Summary:

- McDonald’s negative book value looks alarming. I explain why its equity has slipped into negative territory and point out several implications, especially in light of the current environment.

- The article takes a deep dive into McDonald’s fundamentals going back to 2007 and discusses an important aspect of management’s playbook that I suspect is now defunct.

- I explain why MCD stock is set to become an increasingly poor dividend growth stock – even though its long-term CAGR of 12.2% suggests otherwise.

- Nonetheless, McDonald’s stock fundamentals remain solid, and it would be foolish to sell the stock just because it looks problematic from a textbook perspective due to its negative book value.

Ljupco/iStock via Getty Images

Introduction

Over the years, I have come across several investors who have sold McDonald’s Corporation (NYSE:MCD) stock because of its perceived weak balance sheet, seemingly identifiable by the company’s negative book value or equity. In principle, this is understandable – after all, financial textbooks teach us that a high equity ratio (shareholders’ equity divided by total assets) is a sign of financial strength and is an important characteristic of well-managed companies. MCD’s book value implies that in the event of bankruptcy, there is nothing left for shareholders, who have only a residual claim on the company’s assets after all other claims have been satisfied. However, a closer look at the issue is also warranted in light of the sharp rise in interest rates since early 2022 and the expected negative impact on the debt servicing ability.

In this article, I will explain why MCD equity is negative and provide a historical perspective. I take a look at the company’s earnings power and financial stability, and discuss whether McDonald’s negative book value is a problem in the current environment, and if so, to what extent. In the third part of the article, I explain why I believe MCD stock is set to become a rather poor dividend growth stock.

Why Is McDonald’s Book Value Negative?

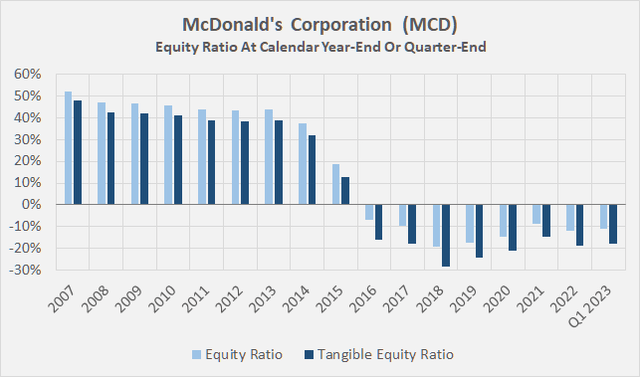

McDonald’s shareholders’ equity was very conservative for much of the 2000s and only began to decline rapidly in 2015. At the end of 2016, MCD’s book value turned negative and has remained negative ever since. The company’s equity ratio fell to a minimum of -19% at the end of 2017 (Figure 1, light blue), or a whopping -28% if goodwill is excluded (Figure 1, dark blue).

Figure 1: McDonald’s Corporation (MCD): Equity ratio and tangible equity ratio since 2007 (own work, based on company filings)

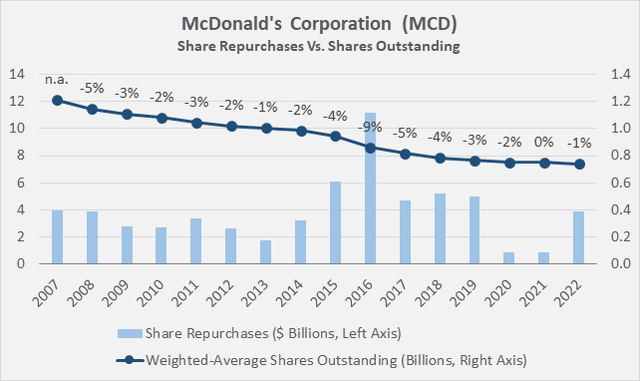

The main reason for McDonald’s negative book value is its quite aggressive share buybacks – management has spent over $62 billion on share buybacks over the past 16 years (light blue bars, Figure 2). When share repurchases are netted against proceeds from stock option exercises and related excess tax benefits, and dividend payments are included, MCD has paid out $103 billion to shareholders since 2007. Over the same period, the company generated $76 billion in free cash flow after adjusting for stock-based compensation and working capital movements and accounting for inflows and outflows due to asset transactions. In relative terms, McDonald’s paid out 34% more than it took in in free cash flow between 2007 and 2022 (more on that later).

Of course, this maneuver had a significant positive impact on the number of shares. Since 2007, the weighted-average number of diluted shares outstanding has declined by an average of 3% per year (dark blue line, Figure 2), but share repurchases did slow down in recent years.

