Summary:

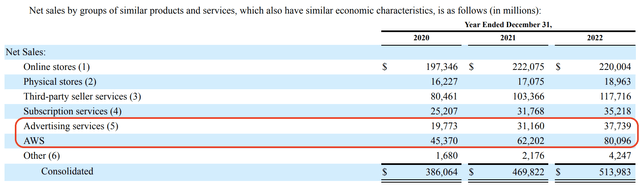

- In the past, I’ve focused heavily on Amazon’s digital ad business, which now operates at about a $40B/year annualized run rate and just grew 20%+.

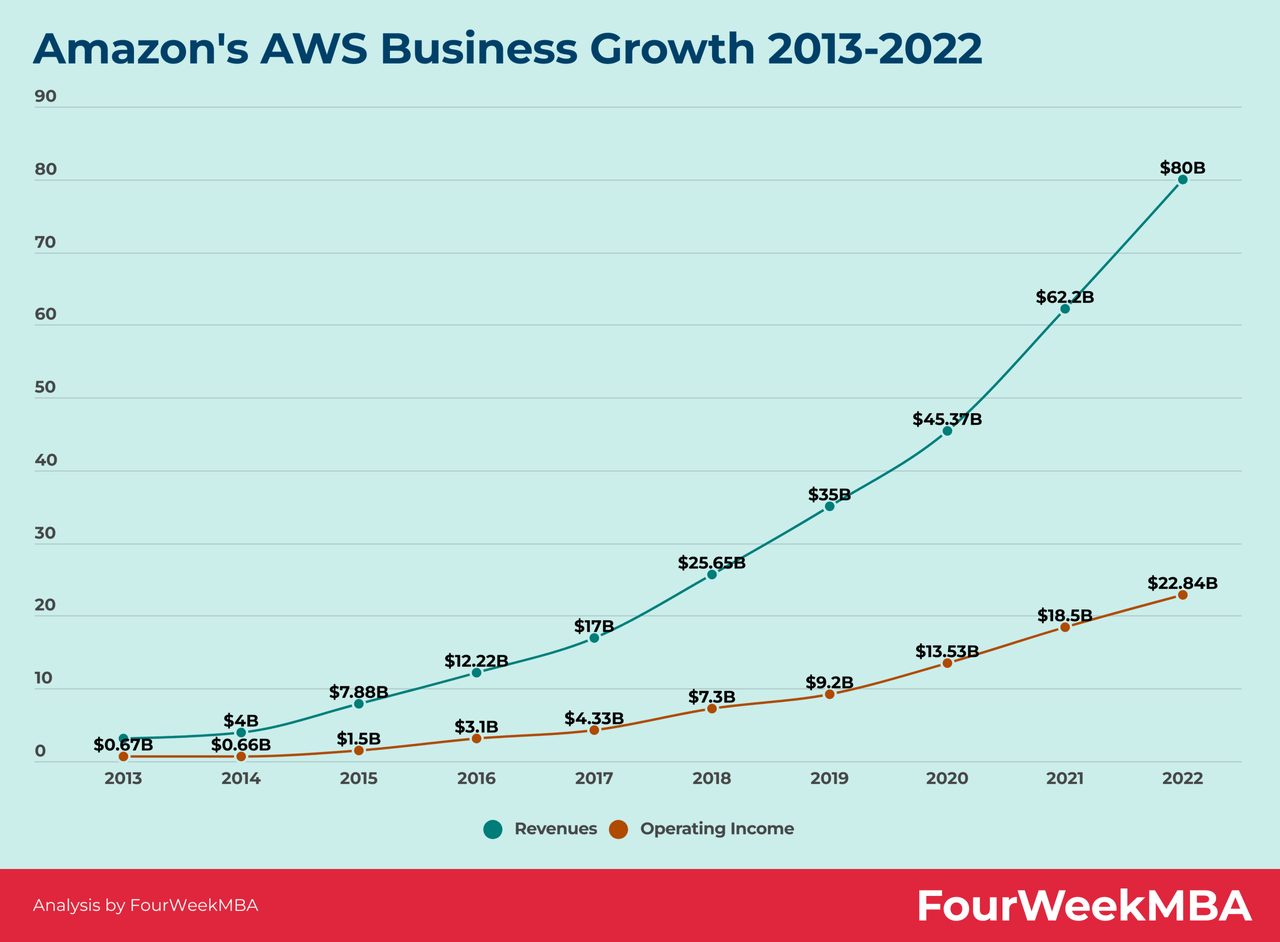

- And while I believe Amazon’s ad business has a very long runway for growth still ahead, I’ve come to believe that AWS is a $1T+ business alone.

