Summary:

- Chevron reported preliminary Q2 earnings of $3.08 per share on revenue of $6.01 billion, beating expectations of $2.97 per share. The company also reported record quarterly Permian Basin production.

- Management changes include the early retirement of CFO Pierre Breber and the promotion of Eimear Bonner to CFO. Chevron also waived its mandatory CEO retirement age, allowing CEO Mike Wirth to continue in his role.

- Chevron is expected to complete its $7.6 billion acquisition of PDC Energy next month.

- I highlight important price levels to watch ahead of the long-form Q2 report due out Friday morning along with a recap of key charts in the oil market.

Mario Tama

Chevron (NYSE:CVX) released its second-quarter profit highlights on Sunday night. Its results helped the Energy sector in trading on Monday. The company reported a solid earnings beat with $3.08 of EPS on revenue of $6.01 billion; Expectations were for $2.97 of per-share operating profits. Adjusted earnings were under year-ago levels but recall that Q2 2022 was a peak period for oil & gas company profits given the bull market in both WTI and Brent prices more than a year ago. I have a buy rating on the oil & gas giant.

The integrated energy company reported record quarterly Permian Basin production and said it remains on track to meet its year-end targets. But what drew the earnings preannouncement? There are a couple of possible culprits.

First, there is a management shift going on at Chevron, including news of the surprise early retirement of CFO Pierre Breber and the promotion of Eimear Bonner from CTO to CFO. The company also waived its mandatory CEO retirement age (65), which paves the way for CEO Mike Wirth, age 62, to continue at the helm. Second, keep your eye on updates on its $7.6 billion acquisition of PDC Energy, which is expected to be completed next month.

Wirth said on CNBC this morning with David Faber that they “are right on that plan” to deliver operating results across its segments. The CEO confirmed more details will be shared on Friday’s quarterly conference call. Wirth also voiced optimism regarding infrastructure spending and permit approval in possible reform measures on Capitol Hill.

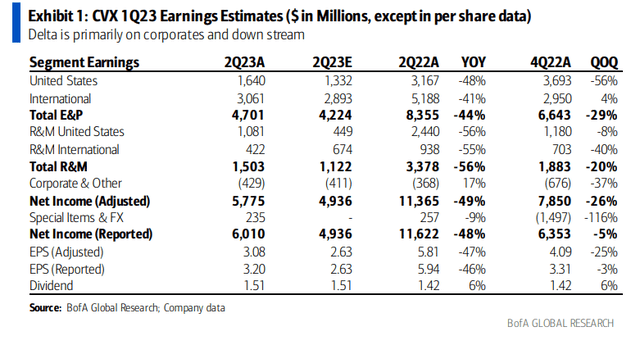

Chevron’s Preliminary Earnings Figures Released Sunday Night

BofA Global Research

According to Bank of America Global Research, CVX is a US-based integrated oil and gas company, with worldwide operations in exploration and production, refining and marketing, transportation, and petrochemicals. In E&P, operations are globally distributed, including North and South America, Africa, Asia, and Europe.

The California-based $297 billion market cap Integrated Oil and Gas industry company within the Energy sector trades at a low 8.3 trailing 12-month operating price-to-earnings ratio and pays a high 3.8% dividend yield, according to Seeking Alpha. Ahead of its official earnings date on Friday morning, the stock has a somewhat low 23% implied volatility percentage and carries a modest 1.1% short interest.

Investors should understand the risks associated with owning a major integrated oil company like Chevron. Of course, a downturn in the price of domestic and international crude oil would be a significant headwind to quarterly profits. Also, overall price volatility in energy commodities can pose risk management issues due to hedging.

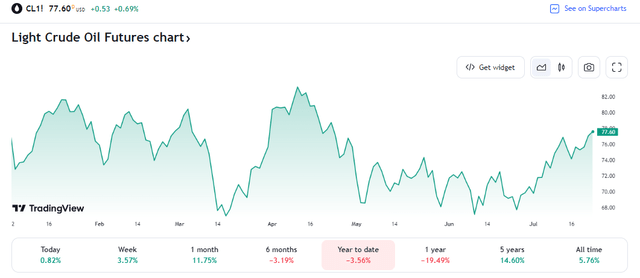

Operational challenges with new projects as well as properly incorporating newly acquired assets and firms is a risk. Higher oil prices and better-managed capex spending are upside catalysts. As it stands, a more stable oil market situation has resulted in strong margins, and those could turn higher if the current oil rally chugs along.

WTI Crude Oil: Fresh 4-Month Highs, Bullish for Chevron

TradingView

WTI Crude Oil Volatility: 52-Week Lows

TradingView

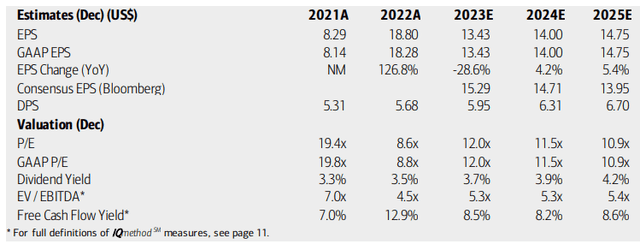

On valuation, analysts at BofA see earnings falling sharply this year following the first half of 2022’s energy bull market. With oil prices much more stable now, we have more clarity on the true earnings picture. Most EPS growth is seen in the out years while the Bloomberg consensus forecast is less sanguine compared to what BofA sees.

