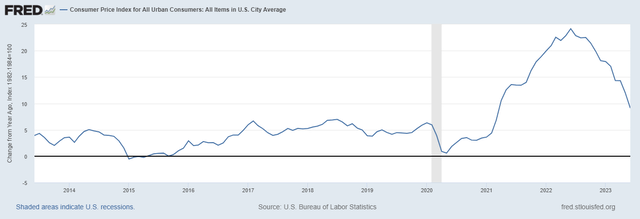

One major development for Visa is the slowdown of inflation in recent months.

FRED

As inflationary tailwinds are fading, Visa’s transactions ticket sizes would face some pressure, which seems to have already started during the March/April period of this year.

Ticket size is up over 1% year-over-year in the first quarter and it’s down about 2% in March through April 21. Ticket sizes are declining as inflation moderates. Most notably, starting in March and through the summer, we will be lapping the peaks in fuel prices last year.

Also contributing discounting in particular retail goods channels, you’ve heard various U.S. retailers comment publicly about price cuts they are implementing to clear out inventory or pass on reductions in costs.

Source: Visa Q2 2023 Earnings Transcript

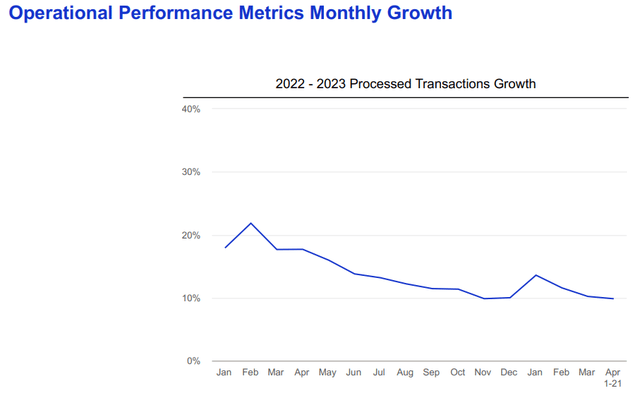

Processed transactions growth has also moderated in the months leading to April of this year and although growth remains in double digits, it seems that we are already off the peak.

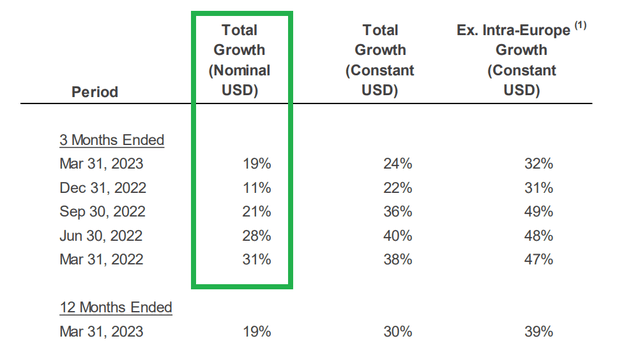

Visa Investor Presentation

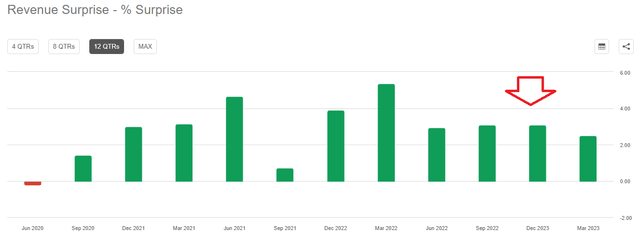

Not surprisingly, Visa’s quarterly revenue growth surprises above the consensus estimates have also followed this trend and narrowed down in recent periods.

Seeking Alpha

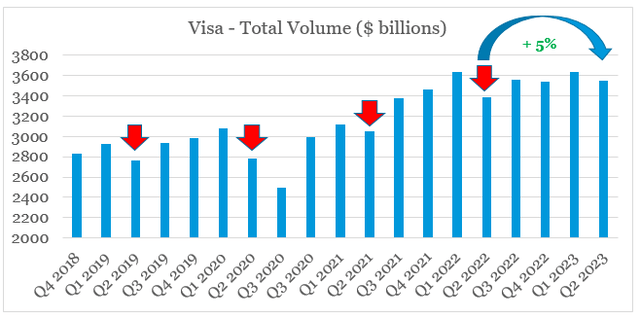

After reporting the seasonally low second quarter in volumes, Visa’s year-on-year growth was only 5%, which is materially different from the Q2 2021 to Q2 2022 period.

prepared by the author, using data from Visa’s Operational Performance Reports

Having said all that, it would appear that growth is bound to experience a sharp drop during the quarter, but that’s not all.

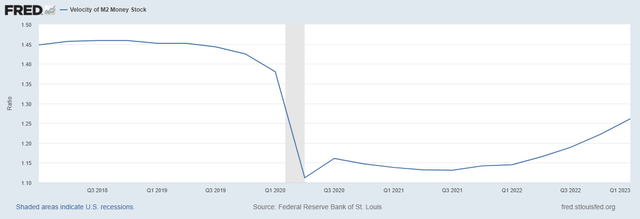

While ticket sizes are falling and volumes appear to be coming off, the velocity of money in the U.S. is noting a sharp increase from its lows in 2020-21 period.