- Despite near term growth headwinds, AWS still has a very long runway for growth ahead, suggesting that it will very likely reaccelerate growth.

- With 90%+ of workloads still on-premises, I believe this is a safe bet to make.

Noah Berger

A Very Long Runway Ahead

FourWeekMBA

We’ve spent a fair bit of time analyzing what we’re seeing, and I’ve spent a good chunk of time myself looking as well, and we like the fundamentals of what we’re seeing in AWS. The new customer pipeline looks strong. The set of ongoing migrations of workloads to AWS is strong. The product innovation and delivery is rapid and compelling. And people sometimes forget that 90-plus percent of global IT spend is still on-premises. If you believe that equation is going to flip, which we do, it’s going to move to the cloud. And having the cloud infrastructure offering with the broadest functionality by a fair bit, the best securing operational performance and the largest partner ecosystem bodes well for us moving forward.

Distilling Amazon To Its Very Essence

On the advertising side, we’re continuing to buck wider advertising trends and deliver robust growth. I think there are a few reasons for it. First, even in difficult economies, most people still shop. And with the largest e-commerce shopping venue, we have a lot of customers that companies seek to reach. That, coupled with our very substantial investment in machine learning to make sure customers see relevant ads when they’re looking for various items, have meant that these advertisements have performed unusually well for brands, which makes them want to advertise on Amazon.

It’s also worth noting that we’re still very early in our efforts to find a way to thoughtfully place ads in our broader video, live sports, audio and grocery properties. We have a lot of upside still in advertising.

My thesis for Amazon (NASDAQ:AMZN) is very simple:

- Amazon generated ~$41B in TTM ad sales (as of today)

- Amazon generated ~$85B in TTM AWS sales (as of today)

These combined lines of business generate about 70% gross margin, and, over the long run, will generate a 25%+ free cash flow margin (and 25% free cash flow margin very well could prove to be conservative).

Three Year Growth Of Ads and AWS

Using these assumptions, by year 10, Amazon will generate about $130B in free cash flow globally via these two lines of business alone.

Using a reasonable 25x EV/FCF multiple by that time, Amazon would trade at $3.2T, and, by that period, I still do not believe AWS would be done growing. I believe the business has decades of growth still ahead of it.

As Mr. Jassy remarked, on-premises workloads still account for 90% of all workloads, and, over time, it’s quite likely that that equation flips such that the majority of workloads occur natively in the cloud.

AWS Is A Juggernaut Cloud Computing Platform With Decades Of Growth Ahead

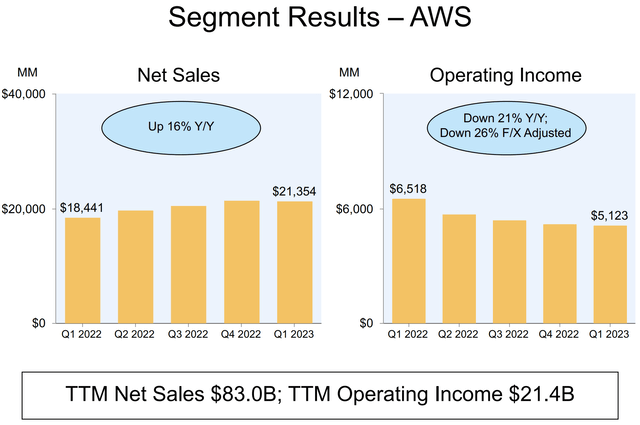

Amazon’s Q1 2023 Earnings Presentation

Notably, for my Amazon thesis, we do not need any of Amazon’s other lines of businesses to generate profit. They will only need to breakeven. This includes Amazon’s Prime Business, Amazon Shipping & Logistics, its ecommerce 1P/3P product businesses, and its services businesses.

These could all be $0s, in a sense. They just need to breakeven from a cash flow perspective, and Amazon should be a successful investment from here.

Now, if we get fiscal discipline, which I believe will actually enhance innovation within Amazon, alongside a disciplined, sustained share repurchase program, I believe Amazon will be arguably the best performing megacap tech stock of the next decade.

In the next section, we will further explore this contention.