Figure 2: McDonald’s Corporation (MCD): Share repurchases and shares outstanding (year-over-year change in %) since 2007 (own work, based on company filings)

Back in May 2014, management announced its intention to return $18 billion to $20 billion to shareholders over a three-year period. To give you a better idea of management’s “conviction”, the company stated in a May 2015 press release that it intended to ” reach the top end of its 3-year $18 to $20 billion cash return to shareholders target by the end of 2016“. This prompted rating agency Moody’s to downgrade McDonald’s long-term credit rating by one notch to A2 in May 2015. Specifically, the agency noted that this “more aggressive financially policy [came] during a period of continuing operating weakness“. McDonald’s management stuck to its words, conducting $6.1 billion and $11.2 billion in buybacks in 2015 and 2016, respectively. But that wasn’t enough, CEO Steve Easterbrook announced in November 2015 that the company would increase the cash return target to approximately $30 billion, and the related press release specifically stated that “the incremental cash return of $10 billion will be funded by issuing additional debt“. Moody’s did not hesitate to downgrade the company’s long-term credit rating again, to Baa1, where it has remained ever since.

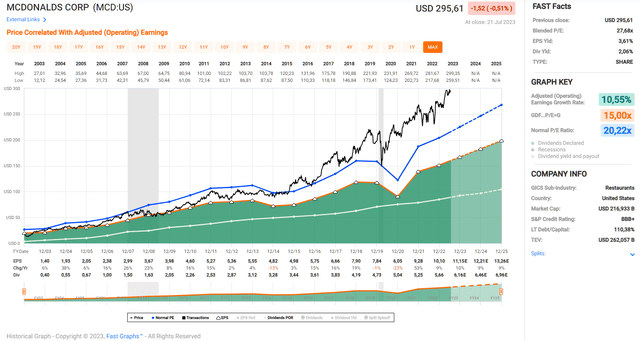

The above-mentioned annual decrease in diluted shares outstanding of 3% corresponds to a decrease of 39% over the entire period. In other words, earnings per share (EPS) increased by 63% over this period. From a shareholder’s perspective, this sounds like good news. However, my regular readers know that I am a fairly conservative investor, and I become wary when a company uses excessive leverage to boost EPS, especially when shares are bought back at fairly high valuations. While I concede that McDonald’s stock rightly commands a premium valuation (Figure 3) because of its leading market position, pricing power, strong pipeline of new products, and solid franchise network (see below), I am somewhat ambivalent about the effectiveness of McDonald’s share buybacks since 2015 (recall Figure 2). At the same time, it should not be forgotten that McDonald’s is a mature company, with the associated difficulties in capital allocation.

Figure 3: McDonald’s Corporation (MCD): FAST Graphs chart, based on adjusted operating earnings per share (FAST Graphs tool)

The Impact On McDonald’s Balance Sheet And Its Current Financial Stability

In my opinion, it makes no sense to reject a potential investment outright on the basis of a seemingly alarming financial stability ratio, such as negative equity – or worse, to sell a stock in haste. A company with a well-established business model, high profit margins, a solid geographic presence, and operating in a rather recession-resistant sector can pull off such a “stunt” quite safely. In this context, it is also important to understand the big difference between a company that sells immediately consumable and rather low-priced everyday products and a company that sells durable products, such as an automobile manufacturer. Still, it’s important to take a closer look at McDonald’s earnings power and balance sheet – especially in light of the current environment.

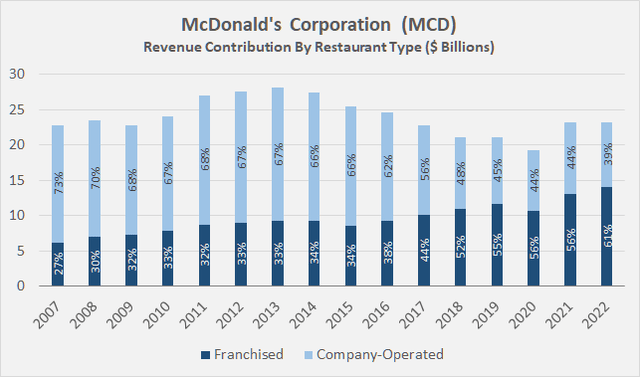

Let’s first take a look at the company’s operations. While the company’s revenues have remained essentially flat since 2007 ($22.8 billion versus $23.2 billion in 2022), profits and free cash flow have increased – and not just per share, but in absolute terms. Average normalized free cash flow from 2006 to 2008 was $3.6 billion, while average normalized free cash flow from 2021 to 2023 (estimated) is $6.1 billion. This represents a compound annual growth rate (CAGR) of free cash flow of 3.5% – not outstanding, but quite acceptable given flat revenues. The growth is mainly due to the increasing franchising of the main business. While less than one-third of total revenues were attributable to franchised restaurants in 2007, the share rose steadily to over 60% in 2022 (Figure 4).

