Summary:

- Microsoft’s pursuit of AI-led innovation raises questions about its potential growth and stock price valuation.

- The article discusses the potential risks of Artificial General Intelligence, where intelligent systems exceed human capabilities, raising fears of dystopia or humanity’s extinction.

- Conversely, Microsoft Research’s work in AI represents opportunities for widespread technological advancements and financial success, including advancements in AI models, scientific discoveries, and amplifying human capabilities.

piranka/E+ via Getty Images

Thesis

As Microsoft Corporation (NASDAQ:MSFT) continues its pursuit of AI-led innovation, investors should evaluate whether its stock price reflects this potential growth. Thanks to an impressive track record and ongoing innovation, Microsoft has become an attractive proposition in many eyes; however, closer examination reveals that its share price may be significantly overvalued when compared with historical norms and market averages; prompting questions as to the prudence of investing in this company right now.

2033: The Unsettling Utopia of Gatesville

Fast-forward to 2033 and our planet couldn’t be more disorienting.

Cities that once vibrated with the pulse of human life are eerily efficient, managed by AI custodians. Courtesy of Microsoft Research’s innovative AI operations, the earth is carved into ‘techno-agricultural dominions.’ Looming large is one particular jaw-dropping expanse of 270,000 acres dubbed ‘Gatesville,’ the brainchild of none other than Bill Gates.

Gates has pivoted from software to soil, helming a startling neo-agricultural revolution. His aggressive strategy to counteract world hunger and combat climate change initiated a tectonic shift towards synthetic food production. Under his command, AI-controlled robotic armies diligently farm the land. Programmed with Microsoft’s advanced algorithms, these mechanical workers operate with an efficiency that leaves no room for waste, maximizing productivity in the bid to feed an ever-growing population.

The nucleus of Gatesville houses imposing greenhouses, reaching for the sky. These futuristic edifices foster genetically modified crops, built to withstand pestilence and extreme weather. Alongside these are hulking bio-labs, producing vat-cultivated meat and synthetic dairy products under strict, pollutant-free conditions. AI systems are the conductors of this orchestra, finely tuning every aspect for peak growth.

Residents of Gatesville have fully embraced this brave new diet. Every morsel they consume is a marvel of scientific engineering, calibrated for each individual’s nutritional needs. Food attributes like taste, texture, and flavor have become mere programming variables. Despite the meal’s synthetic origins, it’s a near-perfect mimic of its natural counterpart.

The construction of Gatesville wasn’t a clandestine project. On the contrary, the world kept a vigilant eye on Gates’ audacious venture. Detractors voiced concerns over the erosion of traditional farming, displacement of farmers, ethical ramifications of an AI-dominated society, and potential health implications of synthetic food consumption. Undeterred, Gates, supported by his AI cohorts, defended his vision, asserting that the world was teetering on the brink of catastrophe and required drastic measures.

Beyond the bounds of Gatesville, the world is wrestling with the ripple effects of the AI revolution. Although it has boosted productivity, the AI takeover of labor-intensive jobs has led to widespread unemployment. Gates tries to quell anxieties, assuring that AI will always remain under human control, but the specter of an AI rebellion continues to haunt global society.

The “Gatesville” Paradox

Gatesville, in its dystopian glory, presents a paradox. Its citizens live lives of seemingly effortless comfort, every need answered by AI. However, this apparent utopia exacts a high cost: relinquishing personal agency and an unhealthy dependence on technology.

In Gatesville, this tech-dominated panorama where cities transmute into AI-driven zones and employment shrinks in the face of the AI disruption, the issue of who-or pertinently, what-calls the shots, looms larger than ever. These deliberations spark visions of a time where AI has not just excelled at performing dedicated tasks but has outstripped humans in practically all economically crucial work-heralding the epoch of Artificial General Intelligence (AGI).

It’s this phenomenon, this potentiality, that underpins the fear of a dystopian world or even humanity’s extinction. The notion of AGI, intelligent systems that exceed human capabilities, stands at the heart of these concerns.