FRED

After more than a year of rising consumer prices, it is likely that velocity of money would continue to accelerate as long as the U.S. consumer remains in a healthy state, i.e. we avoid a major recession.

On the other hand, cross-border volumes should also remain strong as travel recovers, especially in Asia where they recovered to 2019 levels during the previously reported quarter.

Visa Operational Performance Data

Lastly, Visa’s new flows would be another important growth driver, not only in cross-border transactions, but in other areas as well.

In the second quarter, Visa Direct cross-border P2P transactions, excluding Russia, grew nearly 50%. While Visa Direct is growing fast, B2B is the largest component of new flows. And traditional issuance is the core of what we do today in B2B, comprising the majority of the over $760 billion in commercial payments volume year-to-date.

Source: Visa Q2 2023 Earnings Transcript

Visa+, for example, is a new network where Visa would allow payments across different payment apps.

And two weeks ago, we announced a new network called Visa+, that further extends our network of networks. This new network allows users to send and receive payments among different P2P apps through a personalized payment address, a Visa+ Payname. This enables P2P payments from one app directly to another app, as well as gig, creator and marketplace payouts. This can be done through an app, a neo-bank, or a wallet. We’re connecting endpoints and form factors and enabling interoperability, our network of network strategy at work. We are launching pilots with several partners including Venmo, PayPal, Tap-to-Pay and Western Union with more to come soon.

Source: Visa Q2 2023 Earnings Transcript

Visa+ is still in its early days and is initially focused on the United Sates alone, but over time is expected to be scaled up cross-border. It is a very good example of innovation happening at Visa and how the company is diversifying its business and capturing new growth opportunities.

It’s Not All About Revenue Growth

Overall, the rest of fiscal 2023 will likely see more mixed results from Visa when compared to the already high expectations.

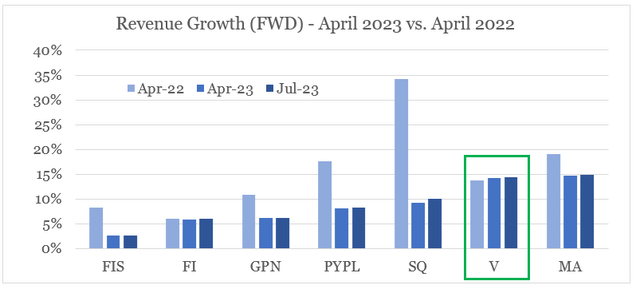

The company’s topline growth is still expected to be among the highest in the industry and these high expectations would put a lot of pressure on the share price, should the company fail to meet the consensus estimate.

prepared by the author, using data from Seeking Alpha

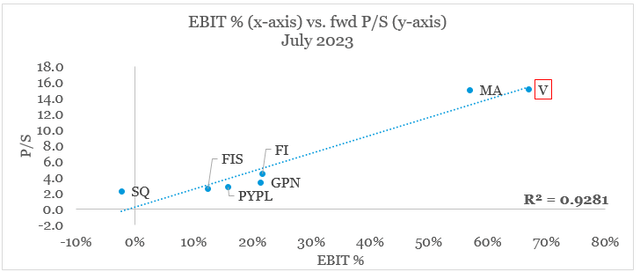

With revenue growth likely to be in the spotlight, investors should also not forget that margins are the key driver of valuations on a cross-sectional basis.

prepared by the author, using data from Seeking Alpha

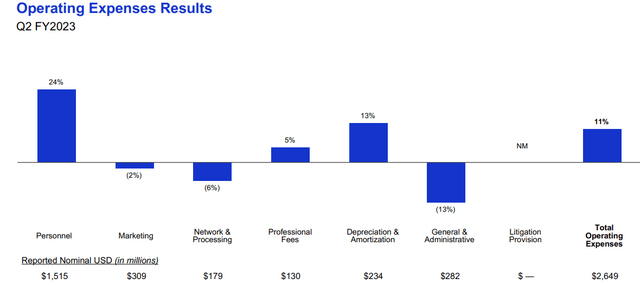

In that regard, however, Visa is also faced with opposing forces. On one hand, improving cross-border volumes are having a significant positive impact on profitability, but on the other personnel related expenses are catching-up with inflation.

Visa Investor Presentation

Investor Takeaway

As Visa is about to report its Q3 2023 results, the pressure to deliver on current expectations is enormous. Overall, the company is in a good position to report yet another strong quarter, but some important headwinds are rising. In my view, this creates certain short-term risks that could surprise investors and cause a negative response for the share price. Whatever the outcome of the upcoming earnings release, my long-term thesis on Visa should remain intact.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the electronic payments space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

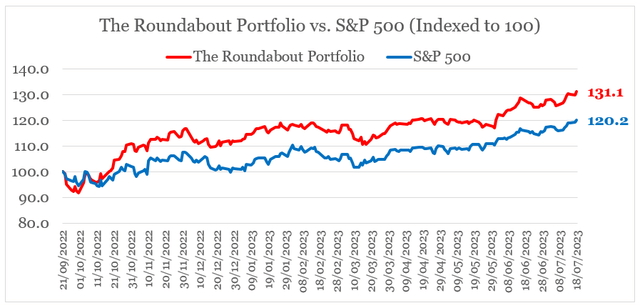

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.