Dividends, meanwhile, are expected to rise at a healthy clip over the coming quarters. With low teens forward P/E ratios, a healthy yield, and ample free cash flow, there is a lot to like fundamentally with CVX. Its EV/EBITDA ratio is also less than half of the S&P 500’s average.

Chevron: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

BofA Global Research

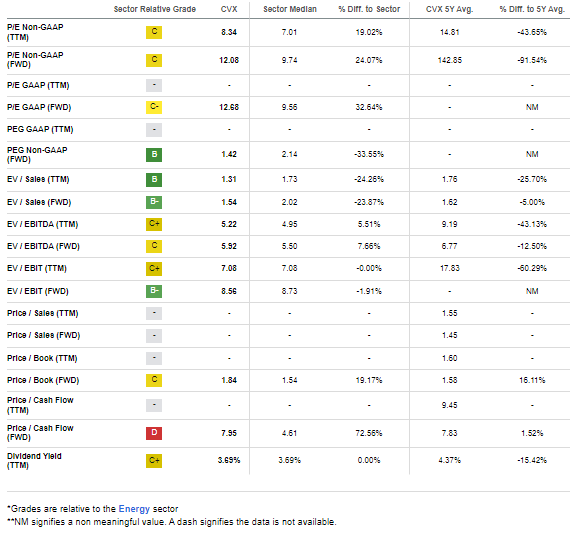

If we assume normalized EPS of $13.50 over the coming 12 months and apply a below-market 14 P/E, then shares should be near $190. I assert the valuation should be higher than where it is today due to more stable commodity prices and the company’s historically high free cash flow yield. Also consider that from 2014 through early 2020, the forward non-GAAP P/E ranged at much higher levels, so it is possible a re-rating higher may take place if the long-term trend merely reverts modestly.

CVX: Somewhat Expensive to the Industry, but Strong Profitability Metrics

Seeking Alpha

Chevron: Low P/E Relative to its 10-year Valuation History

Koyfin Charts

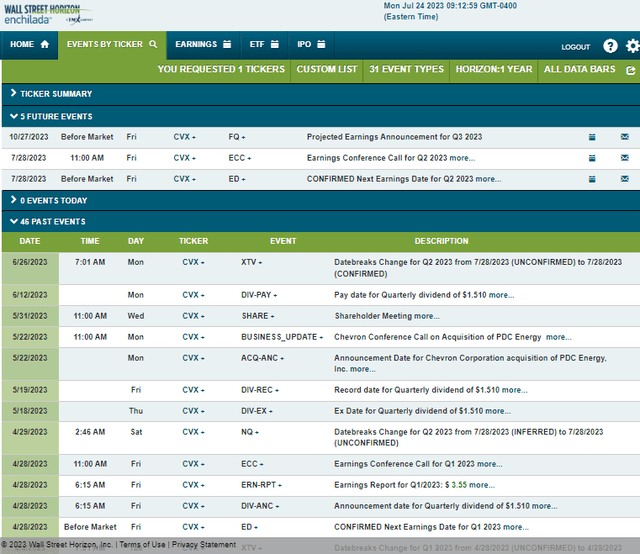

Looking ahead, corporate event data provided by Wall Street Horizon shows a confirmed Q2 2023 earnings date Friday, July 28 with a conference call later that morning. You can listen live here. This will be a full quarterly report, offering more details following Sunday night’s preliminary earnings release.

CVX: Corporate Event Risk Calendar

Wall Street Horizon

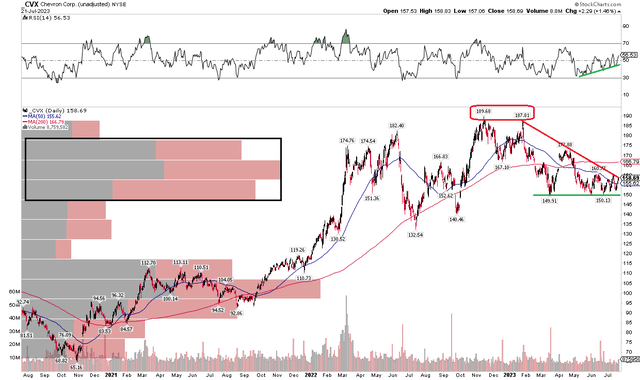

The Technical Take

With solid results reported Sunday evening ahead of the long-form Q2 report and with an attractive valuation, I see price action nearing a crucial level. Notice in the chart below that the stock is consolidating in a descending triangle pattern. The apex is nearing, and a bearish breakdown would trigger a downside price objective to near $115, so it is key that support holds. The good news here is that the RSI momentum indicator at the top of the graph shows a series of higher lows as the price coiled. Often, momentum leads to an eventual share price inflection.

Following a bearish double-top pattern spanning Q4 last year to early February of 2023, the bears have regained some control. That is evidenced by a flat 200-day moving average that had been trending higher since late 2020. Finally, with high volume by price in the $150 to $175 area, the bulls still have their work cut out for them even if support holds. Overall, the chart is neutral in my opinion.

CVX: $150 Key Support

Stockcharts.com

The Bottom Line

I have a buy rating on CVX. While there are technical risks, a positive earnings preannouncement paired with a solid valuation makes me optimistic over the intermediate term. Also, high free cash flow and a solid dividend yield push the needle to the buy side.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.