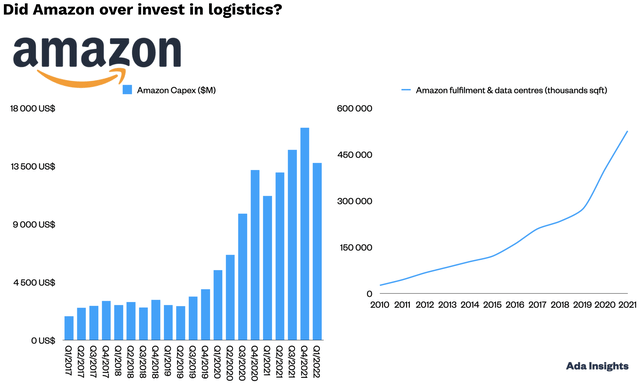

Amazon’s Profligacy Is Destroying Shareholder Value

Over the last few years, I’ve grown increasingly dissatisfied with Amazon’s use of its gross profits and free cash flow, a.k.a., shareholder capital, and this is not about the share price stagnation. I am okay with 6 years of share price stagnation, but, as Amazon begins producing “otherworldly” levels of gross profit, I believe its capital allocation mindset must shift.

A portion of the businesses I buy are stewarded by visionary Founder-CEOs who aggressively reinvest gross profits into the business to the extent that there’s scantly any profitability in the near term; so I am broadly okay with businesses not being exceptionally profitable as they grow at 20% to 30%+.

Historically, Amazon was the quintessential example of this paradigm. It was the paragon of a business operated by a man and his team who were so competent as to redeploy shareholder capital into areas that created simply stunning growth for Amazon.

But I do not believe Amazon should behave this way at its current stage of maturity.

I do not believe any man or woman has the capacity to properly redeploy $70B (and growing quickly) in gross profits into areas that produce sufficient ROI for shareholders, year in, year out, for decades at a time.

As a demonstration of this train of thought, over the last 3-5 years, Amazon vastly over-invested in its business, ultimately leading to “lighting shareholder cash on fire.”

Did Amazon over invest in logistics? – Ada Insights

- (One could argue that its excess warehouse capacity was a good investment, and that it will need it in the future, but the new warehouses of 2027 will likely be different from the warehouses of 2022: There’s still a lot of room for evolution of these warehouses from an autonomy perspective. I believe they will one day be 100% operated by robots, with just software engineers and mechanical technicians as the only labor capital involved. To this end, Amazon very well may have allocated capital to what will become obsolete warehouses.)

In Amazon’s early days, I believe its aggressive use of its gross profits was fine. It was to be expected. We needed to aggressively reinvest; to aggressively place bets whereby the Amazon of today was born.

And that meant reinvesting effectively every single dollar of gross profit the business generated.

In 2020, I wrote a note entitled, “Alphabet’s Cash Hoard Is Destroying Shareholder Value.”

In that note, I urged management to execute two tried-and-true business tactics:

- Execute a leveraged recapitalization

- Execute an accelerated share repurchase program

And, in the last few years, Alphabet (GOOG) (GOOGL) has done just that.

Now, I did not urge management to perform these acts because I wanted “the bean counters” (I am an MBA or bean counter myself) to takeover or because I wanted Alphabet to descend into complacency, sans any investment in innovation.

Quite the opposite!

My central contention was that fiscal discipline would actually strengthen the culture and enhance the ability of the business to evolve.

My central contention was that not even God himself, at this stage in human evolution, could effectively allocate $200B in cash and free cash flow into new lines of business that would produce a sufficient IRR, or ROI, over the next 10-20 years.

The most judicious use of capital was returning that capital to shareholders in the form of buy backs (at the time, this was especially true because there was a great deal of panic being priced into Alphabet’s shares).

And I believe the same ideas could be applied to Amazon today.

I believe it should reset the culture such that it never again operates free cash flow negative.

And I think the lockdown/covid era proved my thinking: Even in a demand-catalyzing event such as covid, Amazon still couldn’t invest 100% of its gross profits effectively. It ultimately lit cash on fire by doing so, even with such a massive tailwind for demand lifting its sails.

Considering its gross profit generation, which is the cash it can use to reinvest in the business, I do not believe any reasonable argument could be made for reinvestment in the business exceeding gross profit generation, whereby the business does not generate free cash flow.

I believe Amazon should, henceforth, operate with these two principles in mind:

- Reinvestment does not exceed gross profit generation

- A capital return program in the form of a buyback should be implemented (Amazon already has a healthy amount of debt (cash neutral presently), so a leveraged recapitalization would not make sense in this instance. It did make sense for Apple (AAPL) and Alphabet (GOOGL) in the late 2010s/early 2020s).

These operating principles would serve to achieve two objectives:

- Disciplined, more productive innovation over the long run

- Maximization of shareholder value, which, behind service to the customer, is the principal goal of any corporation

Capital return programs do not represent a business losing its ability to innovate.