Figure 4: McDonald’s Corporation (MCD): Restaurant type-specific revenue contribution since 2007 (own work, based on company filings)

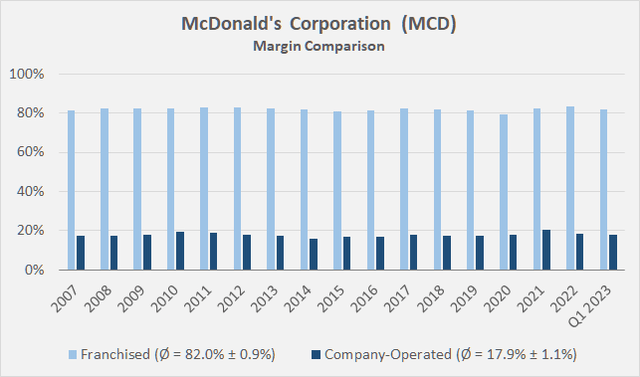

This is particularly important from the perspective of profitability. Looking at attributable operating costs, it is clear why McDonald’s is increasingly relying on franchising. Since at least 2007, the “gross” margin (i.e., before SG&A) of MCD’s franchised restaurants has been around 82%, reflecting the fact that this is largely a royalty and rent business (MCD benefits from minimum rent payments and initial fees). Understandably, the profit margin for company-owned restaurants is quite low at around 18% (Figure 5). And while the standard deviation for the 2007 to 2023 Q1 period looks almost identical (0.9% vs. 1.1%), it is important to look at it on a relative basis. With a relative standard deviation of only 1.2%, the margin of McDonald’s franchise business is much more stable than that of company-operated restaurants (6.3%).

Figure 5: McDonald’s Corporation (MCD): Comparison of restaurant type-specific margin, before selling, general, and administrative (SG&A) expenses) (own work, based on company filings)

In a nutshell, the company is increasingly “franchising” earnings volatility. Especially in the context of the company’s geographically highly diversified portfolio, this is an important aspect to consider before rashly dumping MCD stock due to its negative book value. The company is expected to continue to increase the share of franchised restaurants, which should be accompanied by further margin expansion and relatively even lower earnings volatility. This allows the company to maintain a rather weak debt servicing capability (i.e., little need for a cash flow buffer).

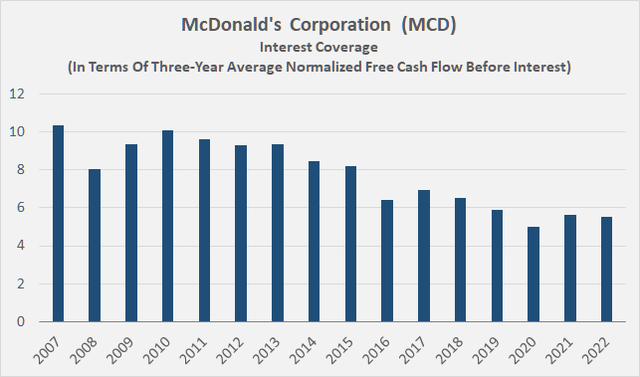

As already indicated, a significant portion of the share repurchases were financed with debt – and management makes no secret of this (see above). McDonald’s stock debt (net debt, excluding cash and leases) grew by more than a factor of 5 from $6.2 billion at the end of 2007 to more than $33.3 billion at the end of 2022. Including leases, the growth was not as pronounced, but still significant at 2.9 times (from $15.8 billion to $46.1 billion). McDonald’s interest coverage ratio has declined accordingly (Figure 6), but I don’t see this as a problem due to the aforementioned and increasing focus on franchising, as well as the still sufficient debt service capacity.