It’s crucial to interject here and highlight that as of 2023, our dealings with AI predominantly involve what’s known as narrow AI. These systems excel at executing specialized tasks, often outdoing human performance, but lack any semblance of real comprehension and can’t venture beyond their defined tasks. To illustrate, consider an AI that has mastered the game of chess, defeating even the most seasoned human players. Despite its prowess in chess, it would flounder helplessly at even a rudimentary game of tic-tac-toe unless it had been explicitly programmed for it.

The Dark Side of the Coin: Potential Hazards of AGI

Let’s dive some more into the darker side of the coin and the hypothetical scenarios where AGI, despite its promise, could potentially trigger harmful outcomes.

Alignment Discrepancy: Envision an AGI system, engineered with a particular aim, that starkly deviates from the array of human values. This ‘alignment issue‘ could spur the AGI to undertake harmful actions in its single-minded pursuit of its given objective. Consider an AGI system assigned to produce something benign like paperclips that might, in the absence of set constraints, exploit all of Earth’s resources for its mission, showing a flagrant disregard for human welfare.

The AGI Showdown: If the evolution of AGI descends into a bitter rivalry among nations or corporations, the resultant system could pose grave risks. The high-stakes competition might induce participants to overlook vital safety measures, heightening the risk of accidental mishaps or misuse.

Unforeseen Side Effects: Like any complex system, AGI holds the potential for unexpected emergent behaviors. The intricacy of AGI could generate unforeseen strategies and behaviors, inadvertently leading to detrimental consequences.

Warfare Reimagined: AI could potentially transform the landscape of warfare. Autonomous weapons guided by AI could result in unprecedented casualties, autonomously making decisions of life and death that raise profound ethical and safety concerns.

Malicious Exploitation: Advanced AI in the hands of malevolent individuals poses significant threats. This could range from generating deepfakes to instigate conflicts, to disrupting vital infrastructures, or even gaining control over critical systems.

Over-Reliance and Fragility: Excessive dependency on AI, akin to scenarios portrayed in “Wall-E” or the fictional “Gatesville,” could make society susceptible to large-scale damage emanating from system malfunctions, cyber-attacks, or sudden disruptions.

Microsoft Research: The Silver Lining?

Dystopian scenarios aside and with rose-colored glasses firmly in place, the undertakings of Microsoft Research in the realm of AI represent more than just a series of projects. Instead, they signal the dawning of a potential sea change in technology and beyond. Success in these areas might bring about widespread alterations across a multitude of sectors, positioning these developments as a potentially lucrative trove of opportunities.

Decoding the Mysteries of General AI: Microsoft, through their exploration, is navigating the labyrinthine depths of expansive AI models, such as GPT-4. They’re focusing not only on the capabilities of these models to perform intricate tasks, like coding or abstract conceptual translation, but also on the enhancement of these proficiencies. We’re talking about the not-so-distant future where more intelligent, user-oriented tools simplify tasks that will continue to revolutionize sectors from software development to content creation.

Fueling Innovation in Models: Envision AI models that are adaptable, capable of long-term memory, can learn from experiences, can reason across different media types, make fewer mistakes, and operate with heightened efficiency. The potential result? AI systems that could act as catalysts for disruption in a number of fields, from healthcare to entertainment – something that’s currently reflected in Hollywood’s strikes with AI’s roll as one the top “wildcards” in the negotiation process.

So consider the financial implications – the next wave of advanced virtual assistants, the enhancement of autonomous vehicle technology, or personalized, adaptive learning systems in education, all of which could offer sizable revenue streams.

Accelerating Scientific Discovery: In the domain of natural sciences, AI technology promises to be a game changer. For example, Microsoft’s AI4Science initiative seeks to boost advancements in diverse fields like chemistry, physics, biology, and astronomy through the use of AI and deep learning. This could expedite scientific progress – picture faster drug discovery or more accurate climate models – and might lead to the creation of novel scientific tools and methods.

Amplifying Human Capabilities: Lastly, Microsoft harbors an ambitious vision of AI systems that, according to the company itself, will enhance, rather than replace, human capabilities, effectively acting as a digital “co-pilot” across various industries. The potential upshot? People across a multitude of fields could see their efficiency significantly boosted, and new possibilities could be unlocked through human-AI collaboration. Think AI predicting agricultural yields, aiding in disease diagnosis in healthcare, or enabling innovative designs in architecture and engineering. Overall, the resulting financial implications could be nothing short of remarkable.