Quite the opposite!

For exceptionally cash rich businesses, capital return programs serve to: 1) create fiscal discipline in a cash flow rich business (where there’s a temptation for profligacy and a lack of discipline due to unbounded resources) and 2) maximize shareholder value.

In short, Amazon should restructure its mindset about reinvestment in its business, and I believe everyone, including Amazon employees and management, and, of course, shareholders, would be vastly happier over the long run.

With these ideas in mind, let’s conclude this note with a review of the principal reason I’ve come to own Amazon.

The AWS Juggernaut

And people sometimes forget that 90-plus percent of global IT spend is still on-premises. If you believe that equation is going to flip, which we do, it’s going to move to the cloud.

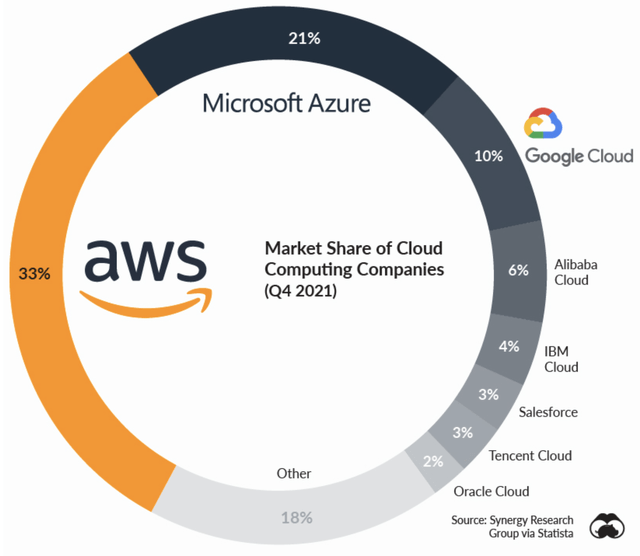

Synergy Research Group Via Statista

In no uncertain terms, I believe Amazon has built what will be seen as the most important computing platform of the next 100 years.

The demand for compute and storage will only grow substantially from here, and AWS will be at the center of this growth in demand.

To this end, I believe we should alter our thinking of Amazon:

It is not an ecommerce business.

That has become a sideshow at this point (note the ad sales however).

AWS is Amazon, and not the other way around.

Over time, I believe this truth will be further revealed, and this simple data point buttresses this belief:

But we’re not close to being done inventing in AWS. Our recent announcement on Large Language Models and generative AI and the chips and managed services associated with them is another recent example. And in my opinion, few folks appreciate how much new cloud business will happen over the next several years from the pending deluge of machine learning that’s coming.

I think it’s important to remember that there’s still so much growth ahead of the cloud, 90-plus percent of the global IT spend is on-premises. And so if you believe that equation is going to flip, it’s mostly moving to the cloud. And I also think that there are a lot of folks that don’t realize the amount of non-consumption right now that’s going to happen and be spent in the cloud with the advent of Large Language Models and generative AI. I think so many customer experiences are going to be reinvented and invented that haven’t existed before. And that’s all going to be spent in my opinion, on the cloud.

I believe it’s entirely conceivable that AWS generates hundreds of billions in total sales over the next 10-20 years.

We are still very early in the cloud computing revolution, and AI and virtual realities will demand compute and storage to degrees that I believe many do not currently appreciate.