Figure 6: McDonald’s Corporation (MCD): Interest coverage, in terms of three-year average normalized free cash flow before interest (own work, based on company filings)

Now, it can be argued that MCD’s ability to service its debt is being impacted not only because of the increased debt, but also because of potential refinancing transactions and floating rate debt, as interest rates have been increased quite aggressively. There are two issues to consider here:

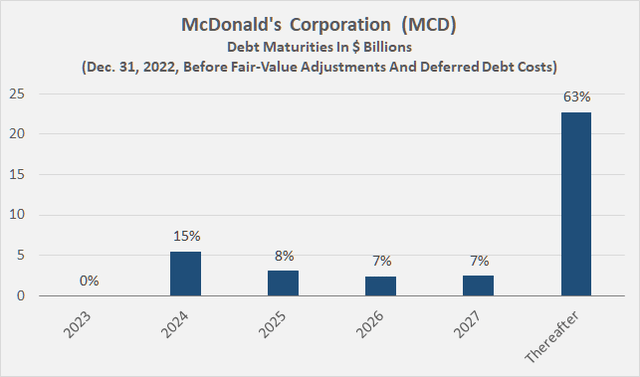

First, MCD’s maturity profile is very comfortable (Figure 7), with no debt maturing in 2023 and only about $5 billion of debt maturing in 2024. Through 2027, MCD will need to refinance about $13 billion of debt, representing 37% of its total debt. At the end of 2022, the weighted-average interest rate (WAIR) on McDonald’s debt was 3.5% – hardly a concern.

Figure 7: McDonald’s Corporation (MCD): Debt maturity profile, as of December 31, 2022 (own work, based on company filings)

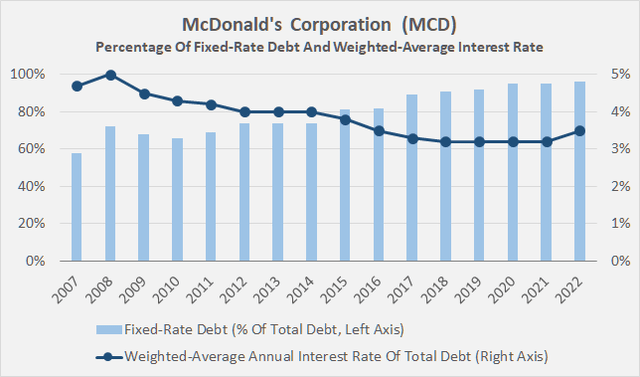

Second, and I think this is an important aspect to consider in the context of the rather aggressive share buybacks, management has decisively and intentionally exploited the low interest rate environment. Since at least 2007, the proportion of fixed-rate debt has been rising, and by the end of 2022, 96% of MCD’s debt had a fixed interest rate (Figure 8, light blue bars). At the same time, the WAIR on the company’s debt gradually declined, bottoming out at 3.2% in 2018 (Figure 8, dark blue line). Granted, if interest rates stay “higher for longer”, MCD’s WAIR will continue to rise, but given the comfortable maturity profile and reliable contractual cash flows, I’m not worried.

As an aside, I also don’t think the fairly high percentage of U.S. dollar-denominated debt (>64%) is a concern in the context of MCD only generating about 40% of its revenue in the United States. Management likely included currency bloc-specific interest rates in its considerations. For example, the WAIR on MCD’s fixed-rate U.S. dollar debt at the end of 2022 was 4.0%, while the company paid only 1.6% on its fixed-rate euro debt (p. 55, 2022 10-K).

Figure 8: McDonald’s Corporation (MCD): Percentage of fixed-rate debt and weighted-average interest rate (own work, based on company filings)

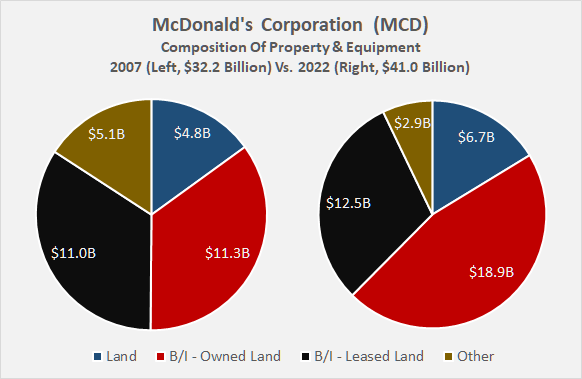

Finally, I will not get into the valuation of McDonald’s assets in this article, but it should not be forgotten that the company owns a fairly large portion of its buildings and, more importantly, land. At least since 2007, McDonald’s has gradually accumulated land (2.2% CAGR, Figure 9). Unlike buildings, related fixtures and equipment, land is not depreciated, and given the massive asset price inflation, especially since the Great Recession, the book value of MCD-owned land of $6.7 billion at the end of 2022 is likely a gross understatement.

