Summary:

- Alphabet is due to report results tomorrow after the close.

- The shares up a lot this year.

- A trader is betting the stock falls below $110.

JHVEPhoto

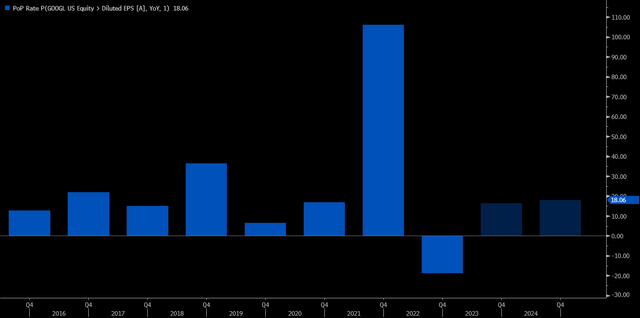

Alphabet (NASDAQ:GOOGL, NASDAQ:GOOG) is due to report results on Tuesday, July 25, after the close of trading. Earnings and revenue are expected to see only modest growth in the second quarter, with analysts forecasting earnings growth of 9.2% to $1.32 per share, on revenue growth of 4.4% to $72.7 billion.

Due to these modest sales and earnings growth estimates, an options’ trader appears to be betting that Alphabet’s stock will move lower in the days and weeks following the results. The stock has risen sharply in 2023 but has recently shown some signs of fatigue and could even be forming a double-top reversal pattern.

Slower Growth

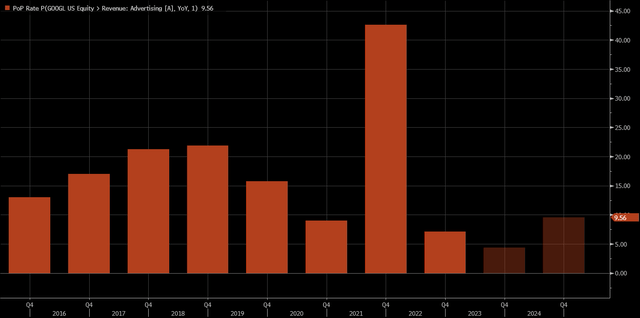

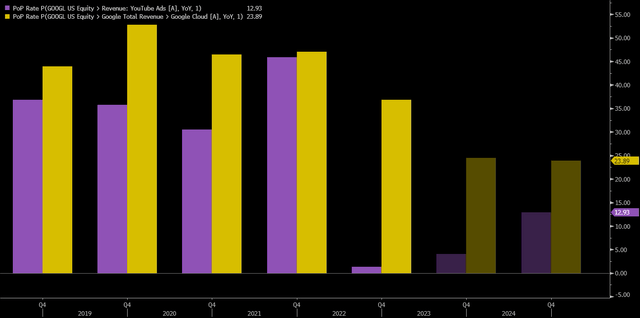

Revenue growth, excluding traffic acquisition costs – TAC – is expected to rise by 4.8% to $60.2 billion, with Google ad revenue rising by just 2% to $57.4 billion. In comparison, YouTube growth is forecast to rise by less than 1% to $7.4 billion. Finally, Google Cloud is expected to be the most significant unit gainer, with revenue climbing by 24.7% to $7.8 billion.

Currently, the stock is trading for 20.7 times its 12 months forward earnings estimates, which certainly isn’t that much more expensive. Historically, Alphabet has traded in a range of 21 to 30 times earnings. So its current valuation is at the lower end of the range.

The problem is that Alphabet is only expected to grow its earnings this year by around 16.4% and by 18% next year. That puts the earnings growth rate at the lower end of its historical range, more similar to 2015, 2017, and 2019, when the shares were closer to the lower end of the historical PE ratio range of 21.

Additionally, Google advertising growth rates also have slipped and are expected to be less than 5% this year and by around 9.5% next year. So given the earnings and sales growth rates at the lower end of the historical range over the next two years, it’s tough to say that there will be much more expansion of the PE ratio unless growth rates start to accelerate.

That would probably mean that Alphabet would need more growth out of its cloud unit because YouTube’s growth is forecast to be flat this year and just 13% next year. But the cloud unit is rising by 24.5% this year and 23.9% next year.

Options Bet

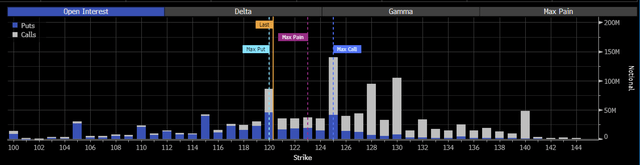

Alphabet’s more modest growth rates could have led an options trader to bet that the stock has run too far and that the results may bring the high-flying stock back to earth. Open interest levels for the GOOG $110 puts and calls rose by about 15,000 contracts on July 24 for the August 18 expiration date. The data shows the calls were sold for $11.53, and the puts were bought for $1.03 per share. The trader received $10.50 to place the bearish bet that the stock would be trading below $110 by the expiration date in August.

This could be a covered call transaction, where the trade is long the underlying stock, sees the shares falling over the next few weeks, and is trying to take in the premium of the elevated call value while benefiting from the share falling in price. If the shares fall below $110, the trader would keep all the call premiums and hold on to their shares. If the stock falls below $110, they also would profit on the puts rising in value. However, if the stock trades higher following the results, the trader risk having their shares called away and the puts expiring worthless.

Implied Volatility Is High

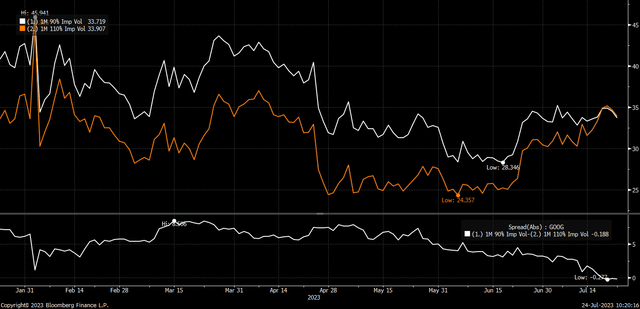

From an options markets perspective, the stock may fall following the results. Implied volatility levels for the calls are higher than for the puts. That means there has been a lot of demand for traders to own the calls, and that view among traders is that Alphabet continues to climb.

Additionally, there are currently big bets in the options market for the expiration date on July 28 for the stock to rise above $125, with lots of open call interest up to $130.

However, with high implied volatility levels, once the earnings are released, implied volatility levels will fall sharply. The call will lose more because the implied volatility levels for the calls are higher than the puts. That means the $125 to $130 calls will lose value quickly as those implied volatility drops following the earnings release. As a result, market makers will be forced to start selling their hedges on the stock, pushing the price of the shares down, which could make the value of the puts worth more and usher in more call sellers, creating a feedback loop, as witnessed in Tesla and Netflix last week.

Weak Technical Trends

Technically, the stock may have formed a double-top pattern. It’s not a confirmed pattern yet; it must fall below $116 for confirmation. But if it does turn into a double top, it could result in the share falling to around $104. Additionally, the relative strength index has decreased since peaking above 70 on May 23, a sign of momentum turning bearish.

Of course, this is based on a short-term to medium-term viewpoint on Alphabet’s stock following results. This stock has risen dramatically off the COVID lows and suffered a sustained pullback in 2022, with a retreat in the short-term likely being part of a longer-term basing process as the fundamentals play catch-up to the stock prices’ big move of the past couple of years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Charts used with the permission of Bloomberg Finance L.P. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Reading the Markets helps readers cut through all the noise delivering stock ideas and market updates, and looking for opportunities.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.