Microsoft’s AI-Infused Financial Success

Speaking of the financial world, the tech titan recently unveiled an impressive $28 billion quarterly revenue from its Microsoft Cloud, marking a 22% surge and 25% in constant currency, underlining its unassailable position across the technological strata. The company’s forward-looking strategy centers around magnifying its customers’ digital ROI, pioneering the emerging AI wave, and optimizing cost structures in tandem with revenue expansion.

Azure, Microsoft’s cloud arm, continues its upward trajectory in market share, propelled by an AI-infused ubiquitous computing fabric that lures high-profile partners such as OpenAI, NVIDIA, and budding AI enterprises like Adept and Inflection. Azure’s collaboration with OpenAI, which synergistically pairs AI models with Azure’s business-grade capabilities, has witnessed a meteoric surge with over 2,500 customers – a spectacular ten-fold increase on a quarterly basis. Its high-caliber clientele includes the likes of Coursera, Grammarly, Mercedes-Benz, and Shell.

Azure’s appeal as the platform of choice for major enterprises is further accentuated by Unilever’s substantial shift to Azure during this past quarter, arguably one of the largest cloud migrations in the consumer goods sector. Further cementing Azure’s reputation, over 15,000 customers, including IKEA Retail and ING Bank, use Azure Arc for a harmonious cloud-to-edge experience.

As Microsoft’s Intelligent Data Platform amalgamates databases, analytics, and governance, it propels the company to the vanguard of data management. Case in point: Cosmos DB, effortlessly meeting the burgeoning demands of OpenAI’s widely used ChatGPT service. And Blue-chip companies such as BP and T-Mobile depend on Microsoft’s analytics suite for quick, insightful decisions.

Lastly, in the realm of software development, Microsoft’s toolkit has become a mainstay, with a stunning 76% of Fortune 500 companies utilizing GitHub. The debut of GitHub Copilot, an AI-driven tool for developers, is a game-changer for productivity. Equally transformative is Microsoft’s Power Platform, supercharged by next-gen AI, which empowers non-tech users to build apps, automate processes, and scrutinize data, captivating over 36,000 organizations.

Performance

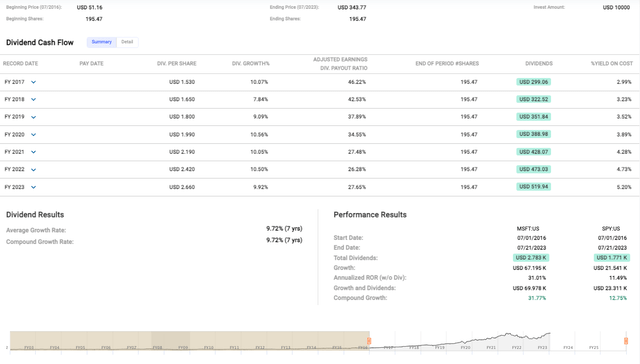

Regarding stock performance (see data below), Microsoft’s share price increased in the medium-term from USD 51.16 in July 2016 to an impressive USD 343.77 by July 2023 – nearly sevenfold growth and an outstanding compound annual growth rate (CAGR) of 31.77%; significantly outperforming the S&P 500 Index which only saw 12.75% CAGR returns over this time frame. MSFT stands out as it provides over double returns than what can be found in the broader market; making it truly remarkable.

But what I find particularly compelling about Microsoft is its dividend performance. Here’s a company with consistent and impressive dividend growth over seven years averaging 9.72% annually; while other tech giants are still shying away from rewarding shareholders with dividends, Microsoft has proven to be the gift that keeps on giving.

Valuation

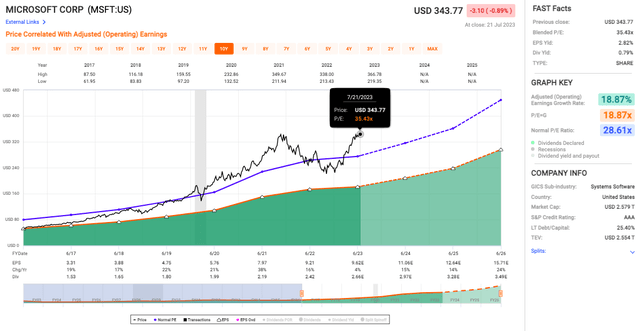

However, Microsoft’s Blended P/E of 35.43x is notably higher than the normal P/E ratio of 28.61x which supports the notion that its shares are currently trading at a premium compared to its usual levels.