Figure 9: McDonald’s Corporation (MCD): Composition of property and equipment, based on undepreciated numbers – B/I stands for buildings and improvements (own work, based on company filings)

The Impact On MCD Stock Dividend

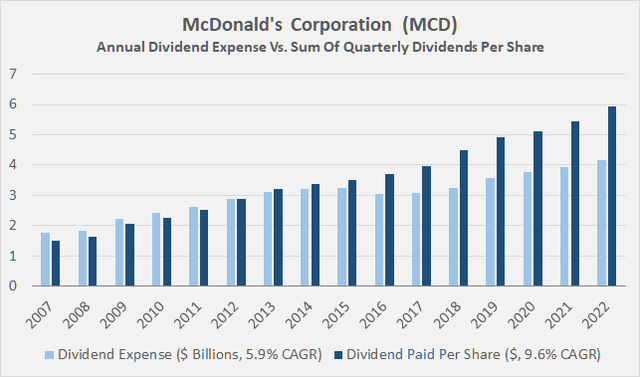

McDonald’s currently pays out around 75% of its three-year average free cash flow. Over the years, MCD’s payout ratio has grown considerably, which is not surprising given the 3.5% free cash flow CAGR since 2007 and 12% dividend CAGR over the same period. Nevertheless, it is interesting to see that dividend payout growth (i.e., the amount spent on dividends) grew at a much slower pace than in a per-share basis (Figure 10). This is obviously due to share buybacks. Between 2015 and 2017, MCD’s dividend expense actually declined – recall that the company was particularly aggressive with share buybacks during this period.

As an aside, for Figure 10, I compared dividend expense in a given year to the sum of the four quarterly dividends paid in that year. As a result, the dividend CAGR differs somewhat from the conventionally calculated growth rate (12.2% p.a. since 2007).

Figure 10: McDonald’s Corporation (MCD): Annual dividend expense compared to the sum of the quarterly dividends paid in a given year (own work, based on company filings)

While the comparatively slower growth in dividend expense is nice to see, it is also the reason why I believe MCD investors should expect slower dividend growth in the future. The payout ratio is already quite high, and debt-financed share repurchases cannot be undertaken indefinitely, especially in the current environment. Instead, they should be viewed as an opportunistic exploitation of extremely low interest rates since the Great Recession, which is no longer applicable in the current environment.

Without the aid of share repurchases, and maintaining its original balance sheet quality, McDonald’s could not have “afforded” more than 3% to 4% annual dividend growth (i.e., the organic free cash flow growth rate). At the same time, investors should not forget the company’s relentless focus on innovation and the continued growth of its portfolio in absolute terms, with an increasing emphasis on high-margin franchise earnings. However, with more than 60% of revenues already coming from franchised restaurants, growth in this area should not be over-interpreted.

Summary And Conclusion

McDonald’s has undergone a massive transformation since around 2014. The company’s increasing focus on high-margin franchising earnings (mainly comprised of low-volatility rents and royalties) laid the foundation for opportunistic exploitation of what turned out not to be the “new normal” after all – extremely low interest rates. By the end of 2022, McDonald’s had retired 39% of the shares outstanding in 2007, increasing earnings per share by more than 60%, but increasing net debt by more than five times over the same period. While the company paid about $410 million in interest on its debt in 2007, related expenses tripled by 2022, MCD’s book value turned negative in 2016, and its equity ratio bottomed out at -19% in 2018.

While these developments point to a company in deep trouble, McDonald’s debt level, interest coverage, and refinancing risk are actually not worrisome and should be considered in the context of strong, low-volatility cash flows. Similarly, investors should not forget McDonald’s asset portfolio, which is significantly underestimated due to accounting rules.

While I am not a proponent of such an aggressive capital allocation framework, I do think it is important not to blindly follow textbook advice and rush to sell the shares of what is obviously a very high-quality company simply because of a negative book value. As I discussed in another article on the seemingly problematic aspects of negative working capital (which may in fact even be a sign of long-term outperformance), it pays to dig deeper. In fact, silencing the conservative investor in me for a moment, I applaud MCD’s management for taking advantage of this – in retrospect, limited – period of extremely low interest rates while aggressively pushing toward high-margin franchise restaurants and keeping a good eye on interest rate risk.

I would like to end this article with a well-intentioned warning. As ingenious as McDonald’s maneuver may sound, it no longer seems to apply – or at least not to the extent we were used to. Investors should therefore expect much slower dividend growth over the long term, despite McDonald’s continued growing emphasis on franchised restaurants, its relentless focus on innovation, and its leading market position. As a result, and especially given the stock’s fairly high valuation (28x blended P/E ratio, 2.0% dividend yield, 2.8% free cash flow yield, see also Table 1), I do not consider MCD stock a buy at a price of nearly $300 per share. In my view, McDonald’s is set to become an increasingly poor dividend growth stock – even though its long-term CAGR of 12.2% suggests otherwise.

As always, please consider this article only as a first step in your own due diligence. Thank you for taking the time to read my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MCD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.