Concluding Thoughts: Cloud Computing Has A Very Long Runway Ahead

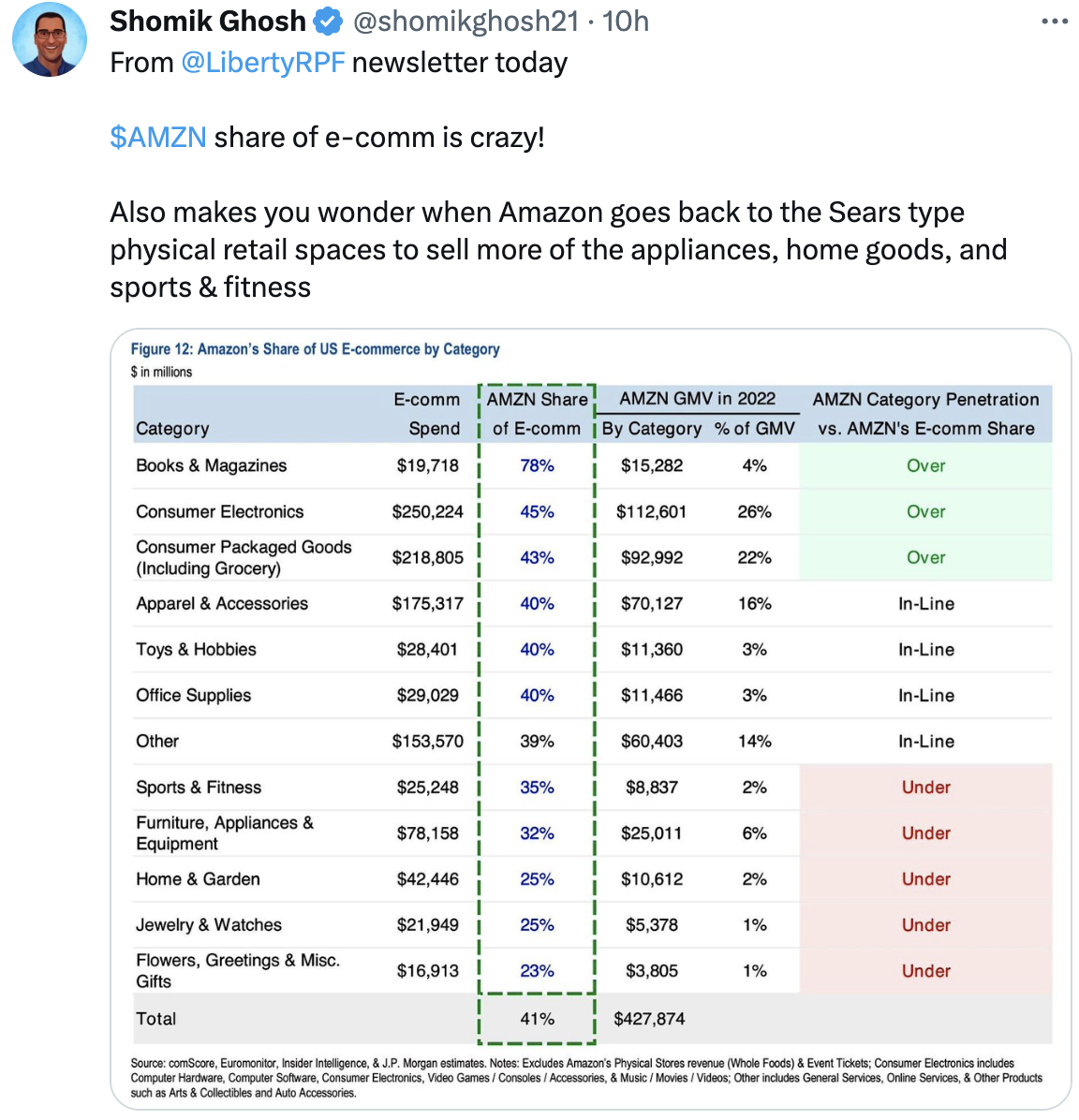

Of course, Amazon’s ecommerce business has an “almost scary monopoly,” and, as we’ve discussed in our considerations of Sea (SE) and Coupang (CPNG) recently, there’s still material evolution that will occur in warehouses, such that these entities become fully autonomous nodes on a “superintelligence fulfillment network.”

Twitter

Amazon’s ecommerce profit margins could actually grow in the decades ahead, as its warehouses become more intelligent, more efficient, and less reliant on human labor capital.

Of course, this is great, and it’s a great reason to own Amazon, but I believe it distracts from the reality that AWS will likely one day generate hundreds of billions in total revenue.

Presently, AWS is experiencing some slowing of growth, but I believe this will prove to be temporary.

In AWS, net sales were $21.4 billion in the first quarter, up 16% year-over-year and representing an annualized sales run rate of more than $85 billion. Given the ongoing economic uncertainty, customers of all sizes in all industries continue to look for cost savings across their businesses, similar to what you’ve seen us doing at Amazon. As expected, customers continue to evaluate ways to optimize their cloud spending in response to these tough economic conditions in the first quarter. And we are seeing these optimizations continue into the second quarter with April revenue growth rates about 500 basis points lower than what we saw in Q1. As a reminder, we’re not trying to optimize for any one quarter or year. We’re working to build customer relationships and a business that will outlast all of us. Therefore, our AWS sales and support teams continue to spend much of their time helping customers optimize their AWS spend so that they can better weather this uncertain economy. This customer orientation is built into our DNA and how we think about our customer relationships and business over the long term.

And I believe AWS’ growth potential provides a template for many of our cloud computing names.

The reality that 90% of workloads still occur on-premises provides the basis for exceptional growth from our smaller cloud computing businesses, some of which I’ve shared with you recently.

Thank you for reading, and have a great day.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, CPNG, SE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.