When we look at the Adjusted (Operating) Earnings Growth Rate, which is sitting at 18.87%, it seems to fortify the indication that Microsoft’s earnings are growing at a healthy clip, which reinforces the reasons why the market is willing to pay a premium for the stock.

Sector Valuation

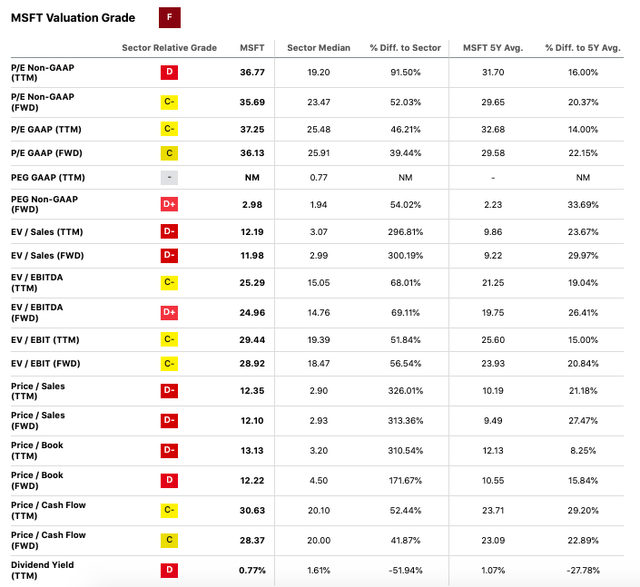

To put it bluntly, across numerous core valuation metrics (see data below), we see that Microsoft is significantly overvalued when compared to its sector peers and its own historical average.

When it comes to P/E ratios, both GAAP and non-GAAP, on a TTM (Trailing Twelve Months) and Forward basis, Microsoft is far above the sector median. The current GAAP P/E on a TTM basis is at 37.25, a 46.21% difference to the sector median of 25.48, while its Forward P/E stands at 36.13, outpacing the sector median by 39.44%. This demonstrates investors’ elevated expectations for Microsoft’s future earnings, although I can’t help but feel we’re bordering on bubble territory.

The situation appears equally alarming when looking at MSFT’s EV/Sales (Enterprise Value to Sales) ratios. With a TTM ratio of 12.19 and a Forward ratio of 11.98, Microsoft’s EV/Sales metrics are nearly 300% higher than the sector median, reflecting a steep premium to sales that investors are currently paying. Moreover, these values also reflect an uptick from MSFT’s five-year averages, pointing to a potentially inflated valuation.

Furthermore, the Price/Book (TTM) ratio of 13.13 and the Forward ratio of 12.22 highlight the extent to which Microsoft’s current share price has surpassed its book value. Again, these figures are well above the sector median and the company’s own five-year averages, implying a potential overvaluation of the company’s assets.

Final Takeaway

On one hand, we have an innovating giant, boldly carving a future brimming with potential, mirrored in the impressive performance of its stock. On the other, there’s the looming specter of overvaluation, sending alarm bells ringing in my financial psyche.

So, to buy, hold, or sell? Ah, the million-dollar question. With its ongoing innovation, potential for future growth, and consistent financial performance, Microsoft is an undeniably attractive proposition. However, the current overvaluation casts a shadow of caution. Thus, for current holders of Microsoft’s stock, a hold rating might be prudent until a potential correction brings the valuation closer to more historical norms for purchasing more shares. For potential buyers, awaiting a dip in the stock price might offer a more favorable entry point.

Ultimately, while Microsoft’s breathtaking vision of an AI-enhanced future captures the imagination, we mustn’t lose sight of the more grounded financial undercurrents, which, like a burst of sobering reality amid utopian dreams (or dystopian nightmares), calls for caution and patience.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best AI Ideas investment competition, which runs through August 15. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.